Like HP, printer OEMs Ricoh Company Limited and Olivetti SpA sell 3D printers under their own brands. The difference is that while HP did all of its 3D development in-house, Ricoh and Olivetti partnered with 3D printer OEMs for their products. Ricoh is working with Aspect, Inc. of Japan, and Olivetti with Gimax of Italy. While both Ricoh and Olivetti claim a role in development of the printers, their 3D printer OEM partners offer similar, if not identical, models under their own brands.

Ricoh’s AM S5500P

Last October, Ricoh announced it would sell its own selective laser sintering (SLS) 3D printer, the Ricoh AM S5500P (see “Ricoh’s First 3D Printer Uses SLS Technology, Sold in Japan Only for Now”). The device is a midrange SLS 3D printer suited for manufacturing applications such as rapid prototyping or limited parts production.

The Ricoh AM S5500P is available only in Japan and Europe, but Ricoh plans to offer the system in other unspecified countries at some point. In September 2014, Ricoh launched its Additive Manufacturing (AM) Business, which at the time focused on selling third-party printers and services. The AM S5500P is now part of the AM Business group’s offerings.

Ricoh’s AM S5500P 3D printer

Ricoh’s AM S5500P is similar to the Rafael series of 3D printers from its development partner, Aspect. Ricoh and Aspect will continue to work together to develop materials for the AM S5500P and to further enhance the system.

The AM S5500P features a large build area of 55 × 55 × 50 cm and a laser scan speed of 15 meters per second. It is bundled with modeling software. Ricoh recommends that AM S5500P customers use its own branded materials, which are polymer powders based on PA12, PA12 GB, PA 11, PA6 GB, and PP.

Olivetti’s 3D-S2

Olivetti jumped into the 3D printing market around the same time as Ricoh last October with a fused deposition modeling (FDM) system aimed at small- to medium-sized businesses (SMBs) (see “Olivetti Enters the 3D Printing Market with All-Italian Filament System”).

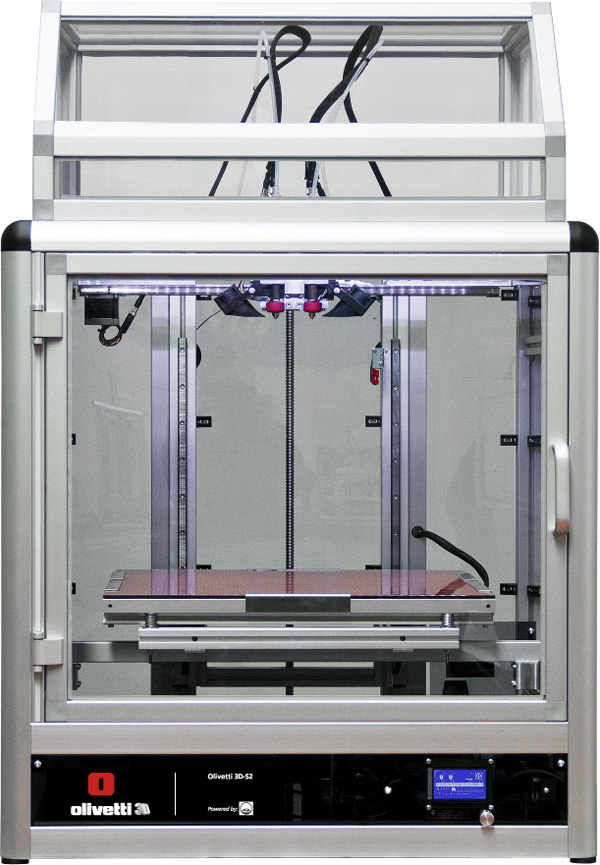

Olivetti developed its 3D-S2 jointly with Italian 3D printer OEM Gimax, and the system is manufactured entirely in Italy. Gimax sells its own line of FDM 3D printers in Europe, and the 3D-S2 seems very similar in appearance and specifications to the Gimax S2 system.

Olivetti’s 3D-S2 3D printer

The Olivetti 3D-S2 is designed for commercial applications and features a large build area of 40 × 40 × 40 cm and a print speed of up to 150 mm per second. It is a dual-extruder system that Olivetti claims can use any thermoplastic material, including carbon, glass, marble, nylon, plastic, resin, and wood.

Olivetti is selling the 3D-S2 only through its distribution and servicing network of dealers in Italy and other parts of Europe.

Our Take

In terms of risk, Ricoh and Olivetti are taking the middle ground by using development partners to enter the 3D market. The investment is much lower than developing a completely new system, and the time to market is faster. It’s not as safe as reselling a third-party’s brand but signals a stronger commitment to the market.

Although neither OEM partner is well-known in the United States, both Gimax and Aspect are strong players in their native markets. The co-branded models appear to have the features and capabilities that would appeal to the professional and industrial markets, and that’s where to best potential for margin can be found.

If Olivetti and Ricoh like what they see in the 3D market, they have a few options for expanding their footprints. They could continue to work with their partners to fill out their product lines and develop new materials, develop their own products that will eventually supplant the co-branded models, or possibly acquire their partners. The latter is particularly interesting because it combines the channels and support infrastructure of the digital imaging OEMs with the engineering and market knowledge of the 3D printing OEMs. If they don’t like what they see, then they can let their agreements lapse without having made too large an investment.

As with HP, we expect both Ricoh and Olivetti to take time to learn about the market and assess where their best opportunities are within it. The consensus is that the 3D printer market will remain flat for 2016, so we likely won’t know about the two companies’ long-term commitment to 3D until next year.