At the end of April and throughout May, printer and copier OEMs reported quarterly financial results for the three-month period ended on March 31, 2018. For all the Japanese OEMs, except Canon, this period was the fourth quarter and the end of their fiscal years. For Canon and Xerox, this period was the first quarter of the fiscal year that will end on December 31, 2018. HP is on a different financial calendar than all the other OEMs. Its second quarter ended on April 30, 2018.

At the end of April and throughout May, printer and copier OEMs reported quarterly financial results for the three-month period ended on March 31, 2018. For all the Japanese OEMs, except Canon, this period was the fourth quarter and the end of their fiscal years. For Canon and Xerox, this period was the first quarter of the fiscal year that will end on December 31, 2018. HP is on a different financial calendar than all the other OEMs. Its second quarter ended on April 30, 2018.

Actionable Intelligence currently covers financial results from traditional printer and copier OEMs including Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, OKI, Ricoh, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available for Actionable Intelligence subscribers.

Key takeaways from these companies’ most recent financial quarters are as follows.

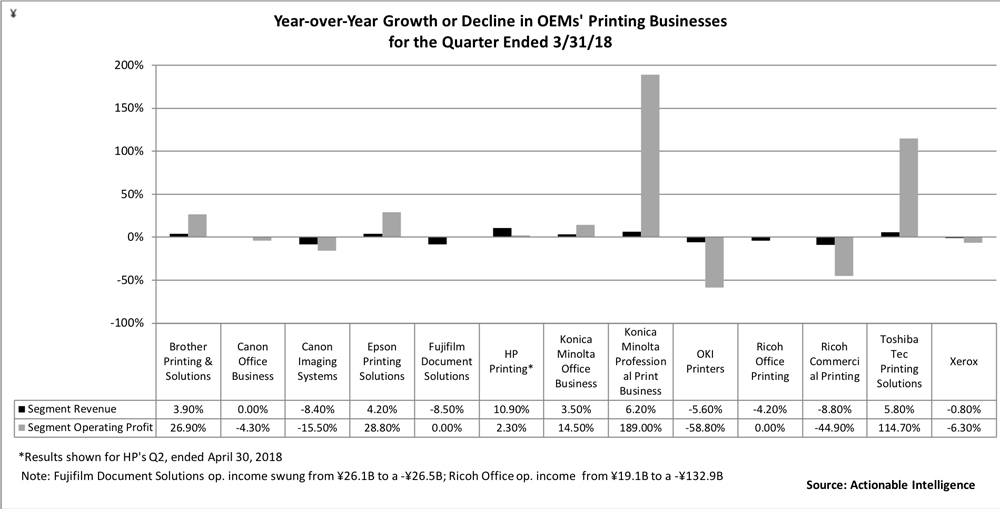

- While most OEMs saw improvements in their quarterly results throughout 2017, the quarter ended in March 2018 proved more challenging for many. Compared with the quarter ended in December 2017 (see “The Big Picture: OEM Financials for the Quarter Ended in December 2017”), which was positive for almost all OEMs, in the quarter ended in March, several OEMs saw the year-over-year growth in their printer hardware and consumables business either slow or turn into declines.

- In the quarter ended in March, the “winners”—firms that posted both revenue and operating income growth year-over-year in their printing businesses—included Brother’s Printing and Solutions business, Epson’s Printing Solutions business, HP’s Printing business, Konica Minolta’s Office and Professional Print businesses, and Toshiba Tec’s Printing Solutions business.

- The roster of OEMs whose printing businesses saw year-over-year declines in revenue and operating profit included Canon’s Office and Imaging Systems businesses, Fujifilm Document Solutions, OKI’s Printers business, Ricoh’s Office Printing and Commercial Printing businesses, and Xerox (all of Xerox is now a printing business). This is a much longer list of printing businesses reporting both downturns in revenue and profit than in the previous quarter, when only Fujifilm’s Document Solutions business reported such declines.

- The chart above masks just how bad the quarter ended in March was for Fujifilm’s Document Solutions segment and Ricoh’s Office Printing segment. The chart only show year-over-year growth/decline in percentages, but both these business saw the profits from a year-ago completely erased and posted big operating losses in the quarter ended on March 31, 2018.

- When announcing results for the quarter ended in December, Xerox’s and Fujifilm’s results were overshadowed by the two firms’ merger plans (see “Fujifilm to Buy Majority Share in Xerox, Combine It with Fuji Xerox Venture”). This quarter, the big news was that Xerox has called off plans to merge with Fuji Xerox (see “Xerox Gives Up on Fujifilm Deal, Reaches Another Agreement with Deason and Icahn”). The dissolution of this transaction leaves HP firmly ensconced as the industry’s biggest printer vendor.

- Meanwhile, HP’s growth in Q2 continues to be fueled by its acquisition of Samsung’s printer business (see “HP Completes Acquisition of Samsung’s Printer Business”). The rate of year-over-year growth in HP Printing revenue and profits was not quite as strong in Q2 as in Q1, but the acquisition is providing a nice boost to HP Printing results this year.

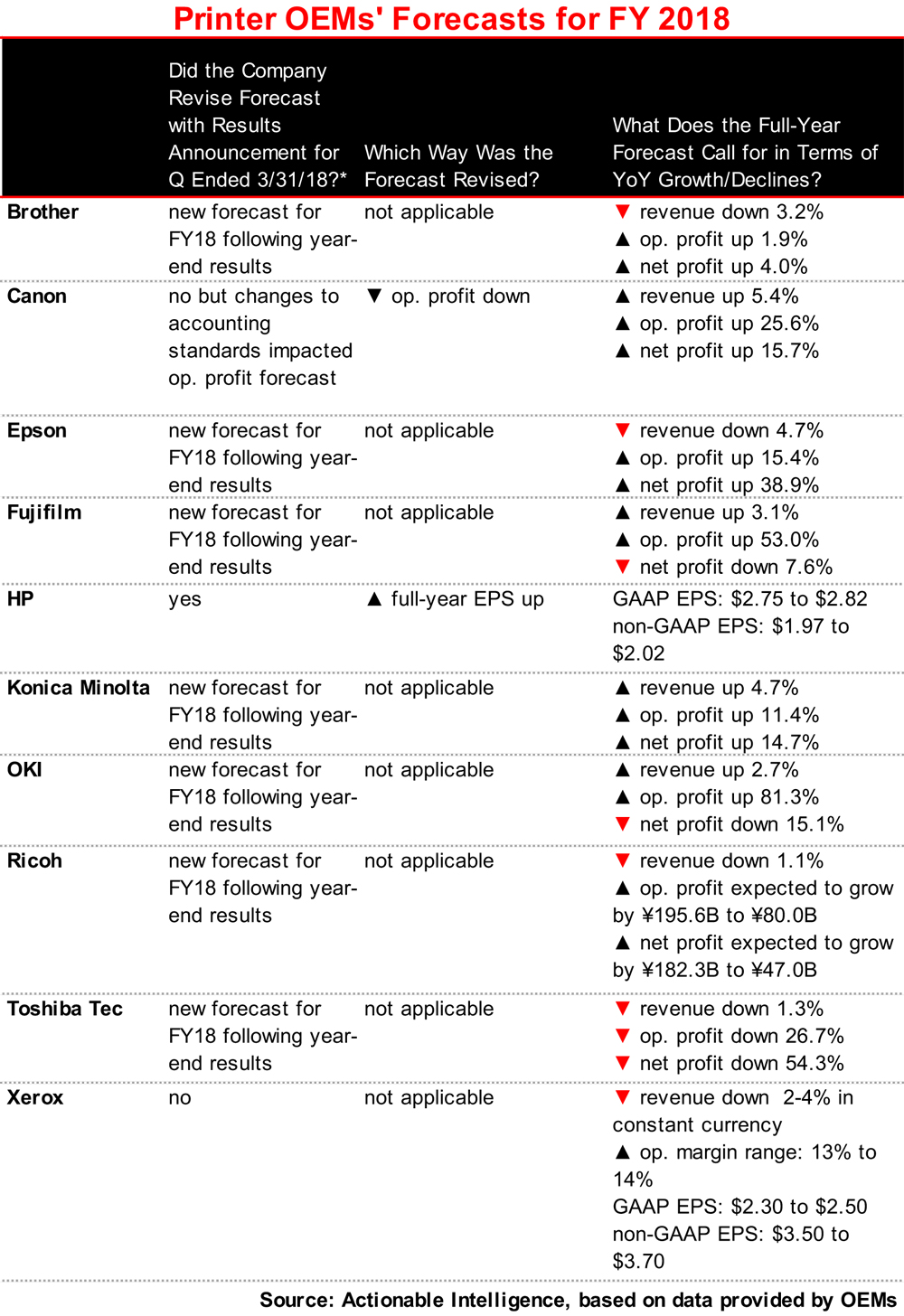

- Of the 10 major OEMs we track, seven (Brother, Epson, Fujifilm, Konica Minolta, OKI, Ricoh, and Toshiba Tec) provided their first forecasts for fiscal 2018. Of these firms, the only one to project increases in revenue, operating profit, and net profit in the year ahead is Konica Minolta. Brother, Epson, and Ricoh expect to see revenue declines but operating and net profits improve. Fujifilm and OKI anticipate growth in revenue and operating profit but decreases in net profit. Toshiba Tec expects across-the-board decreases in revenue, operating profit, and net profit.

- Buoyed by its strong first half, HP raised its full-year guidance for earnings per share (EPS).

- Canon reaffirmed its outlook; however, the firm revised some accounting standards that will shave off some of its operating income compared to its last forecast.

- Due to all the turmoil at Xerox, that OEM declined to provide guidance for the year ahead—sort of. The firm noted that if not for recent events it would have affirmed its previous full-year guidance, which is shown in the table above.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.