As those in the aftermarket supplies business know all too well, printer OEMs have been filing a growing number of patent-infringement lawsuits against compatible makers they perceive as infringing their intellectual property (IP). If OEMs are using patents as a shield to protect their IP, the OEMs’ patent-infringement lawsuits are the sword that the OEMs are wielding to win back market share from compatible makers. But patent-infringement suits are not the only difficulty facing compatible makers today.

As consumers print fewer and fewer pages on their inkjet devices, inkjet printer OEMs have increasingly shifted their focus to targeting business customers. To woo these higher-volume users, inkjet printer makers are improving the performance of their inkjets and equipping them with high-yield cartridges that feature innovative structures and ink-controlling technology. While such cartridge designs improve printer performance, they also have the added benefit for the OEMs of making it increasingly difficult to develop compatibles, a strategy that enables OEMs to win back share from the aftermarket. Below, we look at some examples of how the major inkjet manufacturers are changing their inkjet cartridge designs.

HP

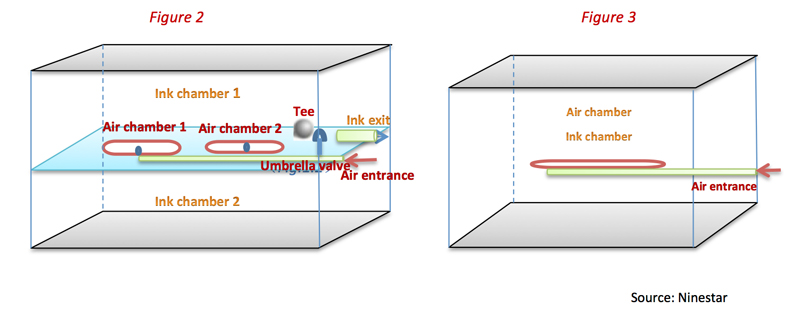

HP introduced the HP 564- and HP 920-series inkjet cartridges in 2008. These cartridges featured complicated chip encryption but a relatively simple structural design, with sponge ink-controlling technology (see Figure 1). The aftermarket was able to quickly develop compatibles due to the simple structure of the cartridges, although these compatibles initially lacked a fully functional third-party chipset. It took the aftermarket longer, roughly two years, to decode HP’s chip and develop a compatible chip, but once this happened the aftermarket share for these HP cartridge families grew rapidly.

HP introduced the HP 564- and HP 920-series inkjet cartridges in 2008. These cartridges featured complicated chip encryption but a relatively simple structural design, with sponge ink-controlling technology (see Figure 1). The aftermarket was able to quickly develop compatibles due to the simple structure of the cartridges, although these compatibles initially lacked a fully functional third-party chipset. It took the aftermarket longer, roughly two years, to decode HP’s chip and develop a compatible chip, but once this happened the aftermarket share for these HP cartridge families grew rapidly.

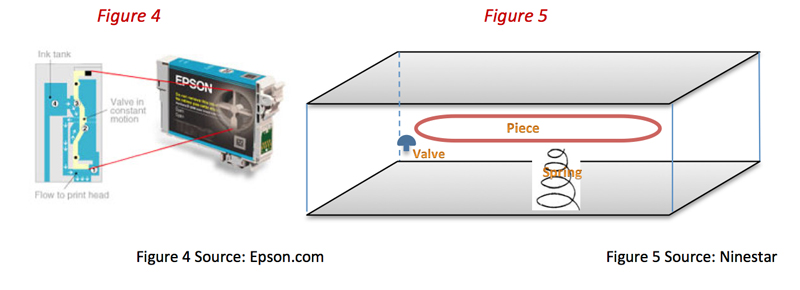

HP learned its lesson. From late 2011 on, HP has released a slew of business inkjet printers featuring new ink tanks. For the low end of the business printing market, HP rolled out new products using the HP 932 cartridge series (see “HP Uses New Supplies in Refreshed Officejet Inkjets”). HP’s “middle market” business printing products use the HP 950 ink tank family (see “New HP Officejet Pro Products Feature New Ink Set and Consumables”), and the firm’s high-end Officejet Pro X series use the HP 970/971 ink SKUs (see “HP’s Groundbreaking Officejet Pro X Units Start Shipping”). While these business inkjet products are marketed to different customers, they share one similarity—a complex inkjet cartridge design (see Figures 2 and 3).

HP’s new ink tank structure has a complicated ink-feeding method, more internal parts, and a closer connection between the print head and the ink tank. These features of HP’s design have a negative effect on compatible makers, especially the issue of how the ink tank connects to the printer, which has become a key technical difficulty for compatible makers to overcome.

Epson

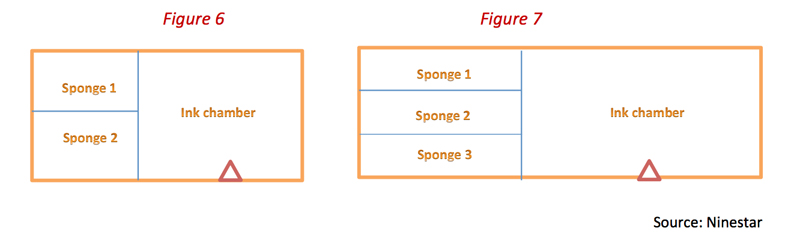

Before 2012, Epson was using its mature Integrated Circuit (IC) chip, MicroPiezo ink sensor, and ink valve structure on its inkjet cartridge designs (see Figure 4). But Epson began employing a different strategy with its inkjet products for the home and business market starting in 2012. The OEM’s newest inkjet cartridges for home users maintain the same basic structure but no longer use the MicroPiezo ink sensor to save on cost. On the other hand, Epson’s newer ink tanks for business inkjet devices employ a more complicated structure (see Figure 5), just as HP’s cartridges do. The more complicated technical structure of the Epson cartridges has made compatible makers’ jobs that much harder.

Canon

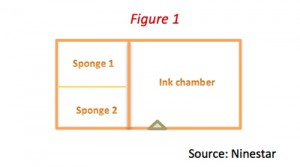

Canon’s inkjet strategy is different than either HP’s or Epson’s. While HP and Epson are targeting business users with their inkjet devices, Canon is not. Instead, the company’s lineup is aimed more at end users interested in photo printing, but like its competitors Canon has revamped its cartridge designs. In 2012, Canon announced new inkjet products that employ the new Canon PGI-250/CLI-251-series ink tanks (see “Canon Launches New Generation of Ink Tanks in PIXMA Printers”). This design features a closer connection between the ink tank and print head due to an enlarged ink exit port. Canon also changed its ink-controlling system from a two-sponge to a three-sponge design (see Figures 6 and 7).

Brother

Brother has carved a niche for itself in the A3 inkjet market. The firm’s previous inkjet cartridges had a light-shielding plate that aided in detecting the ink volume remaining in the cartridge. Starting in 2012, Brother began introducing products based on the LC101/LC103/LC105/LC107/ LC109 family of ink tanks see “Brother Expands Inkjet Portfolio with New Business Smart Units” and “Brother Announces Work Smart Family of SOHO-Oriented Inkjet All-in-Ones”). This newer ink tank design not only featured a set light-shielding plate but also an intelligent chipset. The new design has proven more difficult for compatible makers.

OEM Cartridge Changes Separate the High-End Compatible Maker from the Low-End

All the above examples illustrate that as inkjet OEMs focus on the business printing market, they are investing more to develop new, complex inkjet cartridge structures. OEMs are promoting that their latest inkjet systems offer benefits in output quality and durability, page yield, and cost-per-page for business users, but the increasingly complex cartridge designs also benefit OEMs by placing another stumbling block in front of compatible makers looking to develop their own versions of these newer cartridges. The latest OEM inkjet cartridge designs place even more of a burden on an aftermarket that is already feeling great pressure due to the prevalence of patent-infringement lawsuits.

At present, most compatible manufacturers have little of their own patented technology and even less innovation. The compatible industry is rife with unethical clone makers that simply knock off OEMs’ original and patented designs. This saves clone makers research and development (R&D) costs and allows them to offer ultra-low-priced products. Of course, these low-priced products come at a huge potential cost to customers, as many of these cartridges blatantly infringe OEM patents. The market is also filled with compatible makers that can produce products of adequate quality as long as the OEM inkjet cartridge design is simple but that lack the expertise and resources to produce high-quality compatibles for today’s complex inkjet cartridge designs.

At Ninestar, we see OEMs’ increasingly complex inkjet cartridge structures as a challenge and an opportunity. Just as OEM lawsuits are targeting unethical clone makers, OEMs’ more complicated cartridge designs are helping to separate high-quality compatible makers that have the R&D and IP expertise to develop their own, patented, non-infringing solutions from makers of low-end compatibles and clones. In this respect, the rise of business inkjet printing is becoming an important divider in the third-supplies industry. The high-end compatible players will blaze a path forward, releasing non-infringing consumables based on proprietary intellectual property and strong technological innovation; low-end players may find their business comes to a dead end; and clone makers may find themselves driven out of business by patent-infringement lawsuits. Cartridge resellers are advised to choose a supplier that can meet the challenges posed by OEMs’ changing inkjet strategy.