Printer and copier OEMs have now finished announcing their financial results for the quarter ended on June 30, 2016. For all the Japanese OEMs, except for Canon, this period is the first quarter of the fiscal year that will end March 31, 2017. For Canon and U.S.-based OEMs Lexmark and Xerox, this period is the second quarter of the fiscal year that will end on December 31, 2016. HP Inc. uses a different structure for its fiscal quarters and fiscal years than these other companies, so the results discussed here for HP are for its second quarter, which ended on April 30, 2016. HP is slated to report is third-quarter financial results at the end of August.

Printer and copier OEMs have now finished announcing their financial results for the quarter ended on June 30, 2016. For all the Japanese OEMs, except for Canon, this period is the first quarter of the fiscal year that will end March 31, 2017. For Canon and U.S.-based OEMs Lexmark and Xerox, this period is the second quarter of the fiscal year that will end on December 31, 2016. HP Inc. uses a different structure for its fiscal quarters and fiscal years than these other companies, so the results discussed here for HP are for its second quarter, which ended on April 30, 2016. HP is slated to report is third-quarter financial results at the end of August.

Actionable Intelligence currently covers financial results from traditional printer and copier OEMs including Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Lexmark, OKI, Ricoh, and Xerox. Our coverage goes beyond the press release and company talking points to look at what is really going on in each company’s printer/MFP business and why. Our posts on financial results are typically posted on the same day or within a day or two of the results announcement. Click on any of the company names above to see how these printer OEMs performed in their most recent quarter (note the full article is available only to subscribers).

Key takeaways from printer OEMs’ latest financial results are as follows:

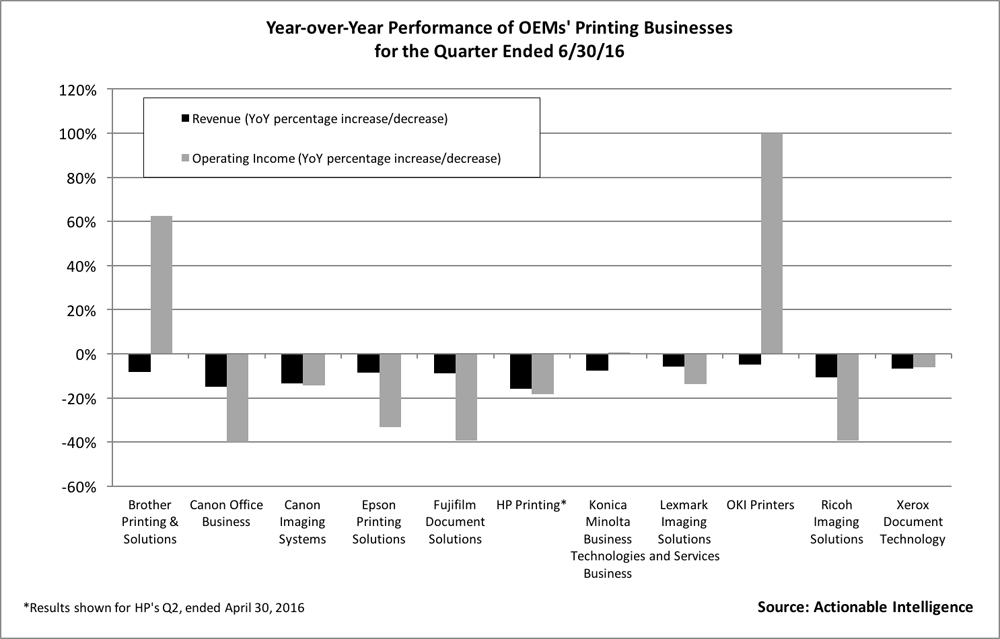

- It is shaping up to be another lousy year. In their most recent quarterly results, all OEMs’ printer businesses posted year-over-year declines in revenue, and all but two reported decreases in segment operating income as well (see chart; click to expand). Bear in mind that the year-ago period to which OEMs are comparing their results was not great for most firms, with many posting declines in operating profit in their printing businesses. Only Brother and OKI reported increases in operating income in their printer businesses for the quarter ended in June.

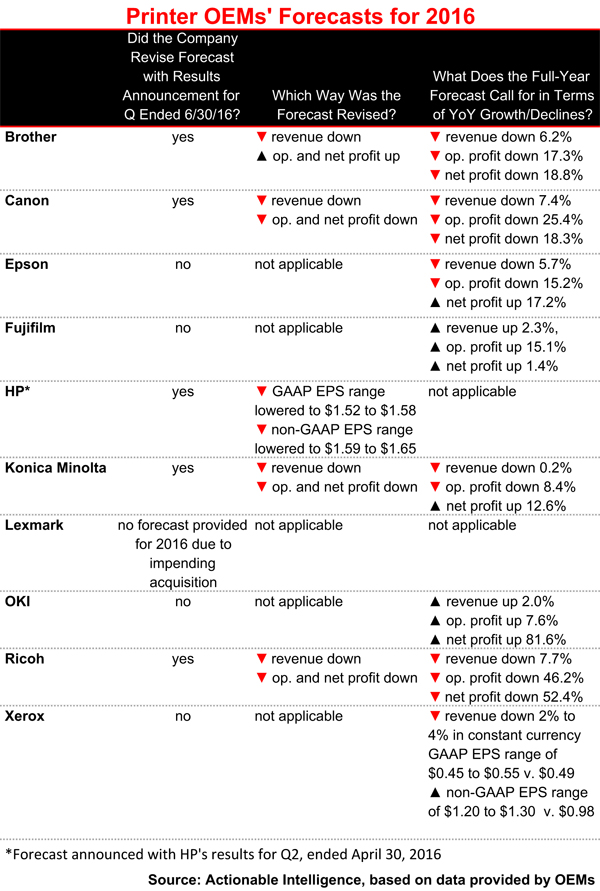

- Most OEMs are forecasting declines in revenue and profits for the current fiscal year, although there are exceptions. Of the 10 OEMs whose financials Actionable Intelligence follows, five adjusted their forecasts when announcing their latest quarterly results, and nearly all of these adjustments were downward (see table below).

- The yen’s appreciation is having a serious negative impact on Japanese OEMs’ financial results. The yen was already expected to appreciate this year, but the Brexit, British voters’ decision in June to withdraw from the European Union, caused big currency fluctuations and a sudden appreciation in the yen (see “Brexit Woes Expected to Impact Printer OEMs”). The fluctuation in the value of the yen was one of the major reasons for all the forecast revisions this quarter.

- Economies in emerging markets such as China, Southeast Asia, Latin America, and Russia have stagnated. This is causing demand to shrink for certain categories of printers and MFPs. Some OEMs have been more affected than others. Canon has been hit hard, but Fujifilm reports increased sales volume for both monochrome and color models in Asia-Oceania, including steady growth in China.

- Despite all the doom and gloom, there are bright spots in the industry. Vendors such as Canon, Konica Minolta, and Xerox are seeing growth in demand for A3 color MFPs. Epson’s high-capacity ink tank business continues to perform well, and office inkjet is a growth area highlighted by most vendors, including Canon, Epson, and HP. Managed print services (MPS) revenue is continuing to grow among those vendors that break out this segment of their business separately.

If you want the most up-to-date information on printer OEMs’ performance, subscribe to Actionable Intelligence. Our smart, timely, accurate analysis is available only to subscribers. For more information on subscribing, view our Membership Options page.

2 Comments

Great analysis! And I especially liked how you ended it with a sales pitch for Actionable Intelligence.

I believe that is officially called a “call to action”! All us Action-Intell folks miss you, Jim! I still recall your HCSJ article on the Romanian remanufacturers’ drinking game/remanufacturing contest with fondness. Best article ever!

–Christina Bonadio, Executive Editor, Actionable Intelligence