At the end of April and throughout the first half of May, printer and copier OEMs reported quarterly financial results for the three-month period ended on March 31, 2017. For all the Japanese OEMs, except Canon, this period also marked the end of their fiscal year. For Canon and Xerox, this period was the first quarter of the fiscal year that will end on December 31, 2017. HP is on a different financial calendar than all the other OEMs. Its second quarter ended on April 30, 2017.

At the end of April and throughout the first half of May, printer and copier OEMs reported quarterly financial results for the three-month period ended on March 31, 2017. For all the Japanese OEMs, except Canon, this period also marked the end of their fiscal year. For Canon and Xerox, this period was the first quarter of the fiscal year that will end on December 31, 2017. HP is on a different financial calendar than all the other OEMs. Its second quarter ended on April 30, 2017.

Actionable Intelligence currently covers financial results from traditional printer and copier OEMs including Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, OKI, Ricoh, Toshiba Tec, and Xerox. Fujifilm, however, has yet to report financial results for the fourth quarter and fiscal year ended on March 31. The firm is investigating accounting irregularities related to its New Zealand subsidiary and has stated its results will be available sometime in June (see “Fujifilm Accounting Probe Pushes Release of FY 2016 Results to June”). Our detailed coverage of how these companies are performing is available only for Actionable Intelligence subscribers.

Key takeaways from these companies’ most recent financial quarters are as follows.

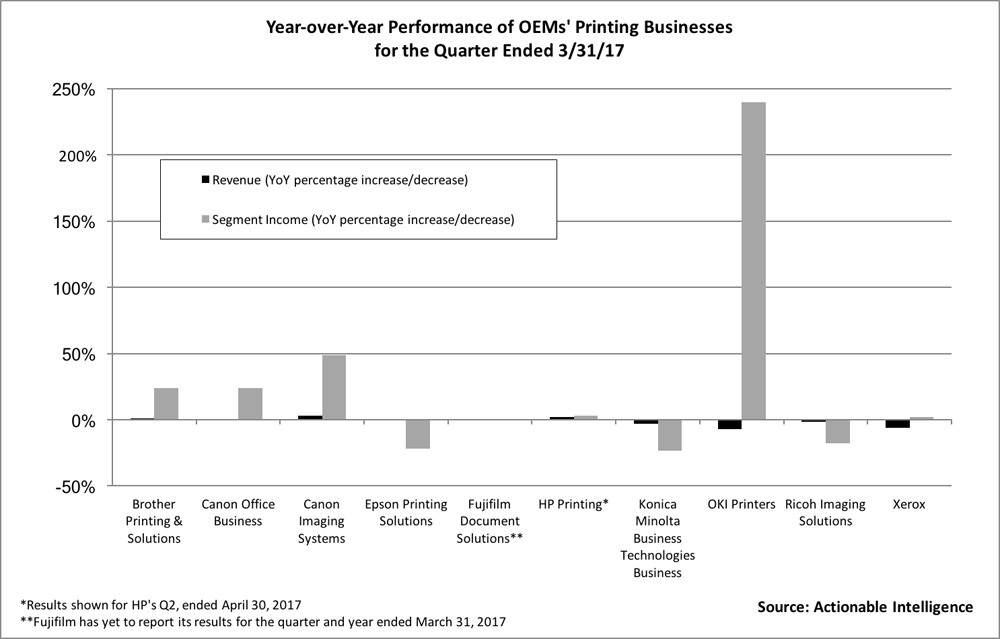

- Last quarter, when we showed the year-over-year revenue and income performance of OEMs’ printing segments, not a single vendor showed year-over-year growth in revenue or income in their printing businesses (see “The Big Picture: OEM Financials for the Quarter Ended in December”). Happily, that changed in the most recent quarter. The big winners this quarter—meaning firms with printing businesses reporting both revenue and segment income growth—are Brother, Canon, and HP. On the other end of the spectrum, Konica Minolta’s and Ricoh’s printing businesses both reported year-over-year declines in revenue and segment income. Epson posted very modest revenue growth in Printing Solutions and a decline in segment income, while OKI’s Printers business reported a revenue decline but a big—at least in percentage terms—increase in segment profit.

- Unfavorable currency exchange remained a factor—especially for Japanese OEMs. However, the effect was less pronounced than it was throughout earlier quarters, easing the pressure on some OEMs.

- All the OEMs posting year-over-year improvements in their printing businesses are benefiting from a soft comparison: the year-ago quarter was a bad one for the printer and supplies industry.

- Both HP and Canon are seeing an uptick in demand in laser printers/MFPs compared with the year-ago period. Canon, of course, is HP’s manufacturing partner for the A4 laser hardware and some of the A3 hardware it sells through traditional channels. Brother, too, reported an uptick in demand for laser hardware, and Xerox saw increased installs of both monochrome and color entry (A4) hardware.

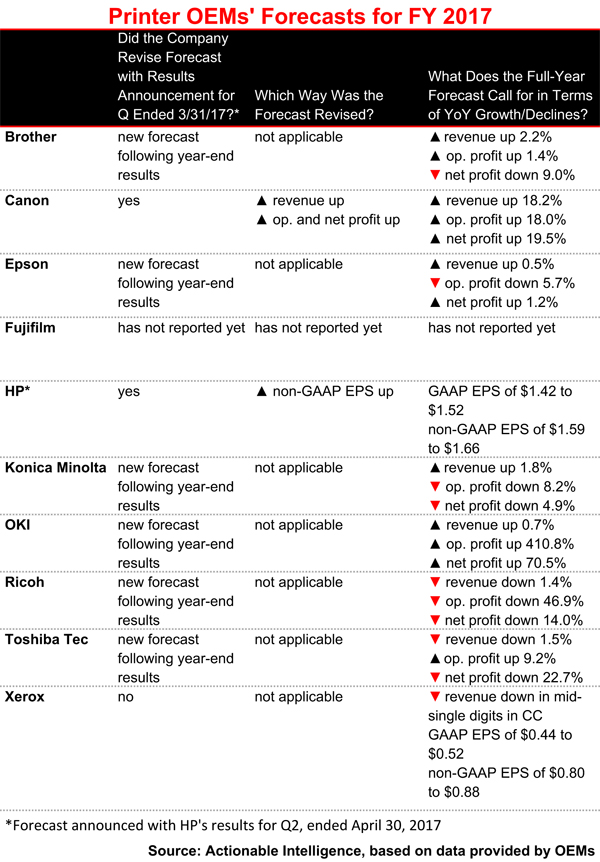

- Meanwhile in the inkjet market, while the traditional cartridges-based consumer inkjet market continues to decline, some vendors, including, Brother, Canon, and Epson said they are seeing growing sales of more profitable models, such as devices that use large refillable ink tanks.

- When looking at vendors’ full-year forecasts, most Japanese OEMs were issuing their very first forecasts for the year ending in March 2018. Most seem to expect a mixed year; however, OKI expects modest revenue growth and big growth in profits. OKI has announced a new turnaround plan in pursuit of this goal (see “OKI Announces Mid-Term Business Plan, Further Printers Business Changes”). Ricoh’s forecast is probably the most downbeat, calling for a modest revenue decrease but some pretty significant declines in profits.

- We did see some positive revisions to outlooks this quarter. Canon raised its outlook and now projects significant year-over-year revenue and income growth, while HP raised its outlook for non-GAAP EPS.

If you want the most up-to-date information on printer OEMs’ performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.

Note for readers: Toshiba Tec is not included in our chart comparing quarterly performance of vendors’ printing businesses because it does not break out three-month results. Note also that this chart now shows results for Xerox as a whole rather than a printing segment because essentially the company’s entire business now is a printing business following the split from Conduent. Xerox stopped reporting results separately for Document Technology with its latest quarterly announcement.