At the end of July and throughout August, printer and copier OEMs reported quarterly financial results for the three-month period ended on June 30, 2017. For all the Japanese OEMs, except Canon, this period marked their fiscal first quarter. For Canon and Xerox, this period was the second quarter of the fiscal year that will end on December 31, 2017. HP is on a different financial calendar than the other OEMs. Its third quarter ended on July 31, 2017.

At the end of July and throughout August, printer and copier OEMs reported quarterly financial results for the three-month period ended on June 30, 2017. For all the Japanese OEMs, except Canon, this period marked their fiscal first quarter. For Canon and Xerox, this period was the second quarter of the fiscal year that will end on December 31, 2017. HP is on a different financial calendar than the other OEMs. Its third quarter ended on July 31, 2017.

Actionable Intelligence currently covers financial results from traditional printer and copier OEMs including Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, OKI, Ricoh, Toshiba Tec, and Xerox. Our detailed coverage of how these companies are performing is available only for Actionable Intelligence subscribers.

Key takeaways from these companies’ most recent financial quarters are as follows.

- Interestingly, both Konica Minolta and Ricoh changed how they segment their printing businesses with the start of the current fiscal year. And both companies did so in a similar way, essentially taking what had been subsegments of their main printing segments and making them segments. Thus, Konica Minolta’s Business Technologies Business was divided into the new Office Business and the Professional Print Business. Ricoh’s former Imaging and Solutions segment became the Office Printing, Office Service, and Commercial Printing segments. We believe the companies have similar goals—to highlight growth in areas outside their traditional office MFP businesses.

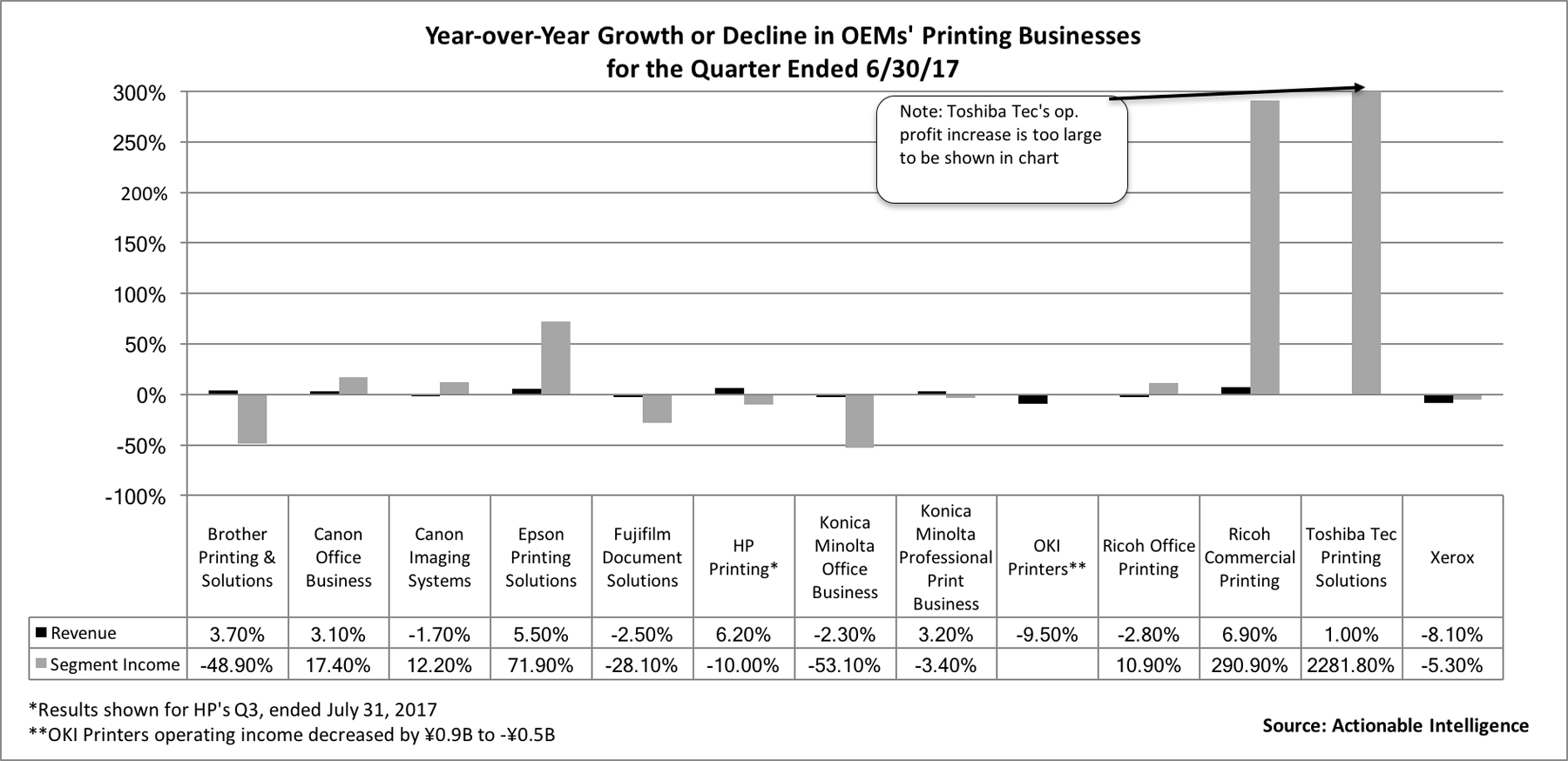

- When we reported on the performance of OEMs’ printing businesses for the quarter ended in March (see “The Big Picture: OEM Financials for the Quarter Ended in March”), we noted that the quarter was a better one for most vendors than the previous quarter in which not a single vendor showed year-over-year growth in revenue or income in their printing businesses (see “The Big Picture: OEM Financials for the Quarter Ended in December”). The quarter ended in June showed similar positive trends for many OEMs (see chart below; click to expand):

- Canon’s Office Business, Epson’s Printing Solutions business, Ricoh’s Commercial Printing business, and Toshiba Tec’s Printing Solutions business all posted growth in both revenue and operating income in the quarter.

- Brother’s Printing and Solutions business, HP’s Printing business, and Konica Minolta’s Professional Print Business reported revenue growth but a decrease in operating income. Meanwhile, Canon’s Imaging Systems business and Ricoh’s Office Printing business posted decreased revenue but increased operating income.

- The printing business that reported both decreased revenue and operating profit include Fujifilm’s Document Solutions segment, OKI’s Printers segment, and Xerox.

- Japanese OEMs are benefiting from more favorable currency exchange rates than in the year-ago period.

- All the OEMs posting year-over-year improvements in their printing businesses are benefiting from a soft comparison: the year-ago quarter was a bad one for the printer and supplies industry.

- OEMs’ outlooks for the fiscal year ahead seem to be improving. Certain Japanese OEMs, in particular, raised their full-year forecasts citing the yen’s depreciation and improving global economic conditions. Of the 10 vendors whose forecasts are shown in the chart below, three (Brother, Canon, and Epson) raised their outlooks for revenue and profits, and both HP and Xerox made favorable adjustments to their estimates for GAAP and non-GAAP EPS. Of the OEMs, Ricoh’s forecast remains the glummest.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence. Until September 15, we are offering $100 off new subscriptions using the promo code Summer100.