In late January and throughout February, printer and copier OEMs reported quarterly financial results for the three-month period ended on December 31, 2017. For all the Japanese OEMs, except Canon, this period marked their fiscal third quarter. For Canon and Xerox, this period was the fourth quarter of fiscal 2017. HP is on a different financial calendar than the other OEMs. Its first quarter closed on January 31, 2018.

In late January and throughout February, printer and copier OEMs reported quarterly financial results for the three-month period ended on December 31, 2017. For all the Japanese OEMs, except Canon, this period marked their fiscal third quarter. For Canon and Xerox, this period was the fourth quarter of fiscal 2017. HP is on a different financial calendar than the other OEMs. Its first quarter closed on January 31, 2018.

Actionable Intelligence currently covers financial results from traditional printer and copier OEMs including Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, OKI, Ricoh, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available for Actionable Intelligence subscribers.

Key takeaways from these companies’ most recent financial quarters are as follows.

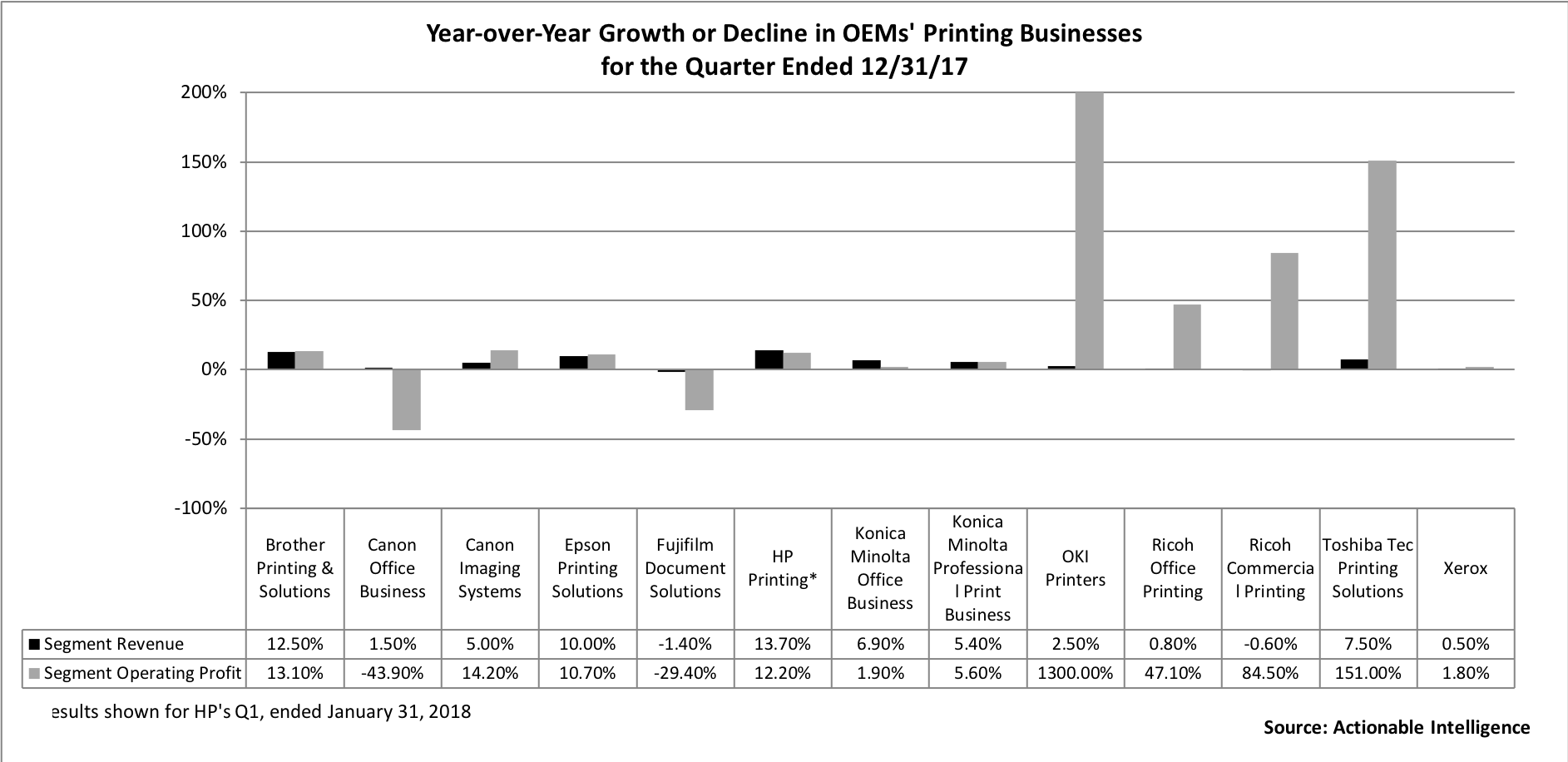

- Throughout 2017, most OEMs have posted improvements in their quarterly results after a very tough fiscal 2016. That trend continued and gained momentum in the fourth calendar quarter ended in December. In their most recently quarterly results, most OEMs posted improvements in their printing and consumables businesses, aided by more favorable currency exchange, an easy comparison to the year-ago period, and cost-cutting efforts but also to growth in demand in some business segments.

- In the quarter ended in September, Brother’s Printing and Solutions business, Canon’s Imaging Systems business, Epson’s Printing Solutions business, HP’s Printing business, Konica Minolta’s Office and Professional Print businesses, OKI’s Printers business, Ricoh’s Office Printing business, Toshiba Tec’s Printing Solutions business, and Xerox (all of Xerox is now a printing business) posted year-over-year growth in revenue and segment profit. It has been years since we have seen so many OEMs post improvements in their printing businesses. The list of “winners” in the quarter even includes firms that have been posting declines in their printing business for quite some time but managed to turn things around in the quarter just ended—firms like Ricoh and Xerox.

- There were two key printing businesses that posted mixed results. Canon’s Office business posted 1.5 percent revenue growth but a steep 43.9 percent decrease in profits. This, however, was because the company wrote down goodwill associated with the commercial printing business it acquired from Océ seven years ago. If not for this charge, Canon’s Office business would have posted a 25.9 percent increase in profits. Ricoh’s Commercial Printing business saw a 0.6 percent decrease in sales, although profits were up 84.5 percent year-over-year, with the company attributing the sales decline to the cyclical nature of the business.

- The one OEM that posted declines in both revenue and profits in its printing business this quarter was Fujifilm. The firm’s Document Solutions business posted a 1.4 percent decrease in revenue and a 29.4 percent decrease in profits. Fujifilm attributed the downturn to lower sales of office products and printers in Japan and Oceania.

- Xerox’s strong Q4 and Fujifilm’s tough Q3 were overshadowed by some bigger news. The two companies announced a plan for Fujifilm to acquire just over half of Xerox shares and combine Xerox and Fuji Xerox (see “Fujifilm to Buy Majority Share in Xerox, Combine It with Fuji Xerox Venture”). The deal, if completed—and that is still an “if” given two of Xerox’s biggest investors vociferous objections to the merger plan—would be the biggest example of consolidation that the industry has seen yet and would create a printing behemoth to rival HP in terms of overall size.

- HP had a particularly good quarter, delivering the highest year-over-year revenue growth in its Printing business since its turnaround began in its fiscal Q2 2017. Supplies revenues grew 10.4 percent. One big factor driving HP’s growth in the quarter ended in January was its acquisition of Samsung’s printing business. This was the first quarter that reflected the inclusion of the Samsung acquisition. HP emphasized its results would have been positive even without the Samsung acquisition. Still, the firm got an undeniable boost from Samsung’s inclusion. For example, HP said the acquisition contributed 6 points to its supplies revenue growth in the quarter, and the firm posted a 73 percent increase in commercial hardware units in the quarter now that the firm moved all Samsung units to its commercial segment.

- While HP posted big increases to its commercial hardware segment, other firms also saw improvements in their laser businesses. Brother said it saw strong global laser printer sales, including creased demand for compact monochrome laser printers aimed at SOHO users and strong sales of color laser printers in the United States and Western Europe. Canon saw increased demand for color laser printers and A3 office multifunction devices. Xerox finally saw its investment in its latest ConnectKey platform pay off in the form of increase installs for entry A4 MFDs and midrange A3 devices.

- In the inkjet market, sales of cartridge-based devices continue to decline, but every single vendor that markets refillable ink tank printers (also known as continuous ink supply system or CISS printers or high-capacity ink tanks printers) reported growth in this category in emerging markets. This includes Brother, Canon, HP, and Epson, the company that founded the category.

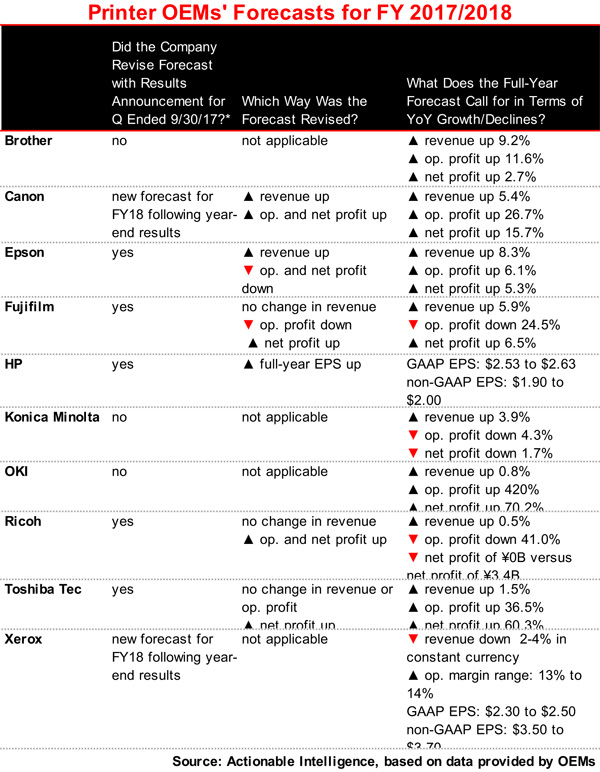

- Of the 10 major OEMs we track, two—Canon and Xerox—provided their first forecasts for fiscal 2018. Canon’s forecast is rosy, calling for 5.4 percent revenue growth and double-digit profit increases. Xerox’s is less so; the firm expects revenue to continue to decline in constant currency. However, Xerox expects more moderate revenue declines last year and a slightly higher operating margin range for the year.

- Five OEMs, including Epson, Fujifilm, HP, Ricoh, and Toshiba Tec, adjusted their full-year forecasts. HP raised its EPS estimates. Ricoh, whose cost-cutting efforts are progressing well, raised its outlook for operating and net profit. Toshiba Tec, too, raised its guidance for net profits. Epson lowered its full-year operating and net profit forecast, while Fujifilm lifted its outlook for net profits but lowered its outlook for operating profits.

- Those firms whose fiscal year ends in March are generally expecting a good year, although some have better outlooks than others. Brother, Epson, OKI, and Toshiba Tec all expect to report full-year revenue and operating and net profit growth. Fujifilm expects to report revenue and net profit growth but a decline in operating profit. Konica Minolta and Ricoh anticipate revenue increase but operating and net profit decreases.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.