At the end of July and throughout August, printer and copier OEMs reported quarterly financial results for the three-month period ended on June 30, 2019. For all the Japanese OEMs, except Canon, this period was the first quarter of the fiscal year ending March 31, 2020. For Canon and U.S.-based Xerox, this period was the second quarter of the fiscal year that will end on December 31, 2019. HP is on a different financial calendar than all the other OEMs. Its third quarter ended on July 31, 2019.

At the end of July and throughout August, printer and copier OEMs reported quarterly financial results for the three-month period ended on June 30, 2019. For all the Japanese OEMs, except Canon, this period was the first quarter of the fiscal year ending March 31, 2020. For Canon and U.S.-based Xerox, this period was the second quarter of the fiscal year that will end on December 31, 2019. HP is on a different financial calendar than all the other OEMs. Its third quarter ended on July 31, 2019.

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available for Actionable Intelligence subscribers.

Key takeaways from OEMs’ most recent financial quarters are as follows.

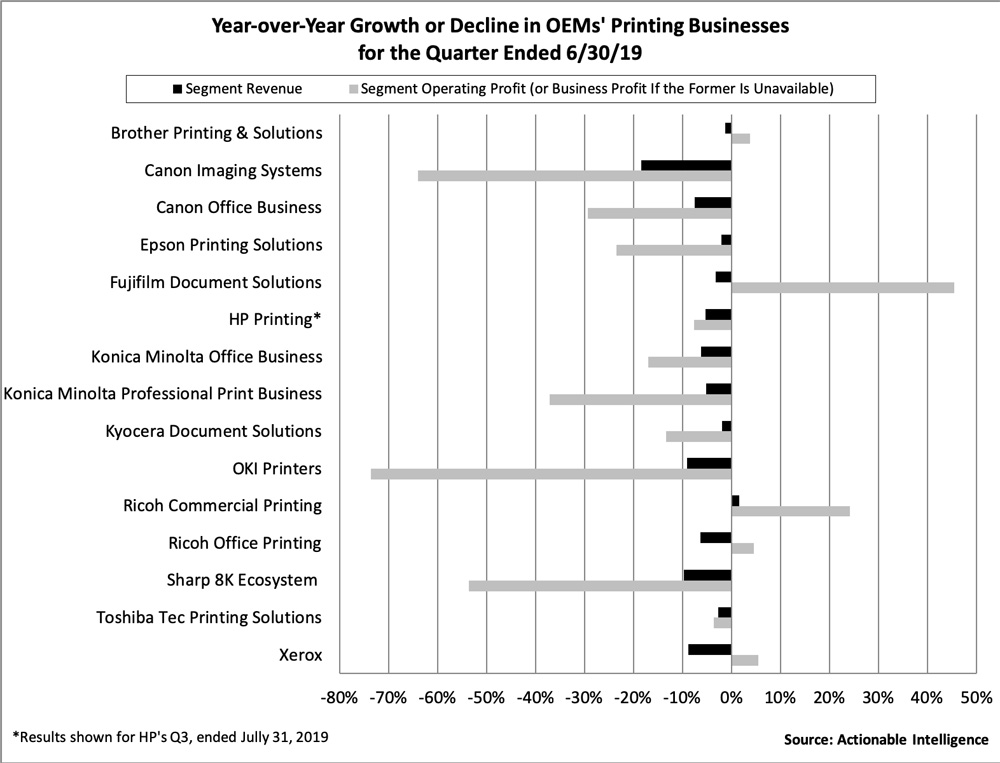

- The challenging market conditions that we saw in the quarter ended in March 2019 continued and indeed worsened in the quarter ended in June 2019. With very few exceptions, OEMs’ printer businesses reported declines in both revenue and profits. Most OEMs reported that their printing businesses were negatively impacted by U.S./China trade friction and a resulting slowdown in the Chinese market. Certain OEMs expressed concern about Europe’s economy as well. There seems to be growing concern that while the overall world economy continues to expand, driven in part by growth in the United States, this could change and there is the potential for a period of contraction.

- In the quarter ended in June 2019, the list of “winners”—firms whose printing businesses posted both revenue and operating income growth year-over-year—included only Ricoh’s Commercial Printing business. That is one of the smallest rosters of firms reporting growth we have seen in some time.

- The list of OEMs reporting a mixed quarter included Brother’s Printing and Solutions business, Fujifilm’s Document Solutions business, Ricoh’s Office Printing business, and Xerox. All these firms reported that these printing businesses saw revenue decline but segment profits increase. That is a sign of a very mature industry that is trying to wring profits from shrinking divisions by cost-cutting, adjusting product mixes, and other efforts aimed at maintaining margins.

- With this latest quarter, more OEMs are reporting both revenue and profit declines in their printing businesses. Printing businesses that posted downturns in both revenue and profit included Canon Imaging Systems, Canon Office, Epson Printing Solutions, HP Printing, Konica Minolta Office, Konica Minolta Professional Print, Kyocera Document Solutions, OKI Printers, Sharp 8K Ecosystem, and Toshiba Tec Printing Solutions. (Note, however, that Sharp 8K Ecosystem is a new segment that includes lots of other businesses besides MFPs.) Many of these segments reported steep double-digit declines in profits.

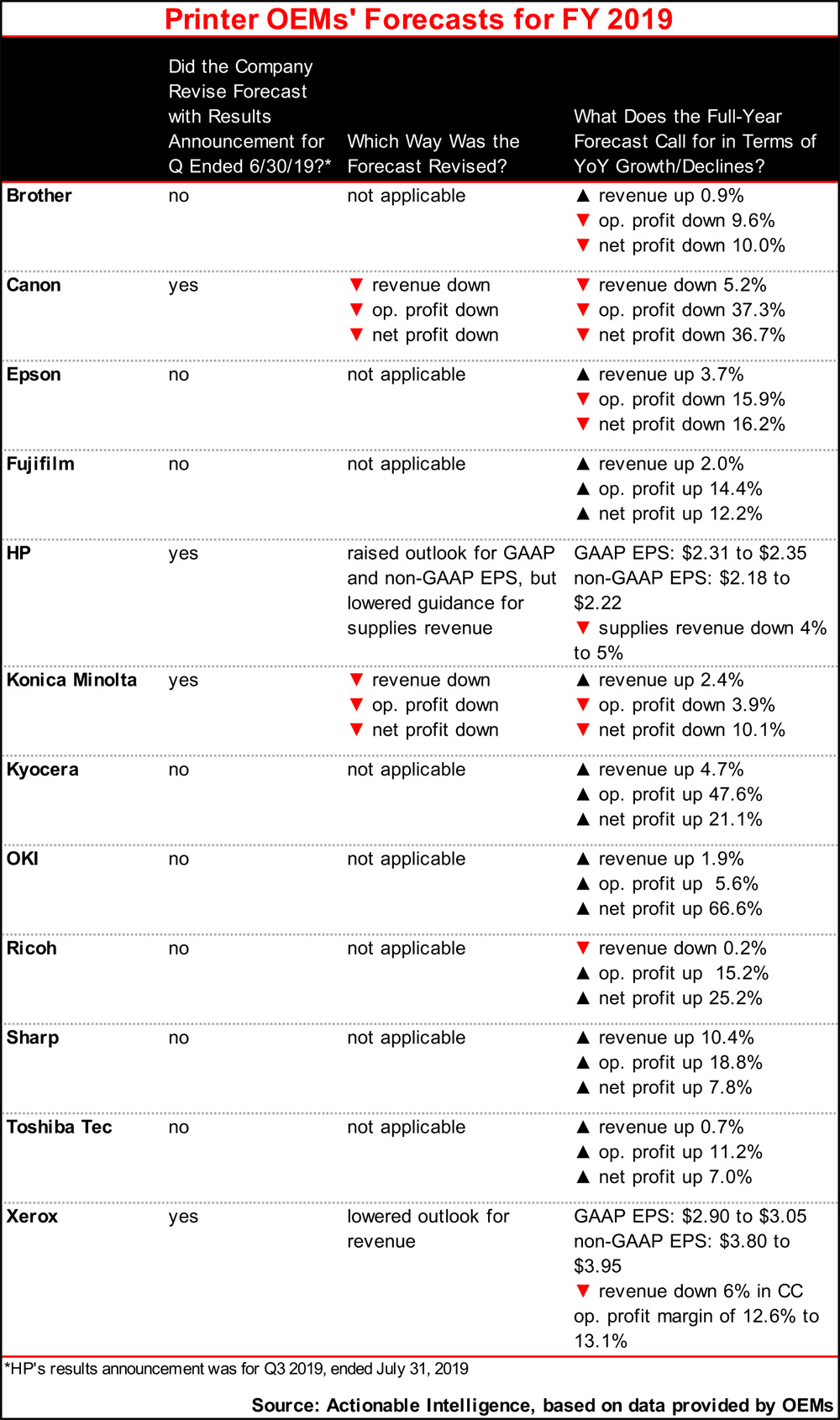

- Of the 12 major OEMs we track, four (Canon, HP, Konica Minolta, and Xerox) made adjustments to their guidance for the remainder of the year ahead. While HP raised its earnings per share (EPS) forecast, it also lowered its outlook for supplies revenue for the year. Xerox lowered its outlook for full-year revenue. Both Canon and Konica Minolta slashed their full-year forecasts pretty drastically. Canon now expects to report a revenue decline and some enormous profit decreases in the year ended in December. Konica Minolta is projecting modest revenue growth and decreased profits in the year ended in March 2020.

- While many OEMs maintained their full-year forecasts, most Japanese OEMs are basing this on only one quarter of results. We expect that we may see more OEMs lowering forecasts in quarters ahead, especially if the trade war worsens and there are more signs that the global economy may slip into recession.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.