In late October and throughout the month of November, printer OEMs announced financial results for the three-month period ended September 30, 2020. The quarter was the third in which printer and MFP makers reported a strong negative impact from the coronavirus (COVID-19) pandemic. The quarter ended in September was not a good one for the industry, to be sure. However, it followed a quarter that many deemed to be the worst in the industry’s history (see “The Big Picture: OEM Financials for the Quarter Ended in June 2020”). In general, most OEMs posted sequential improvements for the quarter ended in September, although results were still down sharply year-over-year.

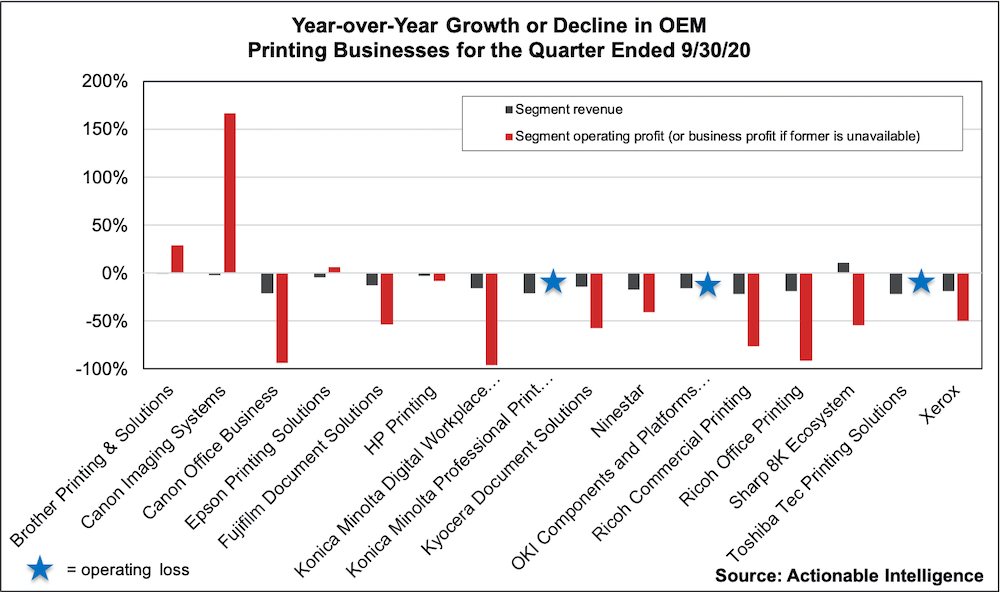

With just two exceptions (Sharp, which combines its printing segment with other business such as TVs, and Brother, whose printing business reported flat revenue), OEMs reported revenue declines in their printing businesses of anywhere from 2.0 percent to 22.1 percent. Those year-over-year declines aren’t great but are better than the revenue declines of 15.4 percent to 39.1 percent reported by OEMs in the previous quarter.

Things were better this quarter compared with the last in terms of printing segment profits as well. Last quarter, just one firm (Epson) reported profit growth in their printing business. This quarter, three firms did. Canon’s Imaging System segment reported a huge uptick in profits, and profits grew for Brother’s and Epson’s printing segments as well. For the quarter ended September 30, 10 segments reported year-over-year declines in profits, but just three segments reported operating losses. That compares with the seven segments that reported operating losses in the quarter ended June 30.

For all the Japanese OEMs, except Canon, the period from July 1 through September 30 was the second quarter of the fiscal year ending March 31, 2021. For Canon, U.S.-based Xerox, and China-based Ninestar, this period was the third quarter of fiscal 2020. HP is on a different financial calendar than all the other OEMs. Its fourth quarter of fiscal 2020 ran from August 1 through October 31, 2020.

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available only for Actionable Intelligence subscribers, but key takeaways from our coverage are summarized below.

Overview

In the quarter ended September 30, those OEMs that offer small-office/home-office (SOHO) printers and MFPs continued to experience upticks in demand for those products due to pandemic-wrought work/study-from-home trends. This mostly meant increased demand for inkjet printers and their consumables. In the previous quarter, most inkjet makers experienced product shortages that limited growth. While shortages remain for some products, the big three inkjet OEMs—HP, Canon, and Epson—all benefited from strong inkjet demand in the quarter. Compared to its rivals, Brother experienced more severe inkjet shortages that left it unable to fulfill demand, so its inkjet sales were down year-over-year. Instead, Brother pushed its lower-priced laser devices as SOHO solutions and experienced some growth in this area of its business.

As was true last quarter, those OEMs focusing mainly on A3 MFPs and production printers and their supplies experienced a stronger negative impact from the pandemic than did firms with robust SOHO printer portfolios. As a result, many traditional copier OEMs rushed to offer dealers and customers work-from-home bundles that include A4 printers/MFPs, but—at least so far—such bundles do not seem to have done much to offset steep declines seen in other areas of their business.

Performance by Vendor

When we look at the performance of OEMs’ printing businesses, there are a few helpful things to keep in mind. We classify all of Ninestar and Xerox as printing businesses. Sharp’s 8K Ecosystem business includes various products in addition to MFPs, including Sharp’s TV business, so the segment’s results don’t necessarily say much about the MFP and supplies business. Similarly, OKI’s new Components and Platforms Business includes its former Printers business, Mechatronics Systems business, and EMS business and thus does not necessarily reveal much about printers and supplies specifically. Canon’s Imaging Systems segment includes its shrinking camera business in addition to its now-booming inkjet business. In other news, Konica Minolta renamed its Office Business unit the Digital Workplace Business. It still includes office and IT service products, only now Konica Minolta is also breaking out its Workplace Hub sales.

As was the case for the quarter ended in June, not a single OEM reported both revenue and profit growth in their printing businesses in the quarter ended in September. Brother Printing and Solutions reported flat revenue and operating profit growth. Two other printing businesses—Canon Imaging Systems and Epson Printing Solutions—reported revenue declines and profit growth. Sharp’s 8K Ecosystem segment also had mixed results in the form of revenue growth but a profit decline. All other printing segments saw revenue and profits shrink, but the year-over-year declines were mostly smaller than in the previous quarter. Also, only three printing businesses (Konica Minolta Professional Print, OKI Components and Platforms, and Toshiba Tec Printing Solutions) had operating losses for the quarter. While that’s not great, seven printing segments reported operating losses in the quarter ended June 30.

We have boiled down the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: In Q2, revenue in Brother’s Printing and Solutions segment was unchanged from the year-ago period—no mean feat amid a pandemic. Moreover, segment profit was up 28.7 percent. The firm reported an increase in sales of laser printer hardware and laser consumables. This was driven by demand for SOHO-class products, as sales of SMB-class laser hardware and their consumables declined due to work-from-home trends. Hobbled by severe product shortages, Brother reported big year-over-year declines in inkjet printer hardware revenue and a modest dip in inkjet consumables revenue. Supply issues for inkjet consumables were improved compared with the previous quarter.

- Canon: Like many vendors, Canon reported steep year-over-year declines in Q3 but sequential improvements. Office segment revenue fell 21.0 percent, while Office profits were down a steep 93.7 percent, but at least the business avoided reporting an operating loss like it did in the previous quarter. Interestingly, while both sales of laser printers and MFDs were down sharply in Q3, laser printers saw bigger revenue declines than MFDs, while in Q2 the reverse was true. Canon noted it saw some recovery in its MFD business. The company’s laser printer business was hurt by a shift toward lower-priced products and a decline in consumables and service sales. In Canon’s Imaging System segment, revenue was down a modest 2.0 percent, and profits were up a whopping 167.0 percent. While Canon’s camera business continued to shrink, its inkjet business saw sharp sales growth of 20.9 percent on increased demand for both inkjet hardware and consumables.

- Epson: In Q2, Epson’s Printing Solutions segment reported a 4.6 percent revenue decline, although revenue improved sequentially. The Printing Solutions business also reported 6.3 percent profit growth year-over-year and even stronger growth sequentially. Inkjet printer revenue was up but not as much as it could have been because Epson, too, continued to be impacted by product shortages. While net sales of office and home inkjet printers were up, sales volumes of these devices were down—mainly for cartridge-based models. Unit sales of high-capacity ink tank printers were flat. Similar to what Brother saw, shortages were worse for hardware than consumables, as inkjet ink revenue was up 7 percent. It was largely improved consumables sales plus rigorous cost-cutting that enabled Epson’s Printing Solutions segment to post improved profits.

- Fujifilm: In Q2, Fujifilm’s Document Solutions segment saw its revenue shrink 12.5 percent from the year-ago period. However, revenue improved from Q1. Segment profits was down 53.6 percent in Q2. Fujifilm said it saw sales volumes of office products such as MFPs improve year-over-year in Japan, China, and other regions, but this was offset by a steep year-over-year drop in sales of consumables stemming from shrinking office print volumes. Net sales and sales volumes for office printers were down sharply.

- HP: While FY 2020 has been a terrible year for all printer vendors, HP closed its year by reporting some improvements and good news in certain subsegments of its Printing business. Printing revenue was down 3.1 percent year-over-year in Q4 but up sequentially. Segment profits were down 8.2 percent. The good news was consumer hardware revenue was up a robust 20.6 percent on an 18 percent uptick in units. Also, the supplies revenue trajectory improved. In Q4, supplies revenue was down just 0.9 percent versus the 18.7 percent plunge in supplies revenue reported in Q3. The commercial hardware segment fared worse—revenue there was down 22.0 percent in Q4 on a 10 percent decline in hardware units.

- Konica Minolta: Konica Minolta, too, reported some rebound in its business in Q2 compared to Q1, although the year-over-year numbers remain quite grim. In the Digital Workplace Business, revenue was down 15.9 percent, and profits were down a steep 96.0 percent compared to the year-ago period. However, at least the Digital Workplace Business remained in the black—in Q1 the segment then known as the Office business reported a big operating loss. The firm said equipment sales of high-speed MFPs were down sharply, especially in the United States, and sales of consumables sagged as office print volumes declined. The Professional Print segment fared even worse—revenue was down 20.9 percent and the group had an operating loss.

- Kyocera: Kyocera’s Document Solutions segment reported a year-over-year revenue decline of 14.0 percent in Q2, although segment revenue improved significantly compared to Q1. While segment profit also improved sequentially, Document Solutions segment profit decreased a steep 57.2 percent year-over-year in Q2. The firm said it saw lower sales of both equipment and consumables.

- Ninestar: Unfortunately, Ninestar shared much less detail with its Q3 financial report than it did with its Q2 report. The firm’s Q3 revenue improved sequentially but was still down 17.1 percent from the year-ago period. We presume that, as was the case in Q2, the big drag on the firm’s business in Q3 was Lexmark, which mainly sells printer equipment and supplies for office environments. One good indicator that this segment continues to be Ninestar’s main problem is that Lexmark announced it will be laying off workers (see “Lexmark Sheds Jobs in the U.S. Due to Pandemic”). Ninestar’s operating profits were worse in Q3 than they were in Q2 as well as down year-over-year. Ninestar’s operating profit was down 40.7 from the year-ago period. Ninestar attributed its profit declines to Lexmark being negatively impacted by COVID-19 and exchange losses on loans Ninestar took out to buy Lexmark.

- OKI: In Q2, OKI officially announced its retreat from the printer business in certain markets. In September, OKI Data Americas announced that starting March 31, 2021, it will no longer distribute printer hardware under the OKI brand to the North, Central, and South American markets (see “OKI Data Americas to Stop Selling Printers in the Americas” and “OKI Data Americas Shares Additional Details on Its Market Exit”). The Components and Platforms segment, in which the printer business is now included, saw net sales shrink 15.8 percent in Q2, but sales did improve sequentially. Profits were down year-over-year and did not improve sequentially. The group reported an operating loss in Q2—and a bigger one than it did in Q1. The firm laid the blame on lower sales in overseas markets but said it saw some improvement in printer consumables sales in Asia.

- Ricoh: Major restructuring initiative are almost always a sign of dire times, and Ricoh—one of the vendors hit hardest by the pandemic—announced it will be adopting a new corporate structure with more independent, autonomous business units starting in FY 2021. But the firm hasn’t adopted this structure quite yet. In its old Office Printing segment, Q2 revenue was 18.6 percent lower than in the year-ago period but improved from Q1. Office Printing profits were slim and down 91.9 percent year-over-year, but that is improved from the operating loss this business posted in Q1. Sales of MFPs were down, and sales of MFP non-hardware were down even more sharply. In contrast, in the laser segment, hardware sales decreased more steeply than did non-hardware sales. Ricoh’s Commercial Printing sales were down 21.6 percent and profits were down 76.3 percent.

- Sharp: Sharp’s 8K Ecosystem segment is the only segment we covered this quarter to report revenue growth. Its revenue was up 10.5 percent year-over-year in Q2, and revenue was up sharply sequentially, but that is largely due to an increase in sales of TVs and panels. The firm said sales of MFPs improved sequentially but were still down year-over-year. The group’s Q2 profits were down 54.1 percent; however, that is better the loss the group reported in Q1. 8K Ecoystem also had a loss in Q4, so this marked the first time the group turned a profit since the pandemic began. The firm said profits were down in the MFP business due to lower print volumes.

- Toshiba Tec: Like other copier vendors, Toshiba Tec has been hit hard by the pandemic, although the firm’s results showed improvement in Q2 compared to the firm’s terrible Q1. In the Printing Solutions segment in Q2, net sales fell 22.1 percent, and the segment posted a loss, albeit a smaller one than in Q1. Toshiba Tec said MFP sales were down overseas, it is focused on reducing fixed costs and structural reforms, and it continues to explore strategic options for its Printing Solutions business.

- Xerox: Like so many others, Xerox posted results that were down compared to the year-ago period but up compared to the prior quarter. In Q3, the firm’s revenue decreased 18.9 percent on a 15.2 percent decrease in equipment revenue and a 20.0 percent decline in post-sale revenue. Operating profit was down 50.0 percent—the decline would have been worse if not for government assistance and furloughs. While sales of midrange and high-end equipment were down year-over-year, Xerox actually was able to grow sales of entry-level equipment on a string uptick in demand for monochrome models—something it was unable to do in the prior quarter.

Forecast Revisions

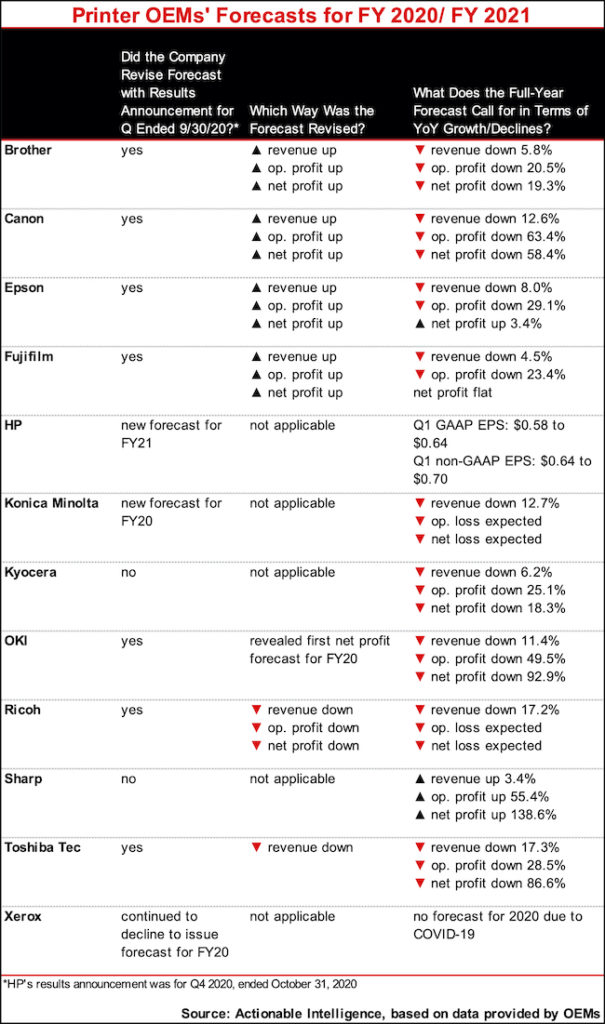

Last quarter, most OEMs finally issued forecasts for FY 2020 after delaying them earlier in the year due to uncertainties surrounding COVID-19. This quarter, Konica Minolta at long last issued its forecast for FY 2020. Xerox continued to decline to provide guidance.

Certain OEMs seem to have felt their results hit a bottom in the quarter ended in June and were encouraged enough by improvements in the quarter ended in September to raise their guidance for the year. Firms lifting their revenue and profit forecasts for FY 2020 included Brother, Canon, Epson, and Fujifilm. Ricoh revised its outlook for revenue and profits downward, and Toshiba Tec cut its revenue forecast.

While some OEMs lifted their forecasts, almost nobody is projecting growth for FY 2020. The only upbeat forecast comes from Sharp, which derives most of its revenue and profits from product categories other than printer equipment and supplies. All other OEMs are projecting steep revenue and profit declines (although Epson expects modest net profit growth).

Want more financial comparisons? We’ve got them! Check out our subscriber-only Actionable Briefing on OEMs’ financial performance this quarter (see “A Battered Print Industry Begins to Show Some Signs of Life”). For information on subscribing to Actionable Intelligence, see our Membership Options page.