In late April and throughout the month of May, printer OEMs announced financial results for the three-month period ended March 31, 2021. The quarter was the fifth since printer and MFP makers began to feel an impact from the coronavirus (COVID-19) pandemic.

This is significant for a few reasons. First and foremost, most OEMs had an easy comparison because the prior year period was one in which OEMs saw steep downturns as a result of the pandemic. Second, despite the easy comparison, most OEMs are seeing improvements in their businesses as customers adapt to the “new normal.” The small-office/home-office (SOHO) printer business is booming due to continued strong consumer demand and the shift to hybrid work environments in which business support workers in the office, at home, or on the go. Moreover, in the quarter just ended, most OEMs saw improved demand for office equipment and better print volumes than in the early days of the pandemic as more workers returned to the office.

Concerns remain about outbreaks and the spread of new coronavirus variants causing new lockdowns—including most recently in some Asian nations. There is also concern that hybrid work means print volumes will never return to pre-pandemic levels. Moreover, in the quarter ended in March, OEMs faced growing pressure from chip shortages and rising costs for chips and other components. OEMs also saw logistics challenges and a big increase in shipping costs (see “Shipping Industry in Chaos Faces Choppy Seas Ahead”).

Still, after a series of dark, dismal quarters, the quarter ended in March brought a ray of light. That light shone more brightly on some than on others, however.

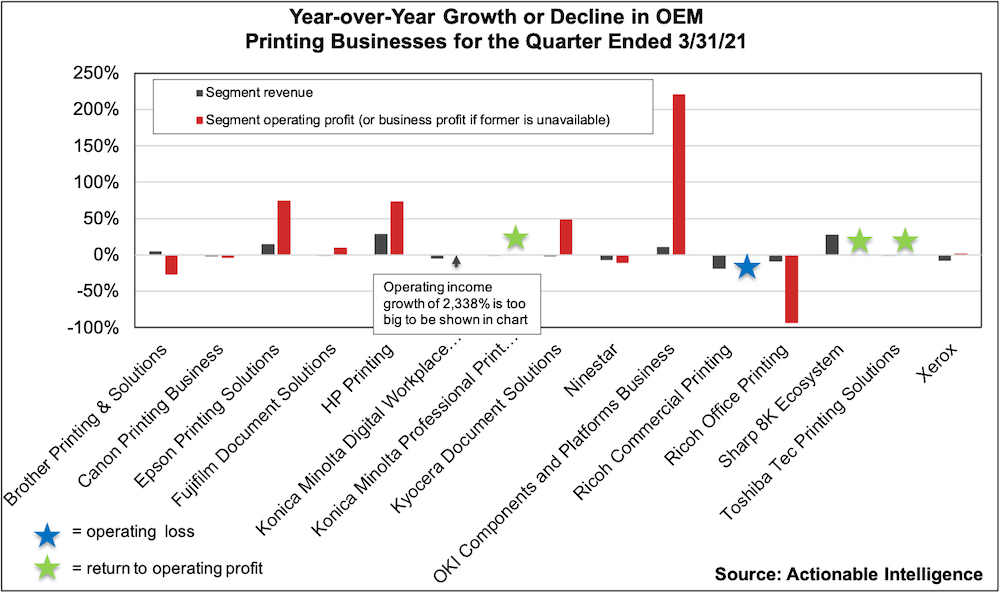

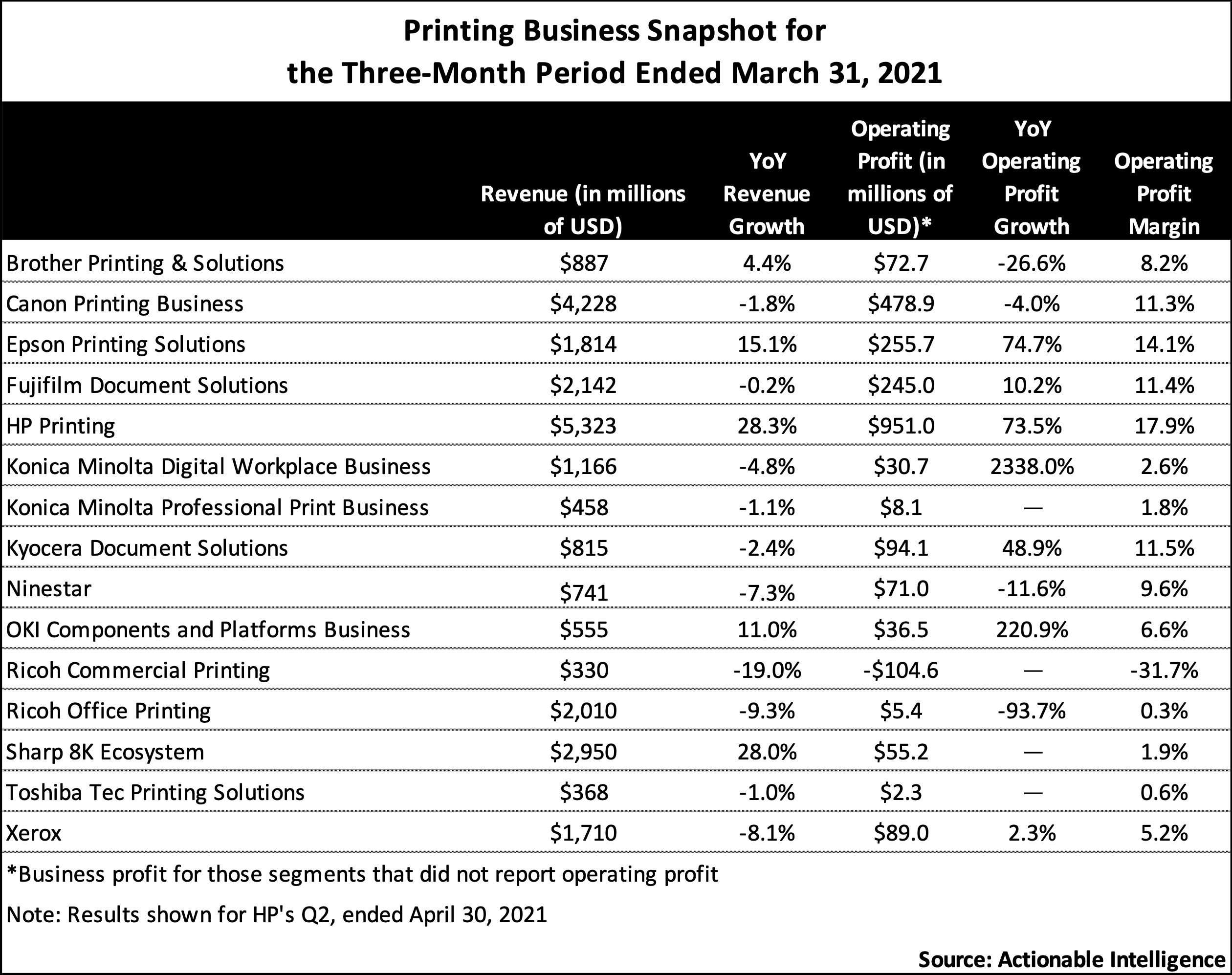

This quarter five printing businesses were able to post revenue growth: HP Printing (+28.3 percent), Sharp 8K Ecosystem (+28.0 percent; however, this segment includes other businesses and mainly benefited from increased demand for TVs); Epson Printing Solutions (+15.1 percent), OKI Components and Platforms Business (+11.0 percent, but, like Sharp, OKI includes a variety of other businesses in this segment); and Brother Printing and Solutions (+4.4 percent). Firms like HP, Epson, and Brother saw a return to revenue growth as they benefited from growing demand in the consumer/SOHO portions of their business. Other OEMs saw revenue declines ranging from 0.2 percent to 19.0 percent. In comparison, at the height of the pandemic, OEMs reported revenue declines ranging from 15.4 percent to 39.1 percent in the quarter ended in June 2020.

Profits in printing segments are improving as well. And both printer- and copier-focused OEMs saw profits grow. Konica Minolta’s Digital Workplace Business saw a 34-fold improvement in profit. OKI Components and Platforms saw profit improve 220.9 percent. Other business reporting improved profits include Epson Printing Solutions (+74.7 percent), HP Printing (+73.5 percent), Kyocera Document Solutions (+48.9 percent), Fujifilm Document Solutions (+10.2 percent), and Xerox (+2.3 percent). Some businesses like Konica Minolta Professional Print, Sharp 8K Ecosystem, and Toshiba Tec Printing Solutions posted profits in the quarter ended in March after a loss in the year-ago period. In the quarter ended in March, just one business, Ricoh Commercial Printing, reported an operating loss. That compared with three businesses that reported operating losses in the quarter ended December 31, 2020, and in the quarter October 31, 2020, and with the seven segments reporting an operating loss in the quarter ended June 30, 2020.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from January 1, 2020, through March 31, 2021, was the fourth quarter of the fiscal year ending March 31, 2021. For Canon and U.S.-based Xerox, this period was the first quarter of fiscal 2021. HP is on a different financial calendar than all the other OEMs. Its second quarter of fiscal 2021 ran from February 1, 2021, through April 30, 2021.

As described above, overall conditions are improving, but OEMs with SOHO businesses are recovering faster. This quarter, four OEM business segments could boast of both revenue and profit growth: Epson Printing Solutions, HP Printing, OKI Components and Platforms, and Sharp 8K Ecosystem. Again, we think OKI’s and Sharp’s growth mostly came from areas outside of printing. The printer businesses that saw both revenue and profits shrink included Ninestar, Ricoh Commercial Printing, and Ricoh Office Printing. All other businesses reported mixed results: either revenue was up and profits were down or vice versa.

We have boiled down the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Brother’s fourth quarter was worse than anticipated due to some goodwill write-downs for its Domino subsidiary and reorganization costs at some manufacturing subsidiaries in its Printing and Solutions segment. As a result, revenue was up for the company for the quarter, but Brother reported operating and net losses. In Q4 2020, Brother’s Printing and Solutions segment saw revenue grow 4.4 percent on strong demand for SOHO lasers devices. However, laser consumables sales were still down year-over-year due to less office printing. Unlike other OEMs, Brother has not seen any uptick in its inkjet business amid the pandemic due to suspension of factory operations and severe product shortages, and both inkjet hardware and consumables sales sank year-over-year in Q4. Operating profit in the Printing and Solutions segment tumbled 26.6 percent because of reorganization costs at manufacturing sites.

- Canon: In Q1 2021, Canon has a strong start to the year, reporting net sales and profit growth. However, results weren’t as sunny in Canon’s new Printing Business, which combines the firm’s former Office Business with the inkjet piece of its former Imaging System segment. Printing Business net sales fell 1.8 percent year-over-year in Q1, while operating profit sank 4.0 percent. What Canon terms the Office category (office multifunction devices or MFDs) remains a real weak spot with sales declining 7.9 percent. The good news is office MFD hardware units and sales were up, but this was offset by continued steep declines in Office non-hardware sales. Meanwhile, in the Prosumer category (laser printers and inkjet printers), Canon had better news: a 4.4 percent net sales increase. The firm reported growth in laser printer hardware units and sales, but laser non-hardware sales were down year-over-year. The inkjet business performed well: inkjet printer units, inkjet hardware net sales, and inkjet non-hardware net sales were all up sharply.

- Epson: Epson ended FY 2020 on a strong note by posting good growth in revenue and enormous increases in profit in Q4. In the Printing Solutions segment, revenue grew 15.1 percent year-over-year in Q4 2020, while segment profit increased 74.7 percent. Epson saw strong growth in home and office inkjet printer units and revenue—revenue growth exceeded unit growth due to rising average selling prices. Epson also saw strong sales of high-capacity ink tank printers such as its EcoTank and L-series units. Epson even saw a sales increase for its high-speed Line Head inkjet MFPs. Ink revenue, however, declined a modest 1 percent in Q4 as Epson’s installed base shifts from cartridge-based models to high-capacity ink tank models.

- Fujifilm: Fujifilm is another firm that closed FY 2020 with goods news including Q4 revenue growth, double-digit operating income growth, and a massive uptick in net profits due in part to Fujifilm’s acquisition of Xerox’s stake in the former Fuji Xerox joint venture. While Fujifilm’s Document Solutions segment was hit hard by COVID-19 in 2020, the business began to see some improvements in Q4. Segment revenue was down just 0.2 percent, and Document Solutions operating income was up 10.2 percent. Revenue from office products and printers declined 0.5 percent due largely to lower office print volumes. Office printer revenue shrank 12.3 percent in Q4 as unit sales flagged.

- HP: HP’s Q2 2021 was its best quarter, by far, since the start of the pandemic with revenue, operating profit, and net profit all exhibiting double-digit year-over-year growth. The Printing business was also booming in Q2. Segment revenue increased 28.3 percent year-over-year, and segment profit jumped 73.5 percent. All categories in the Printing business performed well. Consumer hardware revenue was up a whopping 77.0 percent. Even commercial hardware revenue, which was down sharply throughout the pandemic, grew 34.3 percent. Supplies revenue was up 17.5 percent due to favorable pricing, consumer demand, and improving commercial demand.

- Konica Minolta: Konica Minolta’s Q4 2020 was its strongest since the pandemic began. Revenue declined a modest 0.2 percent, but the firm posted big gains in operating and net profit compared to the losses it posted in the year-ago period. The Digital Workplace Business also saw some recovery. Segment revenue in Q4 was down 4.8 percent; however, Digital Workplace Business operating profit soared 2,338 percent or was 34 times what it was in Q4 2019, the first quarter the company began to be impacted by the pandemic. In encouraging news, A3 MFP units were up 7 percent in the quarter, although consumables proved more sluggish. Non-hardware sales on Q4 were 84 percent of last year’s levels.

- Kyocera: Like many of its rivals, Kyocera had a lot to crow about in Q4 2020, including revenue growth and massive increases in operating and net profits. The Document Solutions segment’s performance in Q4 looked a lot like it did in Q3. Document Solutions revenue declined 2.4 percent, but segment profits were up 48.9 percent. While the trajectory of the business has improved since the start of the pandemic, a big factor in the improved profits was cost-reduction efforts.

- Ninestar: Ninestar announced both its Q4 and Q1 results at the end of April. Unfortunately, this meant that in our last quarterly comparison we couldn’t look at Ninestar’s Q4 results. For more information on those results, see “Ninestar’s Revenue and Net Profit Shrink in FY 2020.” Here, we focus on the firm’s results for Q1 2021, ended March 31. In Q1 2021, Ninestar’s revenue declined 7.3 percent and its operating profit was down 11.6 percent. In its Lexmark business, unit sales of Lexmark printers increased 11 percent, although presumably this was offset by continued declines in sales of supplies. Pantum reported 119 percent unit sales growth for printers. Apex’s revenue was up 86 percent on a 35 percent increase in units. The firm noted that semiconductor prices are rising—as is pricing for Apex’s chips. Ninestar’s general printing supplies business reported 39 percent growth in revenue on a 23 percent increase in unit sales.

- OKI: Like many of its rivals, OKI has seen its results gradually improve from the lows seen early in the pandemic. In Q4 2020, OKI’s revenue was down modestly, but it posted big improvements in operating and net profits. It is hard to determine how OKI’s printing business performed now that it is part of the Components and Platforms business. This segment, however, saw its Q4 revenue rise 11.0 percent and its operating income swell 220.9 percent compared to the year-ago period. The firm did note that structural reforms in its printer business contributed to improved segment profits. The year was a notable one for OKI because the firm made the strategic decision to discontinue distribution of OKI-branded printer hardware in North, Central, and South America (see “OKI Data Americas to Stop Selling Printers in the Americas” and “OKI Data Americas Shares Additional Details on Its Market Exit”). That change became effective March 31, 2021.

- Ricoh: Ricoh’s Q4 2020 remained challenging. While the firm’s 5.0 percent revenue decline in Q4 was the most modest of those posted this year, Ricoh posted hefty operating and net losses due in part to impairment losses taken in the Commercial Printing business. In Ricoh’s Office Printing segment, revenue was down 9.3 percent in Q4 (again the smallest decline seen this year), while operating profit tumbled 93.7 percent. MFP hardware sales declined 10 percent on a 16 percent downturn in MFP units (the decline was 8 percent for A3 MFPs and a steeper 32 percent for A4 MFP units). Laser printer hardware sales declined 17 percent, although units were up 8 percent. In Q4, non-hardware sales decreased by 15 percent on a 17 percent decline in MFP non-hardware sales and a 7 percent downturn in laser printer non-hardware sales.

- Sharp: Unlike many vendors, Sharp actually saw improvements in its results in FY 2020. In Q4, net sales grew, and the firm managed to turn the operating and net losses it reported one year ago into profits. Sharp’s 8K Ecosystem segment includes many key businesses for Sharp other than office MFPs and their consumables, so its results don’t necessarily reveal much about this category. However, in Q4, Sharp’s 8K Ecosystem segment reported net sales growth of 28.0 percent and an operating profit of ¥6.1 billion, up from the operating loss of ¥13.9 billion reported in the year-ago period. Sharp said it saw declines in its MFP business, and lower MFP print volumes negatively impacted profits.

- Toshiba Tec: Like many of its rivals, Toshiba Tec found that Q4 was the best quarter of the year for the company following steep downturns earlier in the year. Even so, Toshiba Tec’s net sales were down 5.1 percent year-over-year in the quarter. Operating profit, however, soared and the company managed to turn the net losses seen in Q4 2019 into net profits in Q4 2020. Trends were similar in the Printing Solutions segment, which posted a net sales decline of 1.0 percent in Q4 but posted a slim operating profit, marking an improvement from the losses posted in the segment in Q4 2019. Toshiba Tec said it was focused on cost reductions and structural reforms in the business.

- Xerox: In Q1 2021, Xerox saw its revenue decline 8.1 percent—one of the more modest year-over-year declines for the company since the pandemic began. The company also managed to grow operating income 2.3 percent. The company has good news about equipment revenue, which was up 17.2 percent. Entry equipment revenue was up 41.7 percent. Black-and-white A4 MFP installs rose 97 percent while color installs rose 9 percent. Midrange equipment revenue rose 15.5 percent on 13 percent growth for monochrome installs and 11 percent growth for color installs. High-end revenue rose a more modest 4.5 percent. On the other hand, post-sale revenue was still 13.4 percent lower than in the year-ago period—something Xerox attributed to lower print volumes as a result of COVID-19-related business closures.

Forecast Revisions

With this quarter’s results, nine OEMs—Brother, Epson, Fujifilm, Konica Minolta, Kyocera, OKI, Ricoh, Sharp and Toshiba Tec—closed the books on FY 2020 and announced new guidance for FY 2021. Canon issues a forecast for FY 2021 last quarter but raised its guidance this quarter. HP, too, raised its forecast for earnings per share for FY 2021 when announcing this past quarter’s results.

By and large, most OEMs expect FY 2021 to be much brighter than FY 2020. Some exceptions include Brother, which anticipates a modest revenue decline, and Fujifilm, which expects to see net profit decline due to the absence this year of certain one-off factors that benefited it in FY 2020.

Of course, OEMs have an easy comparison. Whether expected growth for FY 2021 will mark a return to pre-pandemic levels varies by vendor.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.