In late October and throughout November, printer original equipment manufacturers (OEMs) announced financial results for the three-month period ended September 30, 2021.

While it seems hard to believe, it is now the seventh quarter since printer and MFP makers began to feel an impact from the coronavirus (COVID-19) pandemic. COVID has impacted OEMs’ businesses in various ways, with the initial lockdowns causing steep declines in hardware and supplies sales. After the initial sharp downturn, certain OEMs saw strong sales of small-office/home-office (SOHO) printers and their consumables, and more gradually all OEMs have seen improvements in the office equipment and supplies. Meanwhile, OEMs have been hampered by periodic lockdowns at Asian factories that have hurt production, shortage sand rising costs for semiconductors and other components, and shipping delays and increased transportation costs.

In the quarter ended June 30, 2021, every single OEM posted year-over-year growth (see “OEMs Report Big Improvements in Quarter Ended in June 2021”). The numbers were particularly impressive because the quarter one year ago was the worst ever seen for the printer and supplies industry (see “The Big Picture: OEM Financials for the Quarter Ended in June 2020” and “OEMs Look into the Abyss in Industry’s Toughest Quarter Ever”).

For the quarter ended September 30, 2021, OEMs still had an easy comparison but not quite as easy as in the previous quarter. The quarter ended September 30, 2020, was still a brutal one for most OEMs, but printer and copier makers saw some sequential improvements that quarter (see “The Big Picture: OEM Financials for the Quarter Ended in September 2020” and “A Battered Print Industry Begins to Show Some Signs of Life”). Thus, one would expect that OEMs would report less robust growth in the quarter ended in September 2021 compared with the quarter ended in June 2021.

But there was another big factor tamping down growth. Last quarter, certain OEMs had to suspend operations at factories in Southeast Asia, leading to some product shortages, and several OEMs complained about rising costs for components, raw materials, and shipping, as well as long transportation times that worsened product shortages. In the quarter ended September 30, the chorus of voices citing these same issues grew in number and vociferousness. Although the product categories that were in short supply varied from OEM to OEM, every vendor saw shortages of one product category or another in the latest quarter. Supply falling short of demand either limited growth in the quarter or led to year-over-year declines, especially when combined with OEMs’ rising costs.

Results would have been worse for many OEMs if not for the good old-fashioned law of supply and demand. With supply decreasing and demand either remaining the same or increasing, depending on product category, OEMs did not have to offer many discounts on hardware. Moreover, shortages and the return to the office in many regions spurred sales of higher-priced units. That was not true uniformly, however—we saw signs of price contraction in certain vendors’ results, especially in A3.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from July 1, 2021, through September 30, 2021, was the second quarter of the fiscal year ending March 31, 2022. For Canon and U.S.-based Xerox, this period was the third quarter of fiscal 2021. HP is on a different financial calendar than all the other OEMs. Its fourth quarter of fiscal 2021 ran from August 1, 2021, through October 31, 2021.

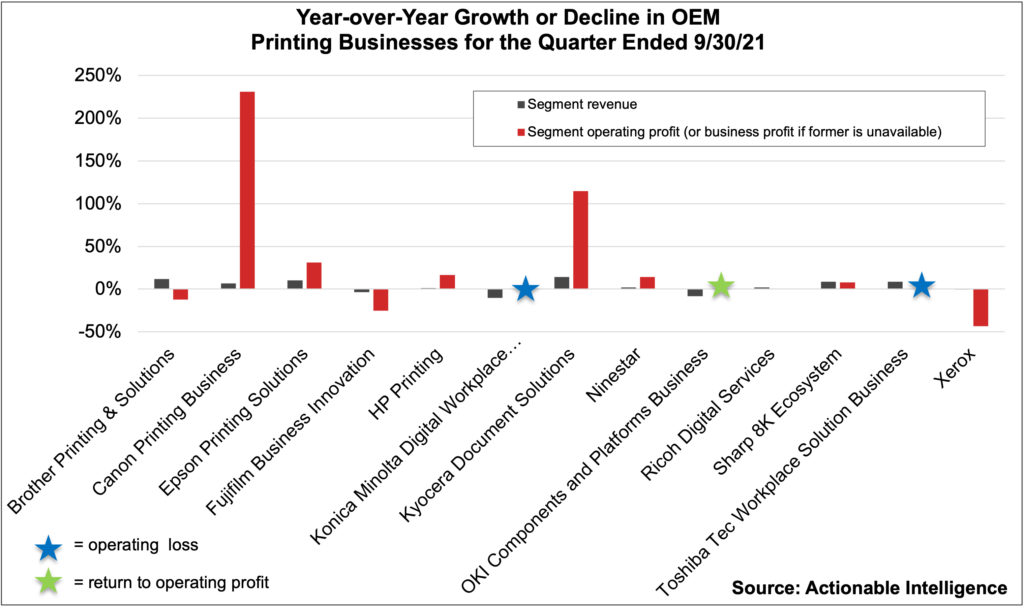

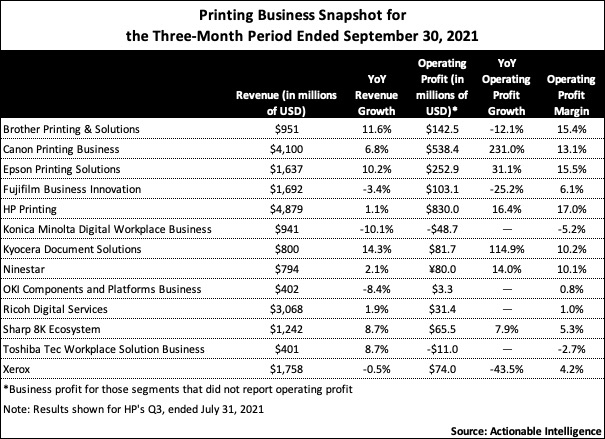

As noted above, due to a less easy comparison, rising costs, and product shortages, OEMs did not have quite as easy a go of it in the quarter ended September 30 as they did in the prior quarter. In the quarter ended June 30, every single OEM could boast of improved revenue and profits in their printing business, and some of the year-over-year increases were massive—in some cases, the biggest we have ever seen. In contrast, in the quarter ended September 30, not every OEM saw increases and those that did typically saw more modest growth than in the quarter prior.

The list of “winners” that saw both revenue and profit growth in the quarter include Canon’s Printing business, Epson’s Printing Solutions segment, HP’s Printing business, Kyocera Document Solutions, Ninestar, Ricoh Digital Services, and Sharp’s 8K Ecosystem segment. Brother’s Printing and Solutions business posted revenue growth but a decline in operating profit, while OKI did the opposite, reporting a revenue downturn but improved operating profit. Toshiba Tec’s Workplace Solution business posted improved revenue but it still had an operating loss, albeit a smaller one than a year ago. The worst-performing printing businesses were Fujifilm’s Business Innovation segment, Konica Minolta’s Digital Workplace Business, and Xerox, all three of which posted shrinking revenue and operating profit.

We have summarized the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Brother got off to a strong start in Q1 2021. In Q2 2021, the company posted continued revenue growth and modest operating and net profit growth, but rising costs for parts, materials, and logistics, as well as product shortages, limited the company’s growth. In the Printing and Solutions business, revenue was up 11.6 percent year-over-year, but the group didn’t see the robust operating profit growth that it did last quarter. Instead, segment operating profit fell 12.1 percent. Whereas in FY 2020, Brother’s Printing and Solutions segment suffered from product shortages for inkjet hardware and consumables, in FY 2010 Brother is seeing shortages of laser printers and MFPs. Thus, in Q2 2021, sales volumes of laser hardware shrank 16 percent and laser hardware revenue was down 4 percent, but laser consumables sales rose 15 percent. Meanwhile, inkjet hardware units were up 101 percent and inkjet hardware revenue was up 95 percent, although inkjet consumables revenue contracted 6 percent.

- Canon: In Q3 2021, Canon reported high-single-digit revenue growth and triple-digit operating and net profit growth as it continued to see its business recover from COVID-19. In Canon’s Printing business, revenue increased 6.8 percent year-over-year, while operating profit soared 231.0 percent. However, like so many others, Canon was negatively impacted by supply-chain woes, especially the shortage of semiconductors, and lockdowns to fight COVID in Southeast Asia, which hurt the firm’s production of A3 MFPs, laser printers, and inkjet printers. The Office subsegment saw only modest 0.6 percent net sale growth. While office MFD non-hardware sales improved 4 percent as more folks returned to the office, office MFD hardware sales were down 11 percent as unit sales fell 13 percent (monochrome units were up 1 percent, but color unit shipments tumbled 22 percent). In the Prosumer subsegment, net sales rose 10.8 percent. Laser hardware net sales shank 19 percent on a 34 percent decline in laser printer units. However, in much brighter news, laser printer non-hardware sales soared 62 percent. In the inkjet category, hardware sales were down 19 percent on steep 43 percent decline in units, but inkjet non-hardware sales were flat.

- Epson: In Q2 2021, Epson saw a continuation of the positive trends it saw in Q1, and companywide revenue grew and profits soared. The news from the firm’s Printing Solutions segment was also upbeat: revenue grew 10.2 percent and business profit improved 31.1 percent. In the Office and Home Printing category, revenue increased 6.2 percent year-over-year, and business profit improved 9.2 percent. Epson, however, had been expecting stronger year-over-year growth figures than these and said its revenue and profits were negatively impacted by product and component shortages, supply-chain delays, and rising manufacturing costs due to higher transportation and parts prices. Still, unit sales of office and home inkjet printers increased 4 percent. In contrast, inkjet printer ink revenue declined 4 percent. Epson had a tough comparison for consumables because of the sharp and sudden rise in home printing in the year-ago period.

- Fujifilm: Fujifilm reported strong revenue and operating income growth in Q2 2021, although net income declined modestly. The picture wasn’t as bright for the Business Innovation segment, which, despite an easy comparison, saw revenue shrink 3.4 percent and operating income fall 25.2 percent. Fujifilm said in the office solutions subsegment revenue decreased 3.1 percent, while revenue declined 3.9 percent in business solutions.Fujifilm explained its office product business was hampered by lockdowns in the Asia-Pacific region and shortages of semiconductors and other parts, which caused delays in equipment supply and installation.

- HP: HP wrapped up its year with another strong quarter in which it delivered revenue and profit growth. Like other vendors, however, HP felt some of its growth dampened by product shortages stemming from component shortages and logistics constraints. Thus, the robust growth seen in the Printing segment in Q3 2021 was less robust in Q4 2021. Printing revenue was up a modest 1.1 percent, and segment profit was up 16.4 percent. HP’s supplies revenue declined 2.4 percent year-over-year in Q4. HP attributed this to channel partners restocking inventory in the year-ago period. Consumer hardware revenue decreased 6.1 percent in the fourth quarter, but consumer hardware units were down a steep 28 percent. The commercial hardware segment fared better; units were down 12 percent but revenue actually grew 18.9 percent. HP laid the blame for its unit shipment declines in printing on shortages stemming from factory lockdowns in Southeast Asia.

- Konica Minolta: Konica Minolta had a tougher time than most other OEMs in what was its Q2 2021 despite the easy comparison to the year-ago period. Company revenue was up modestly, but the firm posted operating and net losses. In the Digital Workplace Business, revenue declined 10.1 percent, and segment profit declined over ¥5.7 billion to a loss of ¥5.4 billion. The big problem for the firm was its Office Printing segment, which saw revenue contract 12.9 percent. The firm said sales volumes for A3 MFPs were lower than one year ago due to delays in production causes by the shortage of semiconductors and other materials, long transport times, and port congestion. Office non-hardware revenue was up about 1 percent year-over-year in Q2 as print volumes recovered. However, Konica Minolta is experiencing toner shortages that will continue to impact the firm’s second half, especially in production, due to explosions and fires that shut down toner production at a pair of facilities in Japan.

- Kyocera: While most vendors saw a weaker-than-expected quarter ended September 30, Kyocera’s Q2 2021 was stronger than it expected. Companywide revenue grew by double digits, and operating and net profit grew by triple digits compared with Q2 2020. The Document Solutions segment saw growth as well in Q2, including revenue growth of 14.3 percent and business profit growth of 114.9 percent. The firm noted that demand for printers and MFPs recovered, especially in Europe and the United States. However, the firm lowered its guidance for Document Solutions sales during the second half of the current fiscal year citing supply-chain issues.

- Ninestar: In Q3 2021, Ninestar grew its revenue 2.1 percent year-over-year. Operating profit in Q3 improved 14.0 percent, but net profit skyrocketed 343.1 percent. The firm’s improved performance is due to gains in several business areas. Unfortunately, Ninestar did not highlight segment results for Q3 but it did provide some numbers for the year to date (first three quarters of 2021). Lexmark was hit hard by the pandemic in FY 2021, but in the first three quarters of FY 2021, its performance has improved. Lexmark’s revenue was up 5.7 percent and its net profit was up 800 percent. The firm said Lexmark’s printer unit shipments were up 17.5 percent. Pantum saw strong growth, much as it did last year. In the first nine months of FY 2021, Pantum’s revenue increased 117.8 percent and its net profit surged 363.4 percent.

- OKI: OKI continued to struggle in Q2 2021. Company revenue declined, and it posted operating and net losses—a smaller operating loss than one year ago but a bigger net loss. OKI’s Components and Platforms business also saw revenue shrink 8.4 percent; however, in a more positive development the group posted a slim operating profit of ¥364 versus its significant loss of over ¥2.0 billion posted in the year-ago period. We believe improved consumables sales were the big factor behind group profits, as the firm said demand for consumables increased in Europe and the United States. The firm did not say much about its printer hardware business—it has now exited this market in the Americas—but it did note its production was impacted by “material shortages.”

- Ricoh: In Q2 2021, Ricoh saw modest revenue growth and significant improvement in profits, reversing last year’s losses. The segment we are most interested in, Digital Services, also saw growth. In Q2, Digital Services revenue grew 1.9 percent and segment operating profit improved by ¥1 billion, climbing from a loss of ¥2.6 billion one year ago to a profit of ¥3.5 billion in the current period. Like other OEMs recovering from a terrible FY 2020, Ricoh saw the business’s rate of growth slow compared to last quarter. Ricoh said that in its office printing business, sales of MFPs and laser printers slowed due to “a shortage of materials,” but sales of non-hardware recovered as folks returned to the office and began printing and copying.

- Sharp: In Q2 2021, Sharp’s net sales declined, although operating and net profits continued to rise, albeit at lower rates than in Q1. The 8K Ecosystem segment, however, posted stronger growth rates than the company as a whole. 8K Ecosystem net sales rose 8.7 percent year-over-year, while operating profit increased 7.9 percent. The firm said it saw MFP business sales growth in Europe and the Americas and improved MFP print volumes in Japan; however, Sharp noted that revenue growth would have been higher if not for logistics bottlenecks in Europe and the Americas and the reemergence of COVID-19 in Asia.

- Toshiba Tec: Toshiba Tec posted modest companywide revenue growth in Q2 2021, but its operating profit declined alarmingly, and it had a net loss for the quarter (albeit a smaller one than in the year-ago period). In Q2, the Workplace Solutions business, saw revenue growth of 8.7 percent. While the segment’s operating profit improved by ¥325 million, the group still ended the quarter with an operating loss of ¥1.2 billion. Toshiba Tec said that while sales of MFPs improved, profits in the Workplace Solutions group were negatively impacted by “tight supply and demand of parts and international freight transportation and soaring prices.”

- Xerox: Xerox had a great Q1 2021, but the firm could not keep up the momentum in Q2 2021. For the second quarter, Xerox posted a 0.5 percent decline in its revenue and a 43.5 percent decrease in its operating profit. The firm explained that raw material and component shortages limited the availability of certain of our products and supplies, particularly A3 devices. Meanwhile, profits were also negatively impacted by rising transportation costs. The firm’s best-performing subsegment this quarter was entry-level equipment; revenue in this category rose 4.5 percent, and color A4 MFP installs grew 17 percent, although black-and-white A4 MFP installs fell 7 percent. Xerox said work-from-home trends have helped grow the entry category compared to before the pandemic. Sales of midrange devices, Xerox’s largest category in terms of equipment revenue, fell 11.6 percent. Color midrange installs grew 1 percent, while black-and-white installs increased 20 percent. The growth in installs coupled with declining revenue suggests the average sales price of Xerox’s midrange machines contracted during the current quarter. Revenue from the sale of high-end equipment contracted 5.6 percent. Installs of high-end color units dropped 7 percent, while black-and-white installs increased 34 percent. Xerox reported a 1.7 percent improvement in its post-sale revenue as page volumes improved.

Forecast Revisions

With its Q4 behind it, HP provided upbeat earnings guidance for its FY 2022 although it warned of lingering “component shortages, as well as manufacturing, port, and transit disruptions.” All other OEMs are still working on finishing FY 2021. Of the 11 OEMs providing guidance for FY 2021, eight adjusted their full-year forecasts either with or shortly before their latest quarterly announcement. Three OEMs made only upward revisions. Both Fujifilm and Kyocera lifted their outlooks for company revenue, operating profit, and net profit. Brother adjusted its operating and net profit guidance upward. Three OEMs made only downward revisions. Konica Minolta slashed its outlook for revenue and both operating and net profit. Canon lowered its guidance for operating profit, and Xerox lowered its revenue guidance. Two other OEMs made mixed adjustments. Epson lowered its guidance for revenue but raised its outlook for operating and net profit. Toshiba Tec did the opposite and hiked its guidance for revenue but lowered its forecast for operating and net profit.

That said, most OEMs continue to expect their FY 2021 results to show improvement in most areas over a tough FY 2020.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.