In late January and throughout February, printer original equipment manufacturers (OEMs) announced financial results for the three-month period ended December 31, 2021. Here, we look specifically at the performance of these companies’ business segments that include home and office printer hardware, supplies, and related software and services.

At this point, more than two years after COVID-19 began, the problems that OEMs are facing amid the pandemic are not new. They include shortages and rising costs for semiconductors and other components, shipping delays and increased transportation costs, lockdowns at Asian factories that have hurt production, and product shortages and growing order backlogs. But if the most recent quarter had a theme for OEMs, it is that these challenges are now taking a bigger bite out of revenue and especially profits.

The quarter ended in June was a good one for most OEMs as they bounced back from the terrible period one year ago. Supply-chain pressures made the quarter ended in September more of a challenge for many OEMs, but many managed to still post growth, helped in part because product scarcity meant OEMs had to discount products less. But the pressure on OEMs grew considerably worse in the quarter ended in December. OEMs like Canon, Epson, HP, Kyocera, and Ricoh that posted both revenue and profit growth in their printing businesses in the quarter ended in September, could not do so in the quarter ended in March and either saw profits decrease or both revenue and profits decline.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from October 1, 2021, through December 31, 2021, was the third quarter of the fiscal year ending March 31, 2022. For Canon, U.S.-based Xerox, and China-based Ninestar, this period was the fourth quarter of fiscal 2021. HP is on a different financial calendar than all the other OEMs. Its first quarter of fiscal 2022 ran from November 1, 2021, through January 31, 2022. Ninestar has yet to report its results for Q4 and won’t do so until April. Thus, we excluded the firm from our comparisons this quarter.

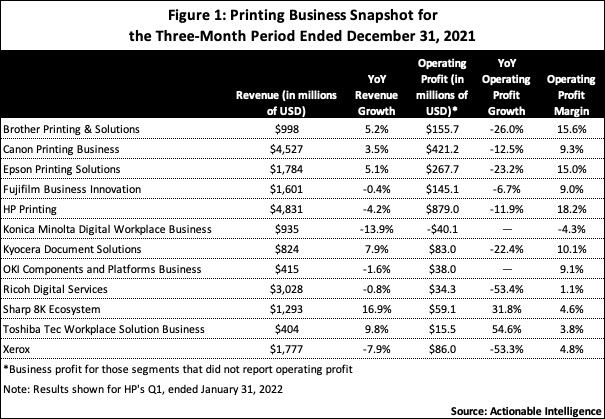

Figure 1 presents a snapshot of the financial performance of OEMs’ printing business in their most recent quarter. Xerox does not provide separate results for a printing segment, so the results shown are those for the company as a whole. It is also worth noting that while the segments shown are those that include OEMs’ printing hardware and supplies businesses and related software and services, some OEMs include other business lines in these segments, too, which means that the performance of these segments may not entirely be a reflection of the performance of their printing businesses. Sharp, for example, includes its enormous TV business in its 8K Ecosystem Business, and OKI includes ATMs, terminals, circuit boards, and consigned manufacturing in its Components and Platforms Business.

Overall, things have steadily gotten more challenging for OEMs since the quarter ended June 30, 2021, when every single OEM could boast of improved revenue and profits in their printing business (see “OEMs Report Big Improvements in Quarter Ended in June 2021”). Due largely to supply-chain challenges, OEMs posted either lower growth rates or declines in the quarter ended September 30, 2021 (see “OEMs Report Uneven Results in Quarter Ended in September 2021 as Supply-Chain Issues and Shortages Worsen”). Then, in the quarter ended December 31, 2021, things grew worse due to unrelenting chip and component shortages, rising costs for these components and logistics, and the omicron coronavirus variant causing production challenges and product shortages.

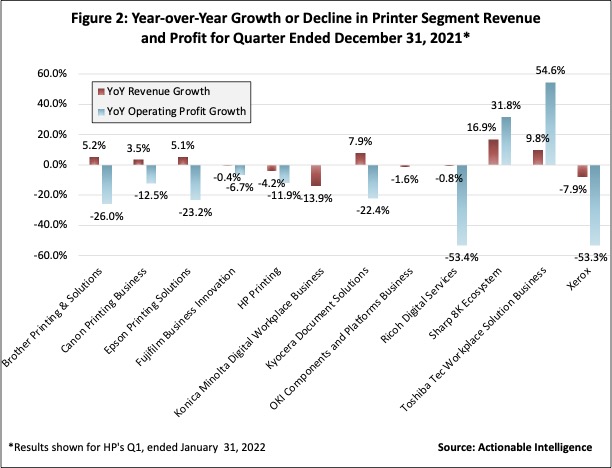

Figure 2 shows how OEMs’ printing businesses fared in terms of year-over-year revenue and profit growth in the quarter ended December 31, 2021. Only two OEMs reported both revenue and profit growth in their printing segments: Sharps’ 8K Ecosystem Business and Toshiba Tec’s Workplace Solution Business. A number of vendors delivered mixed performances. Brother Printing and Solutions, Canon Printing Business, Epson Printing Business, and Kyocera Document Solutions all saw revenue grow in the most recent quarter, but these businesses’ profits declined, reflecting the ill effects of supply chain problems and rising costs. In contrast, the OKI Components and Platforms Business delivered a mixed performance in the opposite fashion: revenue shrank but profits improved. In the latest quarter, five OEMs reported both revenue and profit declines in their printing business, including Fujifilm’s Business Innovation Business, HP’s Printing Business, Konica Minolta’s Digital Workplace Business, Ricoh’s Digital Services Business, and Xerox.

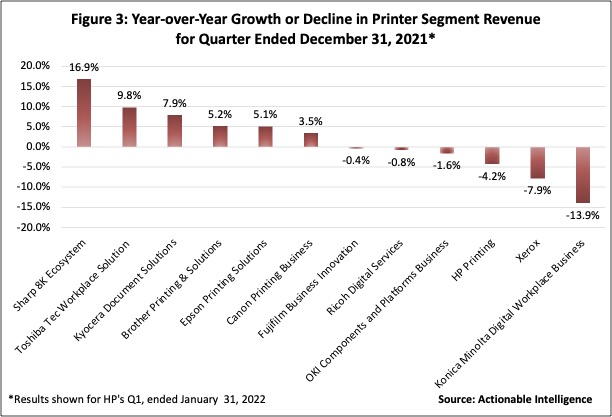

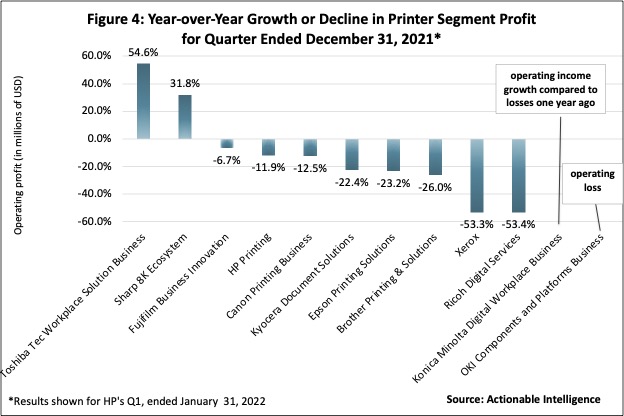

Figures 3 and 4 divvy these same numbers up differently. Figure 3 shows year-over-year revenue growth or decline for the quarter from the strongest growth (Sharp 8K Ecosystem) to the biggest decline (Konica Minolta Digital Workplace Business). Figure 4 shows the year-over-year percentage change in segment operating profit, again from best performer (Toshiba Tec Workplace Solutions Business) to worst (Ricoh Digital Services). It is not possible to show percentage growth/decline for either Konica Minolta’s Digital Workplace Business or OKI’s Components and Platforms Business. In Konica Minolta’s case, the segment was profitable, but it had a loss in the year-ago period. In OKI’s case, it is because the segment had an operating loss in the most recent quarter.

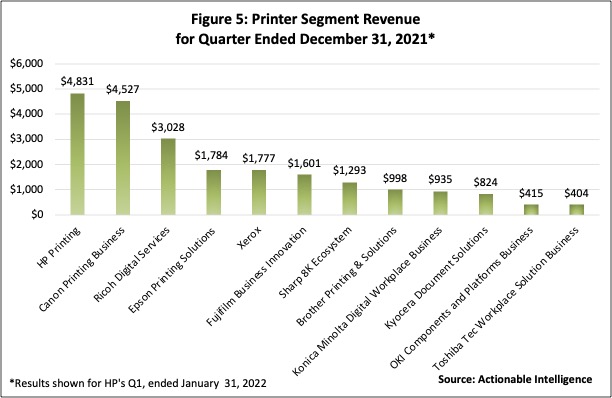

Of course, the above figures just show growth rates, not how much each printing business actually brought in. Figure 5 shows how much revenue each OEM’s printing business delivered in the latest quarter. It is no surprise that HP’s Printing business is in the lead. Now that Canon moved its inkjet business in with MFDs and laser printers into a bigger Printing Business, it is a close number two. We should note that although Toshiba Tec’s Workplace Solutions segment is the smallest in terms of total revenue, OKI’s Components and Platforms business would actually be the smallest in terms of total revenue from printing products if we were to subtract out other product lines included in this segment.

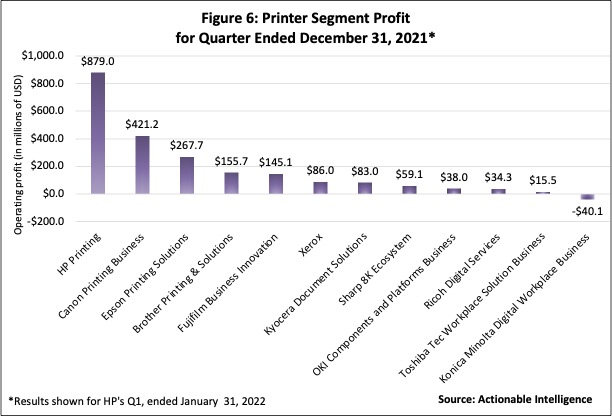

Figure 6 shows how much segment profit each OEM reported in their most recent quarter. Again, HP and Canon are in the number-one and number-two spots, with Epson in number three and Brother in number four. That would seem to be an indication that those OEMs who have robust SOHO businesses were most profitable. Profits were slimmer for firms specializing in A3 MFPs. Konica Minolta’s Digital Workplace Solutions Business was in last place, as the only segment reporting an operating loss last quarter.

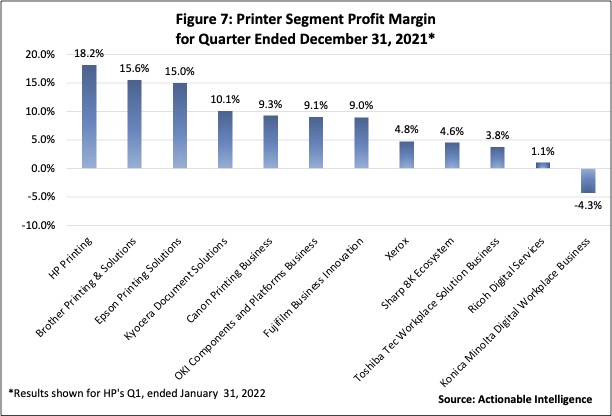

Figure 7 compares operating profit margin in OEMs’ printing business. There, HP is in the lead, followed by Brother, Epson, and Kyocera, all of which had double-digit operating margins. Again, Konica Minolta’s Digital Workplace Solutions Business fared the worst as it had a negative operating margin.

We have summarized the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Similar to many of its rivals, Brother felt an even stronger negative impact from supply-chain trouble and rising parts and logistics costs in its Q3 2021 than it did in the previous quarter. The company still managed to grow revenue, but profits declined year-over-year. In the Printing and Solutions business, trends were similar. Segment revenue increased 5.2 percent in Q3 2021 compared to Q3 2020, but Printing and Solutions operating profit tumbled 26.0 percent. In the quarter, laser hardware units and revenue shrunk (-20 percent and -9 percent, respectively) due to product shortages stemming from the negative impact of the reemergence of COVID-19 and difficulty in procuring parts. But, despite the decline in laser hardware, laser consumables revenue increased 14 percent. Inkjet hardware revenue was up 17 percent on 1 percent unit growth, but inkjet consumables revenue contracted 3 percent. Brother laid the blame for the segment’s profit decline on increased use of air transportation for consumables, soaring sea freight rates, and increased material costs.

- Canon: The quarter ended December 31, 2021, wrapped up a strong fiscal 2021 for Canon, in which it posted double-digit revenue growth and triple-digit profit growth, but the firm’s Q4 was weaker than expected due to component and logistics constraints and product shortages and backorders. In Q4, company revenue was up a mere 1.0 percent and income shrank 1.1 percent. In Canon’s Printing business, revenue increased 3.5 percent year-over-year in Q4, but operating profit declined 12.5 percent. The Office subsegment saw revenue growth of 4.4 percent in Q4, with office MFD revenue up just 0.2 percent but other office revenue up 12.1 percent. Net sales growth for office MFD hardware in Q4 declined 7 percent, but office MFD non-hardware net sales rose 6 percent. Unit sales of MFD declined 15 percent in Q4 on a 23 percent decline for monochrome units and a 9 percent decline for color. The Prosumer subsegment, meanwhile, saw revenue contact 1 percent in Q4. The firm reported laser printer revenue was up 4.3 percent in the quarter as laser hardware sales increased 22 percent while laser non-hardware sales declined 5 percent. Total laser printer units were up 2 percent in Q4 as 12 percent growth in monochrome units offset a 35 percent decline for color units. Meanwhile, Q4 inkjet printer revenue decreased 9.2 percent as inkjet hardware and non-hardware sales were down 2 percent and down 14 percent, respectively, and inkjet printer unit sales contracted 16 percent.

- Epson: Similar to its rivals, Epson’s profits took a hit in its most recent quarter due to “soaring materials and logistics costs.” In the Printing Solutions business, revenue increased 5.1 percent year-over-year in Q3 due to an uptick in sales of high-capacity inkjet printers and higher selling prices, but business profit declined a steep 23.2 percent due to higher material and logistics costs. In the Office and Home Printing category, revenue increased 3.8 percent in Q4, but business profit contracted 25.3 percent. In Q3, unit sales of office and home inkjet printers were down 8 percent because even though demand was strong there were supply constraints. Unit sales of ink cartridge printers decreased, while high-capacity ink tank printer unit volume was flat year-over-year. Revenue increased, however, because Epson “implemented pricing measures based on the supply and demand balance.” Demand for ink shank, however compared to the boom seen last year, so revenue from the sale of inkjet printer ink in Q3 was down 2 percent.

- Fujifilm: Fujifilm saw strong revenue grow and set records for company operating and net profits for the first nine months of the year. In the firm’s Q3, however, growth rates for revenue and operating profit were lower than in the prior two quarters. But Fujifilm’s banner year is due to growth in other segments, not to its Business Innovation segment, which is still struggling to recover from COVID-19 and is now facing the challenge of higher costs for semiconductors and other parts and logistics, as well as product shortages. Despite easy comparisons, the Business Innovation segment saw revenue shrink 0.4 percent in Q3 2021, and operating income ticked downward 6.7 percent. In Q3 2021, the office solutions subsegment posted a revenue decline of 1.4 percent due to delays in equipment supply stemming lockdowns in the Asia-Pacific region and the limited supply of semiconductors and other parts.

- HP: HP started FY 2022 on a positive note, posting revenue and profit growth for the company as a whole in the first quarter, but that was due to growth in the Personal Systems business, as results for the Printing segment were less upbeat. In Q1 2022, Printing revenue declined 4.2 percent year-over-year, and segment profit decreased by 11.9 percent. Consumer hardware revenue took the biggest hit, falling 23.1 percent on a 23 percent decline in units. The firm cited a backlog of inkjet hardware. Commercial hardware, in contrast, did well. In Q1 2022, commercial hardware revenue grew 8.6 percent on a 9 percent increase in units. HP’s supplies revenue fell 2.5 percent due largely due slowing demand for consumables used in consumer machines as the firm noted it saw was improved sales of supplies for commercial devices. On bright spot, however, was the contractual supplies business. HP said Instant Ink subscriptions grew at a double-digit rate in Q1 to over 11 million subscribers, and revenue and contract value in the firm’s managed print services (MPS) grew.

- Konica Minolta: Konica Minolta had a tough Q3 2021. Revenue shrank, and the profits reported in the year-ago period turned into losses. Similar trends were seen in the Digital Workplace Business, which saw revenue slip 13.9 percent, and the group posted an operating loss of ¥4.6 billion ($40.1 million), a sharp reversal from the ¥3.1 billion operating profit recorded in Q3 2020. Konica Minolta explained that recovery in demand for hardware continued during the quarter, but its order backlog increased due to chip and other component shortages along with prolonged logistics lead times. The company also had a backlog for non-hardware including consumables as the firm worked to overcome the disruptions cause by fires and explosions that temporarily shut down a pair of toner factories in Japan. Even so, the firm said real demand for non-hardware was lower than anticipated due to the spread of the omicron variant. Profits turned into losses due to the revenue declines and higher costs for parts and logistics.

- Kyocera: For the company as a whole, Kyocera’s third quarter was quite strong, with revenue and profits up sharply. Performance, however, was mixed in the Document Solutions segment in Q3. While Document Solutions revenue was up 7.9 percent year-over-year, segment business profit tumbled 22.4 percent. The firm noted that demand for equipment and consumables recovered mainly in United States but otherwise said little about the segment’s performance.

- OKI: For the company as a whole, OKI’s revenue shrank but profits improved in the third quarter. In Q3, OKI’s Components and Platforms business saw revenue contract 1.6 percent but operating income improved ¥3.7 billion compared to the loss reported in the year-ago period. The company did not say much about printing other than that the structural reform of its peripheral products business is making progress and improving cost structures.

- Ricoh: In Q3 2021, Ricoh posted anemic revenue growth for the company as a whole but a massive uptick in profits. In the Digital Services segment, revenue declined 0.8 percent year-over-year in the quarter, and segment operating profit tumbled 53.4 percent. Ricoh reported that in its office printing business in Q3 2021, it saw its sales recovery in “edge devices” such as MFPs and laser printers slow due to delays in production resulting from a shortage of parts, COVID-19 at overseas production sites, and delays in transportation stemming from a shortage of container vessels. Because of these product supply shortages, the firm’s order backlog increased. In Q3, hardware sales were 72 percent of what they were in Q3 2019, before the pandemic. However, sales of non-hardware recovered as a result of a return to offices due to the widespread use of vaccines. In Q3, non-hardware sales improved to 82 percent of the level reported in Q3 2019. In the MFP category, hardware revenue declined 9.2 percent, and MFP non-hardware revenue rose 4.0 percent. Printer hardware sales were up 10.5 percent in Q3, while printer non-hardware sales improved 1.4 percent. It seems that rising materials costs in Q3 combined with the dip in MFP hardware revenue were enough to offset the positive impact of rising non-hardware sales on profits.

- Sharp: Sharp posted very modest revenue growth in Q3 2021, but the company’s operating profit declined due to supply-chain disruptions. The 8K Ecosystem segment performed better than the company as a whole in Q3, with segment revenue rising 16.9 percent and operating profit increasing 31.8 percent. Sharp attributed the segment’s improved performance to growth in sales of TVs in Europe and Asia, a firm smart office business in Europe and the Americas, the impact of consolidating Shape NEC Display Solutions, and the impact of MFP business sales growth in Europe and the Americas. This was partly offset by the impact of logistics bottlenecks for shipments to Europe and the Americas.

- Toshiba Tec: Toshiba Tec’s financial news was overshadowed by an announcement from its parent, Toshiba Corporation, that it considers Toshiba Tec to be a non-core asset. Toshiba Corporation owns half of Toshiba Tec’s shares. While the firm did not say for sure that it is selling its stake in Toshiba Tec, Toshiba is selling off other assets deemed to be “non-core.” Toshiba Tec actually had a decent Q3. The company managed to post revenue and profit growth despite rising costs for parts and logistics. In the Workplace Solutions Business in Q3 2021, revenue improved 9.8 percent year-over-year and operating profit improved 54.6 percent. Toshiba Tec said sales of MFPs increased in the Americas, Europe, Asia, and other overseas regions, but the firm saw “tight supply-demand balance and soaring prices in components and international cargo transportation.”

- Xerox: In Q4 2021, Xerox saw its revenue shrink 7.9 percent year-over-year, as operating profit tumbled 53.3 percent. What’s more, Xerox took a goodwill impairment charge of $781 million ($750 million after taxes) in the quarter to reflect COVID-19’s continued negative impact on Xerox’s print business, resulting in a net loss for both Q4 and the full fiscal year. In Q4, equipment revenue was down 24.7 percent. The only equipment category that showed growth was the low end, which saw revenue grow 8.6 percent in Q4 as black-and-white MFP installs rose 24 percent and color MFP installs fell 10 percent. Xerox’s midrange equipment revenue fell 30.7 percent as black-and-white midrange installs fell 28 percent and color installs were down 22 percent. In Q4, high-end equipment sales declined by 27.7 percent with high-end installs flat for color devices and installs of black-and-white installs devices down 5 percent. Post-sale revenue fell by a modest 1.9 percent.

Forecast Revisions

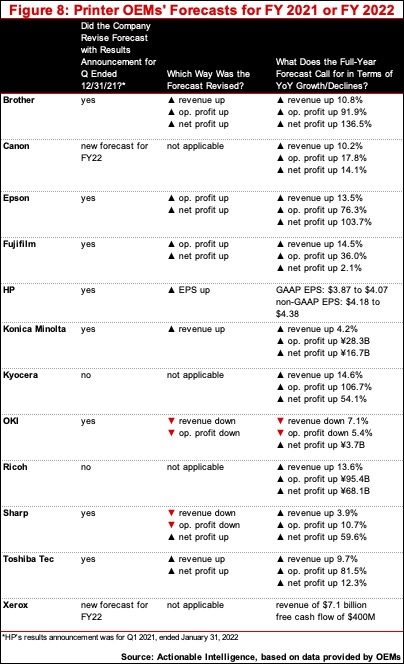

Figure 8 shows OEMs’ guidance for the performance of the company as a whole—a good measure of how optimistic or pessimistic each vendor is feeling about business. Because Canon and Xerox wrapped up FY 2021 this quarter, they each provided some guidance for FY 2022. Canon expects to post revenue and profit growth, albeit at lower rates than in FY 2021. Xerox’s guidance was more cursory, but it did say it expects to see revenue grow. Eight OEMs revised their guidance for FY 2021 or FY 2022. Six OEMs—Brother, Epson, Fujifilm, HP, Konica Minolta, and Toshiba Tec—raised certain forecast numbers. Two, OKI and Sharp, made downward revisions, although Sharp did increase its guidance for net profit.

Despite the challenges in their most recent quarters, most OEMs expect to post growth in the year ahead. The lone exception is OKI, which expects net profit growth but a decrease in revenue and operating profit.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.