In late April and throughout May, printer original equipment manufacturers (OEMs) announced financial results for the three-month period ended March 31, 2022. At this point, over two years since the start of the pandemic, COVID-19 continues to be a major force impacting OEM results. Now the impact is less from school and office shutdowns—although the shift to hybrid work remains a factor that is depressing office printing—and more from the resultant tumult in global supply chains and production. In recent quarters, OEMs have struggled with chip shortages, rising component and raw material prices, rising logistics costs, transportation delays, and COVID-related (and sometimes fire- and explosion-related) factory shutdowns, all of which have led to product shortages. And those product shortages and rising costs have taken a big bite from OEMs’ revenue and profits.

In general, if the quarter ended in March 2022 had a theme, it is that several OEMs had thought the quarter would prove better than it did, and more than one OEMs missed its full-year forecast as a result of the disappointing quarter. But, as is usually the case, some OEMs fared better than others—maybe not as much as they had hoped—but more firms this quarter than last quarter were able to boast of both revenue and profit growth in their printing businesses.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from January 1, 2022, through March 31, 2022, was the fourth quarter of the fiscal year ending March 31, 2022. For Canon, U.S.-based Xerox, and China-based Ninestar, this period was the first quarter of fiscal 2022. HP is on a different financial calendar than all the other OEMs. Its second quarter of fiscal 2022 ran from February 1, 2022, through April 30, 2022. Here, we look specifically at the performance of OEMs’ business segments that include home and office printer hardware, supplies, and related software and services.

Figure 1 presents a snapshot of the financial performance of OEMs’ printing businesses for their most recent quarter. Readers should bear in mind that while the segments shown are those that include OEMs’ home and office printing hardware and supplies businesses and related software and services, some OEMs include other business lines in these segments, too. Most notably, Sharp includes its enormous TV business in its 8K Ecosystem Business, and OKI includes ATMs, terminals, circuit boards, and consigned manufacturing in its Components and Platforms Business. While Ninestar does share selected segment-level results in some quarters, it does not do so every quarter, and because most of the company is home and office print-related, with the exception of a portion of its chip business, we show results for Ninestar as a whole. Ninestar has the Lexmark and Pantum printer businesses plus a third-party consumables business. Xerox used to report results for the company as a whole rather than by segment, but, starting this quarter, the company is reporting results for two segments, including a Print and Other segment, which is our focus here.

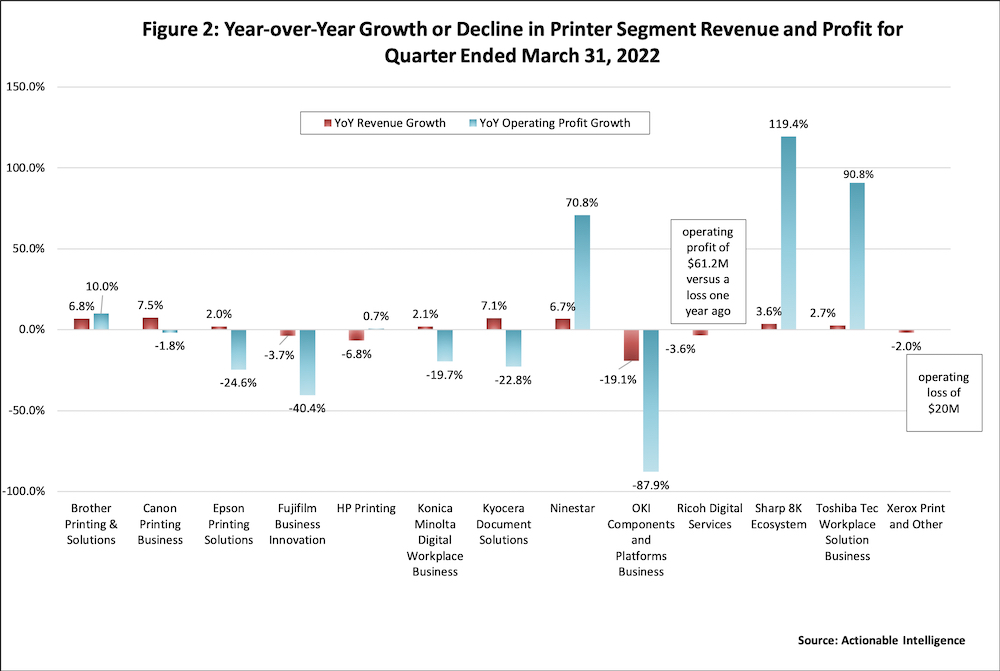

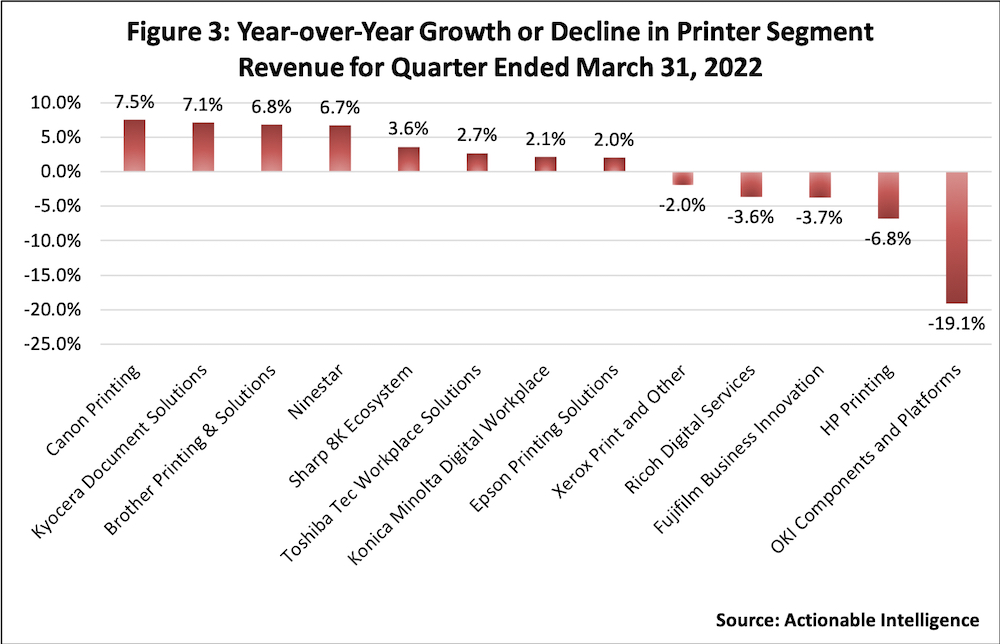

Figure 2 shows how OEMs’ printing businesses fared in terms of year-over-year revenue and profit growth in the quarter ended March 31, 2022. Last quarter, only two OEMs reported both revenue and profit growth in their printing segments: Sharp’s 8K Ecosystem Business and Toshiba Tec’s Workplace Solutions Business (see “OEMs Feel Pressure on Revenue and Profits as Supply-Chain Trouble Persists”). This quarter, four OEMs did: Sharp’s 8K Ecosystem Business and Toshiba Tec’s Workplace Solutions Business, once again, plus Brother Printing and Solutions and Ninestar. Five OEMs delivered a mixed performance in their printing business. Four of these business (Canon’s Printing Business, Epson’s Printing Solutions Business, Konica Minolta’s Digital Workplace Business, and Kyocera’s Document Solutions Business) saw revenue grow but operating or business profit shrink in the most recent quarter. That’s what you’d expect given the cost increases many of these firms are experiencing. HP, in contrast, saw its Printing segment deliver lower revenue but slightly higher profits. HP attributed this to a more profitable product mix, among other factors. Whereas last quarter five OEM printing businesses (Fujifilm’s Business Innovation Business, HP’s Printing Business, Konica Minolta’s Digital Workplace Business, Ricoh’s Digital Services Business, and Xerox) saw both revenue and profit shrink, this quarter only three did: Fujifilm’s Business Innovation Business, OKI’s Components and Platforms Business, and Xerox’s Print and Other Business.

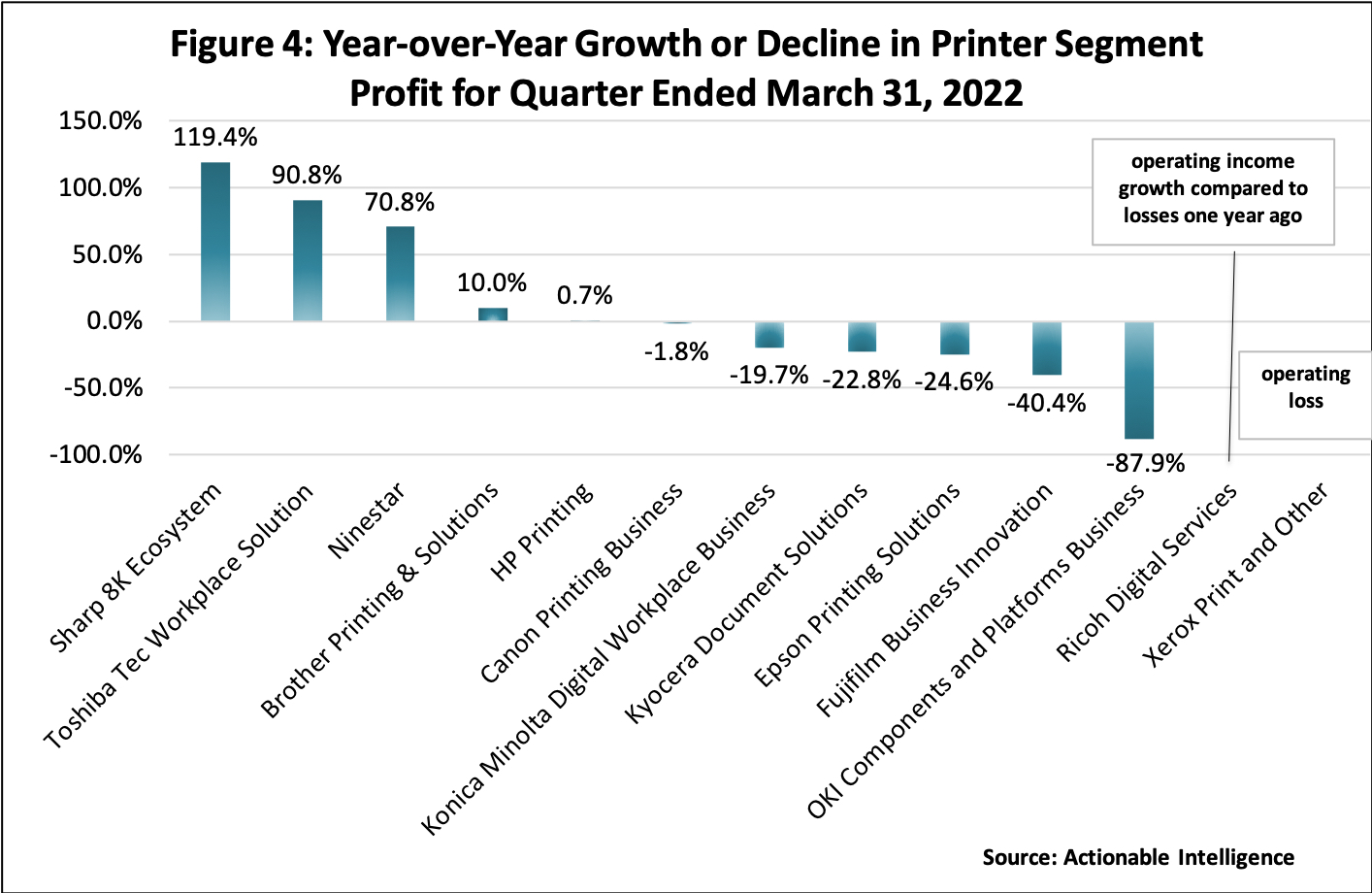

Figures 3 and 4 show these same numbers differently. Figure 3 shows year-over-year revenue growth or decline for the quarter from the OEM with the strongest growth (Canon Printing) to the biggest decline (OKI Components and Platforms). Figure 4 shows the year-over-year percentage change in segment operating profit, again from best performer (Sharp 8K Ecosystem) to worst (OKI Components and Platforms). It is not possible to show percentage growth/decline for either Ricoh’s Digital Services Business or Xerox’s Print and Other Business. In Ricoh’s case, the segment was profitable, but it had a loss in the year-ago period. In Xerox’s case, it is because the segment had an operating loss in the most recent quarter. In fact, it was the only printing business among those shown with an operating loss.

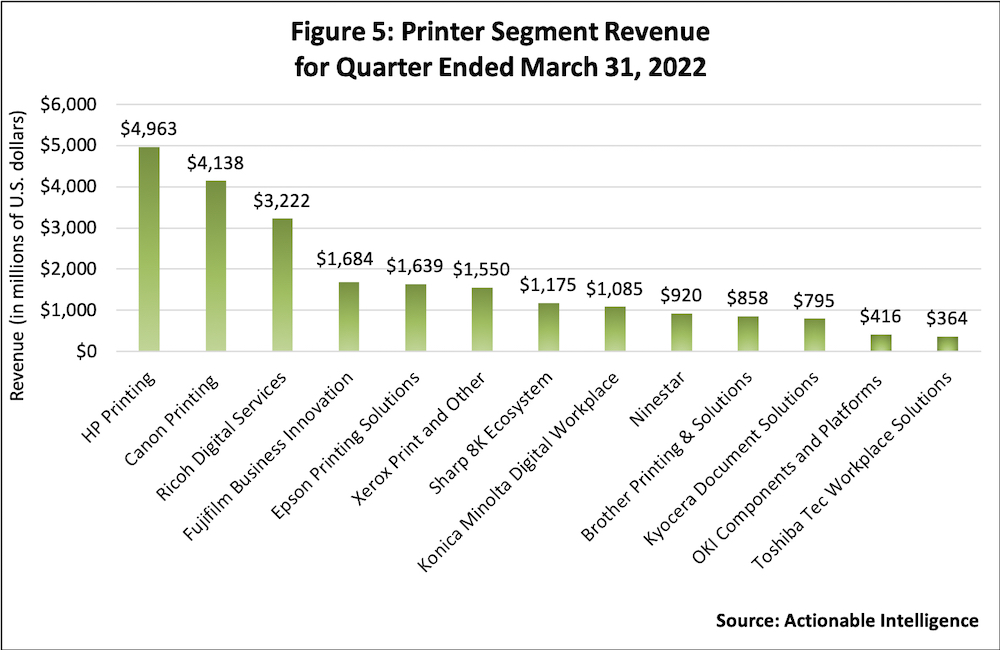

Of course, the above figures just show growth rates, not how much each printing business actually brought in. Figure 5 shows how much revenue each OEM’s printing business delivered in the latest quarter. It is no surprise that HP’s Printing Business is in the lead with Canon’s Printing Business at number two. Although Toshiba Tec’s Workplace Solutions segment is the smallest in terms of total revenue, OKI’s Components and Platforms Business would actually be the smallest in terms of total revenue from printing products if we were to subtract the other product lines included in this segment. One thing that was notable this quarter is that Ninestar has grown to be a sizeable OEM. This quarter, Ninestar as a whole had more revenue that Brother’s Printing and Solutions business, Kyocera’s Document Solutions Business, OKI’s Components and Platforms Business, and Toshiba Tec’s Workplace Solutions Business. When we were doing similar comparisons in the quarters ended September 30, 2020, and June 30, 2020, Ninestar was smaller in terms of total revenue than all these businesses (see “A Battered Print Industry Begins to Show Some Signs of Life” and “OEMs Look into the Abyss in Industry’s Toughest Quarter Ever”). The difference is that Ninestar has since acquired 100 percent of Pantum, which is the industry’s fastest-growing printer vendor.

Figure 6 shows how much segment profit each OEM reported in their most recent quarter. HP Printing is in the lead by far, with more than twice as much profit as number-two Canon Printing. In the third, fourth, and fifth spots are Epson Printing Solution, Fujifilm Business Innovation, and Ninestar. Coming in at the less profitable end of the spectrum were Toshiba Tec’s Workplace Solutions Business and OKI’s Components and Platforms Business, which each had profits of under $10 million. As noted above, Xerox was the worst performer in this area with a $20 million operating loss.

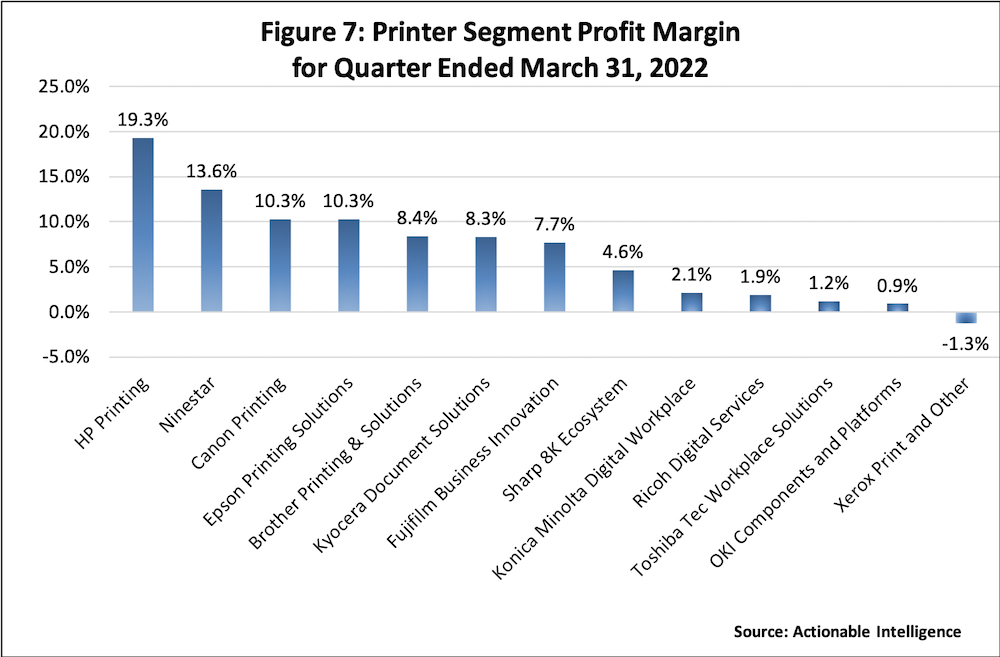

Figure 7 compares operating profit margin in OEMs’ printing businesses. Here, HP’s Printing Business is again in the lead. Its 19.3 percent margin is 5.7 percentage points higher than that of number-two Ninestar. Canon Printing and Epson Printing Solutions were tied for third place, each with a 10.3 percent margin, followed by Brother, Epson, and Kyocera, all of which had double-digit operating margins. Xerox Print and Other clearly had the worst operating margin as it was the only group with a negative operating margin, but Ricoh Digital Services, Toshiba Tec’s Workplace Solutions, and OKI’s Components and Platforms all had operating profit margins of less than 2 percent.

We have summarized the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Brother’s fourth quarter of 2021 was mixed: revenue, operating, and net profit improved, but business segment profit shrank due to rising costs for transportation and raw materials. In the Printing and Solutions business, revenue was up 6.8 percent year-over-year in Q4, marking the sixth straight quarter of revenue growth in this segment. While Printing and Solutions business segment profit declined 23.8 percent due to rising costs, segment operating profit grew 10.0 percent due to favorable exchange rates and gains in consumables sales. In Q4 2021, Brother reported its laser printer hardware revenue shrank 8 percent on a 16 percent decline in laser hardware units. Brother explained it was finding it difficult to procure parts for its laser machines, which led to a decline in unit production and lower sales. Demand for laser devices was also stymied by new breakouts of COVID-19 in various markets. Laser consumable revenue fared better, growing 16 percent. Meanwhile, in Q4 2021, Brother’s inkjet printer hardware revenue rose 15 percent year-over-year with inkjet unit shipments up 7 percent as the firm recovered from the inkjet product shortages it saw in Q4 2020. Inkjet consumables revenue rose 2 percent.

- Canon: Canon had a good start to fiscal 2022 and was able to post single-digit year-over-year growth in net sales, operating profit, and net income in Q1 2022. In the Printing business, net sales increased 7.5 percent year-over-year, marking the fourth straight quarter of net sales growth in this segment, but segment operating profit contracted by 1.8 percent due largely to rising costs for parts and logistics offsetting the improved profits Canon saw from services and consumables. In the Office subsegment, revenue increased 5.4 percent as multifunction device (MFD) revenue improved 1.2 percent but other office revenue grew 12.4 percent. Breaking that 1.2 percent increase in MFD revenue down a bit further, Canon said office MFD hardware sales were down 4 percent on a 16 percent decrease in units but non-hardware sales grew 6 percent. In Q1 2022, Prosumer revenue improved 7.0 percent. The firm’s laser printer revenue jumped 9.7 percent on a 7 percent increase in laser hardware revenue (units were up 1 percent) and an 11 percent increase in laser non-hardware revenue. Inkjet printer revenue improved a more modest 2.6 percent. Inkjet hardware revenue was up a hefty 24 percent on a 6 percent uptick in units, but inkjet non-hardware revenue declined 9 percent.

- Epson: Epson’s Q4 2021 was weaker than some of its recent quarters. Revenue grew at the lowest rate of year-over-year growth all year, business profit declined due to rising costs for materials and logistics, but operating profit improved due to a foreign exchange gain and the fact the firm recorded an impairment loss in the year-ago period in the wearables business. In the Printing Solutions business, revenue grew 2.0 percent in Q4 2021, but business profit tumbled 24.6 percent due to rising costs. In the Office and Home Printing category in Q4, revenue increased 4.8 percent due to higher prices for inkjet printers and favorable foreign currency exchange, but profit in this subsegment declined 1.6 percent as costs increased. Epson reported that although office and home inkjet printer demand remained strong, supply constraints persisted due to materials shortages and logistics disruptions, resulting in lengthy lead times and lower unit sales. However, in brighter news, inkjet ink revenue was up 6 percent in the quarter.

- Fujifilm: Fujifilm posted strong company results for FY 2021, including record high operating and net income; however, the firm’s Q4 was weaker than prior quarters. In Q4 2021, Fujifilm was able to post revenue growth, albeit at a lower rate in the previous three quarters, but the firm’s operating and net profit fell year-over-year. In the company’s Business Innovation segment, revenue fell 3.7 percent year-over-year in Q4, while operating income plummeted 40.4 percent. In Q4, revenue in the office solutions subsegment decreased 4.4 percent. Fujifilm explained that the office solutions business saw delays in equipment supply and installation stemming from the partial shutdown of factories in China resulting from COVID-19 lockdowns, tight supply of semiconductors and other parts, and logistics disruptions.

- HP: HP’s Q2 2022 was mixed. The company delivered top-line growth due to revenue growth in the Personal Systems segment, but operating profit and net earnings declined. In HP’s Printing business, revenue declined 6.8 percent year-over-year. Consumer hardware revenue fell as steep 12.3 percent as units contracted 24 percent. Commercial hardware revenue declined 4.0 percent on a 17 percent decrease in units. Supplies revenue fell 6.2 percent, due largely to what the firm called “normalization” in home printing, partially offset by a gradual recovery on office and industrial printing. While HP certainly wasn’t selling more total printer units in Q2 2022 than it did one year ago, the firm emphasized that it is shifting toward selling more profitable units. HP+ devices and “Big Tank printers” accounted for 48 percent of HP’s printer hardware shipment mix in the quarter. While revenue in the Printing business was down, HP had better news about Printing operating profit, which improved 0.7 percent in Q2, enabling the firm to post a robust Printing segment margin of 19.3 percent. HP attributed improved profit in the Printing segment to the shift toward more profitable hardware units, higher ASPs, growth in the subscription business, and lower operating expenses.

- Konica Minolta: Konica Minolta closed FY 2021 on a sour note. While company revenue improved, Konica Minolta took some big impairment losses of on goodwill arising from past acquisitions in the Professional Print and Industry segments and lowered its assessment of the recoverable amount of accounts receivable in the precision medicine unit. Konica Minolta had hoped to return to profitability in FY 2021, but instead the company posted even bigger operating and net losses than it did in the year prior. In Q4 2021, revenue in the Digital Workplace Business improved 2.1 percent from the year-ago period. Revenue grew 0.8 percent in the Office Printing subsegment. The DW-DX business, which is responsible for sales of IT services and solutions and Workplace Hub technology, saw revenue grow 8.5 percent. In Q4 2021, Digital Workplace Business operating profit declined 19.7 percent year-over-year. Konica Minolta said supply of office printers MFPs were negatively impacted by the semiconductor shortage and the shutdown of a plant in Malaysia due to the COVID-19 pandemic. Meanwhile, the firm had toner shortages due to the temporary shutdown of two of its plants in Japan after a fire and explosion.

- Kyocera: A Q4 in which revenue and operating and net profit grew put the final punctuation point on what was a very strong year for Kyocera. While the Document Solutions segment saw revenue grow 7.1 percent year-over-year in Q4, the group’s profit declined 22.8 percent. Kyocera said little about the Document Solutions segment other than that sales of equipment and consumables recovered in the full year; however, it is likely profits in the group were hurt by rising costs in the last quarter of the year.

- Ninestar: Ninestar announced both its Q4 and Q1 results at the end of April. Unfortunately, this meant that in our last quarterly comparison we couldn’t look at Ninestar’s Q4 results. Here, we focus on the firm’s results for Q1 2022, ended March 31. Ninestar’s revenue rose 6.7 percent in Q1 2022, while operating profit (as calculated by Morningstar because this is not a financial metric Ninestar reports) rose 70.8 percent. Meanwhile, net profit increased 77.7 percent. Much of Ninestar’s growth has been due to its acquisition of all of Pantum and that company’s gangbusters growth. In Q1 2022, Pantum’s printer sales rose 33 percent year-over-year, and its consumables shipments increased by 60 percent. Ninestar reported that Lexmark printer shipments improved 7 percent year-over-year. Ninestar provided precious few details about the performance of its third-party consumables businesses in Q1 2022 other than noting that despite rising costs of raw materials and transportation along with a labor shortage resulting from February’s Chinese New Year celebrations, net profit from general printing consumables sales was up 3 percent.

- OKI: OKI’s fourth quarter was marred by shrinking revenue and operating profit, although net profit improved. The same trends were seen for the full fiscal year. In Q4, net sales in the Components and Platforms segment decreased1 percent year-over-year, and operating profit was down a steep 87.9 percent. While it is clear that the segment that includes the printing business is not doing well, OKI’s financial report said essentially nothing about its printer business. Due to OKI’s retreat from the printers business and the dearth of information provided about printers in OKI’s financial reports, this is the last quarter we will be covering OKI.

- Ricoh: Ricoh saw its net sales decline in Q4 2021 but both operating and net profit improved from the losses reported in the year-ago period. That said, Ricoh’s results fell short of its expectations for the quarter so the company fell short of its full-year sales and earnings targets. The firm attributed the shortfall directly to its former Office Printing segment, saying the spread of the omicron COVID-19 variant stalled a recovery in Office Printing non-hardware sales and that the firm struggle with continued shortages of Office Printing hardware. In the new Digital Services business, which includes Ricoh’s former Office Printing Office Service and units, sales were down 3.6 percent in Q4; however, segment operating profit was up significantly compared with the group’s loss in the year-ago period.

- Sharp: For the company as a whole, Sharp saw revenue and operating profit decline modestly in Q4 2021, although net profit was up sharply. In Q4 2021, the 8K Ecosystem business saw net sales increase6 percent as operating profit soared 119.4 percent. Unfortunately because the 8K Ecosystem segment also includes Sharp’s enormous TV business, it is hard to say how much of the improvement was driven by increased sales of MFPs and supplies, although Sharp said one factor that aided the operating profit growth in this segment was a print volume recovery in the MFP business.

- Toshiba Tec: Toshiba Tec wrapped up its year under a cloud of uncertainty about whether its parent, Toshiba Corporation, might be acquired and brought private and, if so, what the fate of Toshiba Tec, which Toshiba described as a “non-core” business, might be. Toshiba Tec saw its revenue grow in Q4, but both operating and net profit declined. In the Workplace Solutions Business in Q4 2021, revenue increased 2.7 percent year-over-year, and operating profit improved 90.8 percent. Toshiba Tec said sales of multifunction devices increased in all overseas markets, including the Americas, Asia, and Europe. In addition, the company reported sales of auto ID systems and inkjet print heads grew.

- Xerox: In Q1 2022, Xerox’s revenue contracted, and the firm surprised the market by posting operating and net losses, largely as the result of rising costs. Starting this year, Xerox is reporting results for two operating segments: Financing (FITTLE) and Print and Other, which is the segment in which we are most interested. In Q1 2022, Print and Other revenue decreased 2.0 percent and the group had an operating loss of $20 million versus is operating profit of $71 million in the year-ago period. In Q1, Xerox’s entry-level equipment revenue decreased 10.3 percent. Entry A4 MFP installs were flat for color devices but plunged 39 percent year-over-year for monochrome units. Xerox’s midrange equipment sales declined 18.5 percent. Installs were down 9 percent for color midrange devices but down a whopping 61 percent for monochrome midrange units. Xerox said this was the equipment category that saw the biggest negative impact from supply-chain issues, so the decline was due largely to product shortages. Xerox’s high-end equipment sales were down 22.9 percent, and high-end installs were down 15 percent for monochrome units and down 29 percent for color devices. When financing is excluded from Print and Other results, Xerox’s post-sale revenue improved 3.8 percent, which the firm credited to an upturn in page volume in March.

Lots of New Forecasts

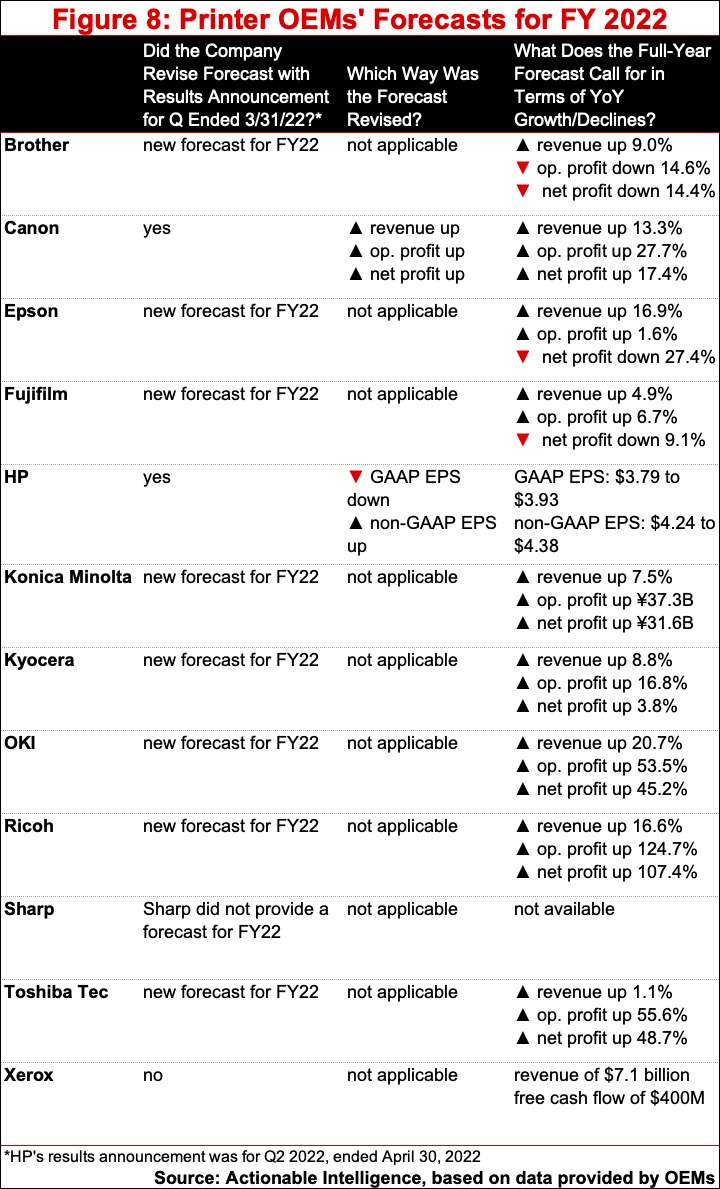

Because the quarter ended March 31, 2021, marked the end of the year for most Japanese OEMs, we saw a lot of new forecasts for FY 2022 issued this quarter, including from Brother, Epson, Fujifilm, Konica Minolta, Kyocera, OKI, Ricoh, and Toshiba Tec (see Figure 8). Sharp has yet to provide a forecast for the year but indicated it will do so soon. Konica Minolta, Kyocera, OKI, Ricoh, and Toshiba Tec all expect to report improved revenue and profits in the year ahead. Brother expects to post improved revenue but lower operating and net profit. Epson and Fujifilm anticipate higher revenue and operating profit but lower net profit.

Two OEMs—Canon and HP—revised their guidance for FY 2022. Canon revised its full-year targets upward, while HP made some mixed changes to earnings per share (EPS) guidance. Xerox does not provide much in the way of guidance for the year ahead, but it left its outlook unchanged.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence. For a limited time (now through July 1, 2022), we are offering $100 off the price of an annual subscription. Simply enter the coupon code SAVE100 at checkout.