In late January and throughout the month of February, printer and copier OEMs reported quarterly financial results for the three-month period ended on December 31, 2018. For all the Japanese OEMs, except Canon, this period was the third quarter of the year ending in March 2019. For Canon and Xerox, this period was the fourth quarter of 2018. HP is on a different financial calendar than all the other OEMs. Its first quarter of fiscal 2019 ended on January 31, 2019.

In late January and throughout the month of February, printer and copier OEMs reported quarterly financial results for the three-month period ended on December 31, 2018. For all the Japanese OEMs, except Canon, this period was the third quarter of the year ending in March 2019. For Canon and Xerox, this period was the fourth quarter of 2018. HP is on a different financial calendar than all the other OEMs. Its first quarter of fiscal 2019 ended on January 31, 2019.

Actionable Intelligence currently covers financial results from traditional printer and copier OEMs including Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, OKI, Ricoh, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available for Actionable Intelligence subscribers.

This month, we did something a little different and created a video overview of trends in revenue and operating profit and key positive and negative takeaways for OEMs. Overall, most OEMs saw companywide revenue decline but operating profits increase due largely to cost-cutting.

Key takeaways from OEMs’ most recent financial quarters are as follows.

- As we have reported throughout FY 2018, for most OEMs, with the exception of HP, FY 2018 has been challenging following a more upbeat FY 2017.

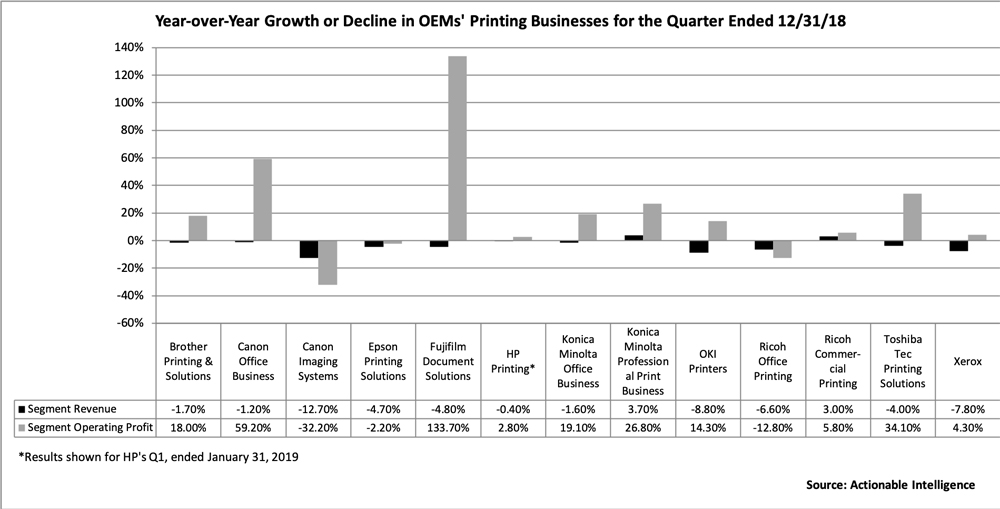

- Just as most OEMs saw their top line shrink and operating profit grow in the quarter, many OEMs reported similar trends in their printing businesses.

- In the quarter ended in December, the list of “winners”—firms whose printing businesses posted both revenue and operating income growth year-over-year—was scant. Only Konica Minolta’s Professional Print business and Ricoh’s Commercial Printing business were able to deliver both revenue and profit growth.

- The roster of OEMs reporting a mixed quarter, in which printing revenue shrank but operating profit grew, was large and included Brother’s Printing and Solutions segment, Canon’s Office business, Fujifilm’s Document Solutions business, HP’s Printing business, Konica Minolta’s Office business, OKI’s Printers business, Toshiba Tec’s Printing business, and Xerox.

- The printing businesses that posted downturns in both revenue and profit were Canon’s Imaging Systems business, Epson’s Printing Solutions business, and Ricoh’s Office Printing business.

- While HP’s fiscal 2018 was very strong, aided by the firm’s acquisition of Samsung’s printing business, HP’s Q1 2019 was more worrisome. HP reported a surprise decline in supplies revenue and revealed that it now expects its supplies revenue to shrink 3 percent this year.

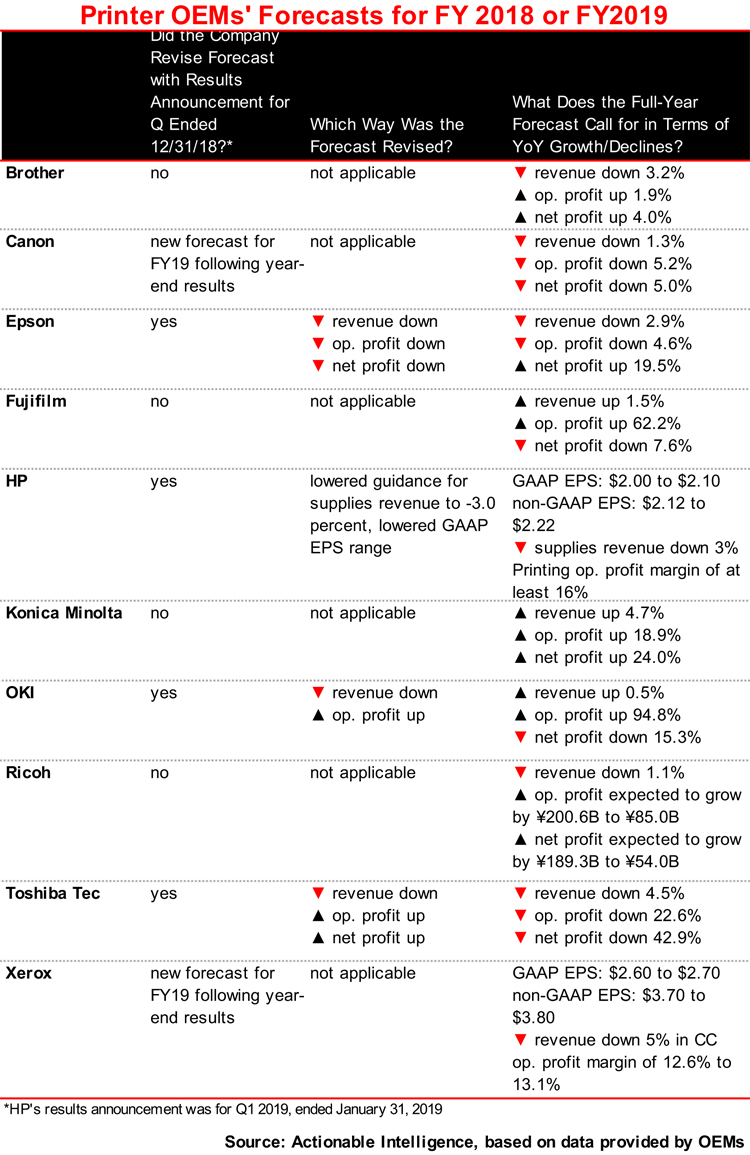

- Of the 10 major OEMs we track, two—Canon and Xerox—provided their initial forecasts for 2019; neither firm is expecting a strong year. Four OEMs, including Epson, HP, OKI, and Toshiba Tec, revised their forecasts. Epson and HP cut their forecasts—Epson for 2018 and HP for 2019. OKI and Toshiba Tec revised their revenue targets down but their profit targets up.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.