In January and February, original equipment manufacturers (OEMs) and vendors of single-function printers and multifunction printers (MFPs) announced their financial results for the three-month period ended December 31, 2023.

One thing that immediately caught our attention in comparing vendors’ performance is that while HP typically leads the industry in terms of printing revenue and profits, Canon overtook HP in terms of printing revenue in the quarter. This is the second time we have seen this happen. The last time was exactly one year ago (see “OEM Financials for Quarter Ended December 2022 Show Revenue Shakeup”). It will be interesting to see if this becomes the new seasonal pattern for the quarter ended in December or if Canon is able to supersede HP in terms of printing revenue in any additional quarters as well.

For most of the vendors we cover, the quarter was a decent one in which they managed to grow revenue and profits in their printing businesses or at least post gains in profits if not revenue. This is despite the fact that printer hardware units declined across most categories. While the quarters ended in December 2022, March 2023, and June 2023 were marked by upticks in A3 hardware shipments as vendors recovered from severe product shortages and fulfilled order backlogs, A3 product backlogs have largely normalized. Thus in the quarter ended in September 2023 and again in the quarter ended in December 2023, vendors reported declines in A3 shipments. But A4 shipments have been faring no better. Most vendors have been reporting declines in unit shipments of both A4 laser and inkjet printers. For some, the declines have been severe. The declines have stemmed from continued secular declines in demand for print but have been exacerbated by the downturn in China’s economy and decreased capital investment at enterprises. The one category doing well for most vendors is refillable ink tank devices.

There was another piece of good news, at last for some vendors. Similar to what we saw last quarter (see “OEMs Mostly See Lower Demand for Equipment but Some See Uptick in Supplies Sales”), some vendors reported improved supplies or non-hardware sales in the quarter ended in December 2023. This uptick was mostly noted by A4-focused vendors like Brother, Canon, Epson, and HP, although Canon also noted improved non-hardware sales in its office MFD business, which consists mostly of A3 devices. As we noted last quarter, there are various reasons for improved supplies sales including the price hikes for consumables most vendors have implemented, foreign currency exchange for Japanese vendors, and a recovery from an overstuffed channel in Brother’s case. However, we continue to believe printer vendors seeing supplies revenue grow may also be benefiting from the Ninestar ban in the United States (see “Ninestar Imports Banned by U.S. Government Due to Forced Labor Concerns”).

Why did most vendors see improved results despite downturns in hardware unit sales? Improved supplies sales were a factor for the aforementioned vendors. However, the biggest factor is that Japanese vendors continue to benefit from the weak yen. Many vendors cited higher product prices as well. Many vendors hiked prices in response to product shortages in prior periods. However, we noticed higher prices are proving stickier for A3 than A4 devices. Certain vendors noted feeling pricing pressure in the A4 categories, and HP noted its business was hurt by Japanese rivals cutting product prices. Certain vendors were able to improve their product mix. Vendors also benefited from lower costs for logistics and raw materials such as chips than in some prior periods. Moreover, most of the companies we cover have been taking cost-cutting actions.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from October 1, 2022, through December 31, 2022, was the third quarter of the fiscal year ending March 31, 2024. For Canon, U.S.-based Xerox, and China-based Ninestar, this period was the fourth quarter of fiscal 2023. HP is on a different financial calendar than all the other OEMs. Its first quarter of fiscal 2024 ran from November 1, 2023, through January 31, 2024. Ninestar has yet to report its results for Q4 and won’t do so until April. Thus, we excluded the firm from our comparisons this quarter. That said, we know that Ninestar isa projecting a downbeat year, which is not surprising given the impact of the U.S. ban and the slumping Chinese economy (see “Ninestar to Report Massive Net Losses in FY 2023”).

Here, we look specifically at the performance of OEMs’ business segments that include home and office printer hardware, supplies, and related software and services.

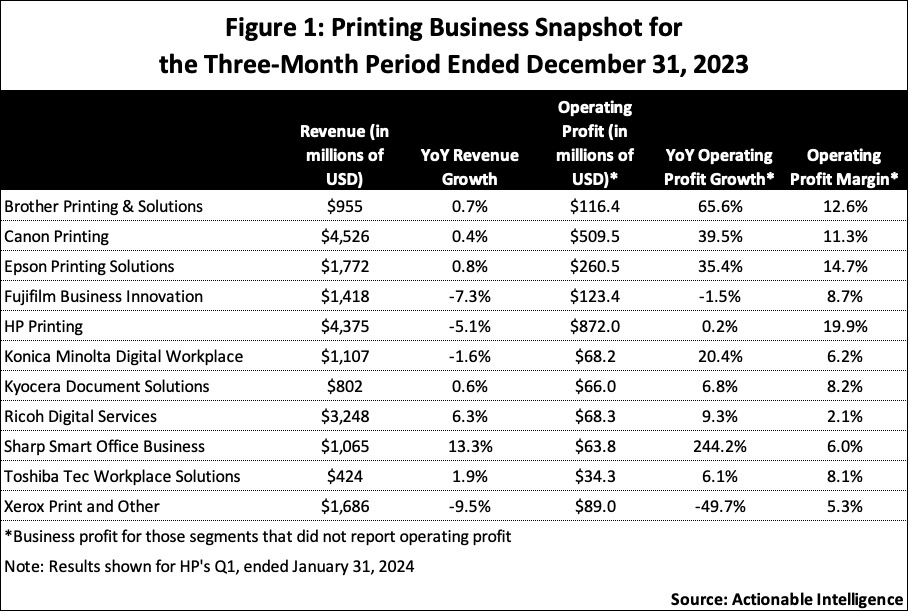

Figure 1 presents a snapshot of the financial performance of OEMs’ printing businesses for their most recent quarter.

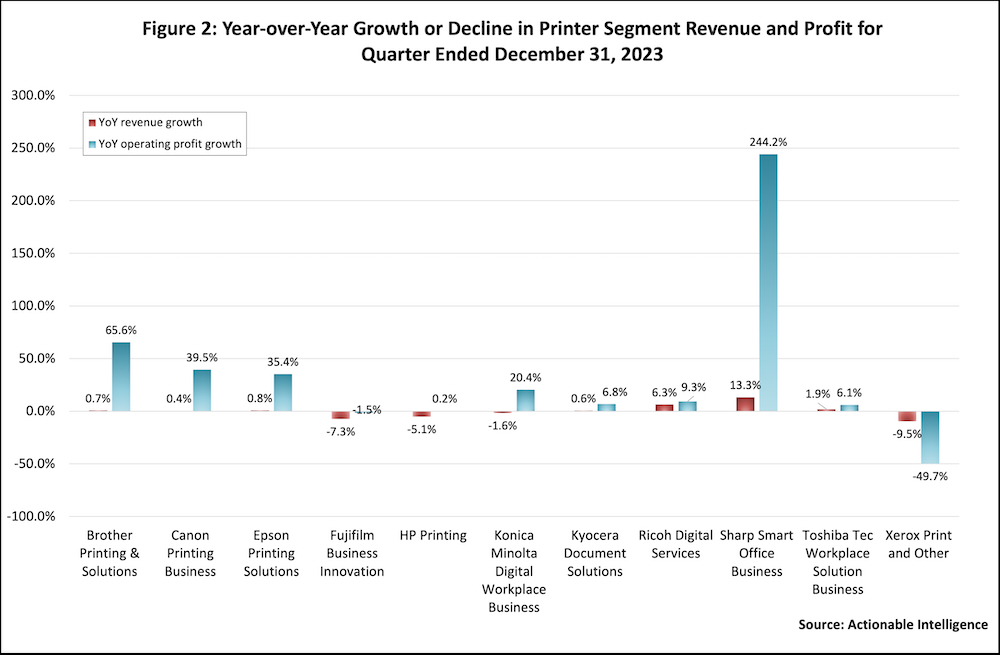

Figure 2 shows how OEMs’ printing businesses fared in terms of year-over-year revenue and profit growth or declines in their most recent quarter. Last quarter six of the vendors we cover saw both revenue and profit growth in their printing businesses (Brother Printing and Solutions, Canon Printing, Konica Minolta Digital Workplace, Kyocera Document Solutions, Ricoh Digital Services, and Toshiba Tec Workplace Solutions). This quarter, seven did (Brother Printing and Solutions, Canon Printing, Epson Printing Solutions, Kyocera Document Solutions, Ricoh Digital Services, Sharp Smart Office Business, and Toshiba Tec Workplace Solutions). Two vendors’ businesses, HP Printing and Konica Minolta Digital Workplace, reported lower revenue but higher profits—significantly higher in Konica Minolta’s case but very modestly (close to flat) in HP’s. Two vendors, Fujifilm Business Innovation and Xerox Print and Other, reported that both revenue and profits shrunk. Of course, Fujifilm is one of Xerox’s engine suppliers, and it indicated its declines were mostly due to lower sales to Xerox. Xerox had the toughest quarter of any vendor and is in the midst of cost-cutting and layoffs (see “Xerox Adds Some Details and a Lot of Layoffs to Reinvention Plan” and “Xerox Employees Get Pink Slips Today”).

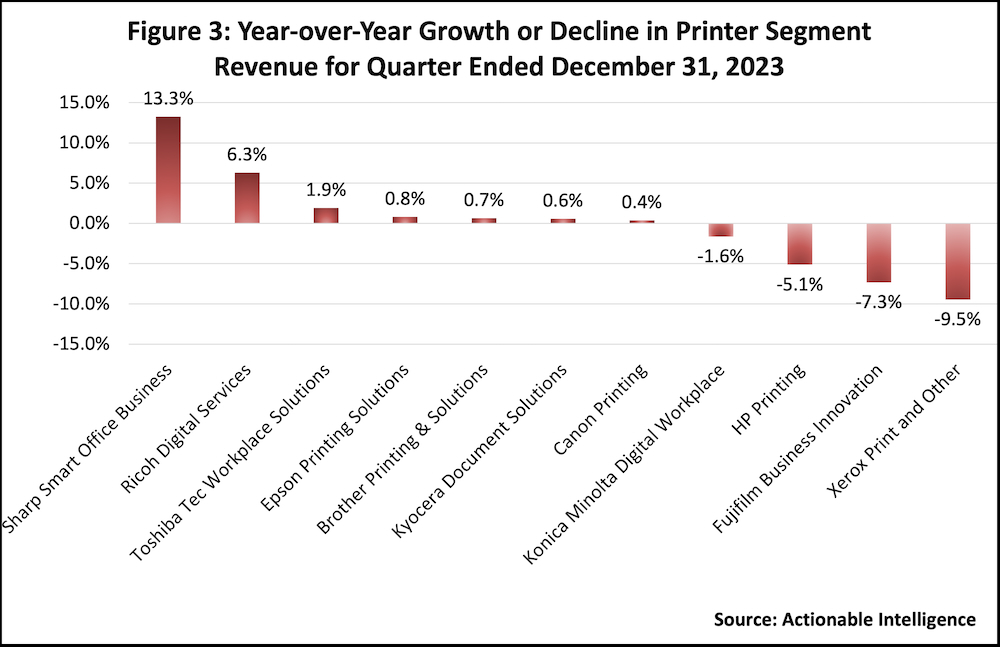

Figures 3 and 4 show these same year-over-year percentage changes separately. Figure 3 shows year-over-year revenue growth or decline for the quarter. Overall, revenue performance was worse this quarter than last. Last quarter, the average was a 1.0 percent increase. This quarter, the average was a 0.3 percent increase . Vendors reporting increases saw less impressive year-over-year growth, and for those vendors reporting declines, the declines grew steeper. The only vendor to report double-digit revenue growth was the Sharp Smart Office Business. The vendor seeing the biggest revenue decline was Xerox Print and Other.

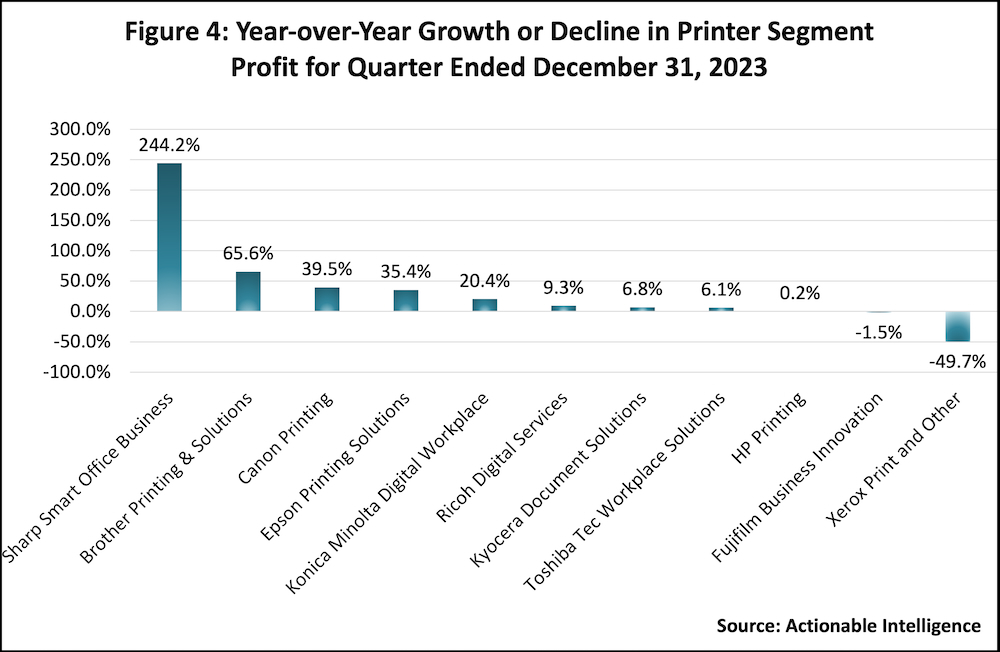

In general, vendors’ profit performance was better than revenue performance. As Figure 4 shows, nine vendors saw improved profits in the quarter. Similar to what we saw for year-over-year revenue growth, Sharp Smart Office Business was the business reporting the most impressive year-over-year profit growth. Other vendors reporting double-digit profit growth included Brother Printing and Solutions, Canon Printing, Epson Printing Solutions, and Konica Minolta Digital Workplace. Notable this quarter is that Epson Printing Solutions posted a big uptick in profit after seeing profit declines last quarter. HP Printing saw a very slight uptick in profit after reporting declines last quarter. In contrast, Xerox Print and Other, which saw profit growth last quarter, reported the biggest year-over-year drop in profits.

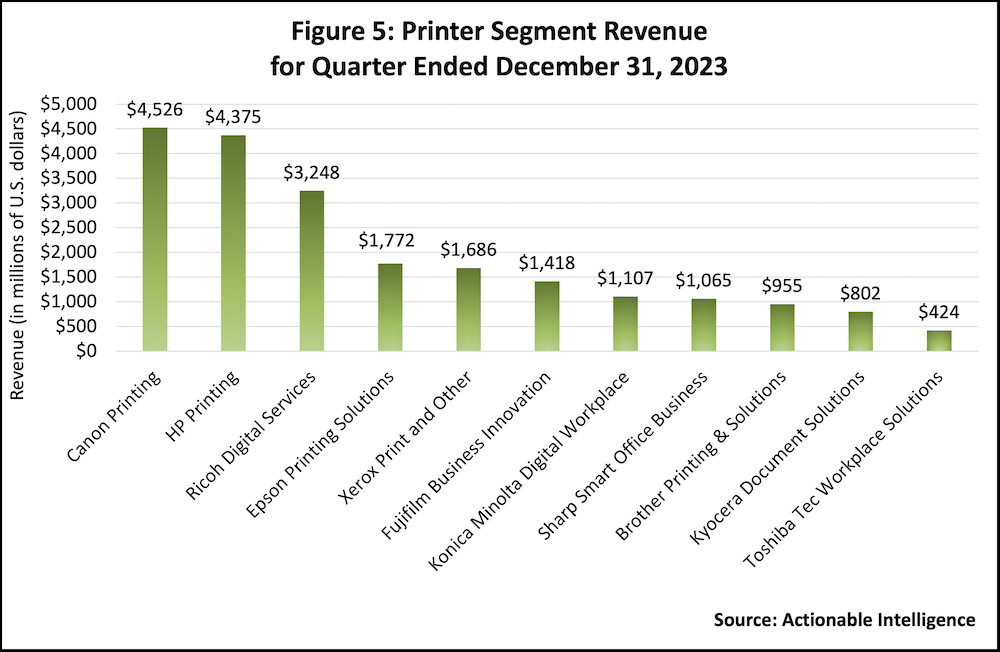

Figure 5 shows how much revenue in U.S. dollars each OEM’s printing business generated in the quarter ended December 31, 2023. Obviously, as noted above, the big change this quarter is that Canon Printing brought in more revenue than HP Printing. As noted, we have only observed this happen once before—in the quarter ended December 31, 2022. After this trend took place a year ago, HP retook its top spot in terms of revenue for the next three quarters and we’ll be watching to see if the same happen this year or if Canon can edge out HP in terms of printing revenue in any other quarters. There was one other change in vendor rankings in terms of revenue. Whereas Xerox Print and Other brought in more revenue that Epson Printing Solutions last quarter, this quarter Epson Printing Solutions topped Xerox Print and Other’s revenue.

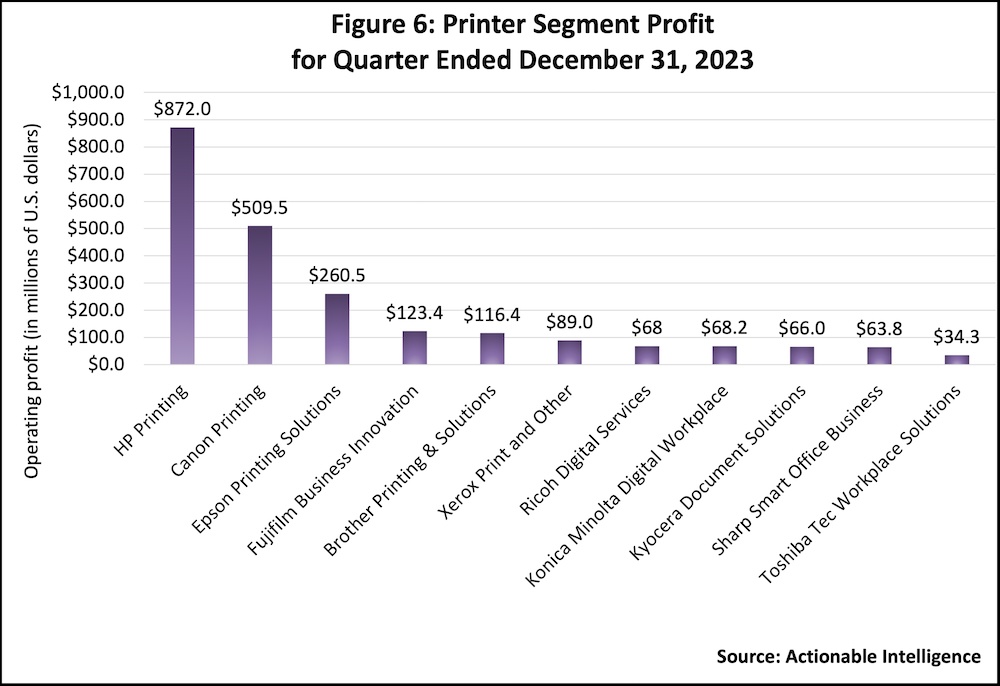

Figure 6 shows the OEMs’ printer segment profits in U.S. dollars. As always, this chart exemplifies the fact that big percentage increases in profit don’t always translate into big profits. Sharp Smart Office saw the highest percentage increase in profit, but it is the vendor with the second smallest profit in terms of actual dollars. HP Printing and Canon Printing remained in their customary first and second spots in terms of profit. Epson Printing Solutions was a distant third, followed by Fujifilm Business Innovation in the number-four spot and Brother Printing and Solutions at number five. Last quarter, Fujifilm Business Innovation was ranked third, Epson Printing Solutions fourth, and Brother Printing and Solutions fifth. Same as last quarter, Sharp Smart Office and Toshiba Workplace Solutions ranked last in terms of profits.

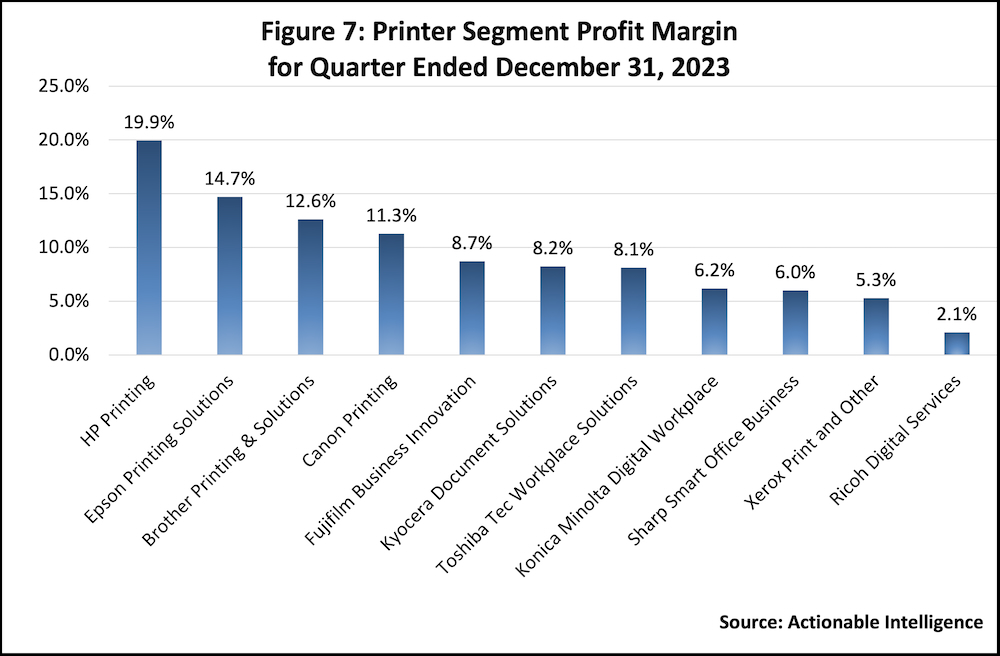

Lastly, Figure 7 compares printing segment profit margin for each of the vendors. Despite the less-than-great performance of its Printing business in recent quarters, HP has managed to maintain industry-leading margin and the same was true in its latest quarter, with the company boasting a margin of nearly 20 percent. Last quarter, only one vendor other than HP Printing (Brother Printing and Solutions), delivered a double-digit profit margin. This quarter three did. HP Printing’s 19.9 percent margin was followed by Epson Printing’s 14.7 percent margin, Brother Printing and Solutions’ 12.6 margin, and Canon Printing’s 11.3 percent margin. The same two vendors had the most meager margins this quarter as last: Xerox Print and Other with its 5.3 margin and Ricoh Digital Services with 2.1 percent.

Below we have summarized the performance of the various OEMs we track, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

Brother: For Brother as a whole, the company saw a decline in revenue in Q3 2023 after 12 straight quarters of revenue growth, operating profit also declined modestly, but net profit improved. Declines, however, were mostly due to the downturn in the firm’s Machinery segment. The business we are most interested in, Printing and Solutions segment, outperformed the company as a whole, with revenue growing a modest 0.7 percent but operating profit up a robust 65.6 percent. Interestingly, the strong performance in this business was mostly due to improved consumables sales as Brother saw a downturn in hardware unit sales and revenue in Q3 2023. Laser printer hardware revenue plummeted 13 percent as unit shipments fell 8 percent. However, laser consumables sales were up a robust 11 percent in Q3. Inkjet hardware revenue fell 5 percent in Q3 on a 3 percent downturn in units, but inkjet consumable sales were flat. Similar to what we saw last quarter, however, it appears that strong consumables sales stem mostly from an easy comparison. Consumables sales plunged in the year-ago period because channel partners had stocked up in advance of a price hike.

Canon: Canon wrapped up a strong FY 2023 with a decent Q4: net sales and operating profit rose, but net income shrank. In the Printing segment, net sales in Q4 2023 rose a very modest 0.4 percent from the year-ago period, but segment operating profit grew 39.5 percent. In Q4, Office net sales grew 6.2 percent year-over-year. Office MFD sales rose 3.6 percent. Canon said that Q4 Office MFD hardware net sales increased 3 percent despite a 11 percent decline in units. Meanwhile office MFD non-hardware sales grew 4 percent. In contrast, net sales in the Prosumer group declined for a fourth straight quarter, dropping 8.7 percent year-over-year in Q4 2023. Laser printer net sales contracted 6.3 percent. The problem seemed to be on the hardware side of the business because laser printer non-hardware sales actually grew 13 percent. In contrast, laser hardware net sales plummeted 30 percent on a steep 34 percent decline in units. Meanwhile, inkjet printer net sales in Q4 dropped by 12.7 percent. Q4 inkjet hardware net sales were down 22 percent on a 14 percent downturn in units, while inkjet non-hardware net sales fell 4 percent.

Epson: In Q3 2023, Epson’s revenue shrunk for a second consecutive quarter, but the firm managed to grow both operating profit and net profit growth after reporting profit declines in the first half of the year. The Printing Solutions segment delivered its 13th straight quarter of revenue growth in Q3 2023, but growth was modest—up just 0.8 percent. Printing Solutions business profit, however soared 35.4 percent. The Office and Home Printing subsegment saw its revenue drop 1.3 percent in Q3 2023. SOHO and home inkjet printer revenue fell 2.5 percent. In contrast, office-shared inkjet printer revenue grew 18.1 percent. Epson noted that inkjet printer hardware revenue decreased 4 percent in Q3 2023 mainly because of declines in unit sales of ink cartridge printers. Inkjet printer ink revenue grew 6 percent in Q3. That helped fuel strong Printing Solutions business profit growth of 37.4 percent.

Fujifilm: In Q3 2023, Fujifilm’s revenue rose to reach a new all-time high, and net income improved, too, but operating income declined modestly. Fujifilm’s Business Innovation fared worse than the company as a whole. In Q3 2023, Business Innovation revenue dropped 7.3 percent year-over-year and operating income decreased 1.5 percent. Revenue in the business solutions subsegment increased 6.7 percent year-over-year in the quarter, but the office solutions group that is responsible for printers, MFPs, and supplies saw revenue decline a steep 13.6 percent. Fujifilm said there were some positives in the office solutions business such as new OEM customers and upward price revisions, but they were not enough to offset lower exports to Europe and the United States—meaning to Xerox.

HP: Q1 2024 marked a mixed start to the year for HP. Company revenue continued to decline, albeit more modestly than in prior quarters, but profits were up significantly. The year-over-year declines in Printing revenue continued in Q1 2024, with segment revenue falling 5.1 percent. Printing operating profit was essentially flat, ticking upward 0.2 percent. This quarter, HP made some changes to its Printing hardware segments, transferring LaserJet printer revenue from consumer printing to commercial printing. In Q1 2024, consumer hardware revenue fell 22.3 percent. However, commercial printing hardware revenue was off, too, dropping 11.6 percent. Total hardware units fell 17 percent—the decline was 15 percent for consumer and 18 percent for commercial. However, HP once again had good news about supplies revenue, which up 0.2 percent.

Konica Minolta: Q3 2023 was not a great quarter for Konica Minolta as company revenue, operating profit, and net profit all fell year-over-year. In the Digital Workplace Business, revenue fell 1.6 percent year-over-year in Q3, but operating profit grew 20.4 percent due to lower production and logistics costs. The cause of the revenue decline was the Office segment, in which revenue declined 3.3 percent. Konica Minolta indicated its hardware revenue was 85 percent of last year’s levels, but the company said this was largely due to the firm reducing its backlog in the year-ago period. Unit sales of A3 color models were 81 percent of last year’s levels but unit sales of A3 monochrome models were 100 percent. The firm said that in Q3 2023 office non-hardware revenue was 96 percent of the level seen in Q3 2022.

Kyocera: In Q3, Kyocera once again saw company revenue drop modestly year-over-year, but both operating and net profit fall by double-digits. The Document Solutions segment fared better than the company as a whole. In Q3, sales revenue in the Document Solutions group ticked upward 0.6 percent and business profit increased 6.8 percent. The company cited the weak yen as a factor in the group’s sales revenue growth.

Ricoh: In Q3 2023, Ricoh reported good companywide results: net sales, operating profit, and net profit all improved year-over-year. It was also a good quarter for Ricoh’s Digital Services segment. The group’s net sales were up 6.3 percent as operating profit improved 9.3 percent. Ricoh did not post its Office Printing net sales for Q3, but it did for the first nine months of the year. For the nine-month period, Office Printing net sales rose 5.6 percent. The company said that while hardware sales in the Office Printing group were up 5 percent during the first nine months of FY 2023, unit shipments underperformed the company’s projections. Moreover, Ricoh non-hardware sales, which includes consumables, were down 1 percent.

Sharp: Sharp had a mixed Q3 2023, with net sales dropping but operating profit improving. The company has a net loss, but it was smaller than in the year-ago period. It was, however, a very strong quarter for the Smart Office business, which saw net sales grow 13.3 percent and operating profit soar 244.2 percent. Commenting on trends in net sales in the Smart Office business in Q3, Sharp noted that sales in the MFP business and the office solutions business increased significantly.

Toshiba Tec: In Q3 2023, Toshiba Tec’s net sales grew year-over-year, but operating profit tumbled and the firm posted net losses. The trouble stemmed largely from the Retail Solutions segment, which is responsible for point-of-sale (POS) systems, because Workplace Solutions, which is the group that we are most interested in, saw growth. In the Workplace Solutions segment net sales rose a modest 1.9 percent in Q3 2023 and operating profit improved 6.1 percent. Toshiba Tec said net sales of MFPs increased due to the impact of foreign currency exchange and strong sales in the Americas, Europe, and other regions. Toshiba Tec said the uptick was the result of “a recovery from product supply disruptions and increased selling prices.”

Xerox: Xerox closed FY 2023 on a sour note. In Q4 2023, Xerox’s year-over-year shrunk, operating profit tumbled, and the firm reported a net loss for the quarter. Trends in Xerox’s Print and Other segment mirrored those at the company as a whole. In Q4, Print and Other revenue declined 9.5 percent, and segment profit fell 49.7 percent. Xerox reported its equipment revenue declined for a second straight quarter, dropping 17.3 percent year-over-year in Q4. Revenue in the entry-level segment in Q4 declined 29.1 percent year-over-year. Total entry-level installs were down 31 percent. Midrange equipment sales also declined, falling 18.2 percent and bringing to an end five straight quarters of revenue growth in this category. Midrange installs were down 19 percent. Declines in this category were due largely to the impact of backlog reductions in the year-ago quarter. The high-end equipment business saw a 6.0 percent year-over-year decrease in revenue even as installs increased 12 percent. In Q4, Xerox’s post-sale revenue declined for a sixth consecutive quarter and fell 5.8 percent year-over-year.

Forecast Changes

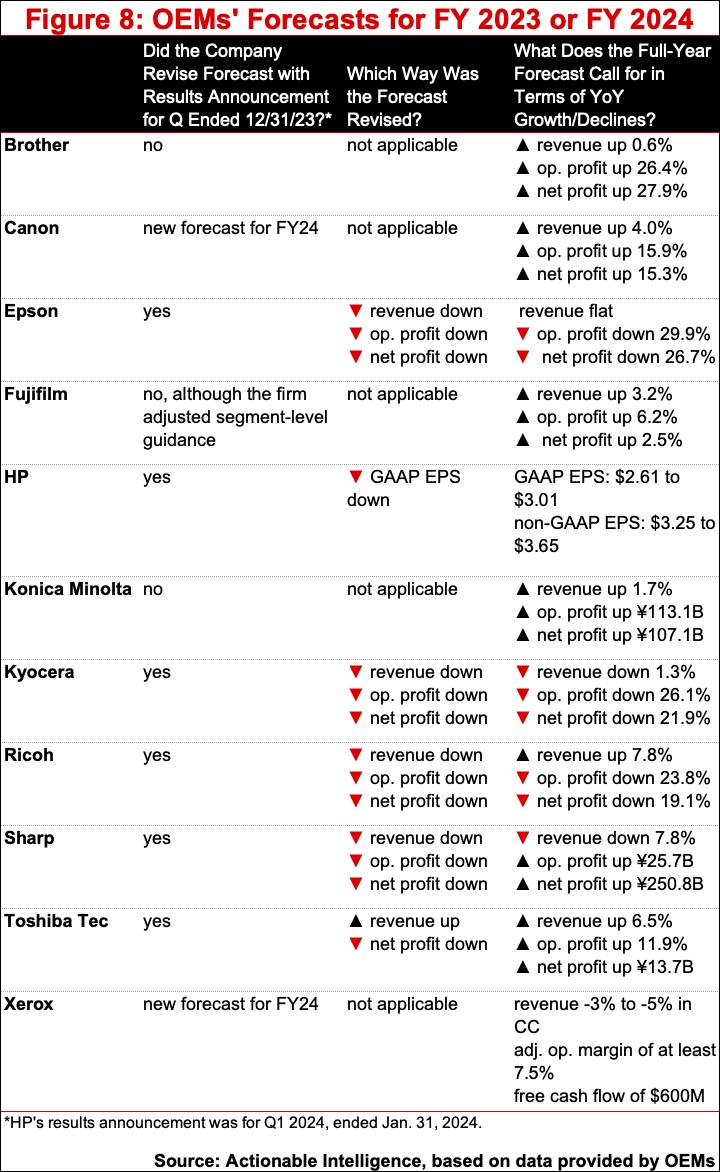

This quarter we saw two vendors that ended their fiscal years, Canon and Xerox, post new forecasts for FY 2024. As Figure 8 shows, Canon expects to post revenue and profit growth. Xerox expects revenue to continue to slide but anticipates a higher operating profit. Five vendors—Epson, HP, Kyocera, Ricoh, Sharp, and Toshiba Tec—revised companywide targets. By and large, all the revisions were downward, with the exception of Toshiba Tec, which raised guidance for revenue even as it lowered its net profit forecast.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.