In January and February, original equipment manufacturers (OEMs) of printers and MFPs announced their financial results for the three-month period ended December 31, 2022.

With this quarter’s results what grabbed our attention was a change in who leads printer OEMs in terms of quarterly revenue in their printing segments. While HP is still the marketplace leader in terms of printer and MFP unit shipments (see “IDC Reports Double-Digit Growth in Worldwide Hardcopy Peripheral Shipments in Q4 2022”), its Printing business did not bring in the most revenue in its latest quarter. Canon’s Printing business superseded HP’s in terms of revenue—for what we believe is the first time. While it is unclear if this shakeup is an anomaly or heralds a new trend, it is music to Canon’s ears. The firm has set a goal of being the number-one vendor in terms of home and office printing market share (see “Canon Says It Will Be the Top Printer Vendor and Printing Demand Will Remain Firm”). It hasn’t done that, but taking more revenue is a pretty big prize.

Of course, there have been some unusual conditions at work in the printer hardware and supplies markets, and we see these broader trends as impacting the revenue change described above and indeed the results of all the companies we cover:

- Japanese companies (like Canon) are seeing sales benefit from yen depreciation, while U.S. companies (like HP) are seeing sales hurt by a strong dollar.

- The height of the pandemic was great for companies with small-office/home-office (SOHO) printer businesses—especially inkjet devices and inkjet consumables. Now home printing demand is normalizing, so some vendors are seeing lower sales of consumables for these devices.

- While the height of the pandemic was bad news for A3 MFP vendors, FY 2021 and the first part of FY 2022 brought its own challenges in the form of a severe chip shortage and lockdowns in China that caused shortages of A3 MFPs and, for some vendors, supplies for these devices. That led to big order backlogs and pent-up demand. Most vendors are now seeing better supply of these product and thus some of the highest growth rates in sales in the A3 MFP we can recall seeing. In short, whereas conditions early in the pandemic favored firms mostly focused on A4, we are now seeing OEMs with A3 businesses perform better than their A4-focused siblings.

- As was the case with the big inkjet boom of early in the pandemic, this A3 boom should be temporary.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from October 1, 2022, through December 31, 2022, was the third quarter of the fiscal year ending March 31, 2023. For Canon, U.S.-based Xerox, and China-based Ninestar, this period was the fourth quarter of fiscal 2022. HP is on a different financial calendar than all the other OEMs. Its first quarter of fiscal 2023 ran from November 1, 2022, through January 31, 2023. Ninestar has yet to report its results for Q4 and won’t do so until April. Thus, we excluded the firm from our comparisons this quarter. Here, we look specifically at the performance of OEMs’ business segments that include home and office printer hardware, supplies, and related software and services.

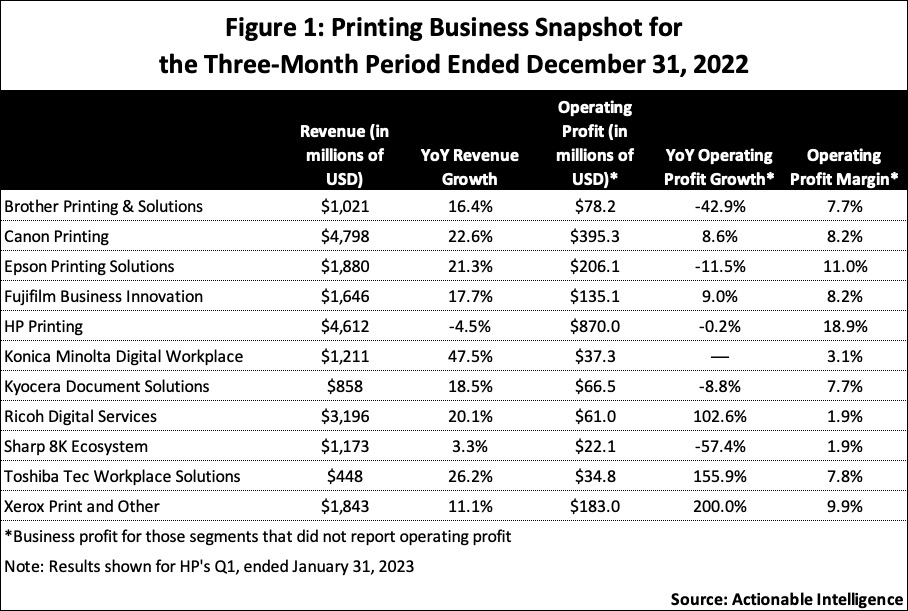

Figure 1 presents a snapshot of the financial performance of OEMs’ printing businesses for their most recent quarter.

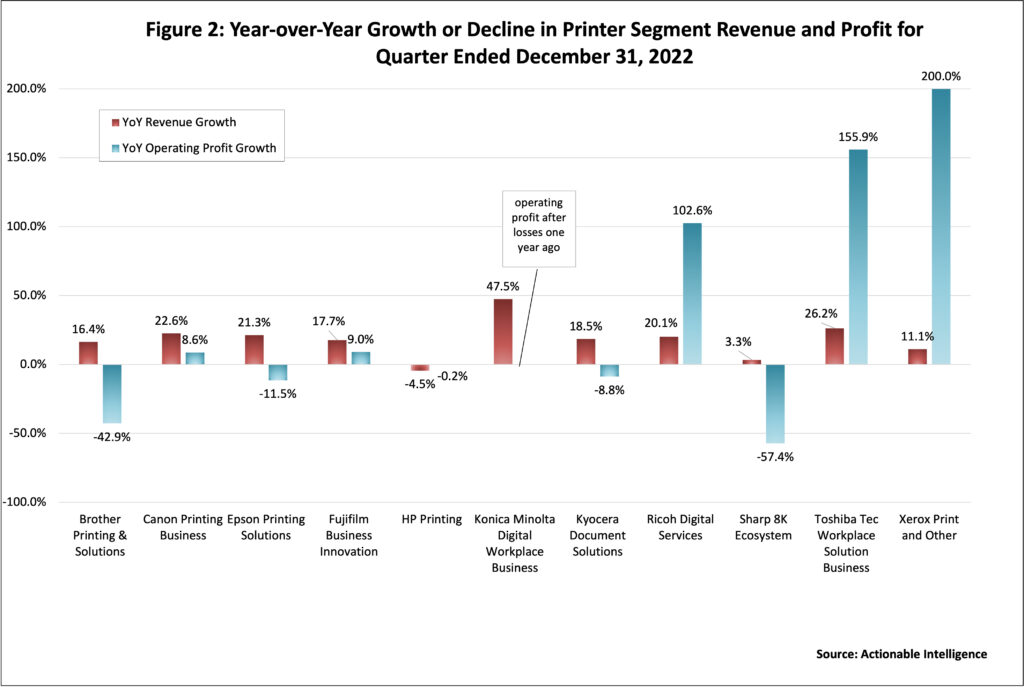

Figure 2 shows how OEMs’ printing businesses fared in terms of year-over-year revenue and profit growth or declines in their most recent quarter. Similar to last quarter (see “OEMs Post Mixed Results as Demand for A4 Supplies Drops”), six vendors were able to report both revenue and profit growth in their printing businesses. And similar to last quarter, those businesses reporting both revenue and profit growth belonged largely to A3 MFP vendors: Fujifilm Business Innovation, Konica Minolta Digital Workplace Business, Ricoh Digital Services, Toshiba Tec Workplace Solutions, and Xerox Print and Other. This quarter, Canon’s Printing Business joined the other five vendors on this list. Four vendors posted mixed results. Brother Printing and Solutions, Epson Printing Solutions, Kyocera Document Solutions, and Sharp 8K Ecosystem all saw revenue grow but profits decline, with these firm citing higher costs. HP Printing was the one OEM printing segment to report lower revenue and profits, although the profit dip was modest and the segment’s operating profit margin actually improved.

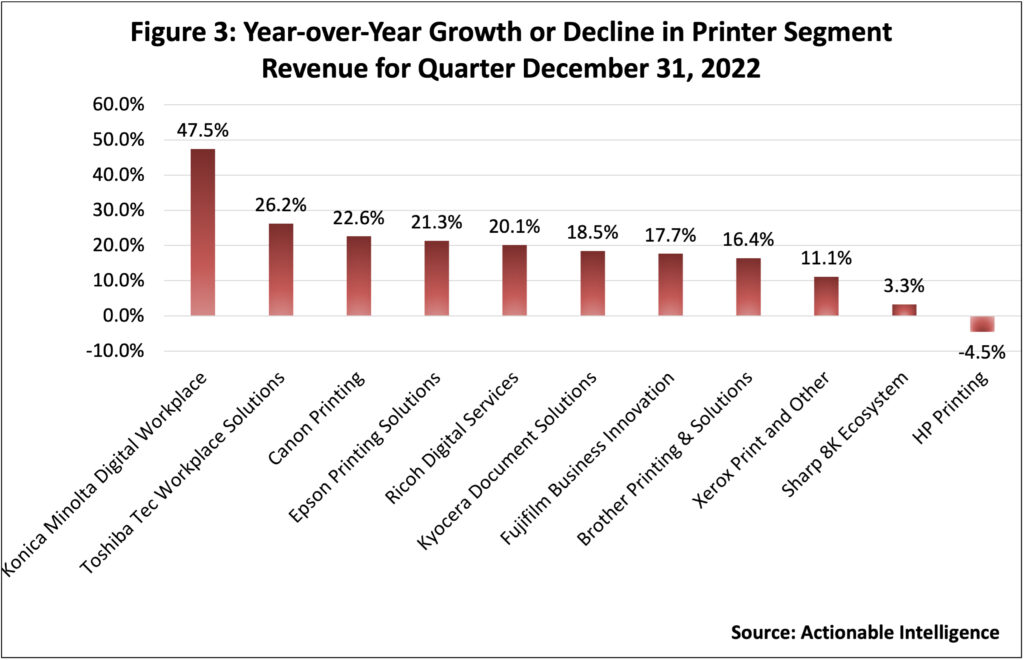

Figures 3 and 4 show these same numbers separately. Figure 3 shows year-over-year revenue growth or decline for the quarter. What stands out is the same thing as last quarter: A3 MFP vendors are seeing strong revenue growth as product shortages improve. Japanese OEMs also received a big boost from yen depreciation. All printing segments that we are comparing, except for Sharp 8K Ecosystem and HP Printing, reported double-digit revenue growth. Those with over 20 percent year-over-year revenue growth include Konica Minolta’s Digital Workplace Business (+47.5 percent), Toshiba Tec Workplace Solutions (+26.2 percent), Canon Printing (+22.6 percent), Epson Printing Solutions (+21.3 percent), and Ricoh Digital Services (+20.1 percent).

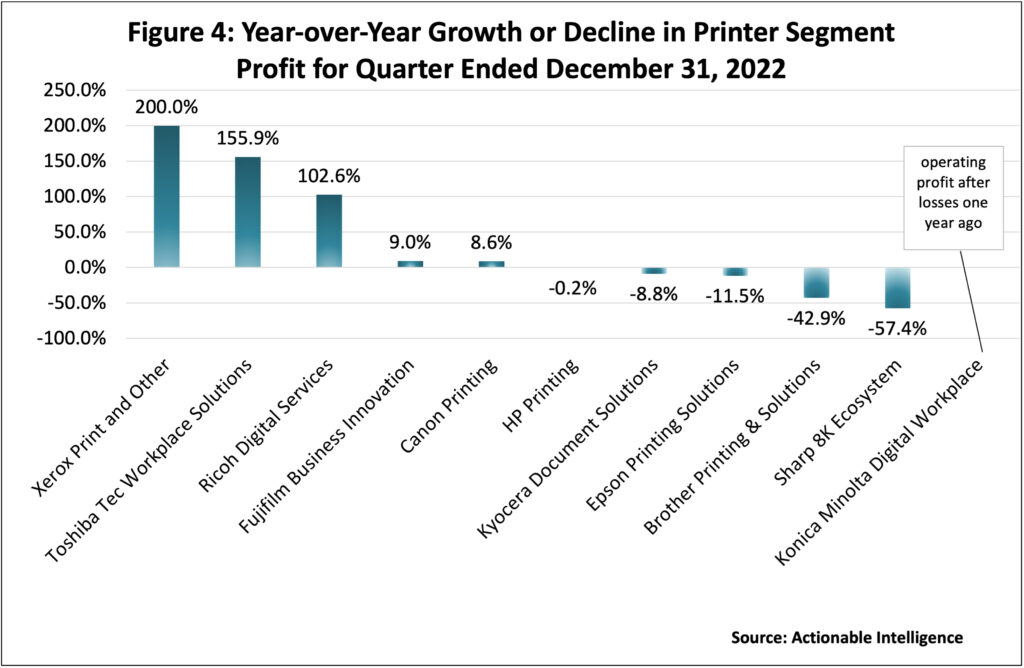

Figure 4 shows the year-over-year percentage change in segment operating profit. Those businesses reporting operating profit growth include Xerox Print and Other (+200.0 percent), Toshiba Tec Workplace Solutions (+155.9 percent), Ricoh Digital Services (+102.6 percent), Fujifilm Business Innovation (+9.0 percent), and Canon Printing (+8.6 percent). Konica Minolta’s Digital Workplace Business also saw improved profits but we can’t show year-over-year growth because it had a loss in the year-ago period.

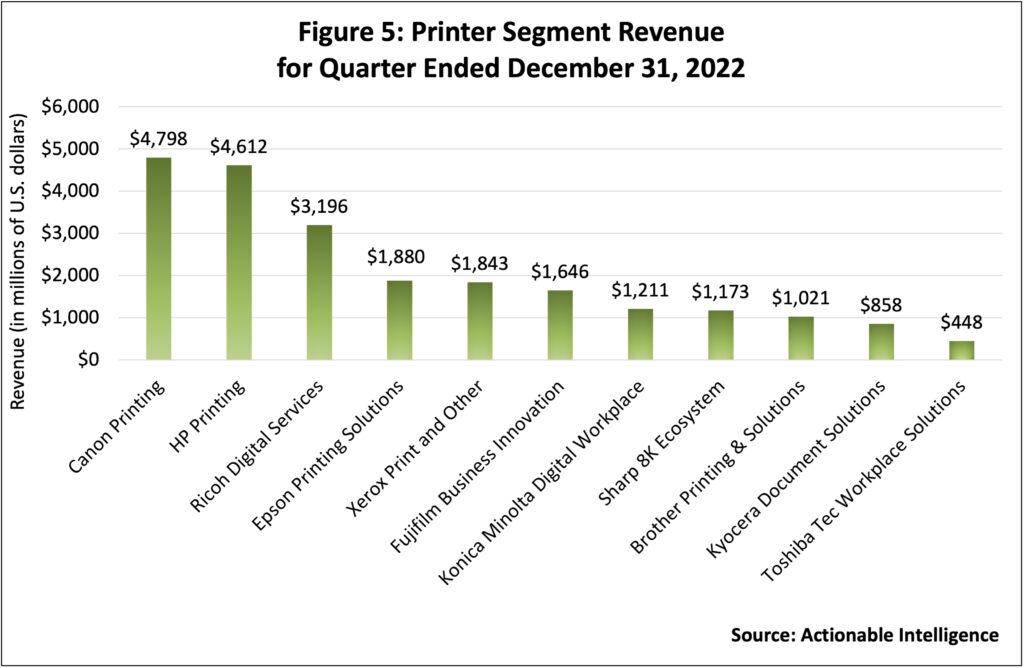

Figure 5 shows how much revenue in U.S. dollars each OEM’s printing business generated in the quarter ended December 31, 2022. As noted above, for the first time that we can recall, Canon Printing held the top spot in terms of quarterly revenue, followed by HP in the number-two spot. Ricoh held the number-three spot as it has for several quarters now. There were some other changes. Epson moved up to the fourth spot from the fifth spot it held in the past couple of quarters, putting it ahead of Xerox. However, seasonally, the quarter ended in December is Epson’s strongest for the year, and it also moved up to the fourth spot in the year-ago period (see “OEMs Feel Pressure on Revenue and Profits as Supply-Chain Trouble Persists”). Another thing to note is that this quarter Konica Minolta Digital Workplace pulled ahead of Sharp 8K Ecosystem in terms of revenue.

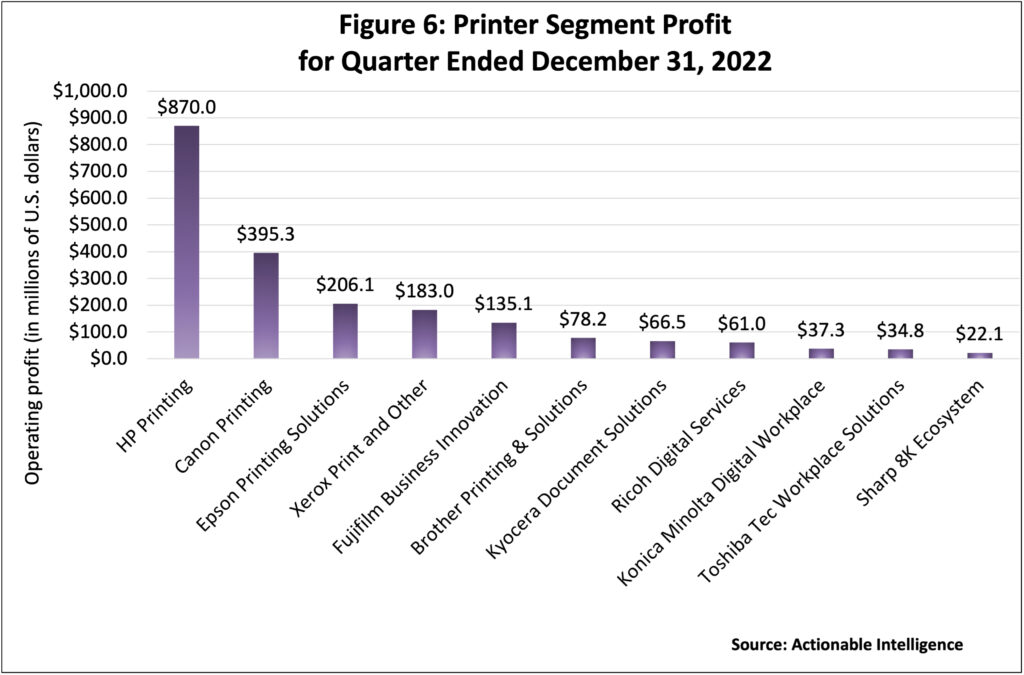

Figure 6 shows the OEMs’ printer segment profits in U.S. dollars. As was the case last quarter, no business had an operating loss. While it did not bring in the most revenue in its most recent quarter, HP Printing continued to deliver the most operating profit. Canon Printing and Epson Printing Solutions followed in what has become their customary number-two and number-three spots. One change is that while last quarter Fujifilm Business Innovation brought in more profit than Xerox Print and Other, in this latest quarter the reverse was true. And, as always, this chart serves as a good reminder that higher year-over-year growth doesn’t always mean higher profits (or revenue for that matter). For example, Toshiba Tec Workplace Solutions saw triple digit operating profit growth but is ranked second to last in terms of total segment operating profit.

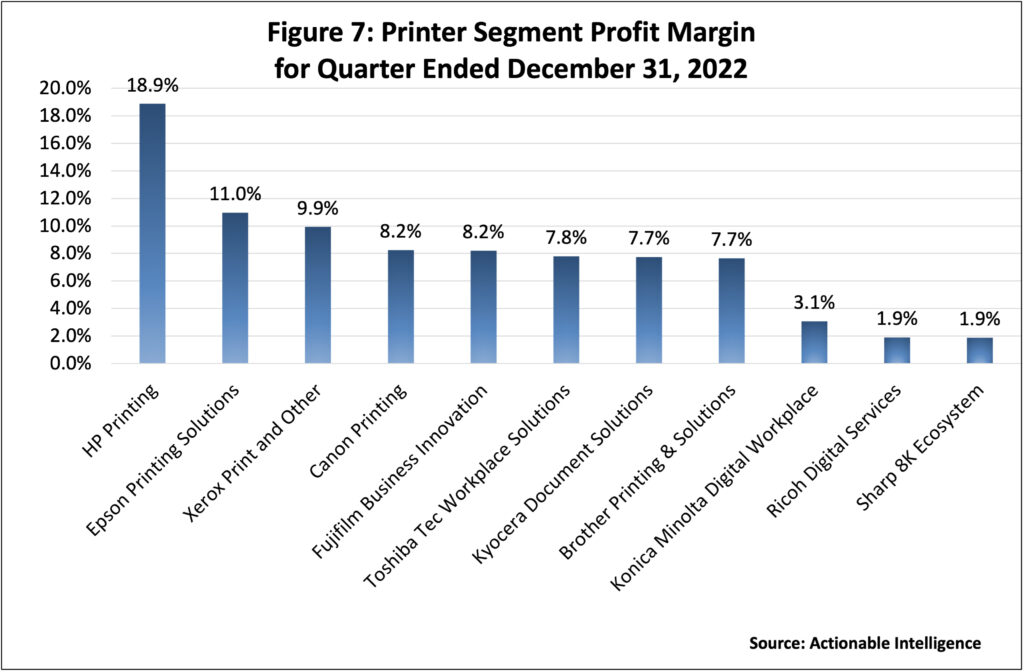

Figure 7 shows the operating profit margin in OEMs’ printing businesses. And in this respect, HP remains the vendor to beat. Despite a tough quarter, HP Printing boasted an operating profit margin of 18.9 percent, 7.9 percentage points higher than its closest competition, which was Epson Printing Solutions with an 11.0 percent margin. While these were the only two vendors with a double-digit operating profit margin, Xerox’s operating profit also grabbed our attention. Xerox Print and Other had an operating profit margin of 3.5 percent last quarter but a margin of 9.9 percent for the quarter ended in December.

Below we have summarized the performance of the various OEMs we track, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Brother’s Q3 resembled its prior two quarters. Company revenue grew but operating and net profit shrank. While the firm said higher costs for materials and selling, general, and administrative (SG&A) were factors in its lower profits, the firm also laid the blame on the segment we are most interested in: Printing and Solutions. The Printing and Solutions segment saw its revenue grow 16.4 percent year-over-year in Q3 2022, but segment operating profit tumbled 42.9 percent. The firm said that product supply improved. Laser hardware revenue increased 42 percent year-over-year in Q3 2022, and laser hardware unit growth was 3 percent. Inkjet all-in-one hardware revenue increased 46 percent on strong 42 percent unit shipment growth. What hurt the group’s profits, in addition to the aforementioned higher costs, is that it sold more hardware but fewer consumables. In Q3 2022, Brother reported its consumables ratio was just 49 percent. In comparison, that same ratio was 58 percent in Q3 2021. Laser consumable revenue was flat (but down 13 percent in local currency), and ink jet consumables revenue rose 8 percent (but decreased 2 percent in local currency). One problem, Brother said, was that channel partners stocked up on consumables in advance of price hikes.

- Canon: Canon wrapped up its fiscal 2022 with good news: revenue and profits were up sharply in Q4 2022, and the company delivered its second straight year of revenue and profit growth. The Printing Business, which is Canon’s biggest business segment, also performed well in Q4. While revenue has been growing in this business segment all year, operating profit declined in both Q1 and Q3. In Q4 2022, however, Printing Business revenue rose a robust 22.6 percent, as operating profit grew 8.6 percent. Canon’s Office segment bounced back from the shortages it saw in the year-ago period. In the Office category in Q4 2022, net sales grew 23.9 percent year-over-year. Office MFD net sales increased 29.4 percent. Office MFD hardware net sales rose an astounding 50 percent on a 27 percent increase in units, while office MFD non-hardware sales improved 13 percent. In Q4, the Prosumer segment reported net sales growth of 19.8 percent. Net sales of laser printers increased 17.3 percent in the quarter, with net sales of laser printer hardware up 33 percent, even as laser printer units were down 10 percent, and sales of laser non-hardware grew 8 percent. In Q4 2022, inkjet printer net sales were up 24.0 percent year-over-year. In Q4, inkjet hardware net sales increased 43 percent on a 17 percent increase in units, and inkjet printer non-hardware net sales grew 11 percent.

- Epson: Epson reported strong revenue growth in Q3 2022, but both operating and net profit fell sharply due to some foreign exchange gains in the year-ago period and weaker profits in Printing Solutions. In that segment, revenue in Q4 2022 increased 21.3 percent year-over-year, due to an easing of supply constraints and increased unit sales, pricing measures, and favorable foreign currency exchange. However, Printing Solutions segment profit decreased 11.5 percent due to higher material and logistics costs, the strong dollar, and shrinking sales of ink cartridges. Breaking the segment down a bit further, in Q3 2022, the Office and Home Printing subsegment saw revenue grow 22.7 percent year-over-year as business profit declined 24.6 percent. SOHO and home inkjet printer revenue was up 25.5 percent year-over year. Inkjet printer unit sales were up 20 percent, and ink revenue rose 2 percent, with that growth due largely to FOREX as Epson said in constant currency ink revenue declined 8 percent. Ink bottle sales rose, but ink cartridge sales declined. Shared office inkjet printer revenue exhibited its strongest revenue growth of the year in Q3, climbing 16.2 percent.

- Fujifilm: In Q3 2022, revenue and operating income grew year-over-year, but net income declined modestly. In the Business Innovation segment, revenue and income increased in Q3, with revenue up 17.7 percent and operating income up 9.0 percent. In Q3 2022, office solutions revenue grew a robust 22.1 percent year-over-year with the firm reporting that domestic office solutions revenue rose as product supply improved and that exports to Europe and the United States fared well. Fujifilm also revealed that in December 2022 it started the sale of office solutions products in a new market for the company: India.

- HP: Q1 2023 marked a tough start to HP’s fiscal year, with company revenue, operating profit, and net profit all down sharply. While both of HP’s business segments saw declines, Personal Systems, the PC business, saw a particularly steep revenue decline of 24.4 percent. The Printing business, which is the segment we care most about, saw revenue shrink 4.5 percent. HP had better news about Printing operating profit. While operating profit declined 0.2 percent, this was essentially flat with the year-ago period and segment operating margin actually improved and was on the high end of HP’s guidance for the group. As was the case last quarter, Printing operating profit benefited from increased supplies market share, cost cutting, and increased sales of more profitable HP+ and “Big Tank” devices. Total printing hardware shipments increased 2 percent with shipments of consumer hardware up 3 percent and shipments of commercial devices down 8 percent. Consumer hardware revenue decreased 3.5 percent, while commercial hardware revenue grew 1.6 percent. HP supplies sales fell 6.9 percent due to “normalization” of home printing, which was partially offset by a gradual recovery in commercial printing.

- Konica Minolta: The turnaround that began for Konica Minolta in Q2 2022 continued and gained steam in Q3 2022. In Q3 2022, Konica Minolta’s revenue grew significantly and the firm achieved its highest quarterly revenue since Q4 2006, and the company was able to post operating and net profit versus the losses posted in Q3 2021. In the Digital Workplace Business, revenue grew 47.5 percent year-over-year as Konica Minolta was able to produce more MFPs and reduce its order backlog. In Q3 2022, operating profit in the Digital Workplace Business grew ¥9.5 billion so the loss of ¥4.6 billion reported in the year-ago period became a profit of ¥4.9 billion ($37.3 million). In the subsegment we are most interested in, the Office, revenue improved a whopping 51.7 percent year-over-year. The company said it saw supply volume of hardware increase due to its efforts to secure components and increase production volume. Sales volumes of color models, monochrome models, and all models reached 148 percent, 97 percent, and 125 percent of the levels reported in the year-ago period. Non-hardware office revenue increased as employees at Konica Minolta’s customers returned to the office but remained at about 86 percent of FY 2019 levels.

- Kyocera: Kyocera’s Q3 2022 looked a lot like the prior quarter: sales revenue increased but operating and net profit declined as the firm saw sales of mobile phone decline and costs for raw materials and logistics increase. In Q3 2022, Document Solutions revenue increased 18.5 percent because of improved sales of products and the weak yen, but profit in this group declined 8.8 percent due to cost increases for raw materials and logistics.

- Ricoh: Ricoh saw net sales, operating profit, and net profit increase in Q3 2022; however, the firm noted profits were lower than expected due to a weaker-than-expected recovery in non-hardware sales. In the Digital Services segment, net sales grew 20.1 percent year-over-year in Q3 and segment profit grew a whopping 102.6 percent. While shortages improved, Ricoh noted shortages of A4 MFPs hampered sales in the office printing business. Because of those lingering shortages, delays in delivery, COVID-19 impacting production in China, and logistics challenges, Ricoh couldn’t resolve its order backlog to the extent hoped. Ricoh reported office non-hardware demand was below expectations in October and November but exceeded expectations in December.

- Sharp: Q3 2022 was a weak one for Sharp. While net sales grew, the company reported operating and net losses. In the 8K Ecosystem segment in Q3, net sales grew 3.3 percent, but operating profit dropped 57.4 percent. This may, however, be due largely to declines in the firm’s TV business because Sharp reported that its MFP business grew steadily in the quarter.

- Toshiba Tec: Toshiba Tec was able to post strong improvements in its net sales, operating profit, and net profit in Q3 2022. And the group we are most interested in, Workplace Solutions, was the stronger of Toshiba Tec’s two business segments in the quarter. Net sales in the Workplace Solutions Business increased 26.2 percent year-over-year, and segment operating profit improved an impressive 155.9 percent. The firm indicated supply of products in the Workplace Solutions Business fell short of demand but is getting better due to changes in trade routes and Toshiba Tec mitigating the effect of component shortages. This led to higher sales of MFPs. Toshiba Tec’s Workplace Solutions Business also benefited from price increases and the favorable impact of exchange rates on overseas sales of MFPs.

- Xerox: Although in FY 2022 Xerox’s revenue was up just 1.0 percent, operating profit fell, and the firm reported a net loss for the year, the firm delivered its strongest quarter of the year in Q4. In Q4, Xerox could boast of strong year-over-year revenue and profit growth. The quarter was also an excellent one for the Print and Other business, which saw its revenue grow 11.1 percent year-over-year and its profit surge 200 percent as the company saw improved product supply and benefited from actions taken to reduce costs. For the company as a whole, equipment revenue increased 44.3 percent year-over-year in Q4 2022—that is one of the highest growth rates we believe we have ever seen for Xerox’s equipment revenue. Entry-level equipment sales rose 3.9 percent. Color entry A4 MFP installs were up 59 percent year-over-year in the quarter, but black-and-white MFP installs shrank 35 percent. Xerox’s midrange equipment sales grew 72.4 percent. Installs of black-and-white and color midrange devices were up 68 percent and 56 percent, respectively. In Q4, revenue from high-end equipment grew 16.3 percent year-over-year Color installs rose 1 percent, but black-and-white installs declined 8 percent. Post-sale revenue in Q4 2022 declined 0.4 percent. Services, maintenance, and rental revenue, which includes bundled supplies, declined 2.8 percent, and financing revenue was down 7.3 percent. However, supplies, paper, and other sales, including unbundled or transactional supplies sales, was up 10.4 percent.

Forecast Changes

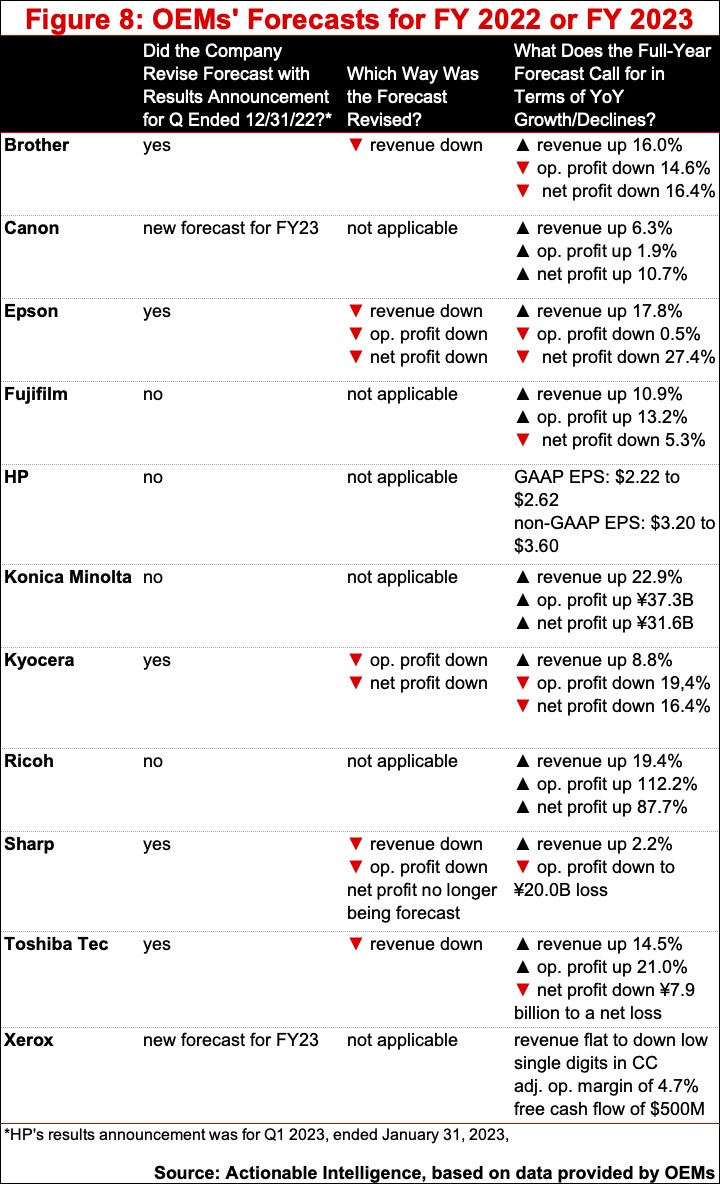

Fewer OEMs adjusted their forecast this quarter than last. While with last quarter’s results, nine firms adjusted their full-year guidance, this quarter five did. The revisions made last quarter were mostly (but not entirely) upward. That was not the case with this quarter’s revisions. Brother lowered revenue guidance, Epson cut its forecast for revenue and operating and net profit, Kyocera reduced its outlook for operating and net profit, Sharp lowered its outlook for revenue and operating profit and pulled its guidance for full-year net profit, and Toshiba Tec lowered its revenue forecast.

In addition, two companies, Canon and Xerox, provided guidance for FY 2023 for the first time, joining HP, which provided its outlook for FY 2023 last quarter and affirmed it this quarter. Canon is projecting a third straight year of revenue and profit growth. Xerox, however, expects revenue to be flat to down in the low single digits in constant currency. Still, the firm said it projects an adjusted operating margin of 4.7 percent, which would mark an improvement over its 3.9 percent margin in FY 2022.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.