Although much of the buzz in the printing industry these days is focused on emerging technologies and new applications for existing technologies such as 3D printing and bioprinting, the consumer and office printing markets are still enormous. And in the home and office, the dominant technologies remain laser and inkjet. Competition is still fierce in these market segments, despite the exits of Kodak (see “Kodak Will Exit SOHO Inkjet Hardware Market but Keep Selling Ink”) and Lexmark (see “Lexmark Inkjets: Requiescat in Pace Part I and Part II”) from the inkjet business. Now, the industry is seeing these two technologies—inkjet and laser—competing head-to-head in the business printing market.

In September 2011, Epson officially launched its inkjet printers and all-in-ones for business printing (see “Epson Makes Big Business Inkjet Push with New WorkForce Pro Series”). With the Workforce Pro line, Epson focused on increasing print speeds, boosting cartridge yields, and lowering cost per page (CPP) to target the business printing market where laser technology has long dominated.

At Ninestar, we see the introduction of the Epson devices as a turning point for the industry. This is because even though HP has long marketed business inkjets, it was after Epson launched its WorkForce Pro models that all of the inkjet players changed their business strategy and sought to compete with laser in various segments of the office printing market, from the low end to the high end. It seems that a war is brewing between inkjet and laser technology for the pages output by office users.

At Ninestar, we see the introduction of the Epson devices as a turning point for the industry. This is because even though HP has long marketed business inkjets, it was after Epson launched its WorkForce Pro models that all of the inkjet players changed their business strategy and sought to compete with laser in various segments of the office printing market, from the low end to the high end. It seems that a war is brewing between inkjet and laser technology for the pages output by office users.

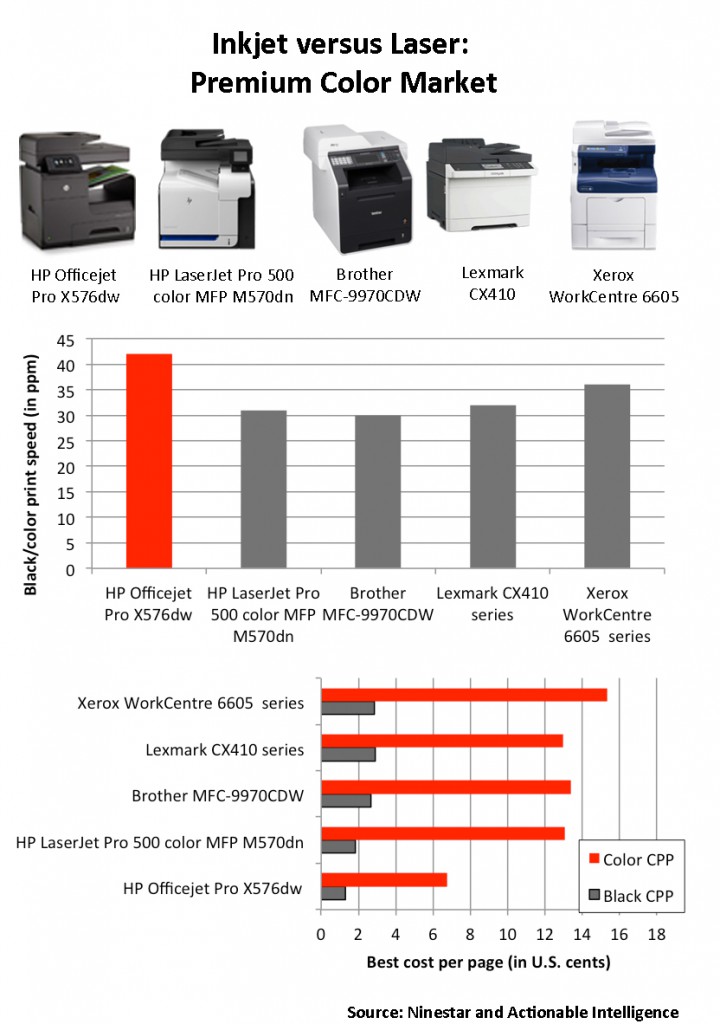

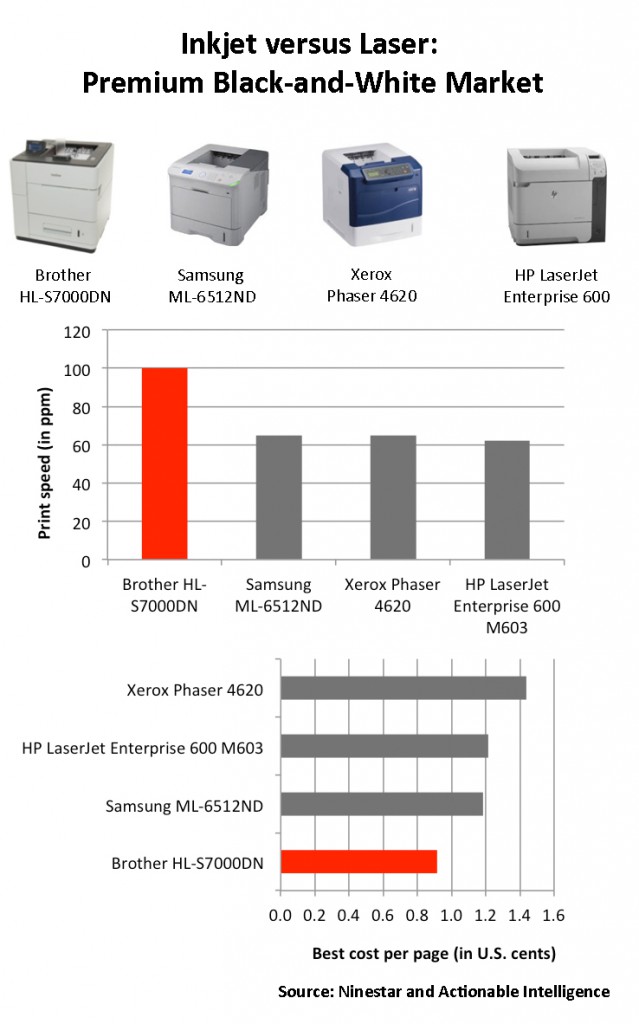

Following the introduction of the Epson machines, we saw HP and Brother change their market strategy to target premium or high-end office printing. Earlier this year, HP started shipping its Officejet Pro X series inkjet devices targeted at the premium color printing market (see “HP’s Groundbreaking Officejet Pro X Units Start Shipping”), while Brother is focusing on the high-end monochrome printing market with the 100 ppm HL-S7000DN. But despite the fact that the HP products are designed for color printing while the Brother machine prints only in black-and-white, the products share the same advantages over competitive laser-based devices—namely fast print speeds and low printing costs.

In the low end to middle of the office printing market, monochrome laser printers have long been the output devices of choice. Inkjet vendors are trying to make headway there as well. Epson attempted to make inroads with the black-only K-series inkjet devices, which made their debut in 2011 (see “Epson Rolls Out K-Series Monochrome Inkjets in Emerging Markets”). While the K-series inkjets were equipped with a high-yield 1,000-page cartridge, the CPP was relatively high, and we have not seen these machines take away significant share from laser devices. Since then, Epson has launched the WorkForce WF-M series inkjets, which feature laser-style performance and use cartridges with significantly higher yields (10,000 pages for the high-yield cartridge on the WP-M4000/WP-M4500) and lower CPP.

To keep its lead in printing industry, HP also changed its strategy and launched HP Officejet Pro 3610 and 3620 black-and-white inkjet MFPs (see “Is It Mono Mania? HP Jumps Back into Mono Inkjet Business”). The company aims to set obstacles for Epson in the premium, middle, and low end of the office printing market.

To keep its lead in printing industry, HP also changed its strategy and launched HP Officejet Pro 3610 and 3620 black-and-white inkjet MFPs (see “Is It Mono Mania? HP Jumps Back into Mono Inkjet Business”). The company aims to set obstacles for Epson in the premium, middle, and low end of the office printing market.

With major inkjet vendors like Brother, Epson, and HP all launching new inkjet devices designed to compete against laser printers, end users in offices now have more choices available to meet their output needs. In contrast with these firms, Canon has not released new inkjet devices aimed at business printing, instead targeting consumers and the professional imaging market with its inkjet devices and businesses with its laser printers and MFPs. Still, we believe that Canon will be paying close attention to the inkjet business printing market.

In the past, delineations were clear and simple: inkjet printers were for the home and laser printers were for the office. But given the influx of inkjet devices designed to compete against lasers printers, traditional market dynamics are changing. The war between inkjet and laser technology is now being waged in the premium business printing market.

The aftermarket must keep informed of market trends to develop the non-OEM cartridges necessary to meet market demand. That is what Ninestar is doing now.

Note: Click on the charts above to view at full size.