In recent months, Actionable Intelligence has heard from readers who value our quarterly summaries of printer and copier OEMs’ financial results and want even more detail in these posts. We aim to please, so with this quarterly summary we are providing a closer overview of how OEMs’ home and office printer and MFP businesses fared.

In recent months, Actionable Intelligence has heard from readers who value our quarterly summaries of printer and copier OEMs’ financial results and want even more detail in these posts. We aim to please, so with this quarterly summary we are providing a closer overview of how OEMs’ home and office printer and MFP businesses fared.

This latest report covers financial results for the three-month period ended on September 30, 2019. For all the Japanese OEMs, except Canon, this period was the second quarter of the fiscal year ending March 31, 2020. For Canon and U.S.-based Xerox, this period was the third quarter of the fiscal year that will end on December 31, 2019. HP is on a different financial calendar than all the other OEMs. Its fourth quarter ended on October 31, 2019. The OEMs we follow reported their quarter results for this period in late October and throughout November 2019.

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available only for Actionable Intelligence subscribers, but key takeaways from our coverage are summarized below.

Overview

Overall, the hardware and supplies business remains challenging for OEMs in 2019. There is a growing sense of unease about the state of the global economy, with many firms pointing to uncertainties in the European economy, a slowdown in China’s market stemming from the U.S./China trade war, and a cooling of other emerging markets. Moreover, most Japanese OEMs are seeing revenue and profits negatively impacted by the yen’s appreciation against other world currencies, and OEMs are bracing for a new round of tariffs to impact their U.S. businesses moving forward. Overall, many OEMs are feeling pessimistic about the overall state of the economy and the state of their businesses, and we saw several OEMs lower their full-year forecasts, in some case quite drastically.

That said, not all was doom and gloom. Certain OEMs outperformed their peers, and many of those who reported declines noted that the year-over-year decreases were more modest than the ones reported in the previous quarter. But no OEM is boasting of the big year-over-year increases many reported just a few years ago.

Challenging market conditions and limited opportunities for growth are driving a new wave of consolidation. We have seen some consolidation in the aftermarket supplies industry this year. For example, Hubei Dinglong has acquired Speed Infotech (see “Dinglong Completes Acquisition of Speed Infotech’s Ink Business”), Clover purchased LMI Solutions after the latter company slipped into receivership (see “Price, Assets, and More Revealed in Court Filings as Clover Closes LMI Asset Deal”), and Clover Imaging Group (CIG) itself recently changed hands (see “Clover Is Bought Out by Management and Norwest Equity Partners”). Now, Xerox is pushing for a mega-merger that would create a printing behemoth with the announcement that it will launch a hostile takeover bid for HP (see “Yes, Xerox Has Made Bid to Acquire HP” and “Xerox Says HP Refusal ‘Defies Logic,’ Plans Hostile Takeover”). The move comes as Xerox is newly flush with cash following a deal with Fujifilm under which the latter company purchased Xerox’s 25 percent stake in the Fuji Xerox venture and Xerox’s 51 percent stake in Xerox International Partners (XIP) for $2.3 billion (see “Xerox to Sell Stake in Fuji Xerox to Fujifilm”). So clearly, the urge to merge is stronger than ever in the industry. It is too soon to say whether the industry will see a combined HP/Xerox, but such a combination would have ramifications for other industry players, including Canon and Fujifilm.

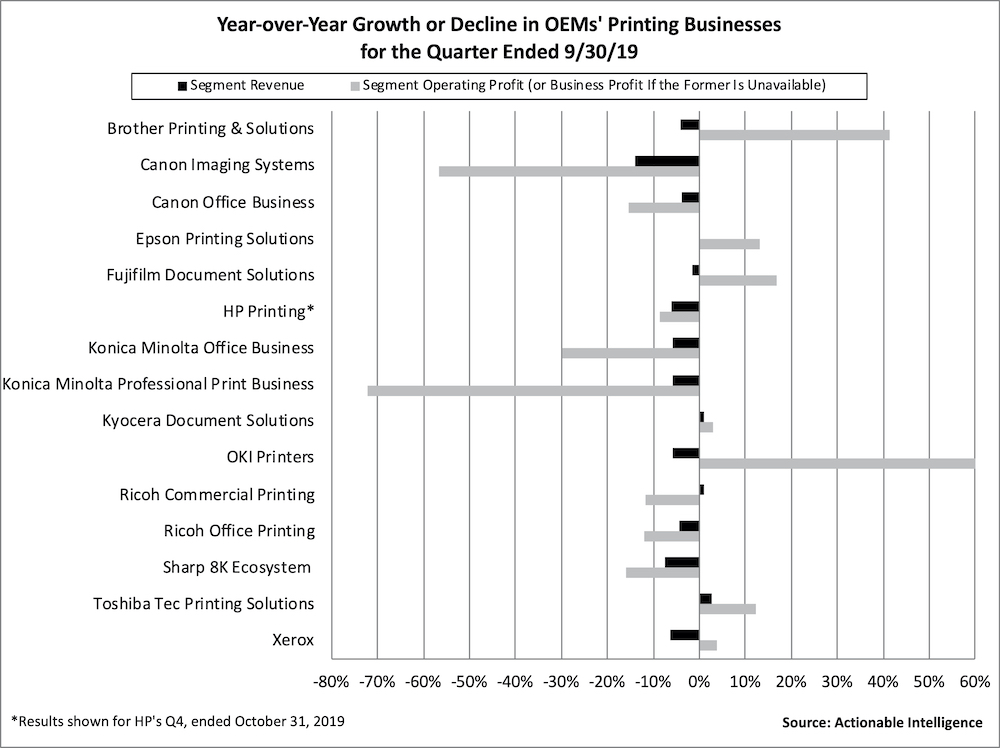

Performance by Vendor

As the chart below shows, very few OEMs’ printing businesses could boast of any year-over-year revenue growth in the quarter ended in September, and those that could like Kyocera Document Solutions and Toshiba Tec Printing posted very modest growth. More OEMs reported printing business profit growth, including Brother Printing and Solutions, Epson Printing Solutions, Fujifilm Document Solutions, Kyocera Document Solutions, OKI Printers, Toshiba Tec Printing, and Xerox. For many of those businesses, improved profits were the result of restructuring efforts, which is what you would expect in a declining industry.

In the quarter ended in September 2019, the list of “winners”—firms whose printing businesses posted both revenue and operating income growth year-over-year—included Kyocera Document Solutions and Toshiba Tec Printing. Epson Printing Solutions posted flat revenue and improved profits, which counts as a win in a tough environment. While the roster is small, it is bigger than it was in the previous quarter when only Ricoh’s Commercial Printing business could boast of revenue and profit growth.

The list of OEMs reporting a mixed quarter included Brother’s Printing and Solutions business, Fujifilm’s Document Solutions business, OKI’s Printers business, Ricoh’s Commercial Printing, and Xerox. All these segments, except for Ricoh’s Commercial Printing, reported declines in revenue but increased profits. Ricoh’s Commercial Printing segment reported the opposite.

Last quarter, 10 OEM printing businesses reported both revenue and profit decreases. In the quarter ended this fall, that number is down to seven and includes Canon Imaging Systems, Canon Office, HP Printing, Konica Minolta Office, Konica Minolta Professional Print, Ricoh Office Printing, and Sharp 8K Ecosystem.

We have boiled down the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Brother had better news to report in its Q2 than most OEMs. While Printing and Solutions revenue shrank due in large part to yen appreciation, profits increased. The firm cited an improved product mix and strong sales of inkjet consumables.

- Canon: Canon’s Q3 was yet another tough quarter for the company. If there was good news to be found, it was that Canon saw the pace of its sales and profit declines slow in Q3 compared with what it reported in the first half of the year. The Office business reported more modest revenue and profit declines than the company as a whole. MFD sales and laser printer sales continued to shrink, as did non-hardware (supplies) sales. Canon’s laser non-hardware sales decline was particularly steep. Meanwhile, revenue and profits have been shrinking in Imaging Systems this year, and sales of both inkjet printers and their consumables shrank.

- Epson: Epson’s Q2 was better than its Q1. Revenue in the Printing Solutions segment was flat year-over-year, but profits grew. Epson saw an increase in unit shipments of high-capacity ink tank printers and office shared printers, although its sales of SOHO/home printers that use ink cartridges continue to decline. Consumables revenue shrank despite an uptick in sales of ink bottles for high-capacity ink tank due to the shrinking installed base of cartridge-based SOHO/home inkjet printers.

- Fujifilm: Q2 marked a continuation of some ongoing trends for Fujifilm, which has been working hard to restructure and shave costs in its Document Solutions business. Document Solutions segment revenue was down modestly, but income improved. The company’s big news this quarter is that it purchased Xerox’s stake in both the Fuji Xerox venture and XIP.

- HP: The persistent weakness shown in HP’s Printing unit throughout the year lingered into Q4. Printing revenue was down due to declines in sales of both consumer and commercial hardware, and supplies revenue once again shrank year-over-year. Printing operating profit also shrank in Q4. Much of the blame for HP’s woes throughout fiscal 2019 were due to declining supplies sales in EMEA as the firm revealed that its European sales models were wrong, and it had less supplies market share than it previously had estimated. Amid these challenges, HP is facing a potential hostile takeover attempt from Xerox.

- Konica Minolta: FY 2019 continues to be tough for Konica Minolta. In Q2, its Office segment reported a revenue decline and a steep decrease in operating profit due to the yen’s appreciation and slumping customer demand for MFPs and their supplies. While some of Konica Minolta’s decline in MFP hardware and supplies sales stemmed from tough economic conditions and the strong yen, the firm also said it was negatively impacted by a transition from selling older devices to the latest generation models.

- Kyocera: In Q2, Kyocera’s Document Solutions segment managed to buck some of the problems faced by rivals and posted both modest revenue and profit growth. Despite the headwinds of unfavorable currency exchange, the group benefited from efforts to improve productivity and reduce costs.

- OKI: While OKI’s revenue and profit performance was strong in Q2, the performance of the Printers segment was mixed. In Q2, Printers revenue shrank, but profits increased, although not enough to offset the big declines in segment profit posted in Q1. The firm commented that it was negatively impacted by foreign currency exchange and lower sales of office printers in the quarter.

- Ricoh: In Q2, Ricoh’s core Office Printing segment posted year-over-year decreases in both net sales and profits due to unfavorable foreign currency exchange. MFP hardware sales were up in Q2, but printer sales were down sharply. A big factor behind the decreases in this segment is that Ricoh says its installed base is shrinking, so consumables sales were down in the quarter.

- Sharp: Unfortunately, Sharp’s MFP business is part of a new segment called 8K Ecosystem that also includes the firm’s TV business, and the firm provides little to no detail about its MFP business specifically in most quarterly reports. In Q2, the 8K Ecosystem group reported year-over-year decreases in net sales and operating profit due largely to weak demand for TVs.

- Toshiba Tec: Toshiba Tec’s Printing Solutions business posted a stronger performance in Q2 than it did in Q1. In Q2, segment net sales and operating profit increase compared with the same period one year ago, although not enough to offset the declines posted in Q1. Toshiba Tec has been working on structural reforms at overseas subsidiaries to reduce fixed costs, which had a positive impact on profits in the quarter, but this was partially offset by currency headwinds. Commenting on MFPs specifically, the firm said it saw net sales growth in the Americas but a decrease in net sales of MFPs in Europe and Asia due to foreign currency exchange.

- Xerox: In Q3, Xerox delivered more of what we have seen from the firm so far in 2019. Revenue continued to shrink in Q3. While both equipment and post-sale revenue declined year-over-year, the declines were smaller than those posted in previous quarters this year. The firm attributed this to Xerox Business Solutions (XBS) bouncing back from the disruptions of earlier this year and an uptick in color installs across the entry, midrange, and high-end segments. Profits improved due to Project Own It, the firm’s restructuring plan, which has resulted in lower selling, administrative, and general costs and improved cost productivity.

Forecast Revisions

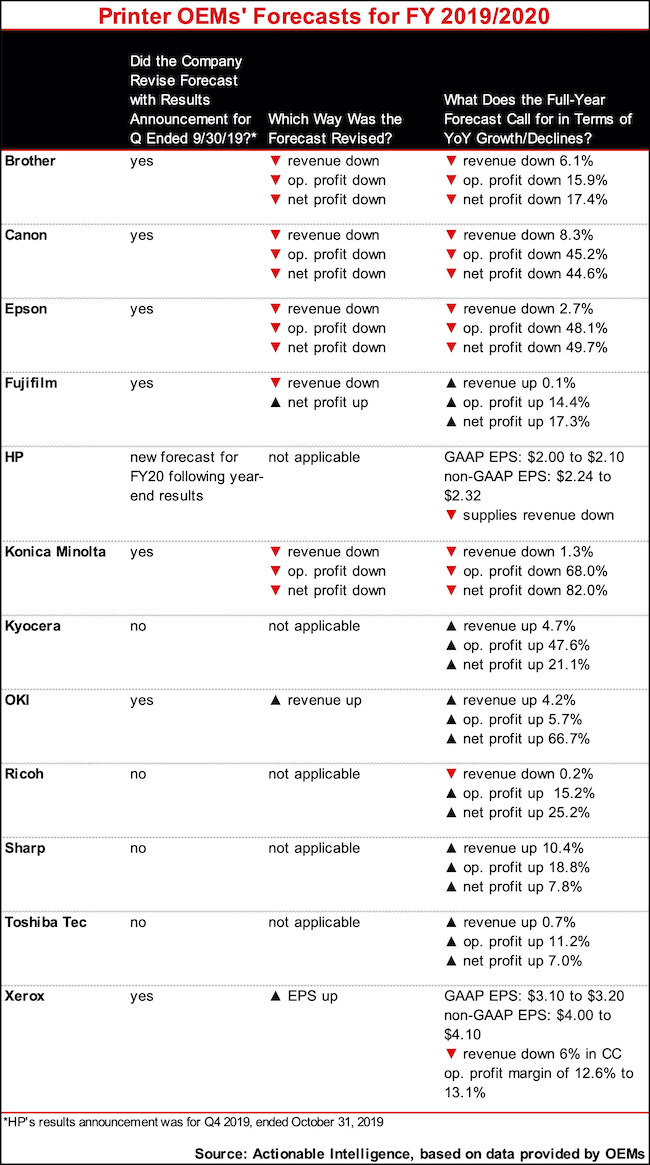

We saw more forecast revisions than we did last quarter, when only four OEMs adjusted their guidance. Although the previous quarter was tough for many vendors, we believe certain Japanese OEMs were hesitant to cut their forecasts only one-quarter of the way through the year. Now, more OEMs have announced changes. Of the 12 major OEMs we track, seven (Brother, Canon, Epson, Fujifilm, Konica Minolta, OKI, and Xerox) made adjustments to their guidance for the remainder of the year ahead. Brother, Canon, Epson, and Konica Minolta all made major downward revisions to their forecasts and now expect to post some significant declines in revenue and operating and net profit in the year ahead.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.