On January 22 and 23, HP Inc. held its “Power of Print” analyst event at its company headquarters in Palo Alto, CA. The analyst event came at a time of great change for the company.

It is no secret that 2020 represents a pivotal moment for HP’s Printing business and, in particular, the supplies segment of that business. In fiscal 2019, revenue in HP’s supplies business, which the firm originally had projected would be flat to up slightly, decreased 4.8 percent year-over-year due to a sharp decline in supplies sales in Europe, the Middle East, and Africa (EMEA) (see “HP Beats ‘the Street’ in Q4 2019 as Headwinds Continue to Dog Printing Business”). Three quarters of the way through 2019, Dion Weisler stepped down as CEO of HP, leading to Enrique Lores’s elevation to this post and various other changes to company management (see “HP Reports Q3 Results: Printing Problems Persist and Dion Departs” and “HP Shuffles Executives in Reorganization Plan”). In what was perhaps even more momentous news, at a securities analyst meeting on October 3, 2019, HP announced that it would be making fundamental changes to its printer hardware and supplies razor-and-blades business model and laying off more workers (see “HP Announces Layoffs, Outlook for 2020, Big Changes to Printing Business”). And, as if all that weren’t enough, Xerox made an offer to acquire HP on November 5 (see “Yes, Xerox Has Made Bid to Acquire HP”). HP has since refused the offer multiple times, leading Xerox to nominate a slate of new directors for HP’s board as part of a hostile takeover attempt (see “Xerox Nominates 11 Candidates to Replace HP Board of Directors”). So, in short, it has been a tumultuous few months for HP.

HP’s message at Power of Print, however, was that it has a strong new management team for its Printing business in place and a bold new business plan—one that promises not so much to overthrow the old razor-and-blades business model but to update it by offering customers more choices for how they want to buy supplies.

Printing Executives Take Stage

One of HP’s central messages is that it has a new, strong management team in place for its Printing business. New CEO Enrique Lores (who was not at the Palo Alto event) was formerly the head of HP’s imaging, printing, and solutions business, so he knows the Printing business well. Various other long-time HP Printing business executives now have new positions and were on hand at Power of Print to talk about their new roles. Tuan Tran is president of the imaging, printing, and solutions business. Anneliese Olson is global head of the print category and sustainability. Xavier Garcia is global head and general manager of print hardware systems. David Prezzano is general manager and global head of HP print services and solutions business. Santi Morera is general manager and global head of the graphics solutions business. Sue Richards is global head of print microfluidics, technology, and operations. These and other speakers rounded out a packed agenda, with the event emceed by Vanessa Yanez, head of print communications for HP. Many other HP Printing employees spoke at the event and interacted with analysts in breakout sessions. We were especially excited to meet Guillaume Gerardin, who is now global head and general manager of HP’s supplies business.

Mr. Tran kicked off the event by providing an overview of HP’s print strategy. He immediately addressed the “elephant in the room”—Xerox’s bid for HP and its hostile takeover attempt—but he said HP’s position is not to comment on “situations like that,” aside from what HP’s board has already stated about Xerox’s bid undervaluing HP and its business. Dismissing all the noise about a possible tie-up, Mr. Tran declared that HP’s focus is on its Printing business strategy.

Mr. Tran declared that HP is the world’s number-one print vendor across numerous categories, including inkjet printers, laser printers, large-format design, large-format production, and digital press label and packaging productions. The company is also the number-one or number-two vendor for ink and laser printers in 56 of the world’s top 61 countries. HP, said Mr. Tran, “has a phenomenal business, but we’re not standing still.” He emphasized that in the home HP is seeing more than 20 percent growth in Instant Ink enrollees (more on Instant Ink below). In the office, HP is seeing greater than 10 percent managed print services (MPS) growth. HP is also seeing greater than 10 percent graphics page growth. Growth in these first two areas are key for HP as it is trying to shift its supplies business from transactional to contractual/subscription-based in order to make its supplies revenue more consistent and predictable and improve its share versus the aftermarket.

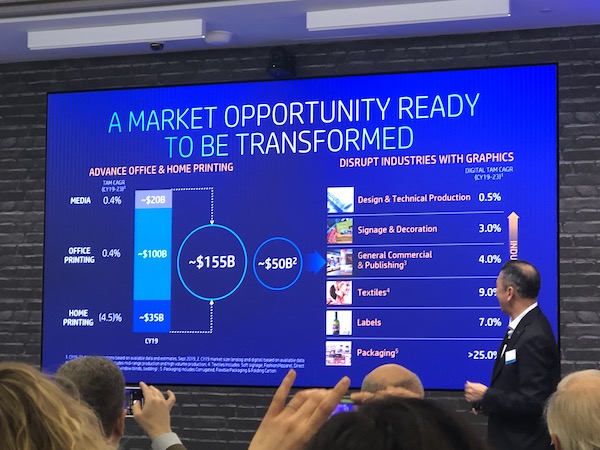

HP discussing the size of the total addressable market (TAM) for print is nothing new, but the numbers Mr. Tran highlighted are impressive. He noted that HP is playing in a market with a $200 billion TAM. Of the market segments it targets, the $35 billion home printing market is seeing the biggest downward trend—the compound annual growth rate (CAGR) for home printing is -4.5 percent. The firm had much brighter news about the $100 billion office market, saying the CAGR in this space is positive, at 0.4 percent. Print, Mr. Tran emphasized, is “a big market that still has opportunities to grow,” largely in the office and graphics segments.

Ms. Olson emphasized that even in the home printing market there are opportunities. She cited research showing that younger people actually print more: 36 percent of people under age 35 say they print a lot, versus only 27 percent for age 35 and older. However, for younger people, including Millennials, doing business with a good environmental steward—like HP—is important. She said 83 percent of Millennials say it is important for companies to implement programs to improve the environment and 75 percent would change their purchase habits to reduce environmental impact. An example of a product clearly aimed at this audience is the Tango Terra, billed as the world’s most sustainable home printer (see “HP Claims New Tango Terra Is World’s Most Sustainable Home Printing System”).

While HP discussed its plans to grow in graphics, 3D printing, and microfluidics at the Power of Print event, it is HP’s plans for the home and office printing markets that Actionable Intelligence readers are sure to find most interesting. And HP does have some bold plans for those markets. As Mr. Tran put it, “We are market leaders because we out-innovate our competitors in the marketplace.” He explained that while most of HP’s competitors “sell the same product to everybody,” HP is moving toward offering more tailored customer experiences—something he called a “segment of one focus.”

Advancing and accelerating the “segment of one” required a change in how HP does business as well as close work with channel partners, according to Ms. Olson. She described how HP made a shift in its go-to-market model from three geographic regions (the Americas, EMEA, and Asia Pacific/Japan) to 10 geographic regions (as shown below). This structure, she said, allows HP to move closer to both customers and channel partners, gives HP better “line of sight end to end,” and because there are fewer layers of management enables quicker decision making.

Ms. Olson emphasized that HP is a channel-led business with 89 percent of its business coming from channel partners and that its new go-to-market strategy is aimed at achieving “4P consistency: price, product, promotion, and place.” For example, she said that HP is working hard to drive consistent pricing and promotions around supplies.

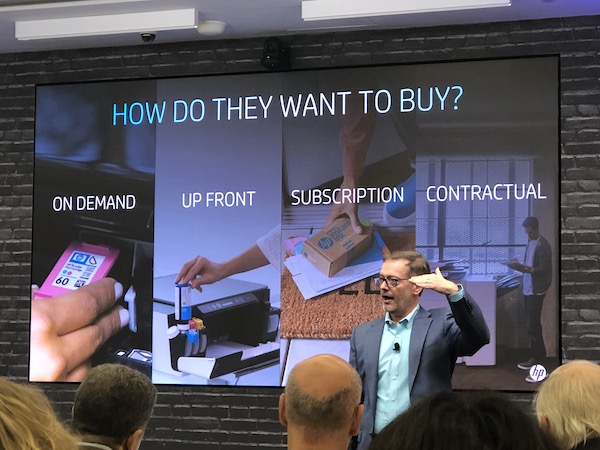

Mr. Garcia provided a look at what this “segment of one” focus means for supplies. He explained that HP, of course, offer customers the ability to buy supplies “on demand,” or transactionally.

HP also offers customers the option to buy ink or toner upfront via its Smart Tank refillable ink tank devices and its Neverstop toner tank devices in emerging markets. The Neverstop series was introduced in emerging markets last year (see “HP Looks to Shake Up Emerging Markets with Toner Tank and Ink Tank Printers”). HP has been selling refillable ink tank printers in emerging markets since 2016, but shortly before 2019 ended the firm introduced its Smart Tank Plus series in the United States (see “HP Brings Smart Tank Refillable Inkjet Models to the U.S.”). These devices ship with years’ worth of ink or toner and thus shift the profits HP would normally make somewhere down the road on supplies upfront with the purchase of the initial printer. HP is well aware that the aftermarket will be able to grab greater penetration of the refills for these devices, but, having already made a profit upfront on the initial purchase, anything HP later realizes in terms of supplies sales down the road on these devices is gravy on top of the already profitable initial sale. These devices are especially important in some emerging markets like India, which HP described as a “big tank country.”

HP’s other key way of selling supplies to customers is Instant Ink, its monthly subscription ink service aimed mostly at home and home-office users. And for businesses, of course, HP sells supplies contractually. The goal is to shift more of its home business toward Instant Ink and more of its office business toward contractual supplies.

But, starting this fall, before its FY 2020 comes to an end, HP plans to roll out yet another option for customers: the end-to-end printing solutions Mr. Tran spoke about at the 2019 securities analyst meeting.

Big Tank Devices

One thing that surprised us about HP’s Power of Print event is that the firm did not make a big hoopla about bringing its Smart Tank refillable ink tank devices to developed markets like the United States. While the Smart Tank devices were on display (see photo below) and HP executives discussed the devices, mainly as part of HP’s efforts to provide customers with more choices, the firm was quieter than we expected about these machines. That is in keeping with how they were rolled out in the United States—quietly, with no press release or major marketing campaign, shortly before the year’s end.

But we think HP’s lack of fanfare over the U.S. entry of the Smart Tank models in itself says something—namely, that HP would prefer to see those customers who want to save money on ink costs achieve that ambition via Instant Ink in developed markets. HP executives repeatedly described refillable ink tank devices as “basic” or as “giving up some functionality” compared with other inkjet devices. In contrast, the firm was eager to highlight the success of its Instant Ink program.

Although this is pure speculation, we had the sense that HP brought Smart Tank devices to market in the United States almost begrudgingly and largely because Epson and Canon already sell their own refillable ink tank models in this market and HP does not want to risk losing share. In emerging markets, in contrast, HP emphasized it is very focused on the Smart Tank units. It is very likely that HP is testing the waters in the United States with the Smart Tank units and may refine its strategy further depending on how these units sell. Whatever HP’s reasons for the U.S. rollout of the Smart Tank devices, they fit in well with the firm’s messaging about offering customers choices for supplies—even if the firm may feel Instant Ink is the superior choice for most customers.

In response to a question from analysts about the Smart Tank devices, Mr. Tran said that HP sees refillable ink tank printers as a “neutral to positive.” HP can indeed make a profit on the printers because customers are willing to pay more for these devices upfront. Mr. Tran said, “CISS [the refillable ink tank category]is a good strategy relative to business models in those [emerging]countries.” But he was quick to add, “In developed geographies, we are pushing Instant Ink hard.”

Doubling Down on Instant Ink

HP did have a lot of positive news to share about Instant Ink. Mr. Tran was one of the key forces at HP behind Instant Ink. The firm first began talking about the subscription program for ink around 2009 and after various pilots Instant Ink was rolled out to the market in 2013 (see “HP Turns to Subscription Business Model for Supplies with HP Instant Ink” and “HP Bets Big on Game-Changing Instant Ink Program”).

Over time, HP has gradually introduced Instant Ink in more countries. The program is now available in 18 countries: the United States, Canada, United Kingdom, Germany, France, Spain, Republic of Ireland, Italy, Netherlands, Belgium, Luxembourg, Austria, Portugal, Switzerland, Norway, Sweden, Denmark, and Finland. Mr. Tran indicated HP plans to add 12 more countries this year, which will include a move east from the Western European countries where the program is now available.

Over time, HP has gradually introduced Instant Ink in more countries. The program is now available in 18 countries: the United States, Canada, United Kingdom, Germany, France, Spain, Republic of Ireland, Italy, Netherlands, Belgium, Luxembourg, Austria, Portugal, Switzerland, Norway, Sweden, Denmark, and Finland. Mr. Tran indicated HP plans to add 12 more countries this year, which will include a move east from the Western European countries where the program is now available.

Ms. Olson argued that the time is right for an expansion given current market trends. “The subscription economy is here to stay,” she said. Mr. Tran added that HP’s research has shown that “if folks use more than three subscriptions, they [are]more likely to sign up for a print subscription.”

The program’s attach rate at point of sale has grown—it is now 40 percent in the UK, Mr. Tran said. HP has long boasted of a retention rate of over 90 percent with the program. While HP did not update this figure specifically, Mr. Garcia said that the percentage of customers choosing to exit Instant Ink is in the “low single digits.” Mr. Tran also said HP is seeing 20 percent enrollee growth. Mr. Prezzano declared that in the post-Thanksgiving holiday shopping season, HP saw a new subscriber join Instant Ink every nine seconds globally.

Interestingly, HP provided the first concrete numbers for Instant Ink enrollees that we have heard from the company since the fall of 2015, when the firm said it had about 675,000 Instant Ink subscribers (see “HP Announces Instant Ink Ready Lineup of Inkjet All-in-Ones”). Mr. Tran stated that HP now has more than 5 million Instant Ink enrollees. New global supplies head Mr. Gerardin told us that number is actually higher—approaching 6 million.

Mr. Gerardin also said HP is seeing higher print volumes from Instant Ink enrollees, which he attributed to enrollees not worrying so much about ink costs or ever running out of ink. The difference in print volumes is significant. Instant Ink enrollees print about 20 percent more pages, according to Mr. Gerardin. While Mr. Gerardin would not say how much on average HP makes per Instant Ink enrollee, he did say that the lower-priced plans are more popular.

The numbers HP provided allow us to do some quick back-of-the-envelope calculations to see how much HP might be making annually from Instant Ink and what this may account for in terms of percentage of total supplies revenue. Five million subscribers at $2.99 a month would mean annual Instant Ink revenue of $179.4 million. While this total is significant, it is important to bear in mind that HP’s supplies revenue in 2019 was $12.921 billion; thus, Instant Ink revenue of $179.4 million would be just 1.4 percent of total supplies revenue. However, if we assume HP has 6 million Instant Ink enrollees, at $2.99 a month, the firm would be raking in $215.28 million annually from Instant Ink or about 1.7 percent of FY 2019 supplies revenue.

If we were to change the assumption to $4.99 per month being closer to the average monthly subscription price, the revenue picture is even brighter. Five million enrollees at that price would mean $299.4 million annually in Instant Ink revenue or 2.3 percent of FY 2019 supplies revenue. Six million enrollees at $4.99 per month would mean $359.28 million in annual Instant Ink revenue, which amounts to 2.8 percent of total supplies revenue in FY 2019.

While hundreds of millions of dollars in Instant Ink revenue each year in itself is a success story and one HP is looking to grow upon, Instant Ink benefits HP in another way. Although Instant Ink users can cancel at any time and switch to using traditional cartridges, as long as they are enrolled that means they are using original consumables rather than aftermarket alternatives.

Mr. Prezzano declared that HP will be “doubling down on Instant Ink in 2020.” The program is a win-win for HP and for customers, he said, adding, “Instant Ink is the rising tide that lifts all boats.”

In a tantalizing tidbit that may hint at further expansion plans, Mr. Garcia stated, “The cloud infrastructure for Instant Ink is highly scalable to create services similar to that one.”

End-to-End Printing Systems

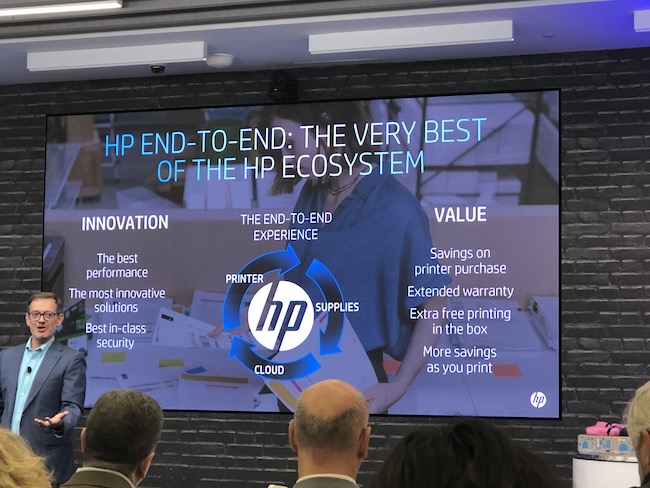

Perhaps the most interesting thing HP is doing from a consumables perspective is planning the rollout of what it calls “end-to-end printing systems.” At the securities analyst meeting in October, Mr. Tran explained that HP’s goal is to provide customers with two choices at the time of purchase. One choice, “an HP end-to-end system,” consisting of both HP hardware and HP original supplies, will be offered at a lower overall price. Alternatively, under an “HP flexible system,” customers can pay more upfront for hardware and gain “flexibility” for supplies.

Unfortunately, what HP is willing to reveal publicly about these end-to-end printing systems is fairly limited until the first products hit the market this fall.

Mr. Tran explained the motivation behind HP’s move to offer end-to-end printing systems. “Our business model is centered around hardware at low prices and supplies at high prices. That model has worked really well. When the market is in a growth phase, you want to drive that. When the market is flat you want to relook at that model.” Mr. Tran said that HP realized the traditional razor-and-blades was no longer working for many of its most valuable customers and thus HP needed to “rebalance” its business model so as to provide some of its most valuable customers with low printing costs and a greater value.

A presentation from Mr. Garcia revealed that key elements of the end-to-end printing system include HP hardware and HP original supplies but also the cloud. We think the cloud element is important and central in making these devices end-to-end HP systems. HP’s traditional printers use the handshake between the chip on the cartridge and the device firmware to ensure that original supplies are installed. Without a properly functioning chip, aftermarket consumables will not function inside an HP printer. That is why third-party chipmakers can command such high prices for compatible chips. One big question on our minds since HP’s securities analyst meeting in October has been what HP will do differently with its end-to-end printing systems to ensure that only HP consumables are used. Obviously, something else is required other than a stronger chipset—OEMs have been trying and failing to lock out the aftermarket by developing stronger chipsets for years. While HP obviously did not share exactly how it will ensure the use of OEM consumables on end-to-end printing systems, we think the firm’s emphasis on the fact that these will be cloud-connected devices is a big clue. Remember how Mr. Garcia stated that the cloud infrastructure for Instant Ink is highly scalable? It seems likely that one key use HP found for this cloud infrastructure is to authenticate the use of HP original consumables in end-to-end printing systems.

Mr. Garcia said that the end-to-end printing systems will be attractive to end users because they provide a greater total value—and not just because of the lower upfront purchase price compared to the traditional or “flexible” printers and MFPs. He explained the end-to-end systems will also feature the best performance, innovative solutions, and best-in-class security, although how these will vary on end-to-end systems versus flexible systems or even if these features will vary was not elucidated. Mr. Garcia said that the value provided by the end-to-end systems does not only come from the lower upfront price. HP will also provide an extended warranty on these models; “extra free printing in the box,” meaning shipping more ink or toner; and “more savings as you print.” What exactly HP means by this last promise was not made plain.

Ms. Olson emphasized that the shift to end-to-end systems is a high priority. She identified three key priorities for the Printing business: accelerating the shift to contractual, bringing added value to customers, and delivering best-in-class HP end-to-end experiences.

Mr. Tran explained that shifting HP’s large installed base of more than 160 million connected printers to a new hardware and supplies business model will take time. HP has planned a “natural set of product introductions over time,” with the first end-to-end systems slated to hit the market by the end of HP’s fiscal 2020 (the firm’s fiscal year ends October 31). HP, he said, will roll out end-to-end systems segment by segment, but only for certain product lines. Mr. Tran said he expects this will take two to three years. But as Mr. Garcia put it, this is no pilot nor beta program. “We’re all in on end-to-end systems,” he said.

Need to Nail the Messaging

HP’s new supplies strategy, which is all about expanding options for customers, is bold. The firm is introducing its Smart Tank refillable ink tank models in developed markets, rolling out Instant Ink in new countries including some emerging markets, continuing the shift from transactional to contractual, and introducing new end-to-end printing systems in additional to continuing to sell traditional, flexible printing systems. It’s a lot for the average customer to take in, even if that customer will likely be choosing between just a couple of different models, not all of them at once.

That is why it is essential for HP to nail the messaging around these various options. Business customers will have channel partners to advise them, but HP needs to ensure its channel partners are educated so that they help customers choose the products that are right for them. Home users, small-office/home-office (SOHO) users, and small-business customers face an even more daunting task in determining what’s right for them: a refillable ink tank device with almost all the ink they could ever need included upfront, an inkjet printer and the Instant Ink plan, a higher-priced printer for which they can purchase the ink of their choice transactionally, or a lower-priced end-to-end printing system. Good luck getting that type of information out of your average Staples employee—and that is if you can find one. HP is going to have to make sure its messaging is spot-on at the point of sale, wherever that point is—at retail stores, on Amazon, on HP’s site, or via other retail and online channels.

Messaging right on the box and on retail and Internet channels is going to be essential for the end-to-end systems for another reason as well. If there’s one thing we have learned over the years it is that class-action attorneys are relentless in scrutinizing how printer OEMs market their products for any language that is less than accurate or potentially misleading. HP will have to be very clear in marketing its end-to-end systems as compatible with only HP original supplies. Even if the messaging is clear, we expect it is at least possible we could see a lawsuit or two over HP’s end-to-end printing systems. We are sure HP’s lawyers are involved with the messaging, however, doing their level-headed best to avoid such a scenario.

If the printer and supplies industry is a battlefield, it is one littered with the bones of past efforts to tinker with the razor-and-blades business model that have failed. But HP is quite correct in its assessment that the business model no longer works for many customers and that customers are increasingly open to alternatives such as “big tank” printers or Instant Ink that save them money on the blades. One of the biggest supplies industry stories to watch moving forward is whether end-to-end printing systems become yet another set of bones on the battlefield or whether they prove more like refillable ink tank printers and Instant Ink—something with the power to help transform the printing industry.

Aftermarket supplies firms must be especially concerned about the development of end-to-end printing systems. Because if there’s one thing Lexmark’s Prebate/Return Program showed it is that if there’s a cheaper product with more restrictions and a more expensive product with fewer restrictions, people are going to choose the less expensive product, with little thought to what those restrictions may be. That means the aftermarket is going to want a share of the consumables market for end-to-end printing systems, so it will be interesting to see if these systems prove to be something the aftermarket can crack or whether the market for supplies for end-to-end systems remains largely impenetrable to all but genuine HP consumables.

[UPDATE: Actionable Intelligence originally published this article in a subscriber-only section of our website on January 28. Due to the high level of reader interest in HP’s Power of Print event, we moved the article to a public-facing section of our website on January 31.]