In late January and throughout the month of February, printer OEMs announced financial results for the three-month period ended December 31, 2019.

In late January and throughout the month of February, printer OEMs announced financial results for the three-month period ended December 31, 2019.

For all the Japanese OEMs, except Canon, this period was the third quarter of the fiscal year ending March 31, 2020. For Canon and U.S.-based Xerox, this period was the fourth quarter of fiscal 2019. HP is on a different financial calendar than all the other OEMs. Its first quarter of fiscal 2020 ended on January 31, 2020.

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available only for Actionable Intelligence subscribers, but key takeaways from our coverage are summarized below.

Overview

For this article, we once again reviewed OEMs’ latest financial results. It was a depressing exercise the first time around, as we reported on individual companies’ financials, and even more depressing when looking at the industry’s performance as a whole. Fiscal 2019 was already challenging for the printer/MFP hardware and supplies industry, and in what is either OEMs’ Q3 or Q4 (or in HP’s case Q1), market conditions did not improve. In fact, it seems fair to say things went from bad to worse.

OEMs pointed to many of the same ills that have been plaguing them in recent quarters, including a slowdown in China and other emerging markets, uncertainties in Europe’s economy, and unfavorable currency exchange. But new concerns mounted in the latest quarter: new tariffs took effect, and most OEMs struggled to find pockets of growth amid steep declines. Although the quarter ended before the coronavirus began impacting the industry, the virus is now spreading outside China. HP’s quarter ended later than other OEMs, and it said it expects an 8-cent negative impact to earnings per share in Q2 as a result of the virus. Moving forward, we expect to see more OEMs talking about a hit to their business as a result of the outbreak.

Meanwhile, the will-they-or-won’t-they-merge drama between HP and Xerox continued. Xerox has said it will make its offer to HP shareholders on March 2, while HP has adopted a “poison pill” and a shareholder value-creation plan to try to prevent a hostile takeover.

Altogether, these are uncertain times for the industry. Last year, Actionable Intelligence began talking about the industry reaching a new downward inflection point. Looking at the latest quarterlies from printer OEMs, that concern seems well-founded.

Performance by Vendor

Just a short time ago, the industry had seemed to reach a new normal. In most quarters, OEMs would post modest revenue declines but managed to grow profits quarter after quarter. That is pretty characteristic of a mature industry. But those were halcyon days compared to the brutal quarter just ended.

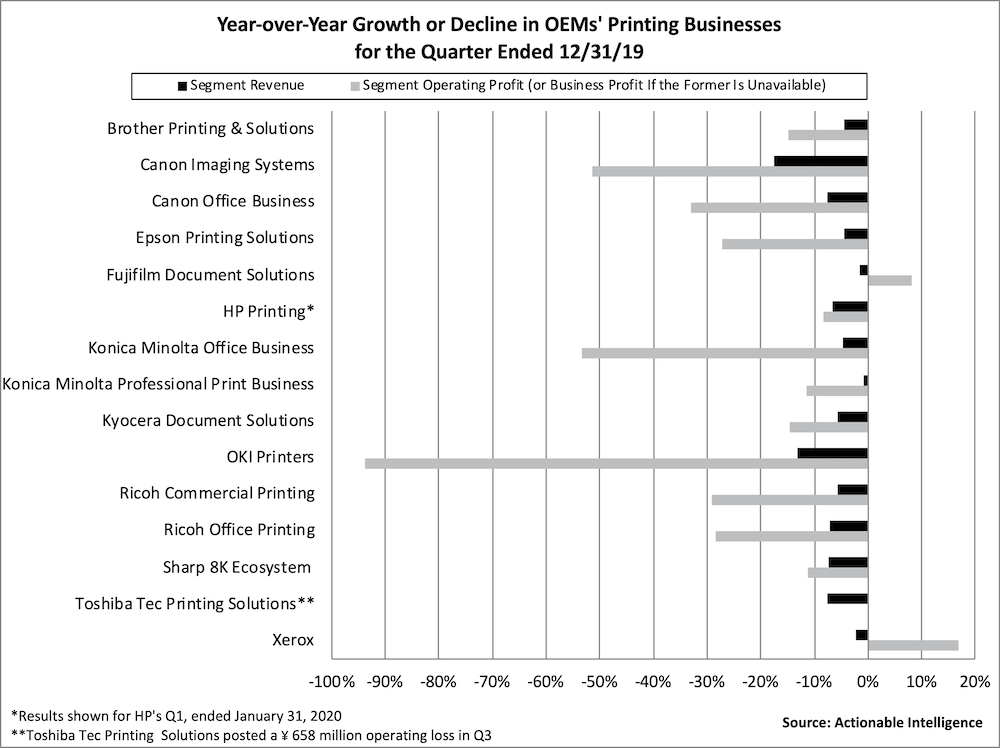

We typically compile a list of “winners,” the OEMs who delivered both revenue and profit growth in the printing businesses in the quarter. That list has been growing smaller, but this quarter no OEM could boast of revenue and profit growth in their printing business.

Just two companies—Fujifilm and Xerox—were able to report the old paradigm of modest revenue declines coupled with operating profit growth.

Every other printer OEM we follow saw revenue and profits shrink in their printing businesses in the quarter ended in December.

We have boiled down the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Brother’s financial results took a turn for the worse in Q3. In the first half of the year, Brother’s Printing and Solutions business saw revenue shrink but profits grow. However, in Q3, Printing and Solutions revenue and profits decreased compared with the year-ago period. In its inkjet business, hardware revenue declined. Brother is seeing continued demand for high-capacity ink tank models in emerging markets, but sales decreased due to continued price declines in the category. Meanwhile, inkjet consumables sales were down to lower hardware sales in Europe and the United States in the previous fiscal year. Laser hardware sales also declined due to Brother’s own efforts to move away from the super-low-end category and decreased demand for monochrome devices in China as a result of that country’s economic slowdown. Laser consumables revenue was down due to unfavorable currency exchange.

- Canon: Canon’s Q4 brought no reprieve to what proved to be a very tough fiscal 2019 for the company. Net sales and operating and net profit fell precipitously in both Q4 and FY 2019, and the company missed many of the full-year targets it had set just a few months earlier. The Office business reported continued sales and profit declines for the period ended in December. Sales of MFDs decreased, despite solid demand for color MFDs, due to shrinking demand for monochrome units and declines in non-hardware sales. The Office business has been particularly hard-hit by a downturn in sales of laser hardware and supplies. In Imaging Systems, Canon reported declines in sales of inkjet hardware and consumables as the market contracted in developed countries and emerging markets, which had been seeing growth until recently.

- Epson: Epson’s Q3 is typically its strongest quarter, but the firm posted continued revenue declines and steep profit decreases in the quarter ended in December. The Printing Solutions segment saw its biggest revenue decrease of the year in Q3, and segment profit fell nearly 30 percent. Epson saw continued growth in high-capacity inkjet printer unit shipments and growth in sales of ink bottles for these devices, but the inkjet business was dragged down by declines in sales of cartridge-based inkjet hardware and steep declines in sales of inkjet cartridges.

- Fujifilm: In Q3, Fujifilm reported that company revenue continued to decline, and operating profit fell for the first time this fiscal year, although the firm managed to grow net profit. The firm’s Document Solutions segment reported a modest revenue decline but continued profit growth. Exports to Xerox in the U.S. and Europe shrank as did sales of Document Solutions products in China. One bright spot was sales of color MFPs in Japan. The big news for Fujifilm last quarter was that it purchased Xerox’s stake in both the Fuji Xerox venture and XIP (see “Xerox and Fujifilm Transaction Closes as Possibility of a Combined HP and Xerox Looms”). With this quarter’s financial results announcement, Fujifilm also announced plans to grow Fuji Xerox (soon to be renamed Fujifilm Business Innovation Corp.) now that it has become a wholly owned subsidiary (see “Fujifilm Announces Plan to Grow Document Solutions Business”).

- HP: HP reported a modest revenue decrease along with declines in operating profit and net earnings in Q1 2020, although adjusted net earnings grew. The big problem for HP in Q1 was the same as it was throughout fiscal 2019: a weak performance in the Printing business. If anything, troubles mounted in this business Q1. The year-over-year percentage decrease in Printing revenue was steeper than in any quarter in 2019 and profits shrank. Supplies revenue saw its biggest percentage decrease since Q3 2019, and even worse than that, HP said it expects supplies revenue to continue to shrink through fiscal 2022. Moreover, both commercial and consumer hardware revenue declined as HP posted the biggest downturn in hardware unit shipments since 2016.

- Konica Minolta: In Q3 2019, Konica Minolta reported continued declines in revenue and profits, as the firm continued to suffer from a sales slump in various business segments, unfavorable currency exchange, tariffs, and a very tough profit comparison due to one-off profits from real estate transactions in the year-ago period. In the Office business, revenue continued to decline, although the decrease was more moderate than in Q1 or Q2. However, segment profits were less than half of what they were one year ago. The firm reported declines in sales volume for both color and monochrome MFPs, although the firm said it is beginning to see an improvement in sales of newly introduced Segment 2 and 3 A3 color MFPs. Non-hardware sales also shrank, although the rate of decrease improved for the second straight quarter.

- Kyocera: In Q3, Kyocera posted a revenue decline but huge increases in operating and net profit. However, none of the growth stemmed from the Document Solutions segment, which reported a bigger rate of revenue decline than the company as a whole and its biggest quarterly revenue decline this year and decreased business profit, again the steepest decline this year. The firm laid the blame largely on unfavorable currency exchange.

- OKI: In Q3, OKI reported continued revenue growth and a big uptick in net profit, but operating profit declined. OKI’s Printers business had a very weak quarter, with a double-digit percentage decline in net sales and a very steep (over 90 percent) decrease in operating income. The firm commented that it was negatively impacted by a decline in sales of office-use printers in Europe and the yen’s appreciation, especially against the euro.

- Ricoh: In Q3, revenue and profits fell at Ricoh. In Ricoh’s core Office Printing segment, both revenue and profits shrank. It was the worst performance for the segment this year. Consumables sales were down, and hardware sales decreased due to Ricoh’s focus on profitable sales, a steep decline in sales of printers, foreign currency exchange, and the impact of U.S. tariffs.

- Sharp: Despite challenges resulting from the U.S.-China trade war, Sharp made progress in Q3 2019. Although the firm’s net sales continued to slide, both operating and net profit were up significantly year-over-year. Sharp’s MFP business is part of a new segment called 8K Ecosystem that also includes the firm’s much larger TV business. In Q3, the 8K Ecosystem group reported year-over-year decreases in net sales and operating profit due largely to weak demand for TVs. Unfortunately, Sharp said nothing about the performance of its MFP business.

- Toshiba Tec: Toshiba Tec saw its revenue and profits decrease in Q3 due largely to weakness in its Printing Solutions business, which was enough to offset strong sales in Retail Solutions. Printing Solutions reported a decline in revenue and a steep downturn in profits to post an operating loss for the quarter. Toshiba Tec indicated the segment was hammered hard by a tough economic environment and price competition. Sales of MFPs grew in the Americas but shrank in Europe and Asia, with foreign currency exchange also negative impacting the business.

- Xerox: Xerox wrapped up its fiscal 2019 with a better-than-expected Q4. Although revenue shrank, its revenue trajectory improved for both equipment and post sale. On top of that the firm was able to grow operating and net profit due largely to the firm’s restructuring and cost-cutting efforts. Some of the profit improvement was due to Xerox’s recent transactions with Fujifilm. For example, an OEM license fee paid by Fujifilm was reported in post sale. The firm said it saw lower sales of entry-level and midrange equipment, although the firm managed to grow high-end equipment revenue.

Forecast Revisions

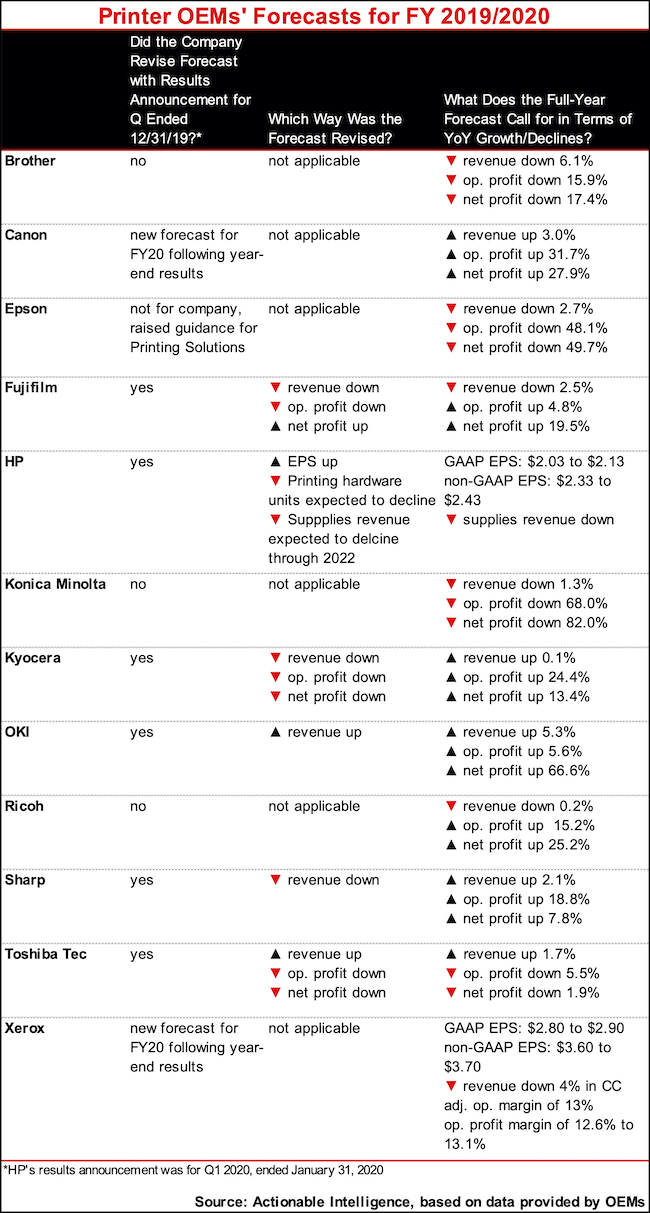

About as many OEMs revised their full-year forecasts this quarter as did last quarter. Of the 12 OEMs we track, seven made adjustments with their previous quarter’s results. With this quarter’s results, six OEMs adjusted their guidance, and two (Canon and Xerox) provided their initial forecast for the year ahead.

As shown below, with a few exceptions (Kyocera, OKI, and Sharp, all of which have other stronger-performing businesses), those OEMs working to wrap up fiscal 2019 expect declines or, at best, mixed years. Those firms like Canon, HP, and Xerox forecasting 2020 had more upbeat outlooks, but we are using that terms loosely and mainly in terms of profit forecasts. For example, HP expects continued printer hardware unit declines and supplies revenue declines in the year ahead and, in fact, says its supplies revenue will decline through 2022. Xerox forecasts an improved revenue trajectory, but the firm is still forecasting a revenue decline.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.