Over the past decade, the market for third-party supplies has changed radically in the United States. During this time, the domestic remanufacturing industry has been decimated and the few remaining remanufacturers in the region have endured dramatic business contractions, while offshore producers have grown to dominate the market. Using a variety of channel programs and pricing schemes, hardware manufacturers have also successfully regained market share and further driven down revenue for U.S. third-party supplies vendors.

Print-Rite, one of China’s largest third-party supplies vendors, has been doing business in the United States for 30 years and has survived all the changes. Unlike most of its Chinese competitors, Print-Rite doesn’t compete with its dealers by selling directly to end users. Instead, the firm relies on its channel partners to drive its business, so its success depends on its customers’ abilities to compete efficiently in today’s brutal market.

Tough Regional Market Conditions

A spokesperson for Print-Rite told us that the company has watched revenue growth for the industry in the region slow over the years. Regardless of the channel, the U.S. market for third-party consumables has historically experienced intense price compression. That’s true whether vendors sell third-party consumables directly to end users online or they sell through offline outlets. As third-party ink and toner cartridge prices have been squeezed, margins have eroded to the point were few U.S.-based vendors can make money selling non-OEM supplies to end users.

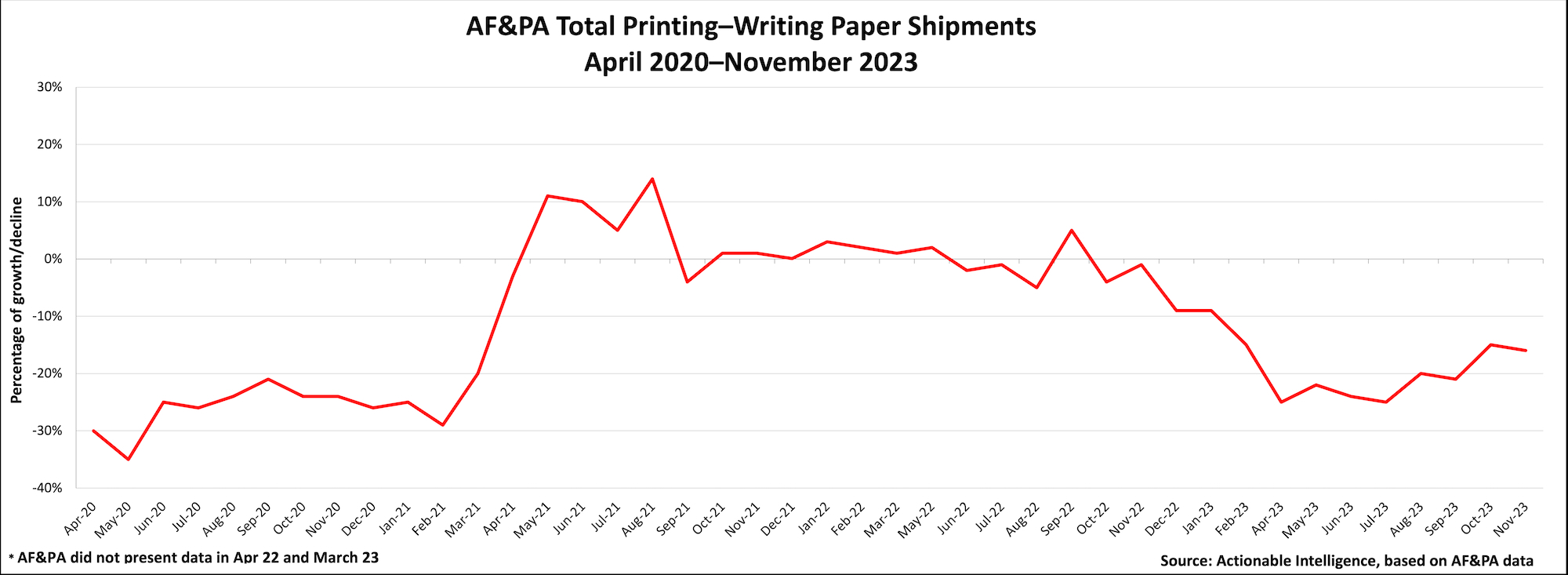

There are a variety of reasons why revenue is falling. The Print-Rite representative we spoke with said that one reason for falling sales is that cartridge usage and demand is falling. A look at the most recent office paper consumption data from the American Forest & Paper Association (AF&PA) reveals that the use of paper in the office has been falling for years. During 2023, printing-writing paper shipments have sometimes declined as much as 25 percent (in April 2023 and July 2023) on a year-over-year basis. While that isn’t quite as steep a downturn as the worst months of the pandemic, it’s not far off either. Shipments continued to decline at a double-digit rate during the closing months of 2023 (see “AF&PA Data Shows Another Big Drop in Printing-Writer Paper Shipment in November 2023”).

While declining cartridge consumption has adversely impacted revenue, the biggest problem for third-party supplies vendors has been the fierce price competition that has plagued the industry for decades. Over the past couple of years, we’ve noted a willingness industry-wide to increase prices, but such price increases are an anomaly. Since the 1990s, offshore cartridge producers and U.S. remanufacturers have relied on slashing consumables pricing to gain market share. Traditionally, OEMs were reluctant to compete on price, but during the 2010s even OEMs developed special pricing programs so that that they and their channel partners could compete more effectively with the shrinking price points on third-party compatible supplies. As a result, for more than 30 years the trend in the average sales price of non-OEM ink and toner cartridges has been mostly downward, which has severely squeezed margins.

Comparing the price of third-party cartridges to the equivalent OEM SKU selling on Amazon shows just how steeply some third-party supplies vendors are willing to discount prices. For example, Aztech-branded toner cartridges compatible with the HP 05A (CE505A) are available in a four-pack for just $53.99 or $13.50 per cartridge (ASIN: B07RKZ1CWY)—that is less than a tenth of the $116.89 that HP charges on Amazon for the HP 05A (ASIN: B001F0R1FG). Likewise, a four-pack of LemeroSuperx toner cartridges compatible with the Brother TN-760 sells for $57.79 (ASIN: B0BJKG6G5Q), so an individual Lemero cartridge is priced at $14.50 while the Brother product sells for $70.49 (ASIN: B075X6C5ZW).

The reason why the third-party cartridges in the above examples can be sold so cheaply is because these brands are marketed by the Chinese companies that manufacture the cartridges. In certain financial filings, Aster Graphics, a part of the holding company Planet Image International Limited of the Cayman Island, has acknowledged that it produces and sells Aztech-branded toner cartridges (see “Aster Files Initial Registration for Planet Image IPO on Nasdaq Stock Exchange”). Likewise, Lemero-branded cartridges are manufactured by the world’s largest third-party cartridge producer, Ninestar Corporation, something that the firm has acknowledged in financial filings (see “Ninestar Reports Startling Net Profit Decline in Q1 2023 but Has Big Plans for Pantum A3 MFPs”).

Of course, manufacturers that sell direct to end users have a distinct cost advantage over their channel partners sourcing product from them. Checking the price of the cartridges sold by U.S.-based third-party supplies vendors like InkCycle and LD Products, one finds the Chinese firms have a pricing advantage. The advantage is even more pronounced if one compares the price of the Chinese compatibles to cartridges produced by U.S.-based remanufacturers like Clover Imaging Group.

A Unique Value Proposition

The Print-Rite spokesperson we talked to told us the company offers its customers a unique value proposition that allows them to succeed. “At Print-Rite, we’re fully committed to working closely with our customers to reevaluate supply-chain relationships and strategically adjust procurement ratios.” Moreover, as noted, the firm does not compete against its dealers by selling direct.

According to the Print-Rite spokesperson, the company is committed to two key principles. “First, for low-priced products that are in high demand but offer minimal or loss-making margins, we will provide a reasonable supply solution to our customers.”

The second key business principle the Print-Rite spokesperson discussed with us is the firm’s commitment to innovation. “We pledge to continue to invest in ongoing technological research and innovation to offer more differentiated and cost-effectiveness products, assisting our customers in maintaining or even gaining market share.” The company has invested heavily in its research and development (R&D) capabilities to offer its customers a competitive advantage by being first to market with the latest popular cartridges. It R&D team also works to try to ensure products do not infringe any other company’s intellectual property. Print-Rite holds over 3,300 patents globally and it adds more patents to its portfolio all the time.

In addition, the Print-Rite spokesperson said the company’s investments include development funding so it can offer greater support in assisting clients to expand categories and develop specific printing solutions for niche markets. For example, the spokesperson said that Print-Rite offers high-page-yield combo versions of its cartridges for managed print services (MPS) and Bio-based toner cartridges to support channel partners targeting customers with environmental programs.

Print-Rite also offers its clients product guidance and support to help customers enhance profitability. To expand the business scope of its customers, Print Rite offers customers higher-margin products like its non-OEM copier cartridges and other digital printing solutions. The company also routinely invests in its support infrastructure to improve delivery and customer services such as its ongoing local manufacturing solution provider plan, which the Print Rite spokesperson told us “provides diverse and flexible supply.”

Want to tell the Actionable Intelligence team what makes your company stand out in a challenging marketplace? We’re always looking for new content! Contact cbrewer@action-intell.com to set up a discussion.