Amazon’s revolutionary business continues to grow at a phenomenal rate. After hitting $177.9 billion in 2017, Amazon’s total revenue swelled to $232.9 billion last year, which is more than the total combined 2018 revenue of all printer OEMs and third-party supplies vendors, and over five times the roughly $45 billion we estimate manufacturers generate annually from the sale of home and office consumables. Moreover, unlike so many companies hawking hardware and consumables, Amazon’s revenue is experiencing strong double-digit growth. During the last fiscal year, Amazon’s revenue climbed 31 percent allowing it to more than double since 2015. And, more importantly, during FY 2018, Amazon’s net income soared over 230 percent.

Much of this robust growth has come from the sale of incredible products based on ground-breaking technologies like Amazon’s Alexa virtual assistant, the Kindle reader, and Amazon Web Services. But in addition to organic growth, Amazon has taken share from competitors in the channels at a punishing rate. Why is the parking lot at your local Staples or Office Depot empty? It’s Amazon. And, of course, office-supplies superstores are only some of the many retailers that have been decimated. Amazon’s victims include book resellers, toy stores, consumer electronic dealers, and so many others. Currently, grocery stores, drugstore chains, and channels with governmental contracts are wringing their hands collectively as the e-commerce colossus moves beyond consumer products.

This Ain’t No Party

Encountering Amazon and its transformative might, one is reminded of Mao Zedong’s oft-quoted quip, “A revolution is not a tea party.” Chairman Mao made the comment while explaining that upending the status quo is messy business and so it is with Amazon. Regardless if your firm sells on the Amazon platform or competes against it—or does both—it is likely that your business has been forever changed over the past few years.

Amazon has completely upended the way that printers and consumables are sold at retail. The firm’s successful pursuit ofthe consumer and small-office/home-office (SOHO) markets for hardware and supplies is apparent across all outlets. In addition to leaving the aforementioned office-supplies superstores reeling, mass merchants, consumer electronic outlets, and virtually every other retailer carrying printers and supplies have lost sales to Amazon. While some contraction in shelf space has been due to the secular move away from printing, many retailers have reduced the square footage devoted to printers and supplies as consumers have flocked to Amazon for hardware and ink and toner cartridges. The decline in retail real estate for non-OEM toner and inkjet cartridges, in particular, has been stunning.

Although Amazon’s transformation of the way printer OEMs sell consumer and SOHO hardware and supplies has been more gradual than what we saw with third-party supplies vendors, most manufacturers now sell a lot of printers and supplies direct on Amazon. We estimate that OEMs generate tens of millions of dollars collectively on Amazon each month in hardware and supplies sales. Hardware vendors with a big retail footprint, like Brother, Canon, Epson, and HP, are doing quite well on Amazon. The marketplace has also provided new opportunities to certain companies selling machines from OEMs like Konica Minolta, Ricoh, Xerox, and others that lacked access to consumers via traditional retail channels.

OEMs Like It!

Despite the problems that OEMs have encountered with intellectual property (IP) infringement and counterfeiting on Amazon (see “Seven Key Findings about Amazon’s Impact on the Printer Supplies Business”), we believe that hardware vendors like selling on the marketplace—and we bet they like it a lot. Amazon seems like a much less expensive channel partner than many traditional retailers. Retailers demand big bucks in slotting fees and for prime in-store real estate like end caps and the shelf space and peg boards located at the front of the store or around cash registers. Add to those product-placement fees all the marketing dollars OEMs spend on store circulars and promotional materials along with rebates and other sales incentives. Enlisting a traditional retailer as a channel partner costs a pretty penny.

To avoid the slightest hint of a perceived channel conflict, most OEMs are reluctant to discuss channel relations or agreements, so we cannot confirm that it is cheaper to sell through Amazon than brick-and-mortar channels. And, to be clear, there are costs associated with running a successful program on Amazon. Doing business on the Internet is not free and there are costs associated with every click. (As Internet publishers that maintain the Action-Intell.com website, we can confirm that investment is required to succeed online!)

We don’t want to suggest that Amazon has allowed OEMs to slash their consumer product marketing budgets to the bone. We suspect that OEMs are increasing their Amazon spending to increase their Amazon business and that investment will grow as the marketplace drives more and more sales. And traditional retail channel partners remain important to OEMs selling consumer and SOHO machines, so their need for a continued retail spending hasn’t gone away entirely. But is it down from what it was in the early 2000s? We think so.

Best-Selling Products on Amazon

A look at Amazon’s Best Sellers list for laser printers reveals that Brother is now killing it on the marketplace. As companies like Kodak, Lexmark, Samsung, and others have removed printers from retail shelfs, Brother expanded its retail presence and grew its consumer and SOHO hardware and supplies business over the past decade. Now the firm appears to be replicating its success in the retail space on Amazon.

As of this writing (the Best Sellers list is updated hourly), Brother monochrome laser devices were among the top three most popular models and the company held seven of the top 10 spots:

- Brother HL-L2350DW;

- Brother MFC-L2710DW;

- Brother HL-L2395DW;

- HP LaserJet Pro M281fdw;

- Brother MFC-L2750DW;

- Brother DCP-L2550DW;

- HP LaserJet Pro M148dw;

- Brother HL-L2300D;

- Brother HL-L3290CDW; and

- HP LaserJet Pro M402n.

With the exception of the Brother HL-L3290CDW and HP LaserJet Pro M402n, the top 10 laser devices are all machines that sell for under $220.That the bestselling devices on Amazon are aimed at consumers and SOHO users is not surprising. While Amazon targets business users with Amazon Business and is pursuing more sales to governmental agencies, the current marketplace remains primarily a B-to-C platform. Reviewing Amazon’s entire top 20 list of monochrome laser printers reveals other vendors, including Canon and Samsung, which each had monochrome single-function units for under $100.

Brother’s success on Amazon impressed us, especially since the market leader, HP Inc., only had three models crack the top 10. Currently, Brother offers a comprehensive range of entry-level machines on the marketplace with a dozen monochrome printers and MFPs selling for under $200. We estimate that monthly sales of Brother’s low-end monochrome machines on Amazon are around $5 million.

Presumably, HP would be happy to add more units to the Amazon Top 10 list, but it seems the company is focused on higher-end market segments. While we did see various sub-$200 LaserJets and some for less than $100 like the $79 LaserJet Pro M15W, HP offers a wide range of monochrome and color workgroup printers and MFPs that sell for over $500. And the firm is not alone. We counted a total of 15 Lexmark monochrome and color printers and MFPs on Amazon. While a few of the machines where SOHO units like the B2338adw, which sold for $137.65, most of Lexmark’s machines were workgroup devices selling between $300 and $800. Canon markets an assortment of its entry-level A4 imageCLASS monochrome and laser printers and MFPs on Amazon at price points under $500.

As noted, machines from copier companies without retail channel partners are also available on Amazon. We found a range of new and refurbished A4 and A3 machines from vendors like Konica Minolta, Kyocera, Ricoh, Toshiba, and Xerox from various distributors such as Polebright and Twelve-Forty Distribution and resellers like ABD Office Solutions and KazoomPC. Some firms offered sub-$500 devices, but most of the machines were higher-end units priced from $1,000 to $7,500. We even found a used Xerox Versant 2100 digital press selling for nearly $35,000 with shipping. In addition to hardware, supplies and installation services are also available on Amazon.

Lots of Low-End Inkjets

Amazon’s Best Sellers list for inkjet printers looked more like we expected. As of the time of writing, HP dominated, claiming all five of the top five slots and six models of the top 10:

- HP OfficeJet 3830;

- HP OfficeJet Pro 6978;

- HP DeskJet 1112;

- HP ENVY 5055;

- HP OfficeJet 5255;

- Canon PIXMA TS9210;

- HP DeskJet 2655;

- Epson WorkForce WF-2750;

- Canon PIXMA TS9210 (bundle product); and

- Canon PIXMA TS51209.

Canon had three models on the top 10 list and Epson had one. Brother is really an “also ran” contender in the inkjet hardware category. The firm managed to place only one model on Amazon’s top 20 list, while all the other models within the top 20 are HP, Canon, or Epson devices. Looking a little more closely at the list, we noted that most of the machines are consumer and SOHO-oriented products with an average price of about $75.50, ranging from a low of $29.99 to a high of $119.99.

In addition to the low-end inkjet machines, there are a limited number of higher-end business inkjet printers and MFPs on Amazon. For example, we found the $1,400 Epson WorkForce Pro WF-R4640 on the marketplace and the HP PageWide Pro 552dw, which was available for around $3,000. OEM ink cartridges for these machines were also available as well as third-party refill inks and cartridges.

OEM Cartridge Sales Are Strong

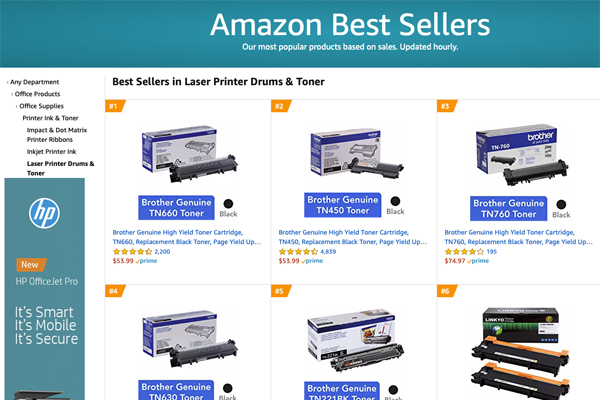

There are scores of third-party brands of toner and ink cartridges on Amazon. However, according to the best-selling laser printer drums and toner list, OEM cartridges rank high on the Amazon list. OEM cartridges are the best-selling toner products. When we checked, Brother held the top five slots and a total of seven spots on the top 10 list. One HP cartridge made the top 10 list. Even the compatibles that made the list were for Brother devices. As of the time of writing, top-selling toner cartridges on Amazon included :

There are scores of third-party brands of toner and ink cartridges on Amazon. However, according to the best-selling laser printer drums and toner list, OEM cartridges rank high on the Amazon list. OEM cartridges are the best-selling toner products. When we checked, Brother held the top five slots and a total of seven spots on the top 10 list. One HP cartridge made the top 10 list. Even the compatibles that made the list were for Brother devices. As of the time of writing, top-selling toner cartridges on Amazon included :

- Brother TN660;

- Brother TN450;

- Brother TN760;

- Brother TN630;

- Brother TN221BK;

- Linkyo compatible replacement for Brother TN660;

- Brother TN850;

- HP 410A (CF410A);

- E-Z Ink compatible replacement for Brother TN630;

- Brother TN730.

Amazon’s list indicates just how consumer-centric the marketplace is. Most of the toner SKUs on the list had page yields of under 3,000, including the Brother TN221BK, TN450, TN630, TN 660, and HP 410A. These cartridges’ yields are too low to support an office environment.

Similar to what we saw with inkjet hardware, HP dominates sales of inkjet cartridges. On Amazon’s list of inkjet printer ink best sellers, nine out of 10 of the most popular inkjet cartridges were HP models. The list included:

- HP 63 black and tricolor twin-pack;

- HP 63XL black;

- HP 61 black;

- HP 902XL black;

- HP 902XL;

- Canon PG-245 black;

- HP 62XL black;

- HP 902 cyan, magenta, and yellow three-pack;

- HP 63 black; and

- HP 61 black twin-pack.

Products this high on Amazon’s rankings sell in enormous volumes. We estimate, for example, that each month HP sells around $3 million worth of HP 63 and 63XL black and tricolor cartridges in various single- and multiple-cartridge SKUs.

The Move Upmarket

We suspect that the OEMs’ gradual move to Amazon has been relatively painless. Since the recession, the assortment of hardware and supplies at retail has contracted significantly. With less printing happening in the home, it seems likely that retailers are somewhat ambivalent about the shrinking presence of printer OEMs in their stores. While they no doubt hate to see their OEM suppliers take up with Amazon, with the sale SOHO hardware and consumables down from the pre-recession high-water mark recorded in 2006, retailers may be happy to find vendors with products that can provide better inventory turns.

We feel that OEMs will find other channel partners less forgiving if more SMB and enterprise machines become available on Amazon. Office-equipment dealers and IT VARs carefully monitor how OEMs bring their products to market. There is a good possibility that dealers will cry foul if they see higher-end devices showing up on Amazon, especially if OEMs use the platform to sell direct.

We’ll be monitoring the situation to see if the product mix begins to shift on Amazon. Stay tuned for more Top 10 lists!