Printer OEMs spent late April and all of May announcing financial results for the three-month period ended March 31, 2020. It was one of the most downbeat earnings seasons Actionable Intelligence has ever witnessed. The novel coronavirus (COVID-19) was declared a pandemic in March and resulted in widespread school and office closures around the world and dramatically changed the market for home and office printers and MFPs and their consumables—perhaps forever.

COVID-19 sparked increased demand for small-office/home-office (SOHO) printers, which has benefited a small handful of OEMs. For most of the industry, however, the disease has led to steep declines in sales of office equipment and caused page volumes to plummet along with sales of consumables for office devices. In addition, the pandemic has disrupted supply chains and caused product shortages in various markets.

For all the Japanese OEMs, except Canon, the three-month period that ended March 31 was the fourth quarter of the fiscal year ending March 31, 2020. For Canon and U.S.-based Xerox, this period was the first quarter of fiscal 2020. HP is on a different financial calendar than all the other OEMs. Its second quarter of fiscal 2020 ended on April 30, 2020.

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. (We also cover financial results for various aftermarket supplies manufacturers, including Ninestar, which owns Lexmark.) Our detailed coverage of these companies’ financial performance is available only for Actionable Intelligence subscribers, but key takeaways from this quarter’s earnings season are summarized below.

Overview

For those OEMs that wrapped up their FY 2019 in the quarter ended in March, the year ended on a decidedly sour note. Even before the pandemic, FY 2019 was shaping up to be a tough year for most vendors due to issues such as tariffs, a slowdown in China and other emerging markets, and unfavorable currency exchange. But then, in the final quarter of the year, COVID-19 struck.

Although the pandemic impacted most sales regions only in the final weeks of the quarter, the effect was profound. For many vendors, China is a key growth market, and COVID-19 caused shutdowns there earlier in the quarter. As a result, Japanese OEMs either missed their full-year guidance or drastically lowered their forecast for the year shortly before announcing their full-year results. Supply chains and manufacturing became an issue for OEMs, especially HP, as the pandemic shut down factories in China first and then in Southeast Asia and other regions.

While we think ultimately COVID-19 is likely to spark a new wave of consolidation once markets settle, the pandemic put an end to one potential merger the industry has been following for months now: Xerox’s hostile takeover bid for HP. As markets and share prices crashed and it became more challenging for Xerox to meet with HP shareholders, Xerox pulled the plug on its offer. But we expect to see alliances and merger-and-acquisition (M&A) activity increase as battered companies emerge from this crisis. There have already been some signs that companies are thinking about such changes: Epson, for example, has decided to let its “poison pill” provision lapse, and Toshiba Tec has signaled that it is exploring possible alliances for its Printing Solutions segment.

Performance by Vendor

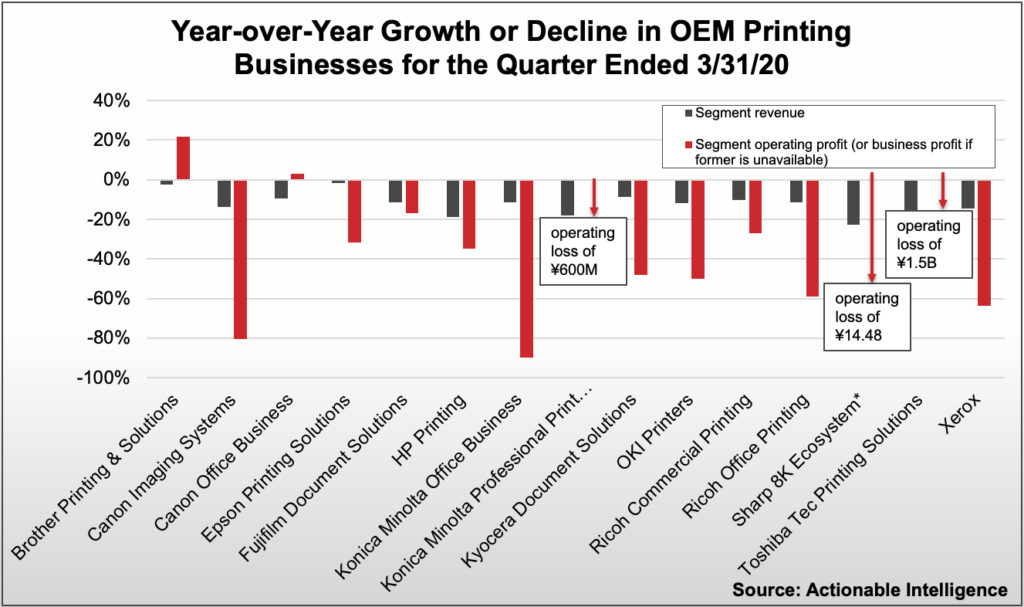

This quarter was similar to the last one (see “The Big Picture: OEM Financials for the Quarter Ended in December 2019”) in that not a single OEM could boast of both revenue and profit growth in their printing businesses.

Just two companies—Brother and Canon—were able to report mixed results in their respective printing organizations: revenue declines coupled with operating profit growth. Both firms saw upticks in demand for SOHO products as schools and office closed.

The other companies we follow saw revenue and profits shrink in their printing businesses in the quarter ended in March. However, the most recent quarter differed from the one ended in December in that most OEMs saw even steeper declines in revenue and profits as COVID-19 impacted their businesses.

We have boiled down the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: In Q4, Brother fared better than many of its rivals. While the company’s revenue shrank, it grew operating and net profit. Similar trends were seen in the Printing and Solutions segment: revenue was down modestly but operating profit grew over 20 percent. The firm noted that sales of inkjet printers were up, especially in Europe, and sales of inkjet consumables increased as channel partners stocked up out of concern about shortages.

- Canon: Canon’s sales and profits were down sharply in Q1 due largely to COVID-19. In the firm’s Office Business, sales declined. Sales of MFDs and laser printers both fell, although the firm did see increased demand for low-end lasers. The firm noted sales were hampered both by COVID-19 and product shortages. The good news, however, is the Office segment was actually able to grow profits modestly due to strict cost controls. The Imaging System business performed fared poorly in Q1—sales declined and operating profit fell over 80 percent. However, that was due largely to the firm’s camera business. The category we are most interested in—inkjet printers—had its best quarter in quite some time. Inkjet printer hardware and supplies sales were up in the quarter. While this was due to work-from-home trends, Canon also saw nervous channel partners worried about product shortage stocking up, much like what happened with Brother.

- Epson: In Q4, Epson reported a revenue decrease, steep downturns in business and operating profits, and a net loss. In the firm’s Printing Solutions segment, revenue decreased modestly, and business profit fell over 30 percent—but that was less than half the rate for the company as a whole. Epson saw continued growth in worldwide demand for high-capacity ink tank printers, a category that includes refillable ink tank devices such as the EcoTank series, but sales of these devices slowed in emerging markets. The firm also saw increased demand for SOHO inkjet printers due to COVID-19. While Epson laid the blame for the group’s lower profits on FOREX and increased spending to drive future growth, we think another problem is flagging ink cartridge sales. As Epson shifts its installed base toward EcoTank units that use low-cost ink bottles, sales of higher-margin ink cartridges continue to fall.

- Fujifilm: In Q4, Fujifilm saw its revenue decline and operating and net profits fall sharply, causing the firm to miss its full-year guidance. Over the past year, Fujifilm has invested to grow its Document Solutions business by buying Xerox’s 25 percent stake in Fuji Xerox. But with a pandemic sweeping the globe, that investment is not yet paying off. In Q4, Document Solutions revenue and operating income both fell by double-digits. The operating income decline ends a string of growth for the unit, which posted improved profits throughout 2018 and most of 2019.

- HP: HP’s revenue, operating profit, and net earnings declined in Q2 2020. While demand was up for certain PCs and printers due to work-from-home trends, HP’s manufacturing operations were disrupted by shutdowns in China and Southeast Asia. As a result, the firm was unable to meet the demand for certain popular products, as other areas of its business withered due to COVID-19. Q2 was one of the worst revenue performances for the company’s Printing business we have seen over the past two decades, with revenue contracting over 18 percent. Segment operating profit tumbled nearly 35 percent, and operating margin fell to its lowest levels since 2012. While HP said it saw strong demand for some inkjet hardware and supplies, that is one area of its business that was hampered by shortages. As a result, consumer hardware, commercial hardware, and supplies revenues all shrank. One bright spot for the company is Instant Ink, which has added about one million users since the firm’s last quarterly report. With so many around the world now working and studying at home, the concept of ink automatically delivered to your door before you need it had great appeal.

- Konica Minolta: FY 2019 was already shaping up to be a tough year for Konica Minolta, but the coronavirus made things far worse. Konica Minolta tipped its hand that its Q4 results would be disappointing when it revised its full-year forecast shortly before its earnings release at the end of the month. In Q4, the company’s revenue declined, and last year’s operating and net profits turned into losses. The firm closed the year with the lowest operating margin we have seen from the firm over the last 14 years—and that includes during the last financial crisis. Konica Minolta’s mainstay Office business posted its biggest year-over-year revenue decrease of the year in Q4, and the segment’s operating profit fell nearly 90 percent. While Konica Minolta has experienced shutdowns at key plants in China, Malaysia, and France, the firm said the impact on product supply has been “slight.”

- Kyocera: Kyocera suffered from declining revenue and big decreases in profits in Q4, causing the company to miss its full-year outlook. The Document Solutions business exhibited these same downward trends. The firm said the business was hurt by both FOREX and the global economic shutdown causes by COVID-19.

- OKI: Like pretty much everyone else, OKI posted revenue and profit declines in Q4. This took some—but not all—of the shine off what was expected to be a growth year for OKI. But the growth OKI saw in 2019 was not a result of its Printers Business, which struggled throughout the year, including in Q4, when revenue shrank 12 percent and operating income fell 50 percent. The firm said it was hurt by decline in demand for office-use printers in Europe.

- Ricoh: In Q4, Ricoh saw its revenue decline modestly, but operating income actually grew over 25 percent, although the firm posted a net loss for the period. Results, however, were worse than what Ricoh had forecast, causing it to miss its full-year guidance. In the segment we follow most closely, Office Printing, both sales and operating profit decreased, as the firm found that “deals and opportunities dwindled” due to COVID-19. The firm reported that hardware sales decreased, and supplies sales shrank as office print volumes tanked. Ricoh suggested it could see a 30 percent drop in sales in the year ahead.

- Sharp: In Q4, Sharp’s revenue declined 18 percent, and the company posted steep operating and net losses, resulting in a dismal fiscal 2019 for the company. The pandemic hurt sales of MFPs but also sales of other products like TVs and household appliances. In the 8K Ecosystem group in Q4, sales tumbled 22 percent, and the group posted an operating loss. Commenting on its MFP business, Sharp said it saw decreases in copy volumes and service sales as a result of the pandemic.

- Toshiba Tec: Toshiba Tec’s Q4 was its worst quarter of the year. Sales were down, operating profit tumbled nearly 85 percent, and the company posted a net loss, all due largely to COVID-19. As a result, the company missed its FY 2019 targets. Of the company’s two main business segments, the Printing Solutions segment was hardest hit. Sales were down sharply in Q4, and the group posted an operating loss that was big enough to result in a full-year loss for the segment. Like some of its rivals, Toshiba Tec also experienced supply-chain issues at manufacturing sites in China and the ASEAN region.

- Xerox: While Xerox’s Q4 may have been better than expected, that was certainly not the case with its Q1. The company was hit hard by COVID-19 in the quarter. Sales and operating income fell, and the company reported a net loss. Both equipment sales and post-sale revenue shrank, although declines were steeper for equipment—down over 27 percent. The company was unable to complete deals and installs in what is typically the strongest month of the quarter for the firm—the third month. While post-sale revenue was down over 11 percent, the firm said declines there were somewhat “contained” by the firm’s contractual business. The firm said it expects an even bigger negative impact from the virus in Q2.

Forecasts? What Forecasts?

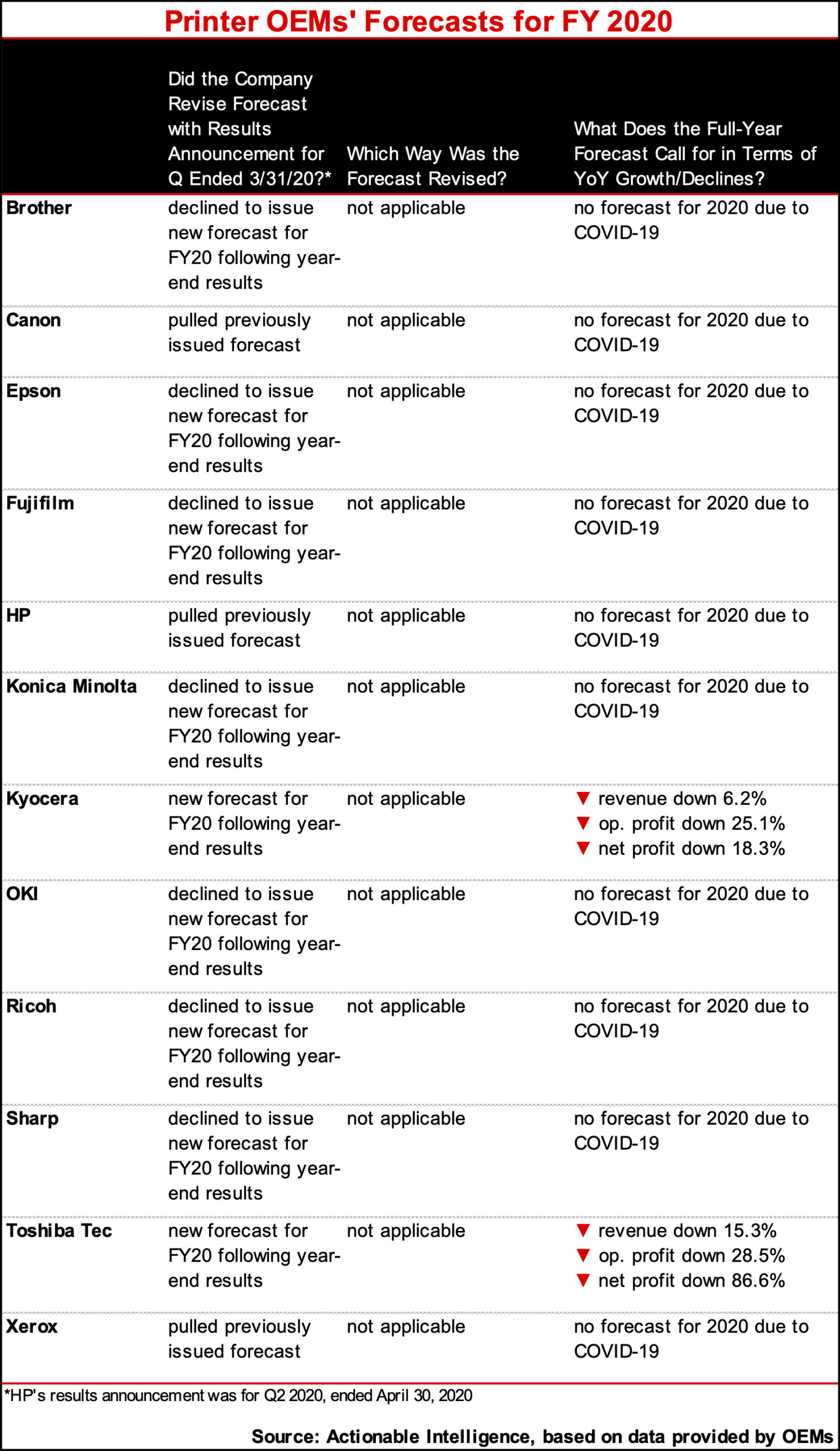

Typically, we reserve the final paragraphs of our quarterly roundup of OEM financials by looking at what newly issued or revised forecasts tell us about the year ahead.

But what OEMs are overwhelmingly saying is that there is so much uncertainty surrounding COVID-19 and its economic impact that it is impossible to issue a forecast for the year ahead. We have never seen so many companies decline to provide guidance, and that includes during the last recession, when most firms still made attempts to provide outlooks for their businesses.

As of the quarter ended in March, the only companies that provided a forecast for the year ahead were Kyocera and Toshiba Tec. Both are projecting across-the-board declines, although, of the two outlooks, Toshiba Tec’s is bleaker.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.