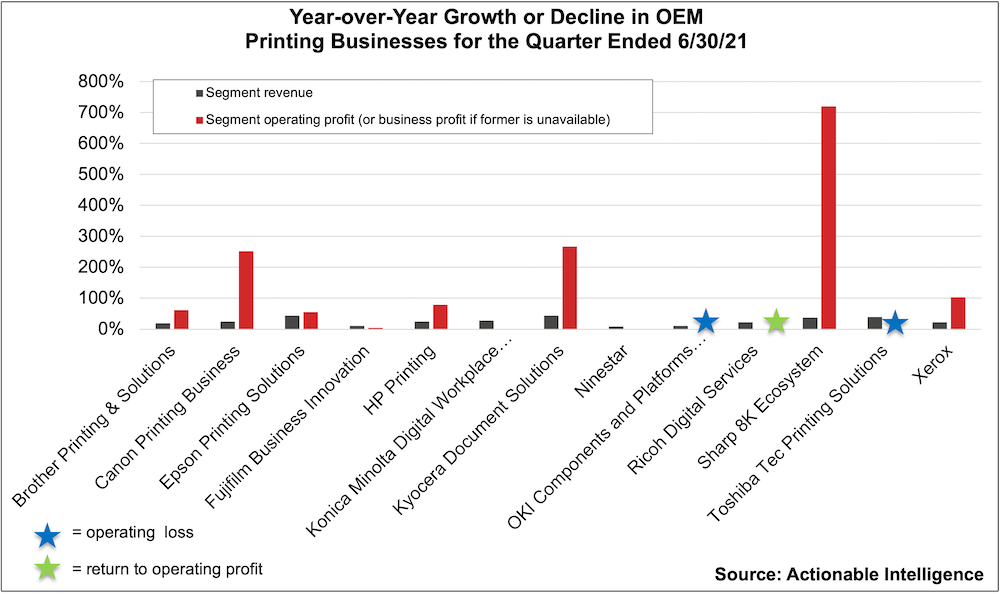

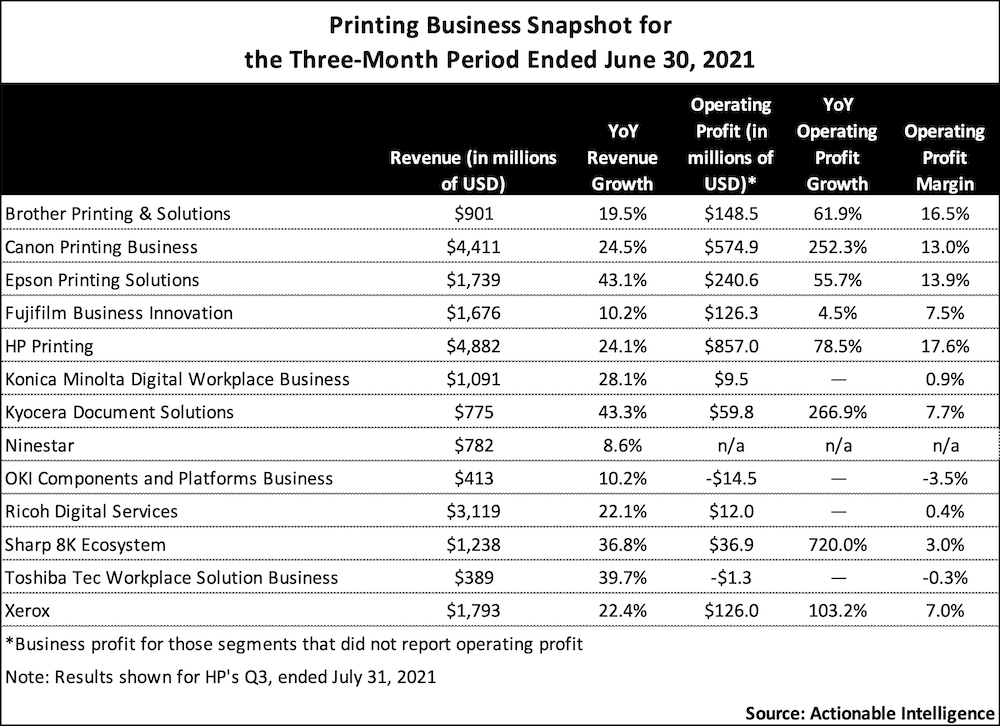

In late July and throughout August, printer OEMs announced financial results for the three-month period ended June 30, 2021. The quarter was the sixth since printer and MFP makers began to feel an impact from the coronavirus (COVID-19) pandemic. Because the quarter one year ago was the worst ever seen for the printer and supplies industry (see “The Big Picture: OEM Financials for the Quarter Ended in June 2020” and “OEMs Look into the Abyss in Industry’s Toughest Quarter Ever”), that meant OEMs had a very easy comparison. As a result, OEMs’ home and office printing divisions posted year-over-year revenue growth of anywhere from 8.6 percent to 43.3 percent and operating profit growth of 4.5 percent to 720.0 percent. And that’s in a shrinking industry in which it has often been said that flat is the new growth.

As they have done in the past few quarters, OEMs with strong small-office/home-office (SOHO) printer/MFP portfolios continued to benefit from work-from-home and learn-from-home trends and the shift to hybrid work environments. Moreover, unlike in recent quarters, many OEMs reported a pickup in demand for higher-volume A4 and A3 MFPs and their consumables as more workers return to the office. These trends and the easy comparison enabled OEMs to post some impressive year-over-year numbers, to be sure. But this is hardly a “let the good times roll” moment.

OEMs expressed concern about the emergence of new coronavirus variants, including the Delta variant, causing renewed lockdowns—restrictions have already been put in place in some markets. HP pushed back its planned reopening of its offices (see “HP Delays Office Reopening Due to Delta Variant, Will Require Vaccines”) and made its Reinvent 2021 partner event a virtual conference. In yet another example, Konica Minolta Business Solutions U.S.A. postponed its dealer summit (see “Konica Minolta Postpones Dealer Summit over COVID-19 Concerns”).

Some OEMs had to suspend operations at factories in Southeast Asia, leading to more product shortages. And virtually every single OEM expressed concern about component shortages especially for chips and said increased costs for components, raw materials, and shipping were eating into margins.

One of OEMs’ saving graces amid these challenges is that because certain desktop printers and MFPs are in short supply, there was no need to discount these devices. Because OEMs could command higher prices for the products that were available and many customers opted to purchase higher-priced products, average selling prices (ASPs) rose, and that helped fuel some of the positive trends we saw this quarter. Moreover, because of shortages in prior quarters, there was a lot of pent-up demand among channel partners, so partners were eager to gobble up whatever inventory OEMs had available.

Comparison to Before the Pandemic

With almost every single OEM reporting strong year-over-year growth this quarter, one thing we have been eager to look at is whether that growth makes up for the big declines posted one year ago. Thus, in our financial reporting this quarter we did lots of comparisons between the results for the quarter ended in June 2021 to that same quarter of 2019. For more details, see our coverage of each OEM’s report.

Here, however, we take a quick look at which vendors performed well in the quarter ended in June 2021 compared to the quarter ended in June 2019 and which did not. Note that here we are looking only at companywide results, nor printer segment results. Because so many companies resegmented and restructured their businesses in recent quarters, it is not possible to get a 2021 versus 2019 look at certain OEMs’ printer/MFP businesses.

OEMs whose revenue, operating profit, and net profit for the quarter just ended mark a return to or exceed pre-pandemic levels, or what was reported in the same quarter of 2019, include Brother, Epson, Fujifilm, Kyocera, and Sharp.

Certain companies exceeded pre-pandemic levels in some areas but not others. Canon saw Q2 2021 profits soar past Q2 2019 levels, but its net sales for the period were lower than what the firm reported in Q2 2019. HP’s revenue and operating profit for Q3 2021 exceeded those reported for Q3 2019, although the company’s net earnings in the period were lower than in Q3 2019. Konica Minolta had higher operating and net profit in Q1 2021 than it did in Q1 2019, but revenue in the quarter was less than what the firm reported two years ago.

OEMs that posted year-over-year growth this quarter but whose revenue, operating profit, and net profit all remained depressed compared to 2019 levels include Ricoh, Toshiba Tec, and Xerox.

OKI was a bit of an unhappy anomaly in that its Q1 2021 results were worse than those posted one year ago, as well as those posted two years ago.

All this tells you something—OEMs with strong SOHO printer and MFP business have fared far better than those focused mainly on A3 MFPs. Other OEMs with a big A3 focus like Fujifilm, Kyocera, and Sharp saw their businesses rebound to exceed pre-pandemic levels because their businesses are diverse and include other products like healthcare, automotive components, and TVs.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from April 1, 2021, through June 30, 2021, was the first quarter of the fiscal year ending March 31, 2022. For Canon and U.S.-based Xerox, this period was the second quarter of fiscal 2021. HP is on a different financial calendar than all the other OEMs. Its third quarter of fiscal 2021 ran from May 1, 2021, through July 31, 2021.

Strictly in terms of year-over-year growth, every OEM’s printer business was a winner this quarter. Every single home and office hardware and supplies businesses we follow saw revenue growth. All saw improvements in operating profit as well, although in OKI’s and Toshiba Tec’s case this meant their printing business saw smaller losses than in the prior-year period. We actually cannot recall another quarter in recent years in which all OEMs saw across-the-board growth in their printing businesses. But, as discussed above, this is also because the year-ago period was the worst in the industry’s history.

We have summarized the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Brother’s Q1 2021 got off to a strong start. Brother’s revenue and profits rose sharply in comparison to the tough period one year ago, and the company reported its highest ever business segment profit and operating profit for Q1. In the Printing and Solutions segment in Q1, revenue was up a robust 19.5 percent year-over-year and operating profit rose 61.9 percent. Brother noted that it benefited from continued demand for compact printers and all-in-ones for working and studying from home. Throughout FY 2020, Brother saw strong demand for its small-office/home-office (SOHO) laser printers, but it was unable to capitalize on the strong demand that other vendors were seeing for inkjet devices due to severe product shortages. In Q1 2021, Brother essentially experienced the opposite. As supply constraints eased on the inkjet side of its business, Brother reported inkjet hardware sales growth of 90 percent on a 65 percent increase in inkjet printer units and inkjet consumables sales growth of 11 percent. But due to the spread of COVID-19 in Southeast Asia, Brother had to suspend operations at a laser hardware factory. Thus, there were supply constraints for laser devices, and Brother saw laser hardware sales decline 10 percent in Q1 on a 28 percent downturn in unit shipments. Laser consumables sales, however, rose 21 percent due to some improvement in office print volumes and continued strong SOHO printing demand.

- Canon: Canon reported robust revenue and profit growth on a companywide basis. Moreover, the firm had good news about its Printing Business, which combines the firm’s former Office Business with the inkjet piece of its former Imaging System segment. Printing Business net sales increased 24.5 percent year-over-year, while group operating profit improved a whopping 252.3 percent. In the office MFD category, net sales improved 40.6 percent. Overall, office MFD unit shipments grew 53 percent year-over-year in Q2 on 48 percent growth for monochrome units and 57 percent growth for color units. Canon noted it saw strong sales of the imageRUNNER ADVANCE DX series as large companies in the United States and Europe brought employees back to the office or prepared to do so. Laser printer net sales in Q2 grew 27.0 percent due largely to improved non-hardware sales. Total laser hardware unit shipments fell 12 percent on a 5 percent decline in monochrome units and a 32 percent decrease in color units. Inkjet printer net sales were up 4.7 percent despite a 12 percent decline in inkjet printer units.

- Epson: Epson’s first quarter of 2021 was excellent, with it posting some of the highest revenue and profit growth figures we have seen from the company. It was also a great quarter for Printing Solutions, which saw its revenue grow 43.1 percent year-over-year and segment profits rise 55.7 percent. In the Office and Home Printing category, revenue rose 33.9 percent year-over-year; however, business profit shrank 16.8 percent. The firm said shipments of both high-capacity ink tank printers and ink cartridge printers increased. It appears that the main cause in the profit drop in this area of the Printing Solutions business was a 7 percent decline of ink revenue for Office and Home Printing solutions. Another factor was rising costs for components and shipping.

- Fujifilm: In Q1 2021, Fujifilm saw revenue, operating income, and net income grow sharply from what the firm reported one year-ago when COVID-19 walloped the firm’s business. The company set records for the highest revenue and net income ever reported in Q1. Fujifilm has reorganized its business into new segments starting this year. The segment we now will be following most closely is the Business Innovation segment, which includes MFPs and laser printers, consumables, and services. Revenue in this segment increased 10.2 percent year-over-year in Q1 2021, while segment operating income grew 4.5 percent. Fujifilm said in the office solutions subsegment revenue improved 9.5 percent, while revenue grew 11.5 percent in business solutions. The firm said unit shipments of office products increased, and after-sale revenue rose sharply as print volumes improved from the lows seen last year.

- HP: Q3 2021 was another quarter of growth for HP, with revenue and profits up compared to the year-ago period. In the Printing segment in Q3 2021, revenue increased 24.1 percent year-over-year, while segment profits soared 78.5 percent. Supplies revenue grew 20.2 percent. The commercial hardware business saw its strongest growth since the pandemic emerged—revenue in this segment improved 46.2 percent, and hardware units increased 29 percent. The consumer hardware segment, however, was a bit weaker than seen in previous quarters. Consumer hardware revenue rose 14.6 percent, but consumer hardware units were down 8 percent due to manufacturing and component constraints.

- Konica Minolta: Konica Minolta’s first quarter of 2021 got off to a much better start than did the first quarter of 2020. Revenue was up sharply, and last year’s operating and net losses turned to profits. In the segment we care most about, the Digital Workplace Business, revenue climbed 28.1 percent year-over-year, and operating profit climbed out of the red and into the black and improved by nearly ¥10.7 billion. In the Office subsegment, revenue was up 31.4 percent from the year-ago period, and Konica Minolta reported sales volumes for3 A3 MFPs recovered to well above last year’s levels. Non-hardware revenue increased as employees returned to the office.

- Kyocera: Kyocera saw robust growth in sales revenue and profits in Q1 2021. In the segment we are most interested in, Document Solutions, the company was able to report both sales revenue and profit growth for the first time since the pandemic first caused results in this segment to tumble. Document Solutions sales revenue was up 43.3 percent year-over-year, and business profit grew a whopping 266.9 percent. The firm noted its saw demand for equipment and consumables recover.

- Ninestar: Ninestar announced results for the first half of 2021, but unfortunately the firm did not break out results specifically for Q2. We were able to calculate that the firm’s revenue in Q2 was up 8.6 percent, but we do not have data for operating profit. However, we do know that for the first half the company’s revenue was flat (up 0.2 percent) and operating profit improved 13.9 percent year-over-year. While we lack quarterly results for NInestar’s business segments, the firm reported that Lexmark saw its revenue improve 4.7 percent year-over-year in the first half and Lexmark printer unit shipments were up 20 percent. Pantum saw its revenue surge 151.4 percent in the first half of the year. Pantum’s printer shipments were up more than 50 percent in the first half, and shipments of Pantum original consumables increased 90 percent.

- OKI: OKI, unlike most of the companies we cover, did not have a good quarter. In Q1 2021, its revenue declined, and its operating and net losses were even bigger than those reported one year ago. OKI’s Components and Platforms business, however, saw net sales in Q1 2021 improve 10.2 percent. The group still had an operating loss, although it was slightly smaller than that reported in the year-ago period. The firm said that improved consumables sales in Europe and the United States contributed to the net sales growth in this segment, but rising costs meant a continued loss in this segment despite the net sales growth.

- Ricoh: In Q1 2021, Ricoh was able to reverse the downward business trends seen one year ago, grow revenue, and turn last year’s losses into profits. Ricoh is one of the printer/copier makers making some changes in its business segments starting this year. The key segment we will be following moving forward is Digital Services. In Q1 2021, this group’s net sales grew 22.1 percent year-over-year, and operating profit increased by ¥8.6 billion, enabling the group to post a profit for the period just ended. The firm said MFP hardware net sales improved 25 percent. Overall MFP unit shipments were up 20 percent (up 26 percent for A3 MFPs and up 6 percent for A4 MFPs). MFP non-hardware net sales rose 19 percent. Laser printer hardware revenue increased 48 percent on a 42 percent growth in unit shipments, while non-hardware laser printer revenue increased 14 percent.

- Sharp: Sharp is yet another vendor that could boast of strong year-over-year revenue and profit growth in Q1 2021. The firm resegmented its business starting with the current fiscal year. MFPs are still part of the 8K Ecosystem segment, as are TVs, but it appears the firm has moved displays out of this segment. Q1 2021 was an excellent quarter for Sharp’s 8K Ecosystem Group. Net sales increased 36.8 percent, and operating profit rose 720.0 percent. The firm attributed this to higher sales of high-value-added TVs and improvements in its MFP and consumables business.

- Toshiba Tec: Like many of its rivals, Toshiba Tec saw big year-over-year improvements in net sales and profits in Q1 2021 due in large part to an easy comparison. The same was true for the new Workplace Solutions Business, which replaces the former Printing Solutions Business. Net sales in this segment rose 39.7 percent year-over-year. The group still had an operating loss but a much smaller one than it did one year ago. The company noted it was unable to post a profit in the group because of “tight supply,” higher prices for parts and components, and increases in freight costs.

- Xerox: In Q2 2021, Xerox’s revenue and profits bounced back strongly from the steep declines seen in the year-ago period. Revenue grew 22.4 percent year-over-year, while operating profit soared 103.2 percent. The company had excellent news about equipment revenue, which grew 38.4 percent. Entry equipment revenue was up 56.8 percent, and black-and-white A4 MFP installs rose 63 percent and color installs grew 19 percent. Midrange equipment revenue rose 41.5 percent on 36 percent growth for monochrome installs and 62 percent growth for color installs. The firm was enthusiastic about the uptick in demand for office-centric devices, explaining that this meant businesses are planning for a return to the office. High-end revenue improved 19.4 percent on 47 percent growth in black-and-white installs and 27 percent growth in color installs. Post-sale revenue improved 18.1 percent year-over-year. Xerox noted that page volumes are improving as certain economies, especially in Europe, come out of lockdown.

Forecast Revisions

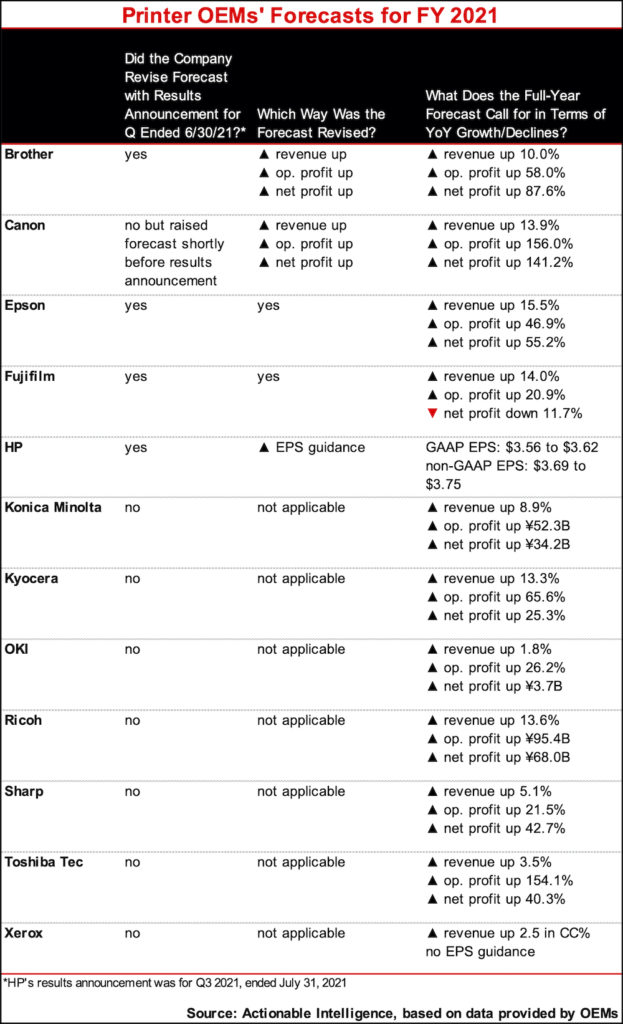

Almost every single OEM started FY 2021 with the expectation that this year would be better than the last. Several OEMs liked what they saw in the quarter ended in June so much that they raised full-year guidance. We saw five OEMs—Brother, Canon, Epson, Fujifilm, and HP—raise their full-year forecast over the guidance provided in the previous quarter.

At this point in time, all OEMs provide outlooks for FY 2021 that shows improvement over the year prior. The one exception is Fujifilm’s net income, which is expected to be lower; however, Fujifilm had recorded net income last year due to certain one-off factors including the impact of it acquiring all of Fuji Xerox.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.