In July and August, printer and copier OEMs reported quarterly financial results for the three-month period ended on June 30, 2018. For all the Japanese OEMs, except Canon, this period was the first quarter of the year ending in March 2019. For Canon and Xerox, this period was the second quarter of the fiscal year that will end on December 31, 2018. HP is on a different financial calendar than all the other OEMs. Its third quarter ended on July 31, 2018.

In July and August, printer and copier OEMs reported quarterly financial results for the three-month period ended on June 30, 2018. For all the Japanese OEMs, except Canon, this period was the first quarter of the year ending in March 2019. For Canon and Xerox, this period was the second quarter of the fiscal year that will end on December 31, 2018. HP is on a different financial calendar than all the other OEMs. Its third quarter ended on July 31, 2018.

Actionable Intelligence currently covers financial results from traditional printer and copier OEMs including Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, OKI, Ricoh, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available for Actionable Intelligence subscribers.

Key takeaways from these companies’ most recent financial quarters are as follows.

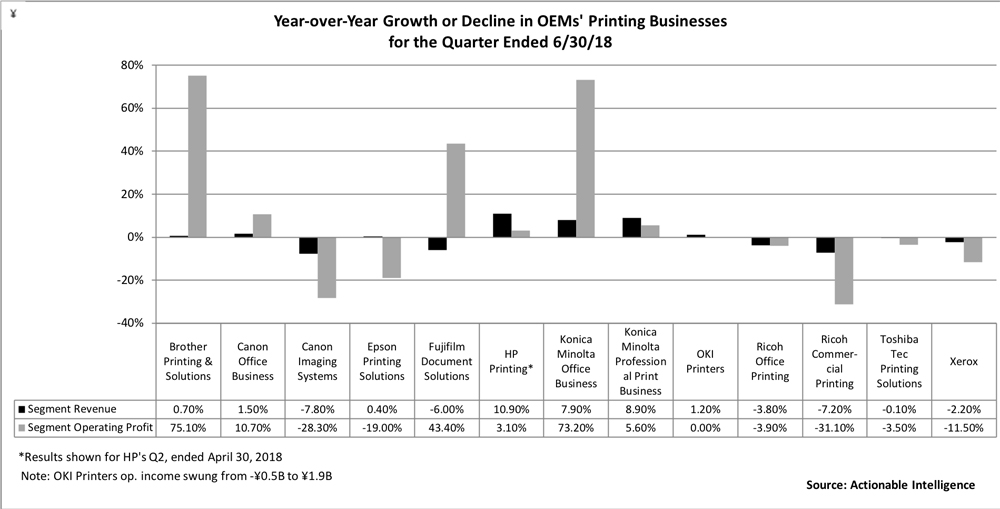

- Throughout calendar year 2017, most OEMs posted year-over-year improvements in revenue and profits. So far, however, calendar year 2018 is proving more challenging. In the quarter ended in March 2018, several OEMs saw the year-over-year growth in their printer hardware and consumables business either slow or turn into declines (see “The Big Picture: OEM Financials for the Quarter Ended in March 2018”). The quarter ended in June 2018 was another mixed one for OEMs, with some firms posting gains in revenue and profits and others posting declines.

- In the quarter ended in June, the “winners”—firms that posted both revenue and operating income growth year-over-year in their printing businesses—included Brother’s Printing and Solutions business, Canon’s Office business, HP’s Printing business, Konica Minolta’s Office and Professional Print businesses, and OKI’s Printers business. It is worth pointing out that Brother, HP, and Konica Minolta have been on the “winners” list for the last few quarters now.

- The OEMs whose printing businesses saw year-over-year declines in revenue and operating profit included Canon’s Imaging Systems business, Ricoh’s Office Printing and Commercial Printing businesses, Toshiba Tec’s Printing Solutions business, and Xerox (all of Xerox is now a printing business). Aside from a blip in the quarter ended in December 2017 when most OEMs posted improved revenue and profits (see “The Big Picture: OEM Financials for the Quarter Ended in December 2017”), certain OEM printer businesses have become regulars on the list of companies posting revenue and profit declines: Ricoh’s Office Printing business and Xerox.

- Two OEMs’ printing businesses posted mixed results in the quarter ended in June 2018: Epson Printing Solutions, which posted very modest revenue growth but a decrease in operating profit, and Fujifilm Document Solutions, which reported decreased revenue but improved profits as the company restructures.

- In mergers and acquisitions news, there was nothing new on the Xerox/Fujifilm front. In May, Xerox called off plans to merge with Fuji Xerox (see “Xerox Gives Up on Fujifilm Deal, Reaches Another Agreement with Deason and Icahn”). While we will probably never know the extent to which all the merger drama impacted the two company’s financial results, we think that the uncertainty contributed to Xerox’s and Fujifilm’s declines in its most recent quarter. In contrast, HP’s successful acquisition of Samsung’s printer business is continuing to fuel the market leader’s year-over-year growth this year (see “HP Completes Acquisition of Samsung’s Printer Business”). The real apples-to-apples test for HP will be next year, which will be its second year with Samsung Printing results included.

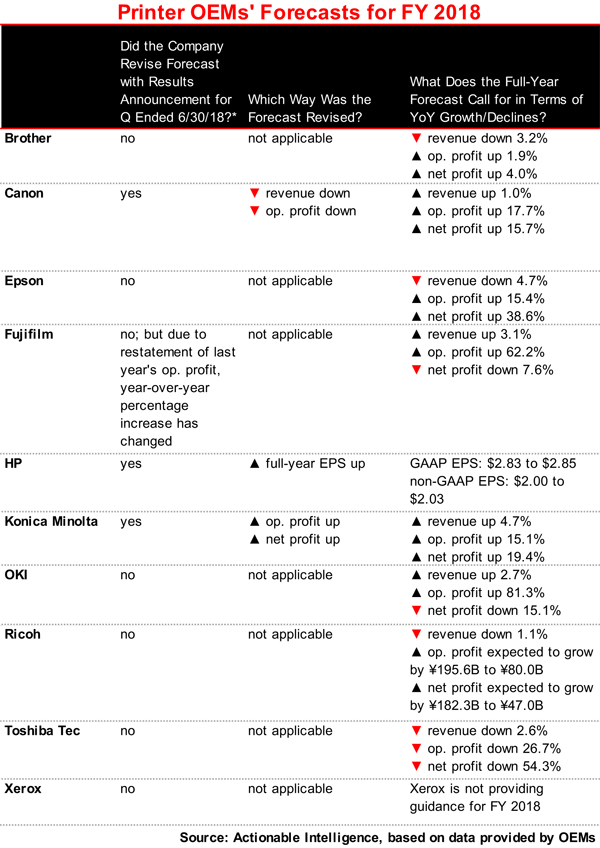

- Of the 10 major OEMs we track, only three—Canon, HP, and Konica Minolta—revised their forecasts for the year ahead. HP raised its guidance for GAAP and non-GAAP earnings per share (EPS). Konica Minolta, too, now expects higher earnings and raised its outlook for operating and net profits. Canon, however, did the opposite and lowered its forecast for both revenue and operating profit. The company cited concern about its ability to maintain sales in its Industry and Others segment, slumping average selling prices (ASPs) for A3 multifunction devices (MFDs), and lower-than-expected inkjet consumables sales.

- Xerox once again declined to provide guidance for the year ahead.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.