In late January and throughout the month of February, printer OEMs announced financial results for the three-month period ended December 31, 2020. The quarter was the fourth in which most printer and MFP makers reported a strong negative impact from the coronavirus (COVID-19) pandemic. However, in this most recent quarter, not everybody saw declines.

Company financials are beginning to bounce back from the steep COVID-19-related declines seen several months ago.

To put things in perspective, COVID-19 and widespread office shutdowns and school closures made the quarter ended in June 2020 the worst in the industry’s history (see “The Big Picture: OEM Financials for the Quarter Ended in June 2020”). From that low point, companies have begun to recover, first in the quarter ended in September and now even more in the quarter ended in December.

Although OEMs are recovering, the recovery was uneven. Market conditions and the shift to work-from-home favored OEMs with robust small-office/home-office (SOHO) A4 portfolios. These include inkjet devices but also some lower-priced lasers for the desktop. Three OEMs with strong SOHO hardware portfolios—HP, Brother, and Epson—actually reported revenue growth in their printing businesses. Canon’s Imaging Solutions segment, which markets inkjets, saw the smallest revenue decline, as shrinking demand for cameras offset some of its inkjet business’s growth.

The big increase in demand for SOHO printers and MFPs over the last several months initially caught vendors by surprise. Moreover, COVID-19 impacted their production. As a result, many vendors including Brother, Canon, Epson, and HP have experiences shortages of SOHO printers and their consumables. While the situation has eased over the last couple of quarters, problems remain.

Times are tougher for OEMs that are more focused on office equipment such as A3 MFPs or production printers. These OEMs reported year-over-year revenue declines in their printing businesses ranging from 1.9 percent to 22.6 percent. Still, things are gradually normalizing. In comparison, in the disastrous quarter ended in June, all OEMs saw revenue declines ranging from 15.4 percent to 39.1 percent.

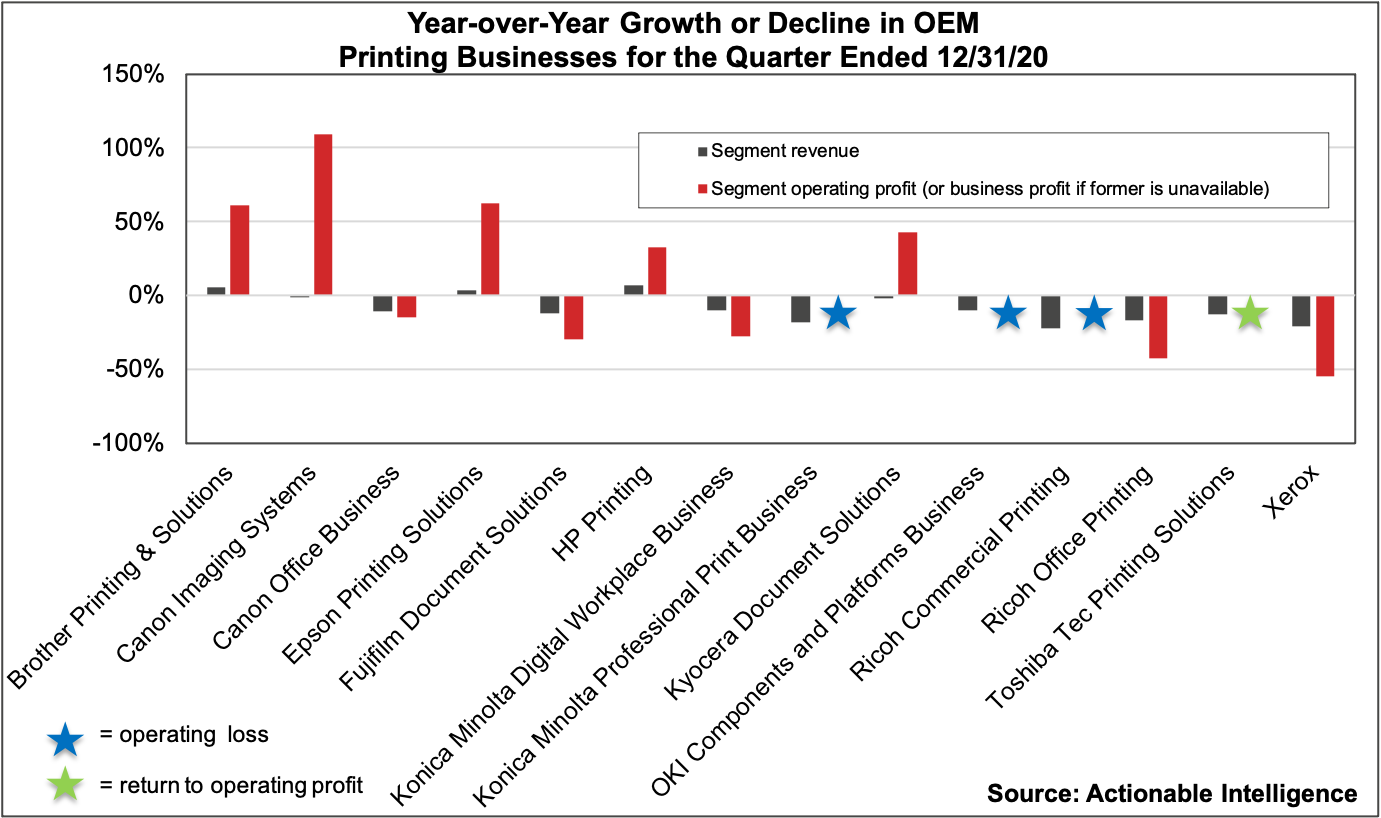

Profits are improving in many OEMs’ printing businesses as well. This quarter, six printing segments saw year-over-year growth. Five printing segments saw year-over-year profit declines, and three continued to report operating losses. In comparison, in the quarter ended September 30, 2020, ten segments reported year-over-year declines in profits, three segments reported operating losses, and another three saw operating profit growth. In the quarter ended June 30, 2020, seven segments reported operating losses, eight posted steep year-over-year profit declines, and just one company reported profit growth in a printing segment.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, OKI, Ricoh, Sharp, Toshiba Tec, and Xerox. However, Sharp is not announcing results until later this month due to accounting issues. We decided not to wait for Sharp to announce to write this post; Sharp’s financial reports say little about its MFP business anyway. We are also not including results for Ninestar this quarter. Ninestar does not report results for the fourth quarter, ended December 31, until April.

For all the Japanese OEMs, except Canon, the period from October 1 through December 31, 2020, was the third quarter of the fiscal year ending March 31, 2021. For Canon and U.S.-based Xerox, this period was the fourth quarter of fiscal 2020. HP is on a different financial calendar than all the other OEMs. Its first quarter of fiscal 2021 ran from November 1, 2020, through January 31, 2021.

As noted above, overall conditions are improving, but OEMs with SOHO businesses are recovering faster. In the previous two quarters, not a single OEM reported both revenue and profit growth in their printing businesses. This quarter, three did: Brother Printing and Solutions, Epson Printing Solutions, and HP Printing.

Three businesses had mixed results. Canon Imaging Systems, Kyocera Document Solutions, and Toshiba Tec Printing Solutions all saw revenue decline but profits grow year-over-year. (Toshiba Tec’s percentage growth can’t be shown on the chart because it represents growth from a negative a year ago.)

All other printing segments saw both revenue and profits shrink, but the year-over-year declines were mostly smaller than in the previous quarter.

We have boiled down the performance of the various OEMs we track to a paragraph, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: Brother delivered one of the stronger performances for the quarter ended in December due largely to the strength of its Printing and Solutions segment. In Q3 2020, Printing and Solutions revenue rose 5.1 percent year-over-year—the segment’s first revenue growth of the year—and segment operating profits was up a robust 60.8 percent. The segment’s revenue and profit growth were due largely to increased demand for SOHO laser printers and consumables. Laser hardware revenue was up 18 percent in Q3, although laser consumables revenue was flat as declines in demand from the SMB category offset growth in sales of SOHO laser consumables. Brother’s inkjet hardware revenue in Q3 fell 12 percent year-over-year, due largely to continuing product shortages for inkjet hardware, but inkjet consumables revenue was up 9 percent as the firm began to recover from the severe inkjet cartridge shortages it saw earlier in the pandemic.

- Canon: In Q4 2020, Canon saw continued sequential improvements. Canon’s Office segment has been hit hard by the pandemic, and while it posted sequential improvements, results were still down year-over-year: Office revenue was 10.7 percent lower in Q4 2020 than in the year-ago period, and Office operating profit was down 15.0 percent. This segment has been hurt by shrinking sales of both MFDs and laser printers. Net sales of MFD hardware in Q4 were down 11 percent, while non-hardware sales fell by 18 percent. In Q4, laser printer hardware sales decreased 15 percent and laser non-hardware sales were down 6 percent. The picture is different for the Imaging System segment where revenue was down a modest 1.6 percent, but profit was up a robust 108.7 percent. This is largely due to the strength of the firm’s inkjet business amid the pandemic. Canon said its inkjet hardware sales in Q4 increased 16 percent, and inkjet non-hardware sales were up a more modest 1 percent.

- Epson: Like other OEMs, Epson has seen improvements over the course of FY 2020, enabling it to post a very modest revenue decline and big profit increases for the quarter. In Q3 2020, Epson’s mainstay Printing Solutions business reported 3.2 percent year-over-year revenue growth and a 62.0 percent increase in segment profits. Epson’s inkjet business is doing well, but it has been plagued by products shortages. While demand and sales of high-capacity ink tank printers were up, the firm said demand outstripped supply. The firm also had product shortages for ink cartridge printers, so unit shipments were down, but revenue was up due to higher selling prices and an improved model mix. The firm said its ink revenue in the quarter was up 5 percent due largely to higher prices.

- Fujifilm: Fujifilm had a mixed Q3 2020, with revenue down modestly but operating profit improved year-over-year. And like virtually all OEMs, Fujifilm saw continued sequential improvements on a company-wide basis. But the firm’s Document Solutions segment continues to struggle. In Q3, Document Solutions revenue shrank 11.9 percent year-over-year and was also down sequentially. Segment profit was down 30.0 percent year-over-year but did improve compared to Q2. Revenue from office products and printers decreased 12.4 percent. Fujifilm said in the office products business, MFP unit sales increased year-over-year in Japan, China, and the Asia-Pacific region; however, office printer sales volumes decreased year-over-year.

- HP: HP announced it had a good start to FY 2021 and posted both revenue growth and a big upturn in profits for the company as a whole. In the firm’s Printing segment, revenue increased 6.8 percent year-over-year, and segment profit was up 32.4 percent. Like others, HP also saw sequential improvements from the previous quarter. HP’s Printing segment growth was driven largely by consumer hardware revenue, which was up a startling 55.0 percent. Commercial hardware revenue, however, was down 11.1 percent. And for the first time since Q4 2018, HP was able to post supplies revenue growth. The firm’s supplies revenue was up 3.5 percent, with much of the growth due to replenishing channel inventory, which ran low due to products shortages in the prior quarters.

- Konica Minolta: Konica Minolta saw sequential improvements in its revenue and profits in the quarter ended in December, but company-wide revenue and profits are still down significantly year-over-year. The same holds true for the firm’s Digital Workplace Business: segment revenue was down 10.4 percent year-over-year, while segment profit shrank 27.5 percent. However, revenue was up sequentially, and segment profit improved significantly compared to Q2 2020. The firm said worldwide A3 MFP units were down about 6 percent in Q3, with the decline was steeper for color units (-8 percent) than monochrome (-2 percent). Konica Minolta said that office non-hardware sales improved to 86 percent of last year’s levels in Q3.

- Kyocera: Kyocera’s Q3 2020 was mixed; revenue was up modestly year-over-year, while profits were down sharply. Still, like others, the firm saw big sequential improvements as the business impact of COVID-19 began to ease. In Document Solutions, the group reported a revenue decline of 1.9 percent in Q3, which is, by far, the most modest decrease all year. What’s more, Q3 segment profit actually grew 42.9 percent year-over-year. The firm said demand for printers, MFPs, and consumables is beginning to recover as restrictions on office attendance eased.

- OKI: OKI’s Q3 was tough despite sequential improvements. Company revenue shrank nearly 15 percent year-over-year, and the company continued to post operating and net losses. The situation was much the same in the Components and Platforms business, which saw revenue shrink 9.9 percent and which posted an operating loss of ¥0.5 billion. OKI said it saw some improvement in its printers business, but the improvement was limited. The firm is restructuring so as to move away from printers. As of March 31, 2021, OKI is discontinuing distribution of OKI-branded printer hardware in North, Central, and South America (see “OKI Data Americas Shares Additional Details on Its Market Exit”).

- Ricoh: Vendors like Ricoh that focus mainly on A3 MFPs and commercial/production printing equipment were the OEMs hit hardest by COVID-19. That remained true in the firm’s Q3, although Ricoh is seeing continued improvements from the lows set in the quarter ended in June. Still, Ricoh’s revenue was down 13.6 percent and its operating profit declined 95.8 percent year-over-year in Q3. In the firm’s Office Printing segment, Q3 revenue was 17.3 percent lower than in the year-ago period, and operating profit fell 43.0 percent. MFP hardware sales fell 14 percent and laser printer hardware sales declined 33 percent. In Q3, non-hardware sales decreased by 18 percent on a 21 percent decline in MFP non-hardware sales and a 5 percent downturn in laser printer non-hardware sales.

- Toshiba Tec: In its Q3, Toshiba Tec’s revenue shrank both year-over-year and sequentially, but its profits improved by both measures. In the Printing Solutions segment, revenue improved sequentially but was still down 12.7 percent year-over-year. And while in both the previous quarter and the year-ago period, the Printing Solutions segment had operating losses, the group managed to turn a profit in Q3 2020. The company characterized the business environment as “difficult,” saying that price competition with competitors continues to intensify due to the impact of COVID-19. Sales of MFPs declined in overseas markets such as the Americas, Europe, and Asia.

- Xerox: Similar to what we saw in its Q3, Xerox posted sequential improvements in revenue and profits in Q4, although results remain down sharply year-over-year. The firm’s Q4 revenue was 21.0 percent lower than it was one year ago. Equipment sales were down 17.2 percent, and post-sale revenue shrank 22.3 percent. Xerox’s operating profit declined 55.2 percent year-over-year. Equipment revenue fell in every segment: midrange revenue saw the steepest year-over-year decline of 20.3 percent, followed by high-end revenue, which fell 17.3 percent. Low-end equipment revenue was down 6.3 percent. Black-and-white A4 MFP installs rose 28 percent due to strong demand for lower-end black-and-white printers and MFPs as a result of work-from-home trends; however, Xerox noted it saw some supply constraints for these products.

Forecast Revisions

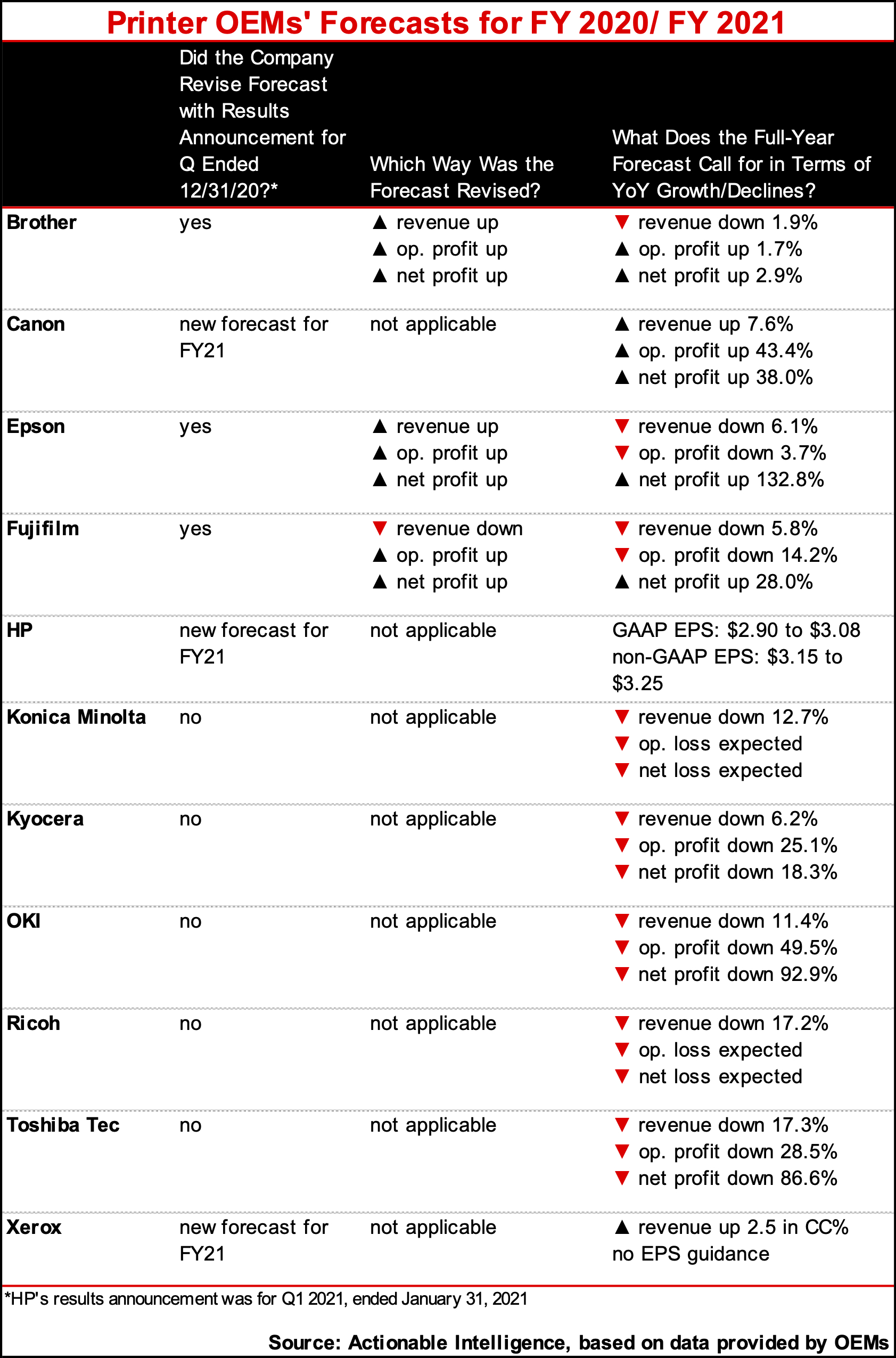

With this quarter’s results announcement, two OEMs—Canon and Xerox—closed the books on FY 2020 and announced new guidance for FY 2021. Canon expects to see rebounds as recovery continues. Xerox was more cautious, saying it projected revenue growth, but the firm declined to provide earnings guidance. HP is one quarter into its FY 2021, but it provided its first full-year guidance following its strong Q1 report.

Five OEMs that will wrap up their fiscal year in March left their full-year forecast unchanged. Those companies include Konica Minolta, Kyocera, OKI, Ricoh, and Toshiba Tec. All expect to post significant year-over-year declines due to the negative impact of COVID-19.

Two OEMs, Brother and Epson, actually raised their revenue and profit guidance for the year. Brother now expects to report a modest decrease in revenue for the year but improved profits. Epson expects revenue and operating profit to decline but net profit to surge. Tellingly, both OEMs that lifted their outlook have strong SOHO businesses.

One vendor, Fujifilm, adjusted its revenue guidance down but its profit guidance up. It expects that FY 2020 will result in revenue and operating profit declines but that net profit will hit a record high as a result of the firm making Fuji Xerox a wholly owned subsidiary.

Want to see more about how OEMs performed against their peers in the quarter ended December 31, 2020? We have published a detailed subscriber-only Actionable Briefing on OEMs’ financial performance: “The Printer and MFP Industry Continues to Recover as Work-from-Home Drives Growth for Some.” For information on subscribing to Actionable Intelligence, see our Membership Options page.