In April and May, original equipment manufacturers (OEMs) of printers and MFPs announced their financial results for the three-month period ended March 31, 2023. For most Japanese OEMs including Brother, Epson, Fujifilm, Konica Minolta, Kyocera, Ricoh, Sharp, and Toshiba Tec, the three-month period was the fourth quarter of fiscal 2022 (although Kyocera terms it fiscal 2023). For Canon, Xerox, and Ninestar, this period was the first quarter of fiscal 2023. HP is on a different financial calendar than all the other OEMs. Its second quarter of fiscal 2023 ran from February 1, 2023, through April 30, 2023. Readers interested in a detailed analysis of OEMs’ results for all of fiscal 2022, should read “A Comparison of Printer OEM Financial Results for FY 2022.” Here, we focus just on the latest three months of results for these companies.

In general, the most recent quarter marked a continuation of trends we noted in previous quarters. OEMs focusing on A3 MFPs tended to perform the best as they recovered from severe products shortages seen a year ago and sold more A3 devices, clearing order backlogs. In addition, as workers return to the office, office printing and thus office consumables volumes improved year-over-year, although they remain depressed from pre-pandemic levels. OEMs with desktop inkjet businesses tended to fare worse, especially in terms of profits, as demand for home printing waned and sales of consumables for these devices shrank. Moreover, as we have been seeing for several quarters now, Japanese OEMs are benefiting from yen depreciation, while U.S. companies saw sales hurt by a strong dollar. Ninestar also felt its results negatively impacted by the yuan renminbi’s appreciation against the dollar and the euro.

Not long after Japanese OEMs closed the books on FY 2022, news broke of a potentially industry-shaking new partnership. Ricoh and Toshiba Tec will merge their hardware and supplies development, design, and production divisions into a new company called Ricoh Technologies Company, Ltd. (see “Ricoh and Toshiba Tec Confirm Business Partnership to Manufacture MFPs”). The new joint venture will be 85 percent owned by Ricoh and 15 percent owned by Toshiba Tec. While operating profit margins at Ricoh and Toshiba Tec have improved, they remain slim, and this joint venture is expected to allow both companies to reduce costs. Together, the combined entities’ A3 market share will be the highest worldwide, ahead of Canon.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, Ricoh, Sharp, Toshiba Tec, and Xerox. Here, we look specifically at the performance of OEMs’ business segments that include home and office printer hardware, supplies, and related software and services, for the latest three-month period.

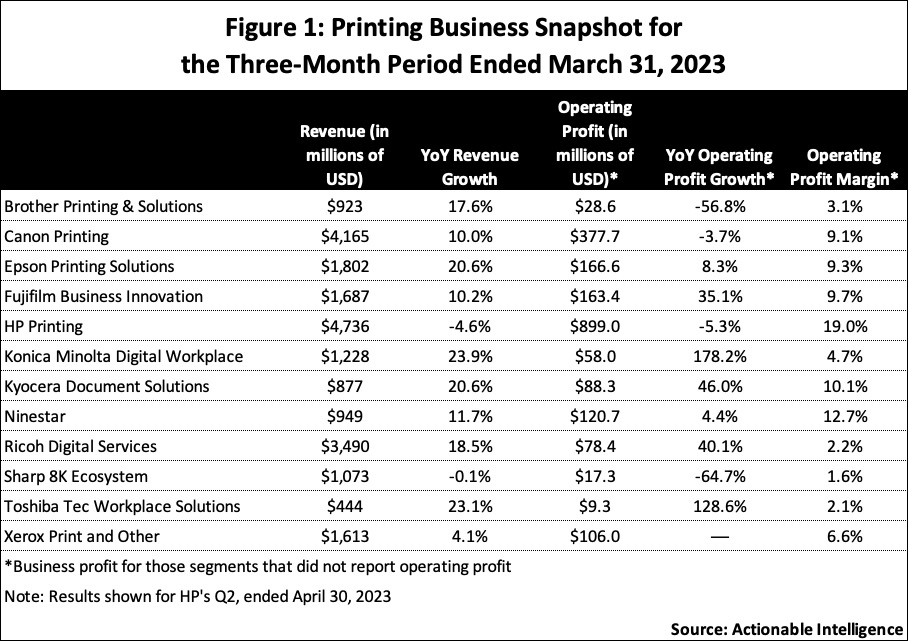

Figure 1 presents a snapshot of the financial performance of OEMs’ printing businesses for their most recent quarter.

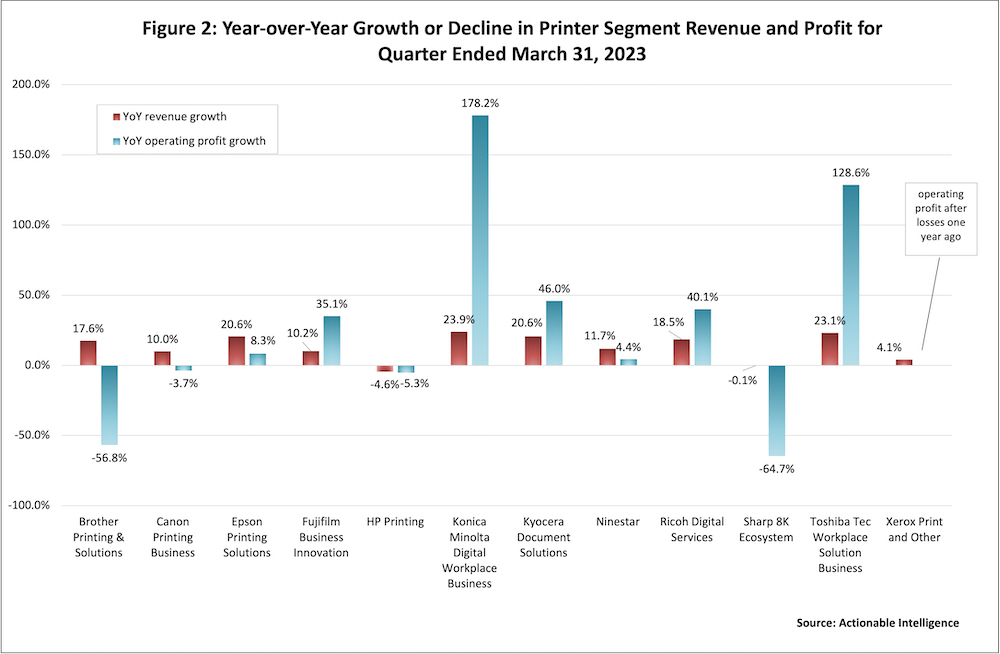

Figure 2 shows how OEMs’ printing businesses fared in terms of year-over-year revenue and profit growth or declines in their most recent quarter. In both the quarter ended in December 2022 and the quarter ended in September 2022, six OEMs saw revenue and profit growth in their printing businesses (see “OEM Financials for Quarter Ended December 2022 Show Revenue Shakeup” and “OEMs Post Mixed Results as Demand for A4 Supplies Drops”). This quarter, eight did: Epson Printing Solutions, Fujifilm Business Innovation, Konica Minolta Digital Workplace, Kyocera Document Solutions, Ninestar (essentially all of Ninestar is a printing business), Ricoh Digital Services, Toshiba Tec Workplace Solutions, and Xerox Print and Other. Like in the previous two quarters, A3 MFP vendors tended to see the biggest year-over-year improvements, but then again they saw tougher conditions as year ago as well. Both Brother Printing and Solutions and Canon’s Printing Business reported revenue growth but operating profit declines, although the downturn in profit was much sharper in Brother’s business than in Canon’s. Similar to last quarter, HP Printing saw both revenue and operating profit decline, but unlike last quarter this time it was joined by Sharp’s 8K Ecosystem segment, although it appears much of the declines at Sharp were due to the TV business.

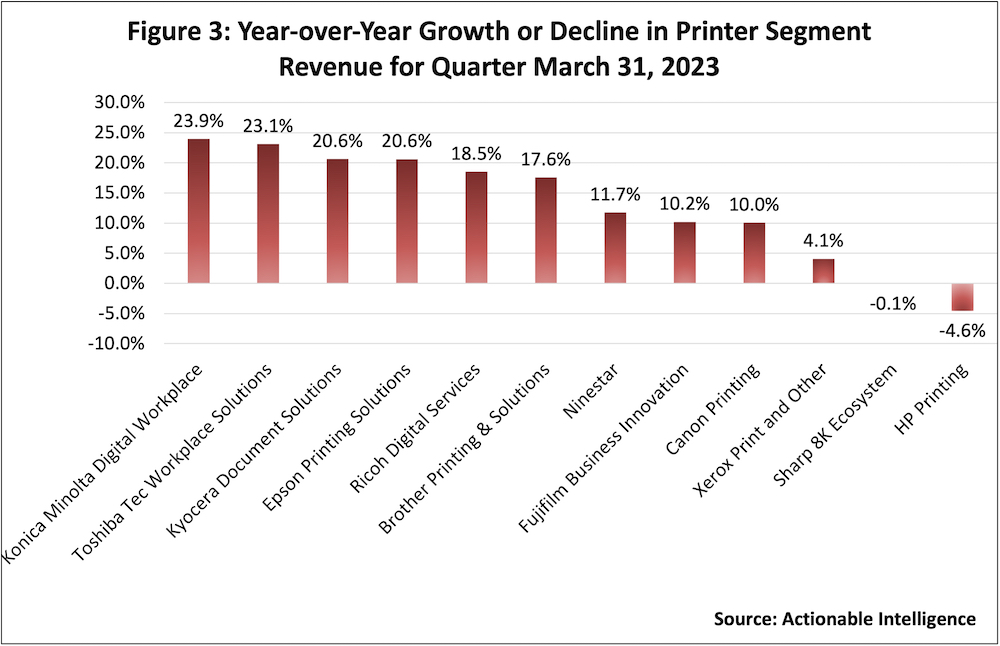

Figures 3 and 4 show these same numbers separately. Figure 3 shows year-over-year revenue growth or decline for the quarter. Just like last quarter, Konica Minolta Digital Workplace and Toshiba Tec Workplace Solutions saw the most robust year-over-year improvement. Something that also grabbed our attention is that Canon Printing Solutions’ year-over-year revenue growth in its most recent quarter was only half what it was in the prior quarter. Similar to last quarter, most OEMs saw double-digit revenue growth. It is no surprise that two of the firms that didn’t—Xerox and HP, the latter one of two firms that saw a contraction—are based in the United States where currency was more of a headwind. Still, there were other reasons for these firms seeing their printing revenue decline.

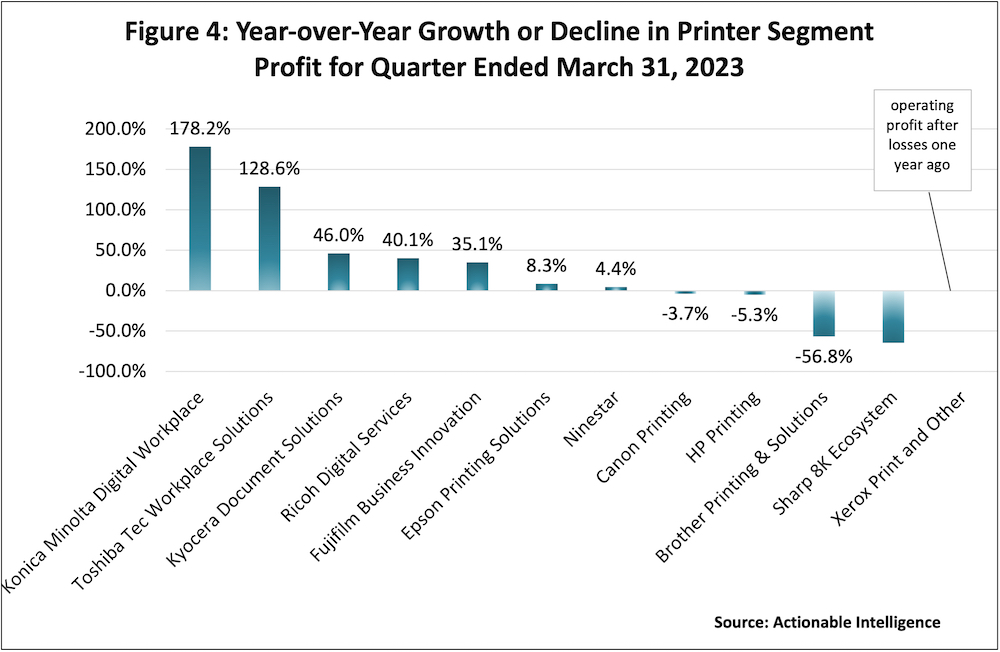

Figure 4 shows the year-over-year percentage change in segment operating profit. More companies saw printing segment profit growth this quarter. Last quarter, five companies did. This quarter, eight did: Konica Minolta Digital Workplace (+178.2 percent), Toshiba Tec Workplace Solutions (+128.6 percent), Kyocera Document Solutions (+46.0 percent), Ricoh Digital Services (+40.1 percent), Fujifilm Business Innovation (+35.1 percent), Epson Printing Solutions (+8.3 percent), and Ninestar (+4.4 percent). Xerox’s Print and Other saw significant operating profit improvement, but we can’t show year-over-year growth because it had a loss in the year-ago period. Again, those companies that saw stronger growth tended to be A3 MFP vendors recovering from last year’s shortages.

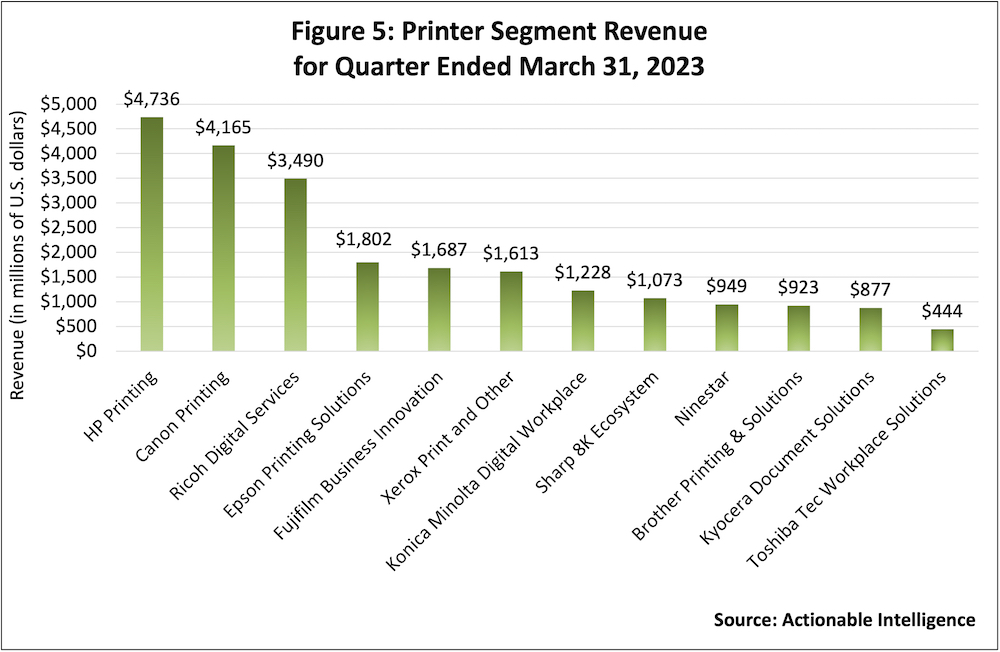

Figure 5 shows how much revenue in U.S. dollars each OEM’s printing business generated in the quarter ended March 31, 2023. Last quarter, for the first time that we can recall, Canon Printing held the top spot in terms of quarterly revenue, followed by HP Printing in the number-two spot (see “OEM Financials for Quarter Ended December 2022 Show Revenue Shakeup”). This quarter, the two companies resumed their normal positions with HP Printing at number one and Canon Printing at number two. Ricoh and Epson retained their third and fourth spots. Fujifilm slipped ahead of Xerox this quarter to the number-five spot. Brother Printing and Solutions, Kyocera Document Solutions, and Toshiba Tec Workplace Solutions remain the three smallest vendors in terms of printing business revenue.

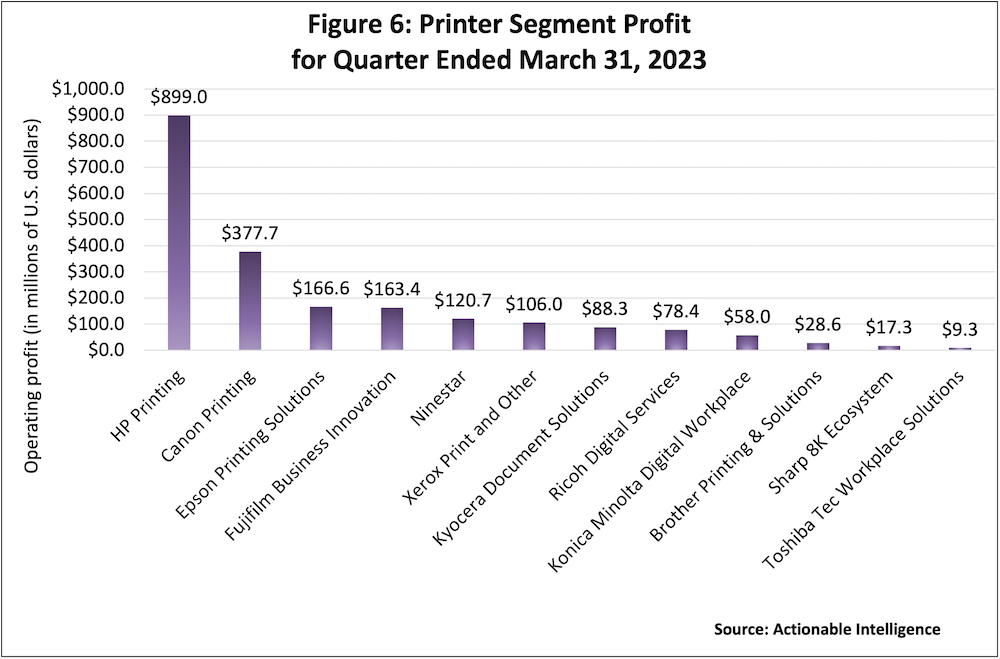

Figure 6 shows the OEMs’ printer segment profits in U.S. dollars. HP Printing was the leader in this regard, followed by Canon Printing and Epson Printing Solutions. These are the customary spots for these firms. Fujifilm and Xerox have traded spots in recent quarters. Last quarter, Xerox Print and Other led Fujifilm Business Innovation in terms of profit, and this quarter Fujifilm led Xerox in this regard.

Both Figure 5 and 6 always serve as good reminders that strong year-over-year growth doesn’t necessarily translate into the most revenue and profits in terms of dollars. HP Printing’s year-over-year declines weren’t significant enough to shake its position as the top vendor in terms of revenue and profits. Conversely, the big year-over-year gains in revenue and profit this quarter for Toshiba Tec Workplace Solutions weren’t enough to change its position as one of the smaller vendors in terms of both revenue and profits.

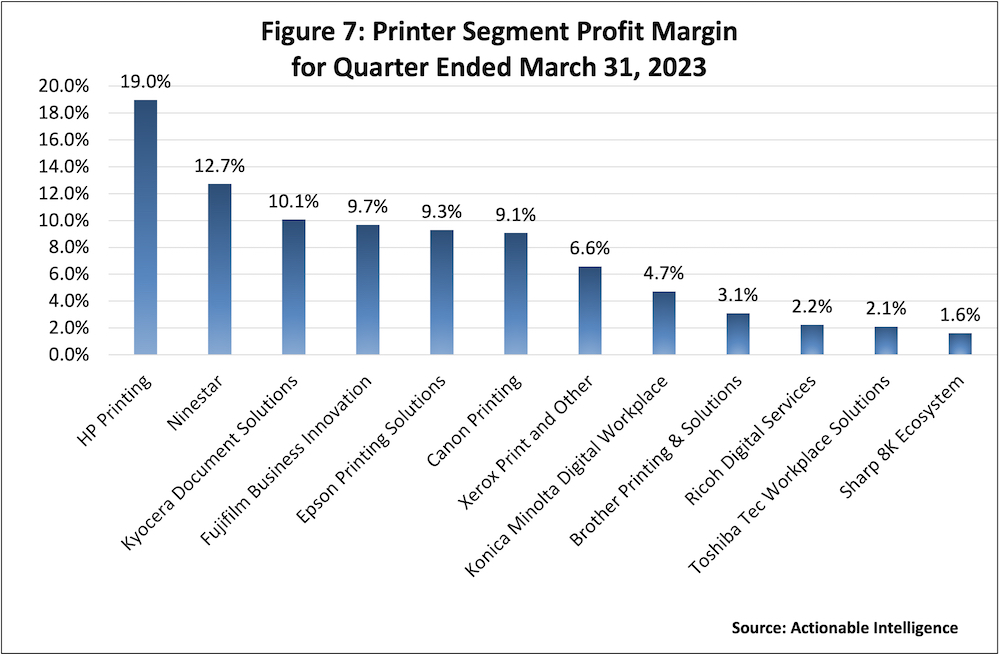

Figure 7 shows the operating profit margin in OEMs’ printing businesses. Margins tended to be higher this quarter than they were last quarter. HP Printing remains the top vendor in this regard with an enviable 19.0 percent operating profit margin. However, from there we saw some changes. Last quarter, Epson Printing Solutions was ranked second with an 11.0 percent margin. This quarter, Ninestar with its 12.7 percent margin was second, followed by Kyocera Document Solutions with a 10.1 percent margin and Fujifilm Business Innovation with a 9.7 percent margin Epson Printing Solutions and its 9.3 percent margin was ranked fifth. This quarter, Canon Printing Solutions was ranked sixth with a 9.1 percent margin. Last quarter, it was ranked fourth. The three business with the smallest operating profit margins this quarter were Ricoh Digital Services (2.2 percent), Toshiba Tec Workplace Solutions (2.1 percent), and Sharp 8K Ecosystem (1.5 percent).

Below we have summarized the performance of the various OEMs we track, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: In Q4 2022, Brother reported total revenue growth, but the firm reported operating and net losses because it took impairment losses on goodwill in its Domino business. As has been the case for 10 straight quarters now, revenue grew in Brother’s Printing and Solutions segment, climbing 17.6 percent year-over-year. However, Printing and Solutions operating profit tumbled 56.8 percent. The firm said that in Q4 laser hardware sales grew 36 percent year-over-year and inkjet hardware sales were up 39 percent. Revenue from toner cartridge sales grew 4 percent during the quarter while ink cartridge revenue grew 13 percent; however, much of this was due to favorable currency exchange—in local currency laser consumable sales were down 6 percent and inkjet consumables sale were up a more modest 4 percent. The lackluster laser consumables sales were a factor in the Printing and Solutions group’s shrinking profits.

- Canon: Canon revealed it was off to a strong start for the year with net sales, operating profit, and net income all growing by double digits in Q1 2023. However, performance in the Printing business was mixed. While net sales in this segment grew 10.0 percent year-over-year due largely to higher sales of office MFDs, segment profit declined 3.7 percent due to weakness in printer consumables sales. The Office subsegment delivered robust net sales growth of 20.2 percent. Canon’s net sales from office MFD hardware rose 39 percent on a 28 percent increase in units due to a significant recovery in product supply after last year’s shortages. Moreover, office MFD non-hardware net sales also rose 12 percent. The underperformer in Canon’s Printing Business in Q1 2023 was the Prosumer subsegment, which saw net sales decrease a modest 0.8 percent. Net sales of laser printers actually grew 0.6 percent due to 15 percent growth in laser hardware net sales. Laser printer units, however, tumbled 24 percent. Canon explained that it saw lower sales of low-priced laser printers, but laser hardware net sales grew due to a combination of favorable currency exchange and a better product mix. Laser non-hardware sales fell 7 percent due to lower sales of consumables. Inkjet printer revenue declined by 3.2 percent as work-from-home demand subsided. Inkjet hardware net sales fell 9 percent as units declined 18 percent, and inkjet non-hardware sales increased 2 percent, although Canon indicated the non-hardware inkjet sales growth was due to favorable currency exchange and that sales declined in constant currency.

- Epson: Epson’s Q4 2022 results were mixed: revenue and business profit rose, but operating profit and net profit fell as the firm struggled with higher costs and took an impairment loss in its manufacturing solutions business. The performance of the Printing Solutions segment, however, was strong in Q4. Segment revenue grew 20.6 percent year-over-year, marking the tenth straight quarter of revenue growth in this business. In excellent news, Printing Solutions business profit improved 8.3 percent, marking the first quarter of year-over-year growth for this business of the year. In the Office and Home Printing subsegment, revenue increased 17.2 percent year-over-year in Q4; however, profit in this business slid 35.5 percent. Shrinking profits in this group stemmed from the strong dollar, higher costs for materials and logistics, and declines in sales of certain consumables. SOHO and home inkjet printer revenue rose 14.5 percent on a 10 percent increase in inkjet printer unit sales. Ink revenue grew 6 percent, but was down 2 percent in local currency, reflecting lower home printing demand. Shared office inkjet printer revenue grew 51.4 percent in Q4.

- Fujifilm: Fujifilm had an excellent Q4 2022 and set record highs for revenue, operating income, and net income for the quarter. In the Business Innovation group, revenue increased 10.2 percent compared to Q4 2021, while operating income grew an impressive 35.1 percent. Office solutions revenue increased 10.9 percent year-over-year due to higher sales of multifunction devices, printers, and consumables in Japan; larger exports to the U.S. and Europe (Fujifilm provides Xerox with hardware and supplies); higher sales of multifunction devices in Southeast Asia; and the impact of exchange rates.

- HP: In Q2 2023, HP’s revenue and operating profit declined sharply but net profit improved. Revenue shrank in both of HP’s business segments, but the revenue decline in Personal Systems was a particularly big drop of 29.1 percent. In the Printing segment, revenue decreased 4.6 percent year-over-year. Printing operating profit also declined, falling 5.3 percent, but the group’s operating profit margin ticked downward just 10 basis points to 19.0 percent. HP’s consumer hardware revenue declined 18.9 percent on a 5 percent decline in units. The revenue decline was higher than the unit shipment decline because average selling prices (ASPs) were lower as HP cut prices on consumer hardware in multiple geographies to remain competitive. In contrast with consumer hardware, commercial hardware revenue improved 4.5 percent on flat unit shipments due to a favorable products mix in the office. HP’s supplies revenue contracted 4.0 percent, which was actually better than HP had expected due to higher demand in the office for supplies, pricing actions HP took last year, and improved market share versus third parties. Nevertheless, supplies revenue declined because HP continues to see lower home printer usage.

- Konica Minolta: Konica Minolta’s Q4 2022 was a study in contrasts. Company revenue grew, but the firm reported enormous operating and net losses because it took impairment charges in the precision medicine business and the MOBOTIX business in the Industry segment. However, the Digital Workplace segment actually performed quite well in Q4. Segment revenue grew 23.9 percent year-over-year, and Digital Workplace profits rose an astounding 178.2 percent. In the segment we are most interested in, the Office, revenue grew 24.5 percent year-over-year in Q4 2022. The company attributed its improved performance in the Digital Workplace business to it boosting production capacity, improving sales volumes of A3 MFPs, and decreasing its backorders stemming from prior shortages. Non-hardware sales improved year-over-year as the firm recovered from last year’s toner shortages, but non-hardware revenue remains down compared to pre-pandemic levels. In Q4 2022, non-hardware sales were 87 percent of what they were in Q4 2019.

- Kyocera: In its final quarter of the year, Kyocera reported top-line growth but shrinking operating and net profit. The shrinking profits were due to higher costs and trouble and charges in some of the firm’s other businesses because the Document Solutions group performed quite well. In the final quarter of the year, Document Solutions revenue increased 20.6 percent and group profit improved 46.0 percent. As usual, however, the firm did not offer much commentary on the business, other that citing improved sales of products and the weak yen.

- Ninestar: In Q1 2023, Ninestar’s revenue increased 11.7 and operating profit improved 4.4 percent; however, the firm’s net profit declined 52.0 percent. The company reported Lexmark’s revenue increased 6.8 percent in Q1, but Lexmark’s printer sales sank 16.9 percent as a 40 percent increase in Lexmark-brand printer sales was offset by a slowdown in the OEM business. Pantum saw revenue grow 30 percent in Q1 and unit sales of Pantum printer rose 36.9 percent, but shipments of Pantum consumables declined 24 percent. Revenue in the third-party consumables business grew 3.1 percent, but net profit in the group plummeted 44.5 percent, with Ninestar saying little about the reason for the precipitous decline.

- Ricoh: Ricoh ended FY 2022 on a very positive note with revenue up by double digits and operating and net profit up by triple digits. In Q4 2022, the Digital Service segment reported net sales growth of 18.5 percent and a 40.1 increase in operating profit. That said, operating profit in margin in the Digital Service segment remains slim at just 2.2 percent for the quarter. Ricoh said it saw improved product supply and logistics, enabling it to reduce its order backlog in the former Office Printing business. In Q4, the firm saw unit sales grow 43 percent year-over-year for all MFPs, with unit sales up 103 percent for A4 devices and up 24 percent for A3 MFPs. Ricoh said, however, that the recovery in non-hardware sales is slower than expected.

- Sharp: Q4 2022 was a very tough quarter for Sharp as company net sales fell and the firm took some hefty changes in its Display Device business, leading to steep operating and net profit losses. In the 8K Ecosystem segment, revenue was roughly flat (down 0.1 percent), but operating profit tumbled 64.7 percent and the group’s margin shrank to an anemic 1.6 percent. The net sales decline in the 8K Ecosystem business, however, was due largely to slumping TV sales in China, Europe, and Asia because the firm said net sales of business solutions including MFPs grew. The firm added that the TV business was also largely responsible for the group’s shrinking profits. Starting in FY 2023, Sharp is changing its reporting structure. MFPs will be part of the firm’s Smart Office Business, which is also responsible for PCs and other office products.

- Toshiba Tec: Toshiba Tec reported double-digit increase in companywide net sales and operating profit in Q4 2022, but the firm reported a small net loss. Similar to last quarter, the Workplace Solutions segment performed better than the Retail Solutions segment. In Q4 2022, Workplace Solutions net sales improved 23.1 percent and segment operating profit improved 128.6 percent. Although operating profit margin in this segment improved, it remains slim at 2.1 percent. Toshiba Tec benefited from improved MFP sales overseas. While the firm said delivery bottlenecks remain, the firm was able to grow sales following the severe shortages it and many other vendor experienced last year. Segment profits also improved due to cost cutting.

- Xerox: The positive trends Xerox saw in the last quarter of FY 2022 continued in Q1 2023, and the company was able to post revenue, operating income, and net income growth for the quarter. It was a strong quarter for Xerox’s Print and Other segment, which saw revenue grow 4.1 percent and profit improve $126 million from last year’s loss of $20 million to $106 million in profits. For the company as a whole, equipment revenue improved 24.5 percent. Revenue in the entry-level segment was up a modest 1.6 percent despite a 3 percent decline in entry A4 MFP installs, which were down 1 percent for black-and-white units and down 9 percent for color. Midrange equipment sales grew 29.9 percent. Midrange installs were up 50 percent—growth was 160 percent for black-and-white units and 26 percent for color units. High-end equipment revenue grew 35.3 percent as installs increased 69 percent (installs were up 84 percent for color units but down 23 percent for black-and-white models). Xerox’s post-sale revenue declined 2.2 percent but grew 0.5 percent in constant currency due to “growth in consumables and contractual print and digital services, including the acquisition of Go Inspire.”

Forecast Changes

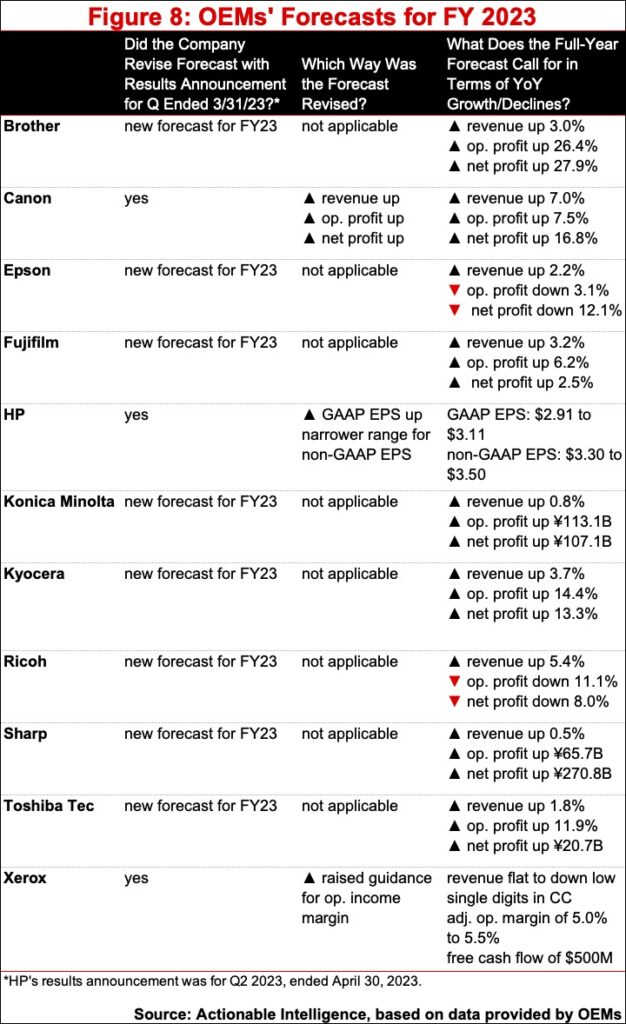

This quarter, we saw lots of new forecasts for FY 2023 as Japanese OEMs wrapped up FY 2022. Most of these firms are expecting growth in revenue and profits in the year ahead, aside from Epson and Ricoh, both of which expect to see their top lines grow but operating and net profit decline year-over-year. Interestingly, the three companies that are further into FY 2023—Canon, HP, and Xerox—all made upward adjustments to their full-year guidance.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.