In July and August, original equipment manufacturers (OEMs) of printers and MFPs announced their financial results for the three-month period ended June 30, 2022. If this quarter has a theme, it is the caveat. In examining companies’ financial results, “yes, buts” abound.

More OEMs were able to post revenue and profit growth in the quarter ended in June 2022 than in the past couple of quarters, but not all of them did. One major reason for certain Japanese OEMs’ year-over-year improvements was not organic growth but rather how much the yen has depreciated against other world currencies. In constant currency, many OEMs would have seen much lower growth rates or in some instances declines. In contrast, for the two U.S. printer/MFP makers, HP and Xerox, currency exchange was a headwind this quarter.

OEMs have put in place measures to deal with the ongoing chip shortages, production challenges, and transportation delays. As a result, OEMs saw some improved product availability. Still, backlogs remain enormous for many OEMs. Some OEMs like Konica Monta are using air freight more frequently to get product like toner to customers. And that has led to higher costs. But higher costs are everywhere.

In recent quarters, as costs for chips, other components, raw materials, and transportation have soared, we have seen lots of OEMs talk about taking pricing actions. That remains the case, and prices on hardware and supplies have risen—as have prices for just about everything else in this inflationary environment. The fact that OEMs have been able to hike prices and that customers have still been willing to pay them due to products being in short supply has been a major benefit to manufacturers in recent quarters, enabling them to help offset the impact of lower sales and rising costs on margins. But there were some signs this past quarter that we may have finally hit a point at which rising prices are leading to less demand, at least in the consumer market. HP, for example, said it is seeing inflation negatively impact consumer demand. It certainly seems that the strong consumer demand that fueled some OEMs’ small-office/home-office (SOHO) businesses last year has been losing steam.

Meanwhile, most OEMs said that office demand is improving but only gradually. It appears that workers’ return to the office has been slower than many had hoped. And there is a growing realization among manufacturers that print volumes in the office will simply never return to pre-COVID levels. Several OEMs focused on the A3 MFP business have discussed in recent quarters how they expect page volumes and/or non-hardware sales to recover to only about 80 to 85 percent of where they were before the pandemic. And given the ongoing focus among businesses on digital transformation initiatives that replace paper-based processes and workflows, the trend is not favorable for office printers, MFPs, and supplies over the longer term. OEMs, of course, want to provide customers with the services and solutions needed for digital transformation, but whether this will provide enough new business to offset declines in sales of hardware and supplies remains an ongoing question.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from April 1, 2022, through June 30, 2022, was the first quarter of the fiscal year ending March 31, 2023. For Canon, U.S.-based Xerox, and China-based Ninestar, this period was the second quarter of fiscal 2022. HP is on a different financial calendar than all the other OEMs. Its third quarter of fiscal 2022 ran from May 1, 2022, through July 31, 2022. Here, we look specifically at the performance of OEMs’ business segments that include home and office printer hardware, supplies, and related software and services.

Figure 1 presents a snapshot of the financial performance of OEMs’ printing businesses for their most recent quarter. Readers should bear in mind that while the segments shown are those that include OEMs’ home and office printing hardware and supplies businesses and related software and services, OEMs include other business lines in these segments, too. Most notably, Sharp includes its enormous TV business in its 8K Ecosystem Business. Meanwhile, because Ninestar is focused on home and office printing with the exception of a portion of its chip business, we show results for Ninestar as a whole.

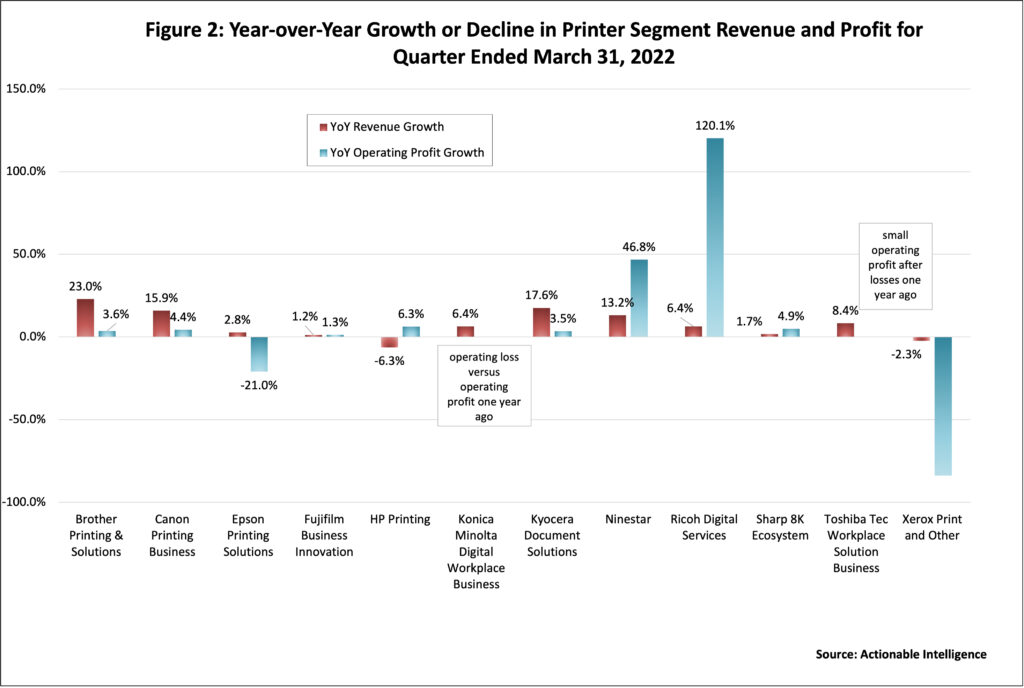

Figure 2 shows how OEMs’ printing businesses fared in terms of year-over-year revenue and profit growth in the quarter ended June 30, 2022. As noted above, more OEMs posted both revenue and profit growth in their printing business this quarter than they did in the prior two quarters. In the quarter ended December 31, 2021, only two OEMs’ printing businesses saw both revenue and profit growth: Sharp’s 8K Ecosystem Business and Toshiba Tec’s Workplace Solutions Business (see “OEMs Feel Pressure on Revenue and Profits as Supply-Chain Trouble Persists”). In the quarter ended March 31, 2022, four OEMs did: Brother’s Printing and Solutions Business, Ninestar, Sharp’s 8K Ecosystem Business, and Toshiba Tec’s Workplace Solutions Business (see “A Mixed Quarter for OEMs as Supply-Chain Woes and Shortages Take a Bite Out of Revenue and Profits”). In the quarter ended June 30, 2022, eight OEMs were able to boast of both revenue and profit growth including Brother Printing and Solutions, Canon Printing Business, Fujifilm Business Innovation, Kyocera Document Solutions, Ninestar, Ricoh Digital Services, Sharp 8K Ecosystem, and Toshiba Tec Workplace Solution Business. That’s a pretty significant improvement in the number of OEMs posting year-over-year growth this quarter.

Three OEMs—Epson, HP, and Konica Minolta—delivered mixed results. Epson Printing Solutions and Konica Minolta Digital Workplace Business each saw revenue grow but profits shrink, with Konica Minolta Digital Workplace Business reporting a big operating loss. HP Printing saw the opposite trend with revenue shrinking but operating profit growing. Only Xerox’s Print and Other Business saw both revenue and operating profit decline.

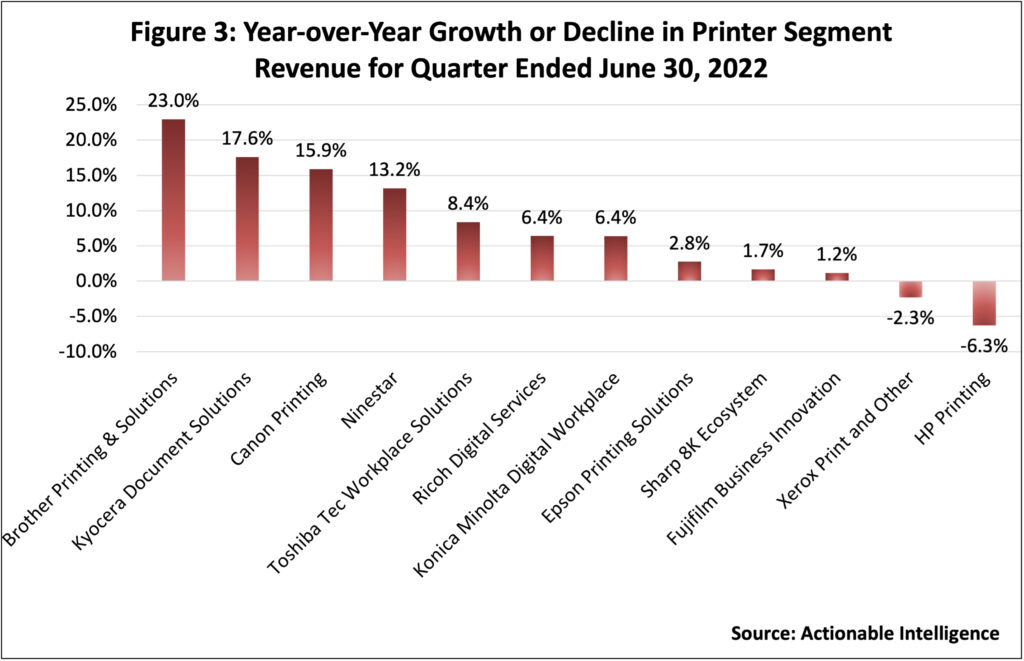

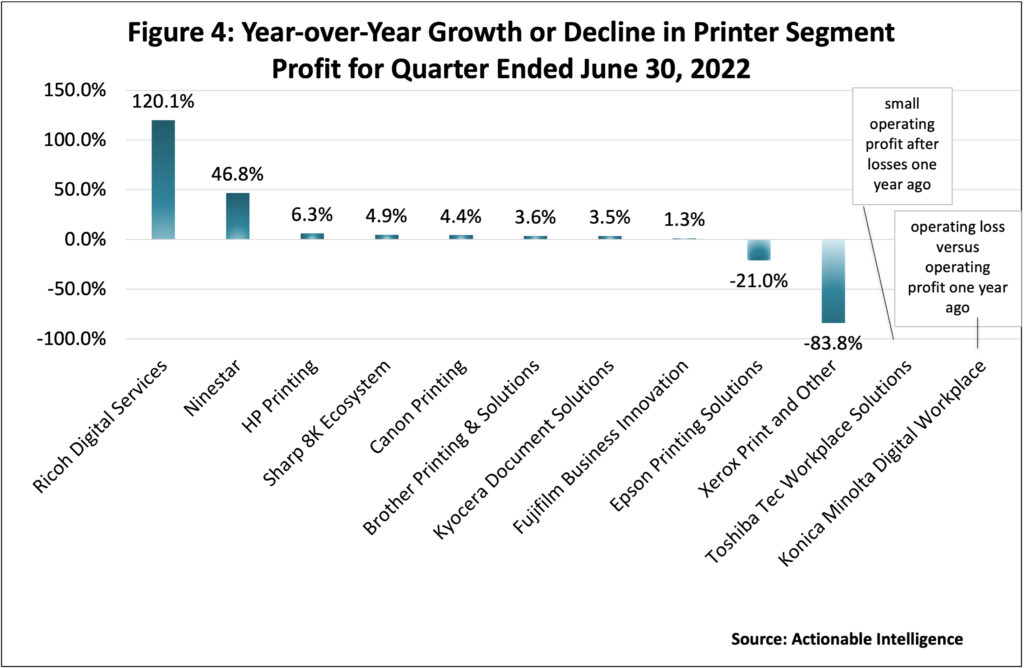

Figures 3 and 4 show these same numbers separately. Figure 3 shows year-over-year revenue growth or decline for the quarter from the OEM with the strongest growth (Brother Printing and Solutions) to the biggest decline (HP Printing). It is notable that three Japanese OEMs, Brother Printing and Solutions, Kyocera Document Solutions, and Canon Printing, saw double-digit year-over-year revenue growth, aided in part by yen depreciation. Ninestar of Zhuhai, China, saw double-digit year-over-year revenue growth as well. The two U.S. OEMs, Xerox and HP, both saw revenue declines in their printing segments, and both companies saw a negative impact from foreign currency exchange.

Figure 4 shows the year-over-year percentage change in segment operating profit, from best performers (Ricoh Digital Services and Ninestar) to those seeing the biggest percentage declines (Epson Printing Solutions and Xerox Print and Other). It is not possible to show percentage growth/decline for Toshiba Tec Workplace Solution Business or Konica Minolta Digital Workplace Business. In Toshiba’s case, the segment had a small profit but it had a loss in the year-ago period. In Konica Minolta’s case, it is because the segment had an operating loss in the most recent quarter and, in fact, was the only one of these segments with a loss. That means Konica Minolta Digital Workplace Business is actually the worst performer in terms of profits this quarter.

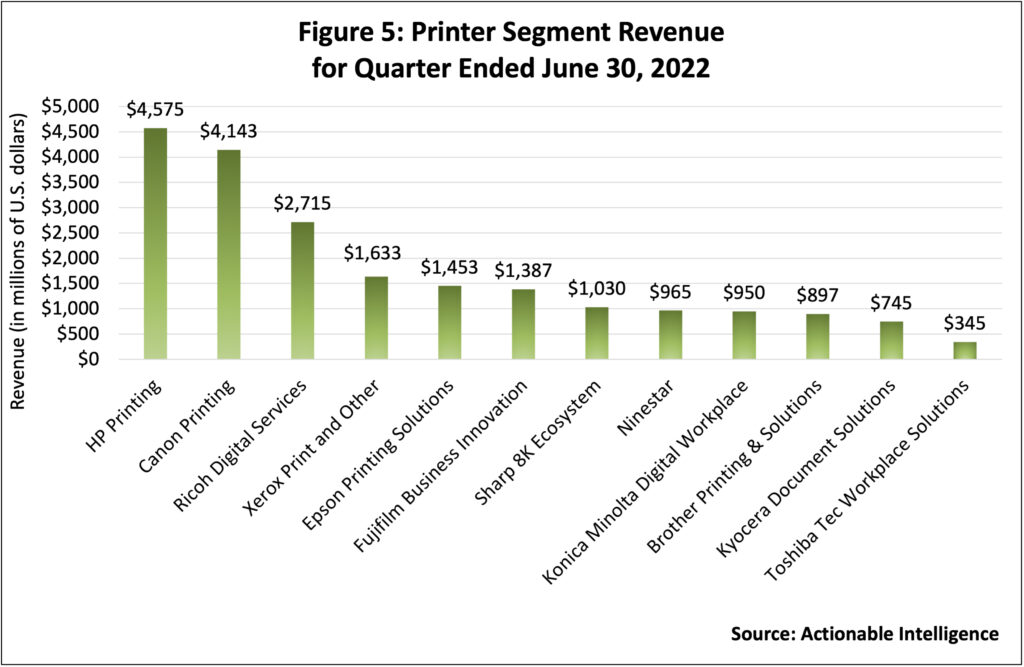

Figure 5 shows how much revenue in U.S. dollars each OEM’s printing business generated in the quarter ended on June 30, 2022. HP Printing and Canon Printing remain the biggest print-related businesses in terms of total revenue while Kyocera Document Solutions and Toshiba Tec Workplace Solutions remain the two smallest. While there has been some reshuffling in the middle of the pack, there are seasonal patterns at play here. One thing to note, however, is that Ninestar appears to be steadily moving up the ranks in terms of total revenue due to both organic growth but also to the fact that the firm closed on the acquisition of 100 percent of Pantum last year.

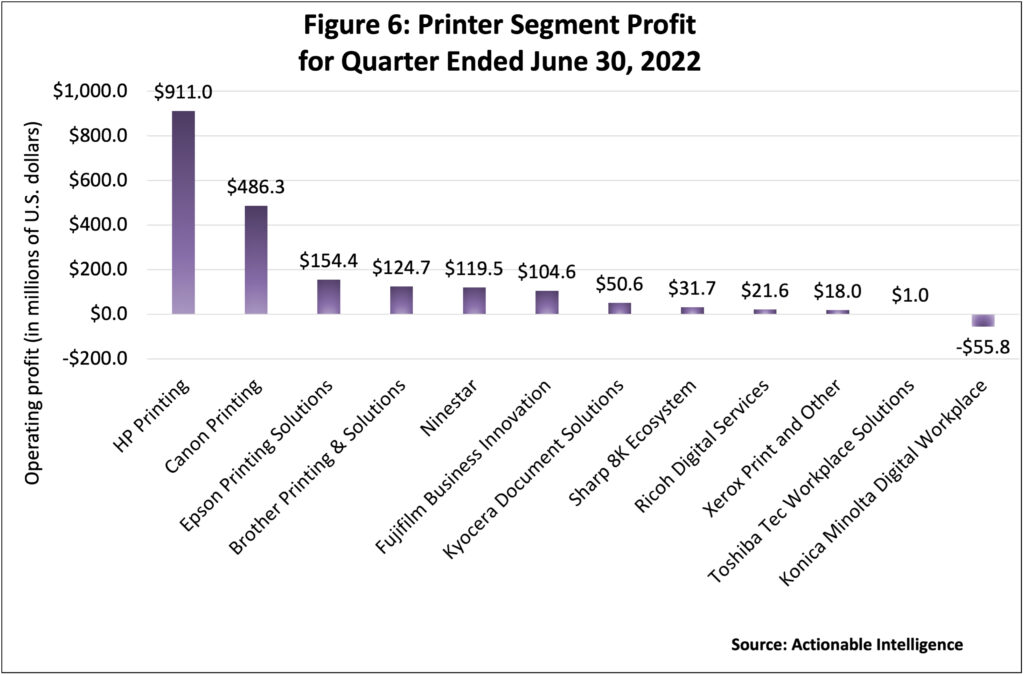

Figure 6, which shows the OEMs’ printer segment profits in U.S. dollars, is a good reminder that strong year-over-year growth rates don’t necessarily translate into lots of money. For example, in Figure 4 we saw that Ricoh Digital Service had the strongest growth rate for operating profit, but that translated into just $2.6 million in operating profit. Meanwhile, HP and Canon had much lower operating profit growth rates, but their operating profits dwarf those of rival vendors. Konica Minolta’s Digital Workplace Business was the worst performer in this area this past quarter with a $55.8 million operating loss.

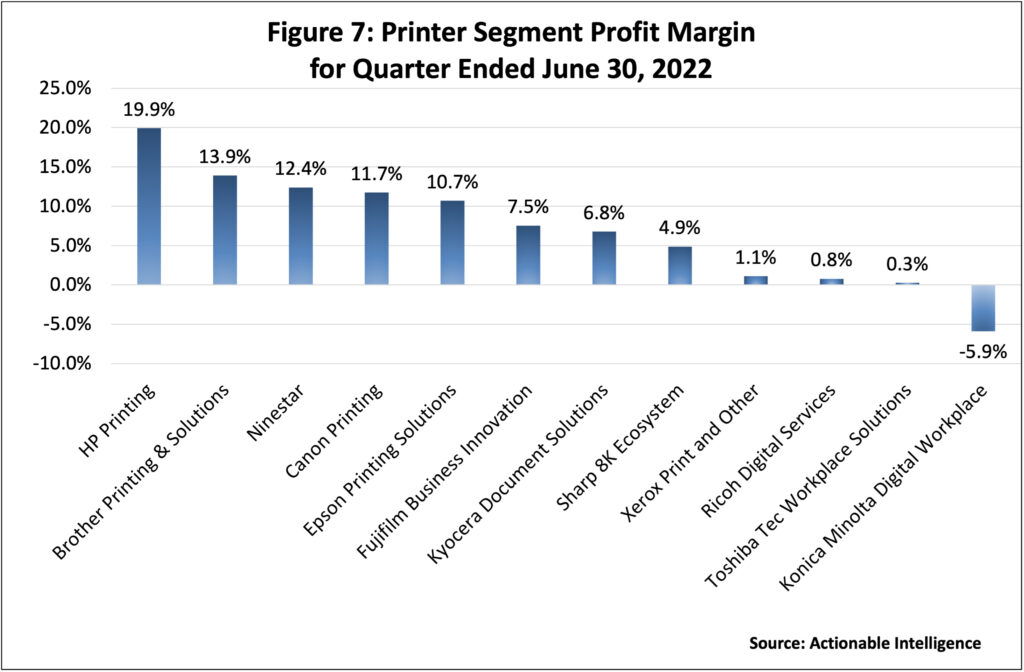

Figure 7 shows the operating profit margin in OEMs’ printing businesses. As is usually the case, HP’s Printing Business leads the pack with an enviable operating profit margin of nearly 20 percent. Rounding out the top five were Brother Printing and Solutions, Ninestar, Canon Printing, and Epson Printing Solutions, all with operating profit margins above 10 percent. Xerox Print and Other, Ricoh Digital Services, and Toshiba Tec Workplace Solutions all had minuscule operating profit margins of around 1 percent or less, while Konica Minolta’s Digital Workplace Business had a negative operating profit margin.

Below we have summarized the performance of the various OEMs we track, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: In Q1 2022, Brother’s revenue increased sharply as the firm benefited from strong sales in its Printing and Solutions segment and the yen’s depreciation. However, profits were down for the company due to soaring parts, materials, and logistics costs and an uptick in selling, general, and administrative (SG&A) costs. In the Printing and Solutions business, revenue increased a whopping 23.0 percent year-over-year. Printing and Solutions profits bucked the downward trend seen for the company as a whole, and the group’ operating profit grew 3.6 percent. Brother had good news about the persistent product shortages it has seen over the past couple of years for first inkjet devices in FY 2020 and then laser devices in FY 2021: supply constraints eased in Q1 2022. Laser hardware revenue increased 41 percent year-over-year on a 14 percent increase in laser hardware units. Laser consumables revenue was up 18 percent year-over-year. Inkjet printer hardware revenue grew 18 percent on an 8 percent increase in inkjet hardware units. Inkjet printer consumables revenue rose 19 percent. Commenting on the Printing and Solutions business’s improved profits, Brother said that strong consumables sales and pricing actions were enough to offset the impact of soaring material costs and an increase in SG&A expenses.

- Canon: Canon had a strong Q2 2022, reporting double-digit year-over-year growth in both revenue and operating profit, although the company’s quarterly net income declined. In Canon’s Printing business, net sales increased 15.9 percent in Q2 2022, while operating profit grew 4.4 percent. In the Office subsegment, net sales improved 11.2 percent as multifunction device (MFD) sales grew 8.6 percent. Net sales of office MFD hardware were up 10 percent, while non-hardware sales rose 7 percent. In the Prosumer subsegment, net sales increased a robust 17.7 percent. Laser printer net sales were up 24.6 percent. Laser printer hardware sales increased 47 percent on a 31 percent uptick in unit sales. Laser non-hardware sales gained 15 percent. In Q2 2022, net sales of inkjet printers increased 5.9 percent. Inkjet hardware net sales grew 35 percent during the quarter and inkjet printer unit shipments grew 17 percent, but inkjet non-hardware net sales declined 10 percent.

- Epson: Epson’s Q1 2022 represented a good start to the year for the company. Although business profit declined compared to the year-ago period, revenue rose, and both operating and net profit were up sharply. In the Printing Solutions business, revenue grew 2.8 percent year-over-year. Epson attributed the uptick to higher selling prices and the positive impact of foreign exchange rates but said sales were hurt by product shortages due to lockdowns in China, logistics delays, and parts shortages. While revenue was up, Printing Solutions’ business profit plunged 21.0 percent despite the positive impact of the weak yen and higher prices for its products. Epson laid the blame on product shortages and higher manufacturing costs due to soaring transportation and parts costs. In the Office and Home Printing subsegment, revenue increased 4.4 percent and business profit rose 11.4 percent. The firm explained that SOHO and home inkjet printer revenue increased 6.2 percent and office-shared inkjet printer grew 9.0 percent.

- Fujifilm: Q1 2022 represented a mixed start to the year for Fujifilm. Revenue grew, but that was mostly due to yen depreciation, and both operating and net income fell by double digits. The Business Innovation segment was able to post modest revenue growth of 1.2 percent year-over-year and a 1.3 percent increase in segment operating income, marking a change from three prior quarters of declines. In Q1 2022, office solutions revenue was up 1.1 percent year-over-year due largely to favorable exchange rates and an increase in export sales of consumables.

- HP: Q3 2022 was tough for HP. The company’s revenue declined, ending a six-quarter string of top-line growth for HP. Operating profit shrunk as well, although the firm saw modest bump in net earnings. One big problem for HP was that what had been a consistent driver of company revenue in recent quarters, the Personal Systems segment, saw revenue decrease for the first time since Q2 2020 on lower notebook units and sales. Meanwhile, the Printing segment saw its third straight quarter of year-over-year revenue declines. In Q3 2022, Printing revenue was down 6.3 percent. Consumer hardware revenue actually rose 0.7 percent as consumer hardware units contracted 1 percent. Commercial hardware revenue was 3.2 percent lower than the year-ago period, and commercial hardware units ticked downward 15 percent. The big problem, however, in the Printing business was the supplies business, which accounts for nearly 62 percent of total Printing revenue. Supplies revenue tumbled 9.0 percent year-over-year in Q3 2022 as demand for consumables for home printing dropped. HP warned that the supplies revenue decline could grow bigger: to the “low double digits” over the “next few quarters.” Despite the drop in revenue, the profit performance of the Printing business was excellent due to growth in HP+, Instant Ink, and “Big Tank” printers. The Printing business’s operating profit grew 6.3 percent year-over-year, and the group’s operating margin was 19.9 percent, which is an excellent margin for the group historically.

- Konica Minolta: In the first quarter of fiscal 2022, Konica Minolta’s revenue grew year-over-year; however, the firm posted operating and net losses due mainly to the group we are most interested in: the Digital Workplace Business. Revenue in the Digital Workplace Business improved 6.4 percent year-over-year as the group benefited from yen depreciation and improved non-hardware sales, but the Digital Workplace Business’s operating profit tumbled over ¥8.6 billion to an operating loss of ¥7.6 billion ($55.8 million) due to rising costs for components and logistics and one-time expenses related to business structural reforms. In Q1 2022, Office revenue increased 7.8 percent year-over-year while DW-DX revenue contracted 1.1 percent. Konica Minolta attributed its improved Office revenue mainly to currency exchange and improved non-hardware sales. Sales volumes of MFPs were down 21 percent due to product shortages stemming from the lockdowns in Shanghai and the firm’s order backlog increased, Konica Minolta said it saw an increase in revenue from office non-hardware sales such as consumables and services despite a decline in non-hardware revenue in China due to the lockdowns in Shanghai. The firm said office non-hardware sales have now recovered to 85 percent of FY 2019 levels.

- Kyocera: In the first quarter of its current fiscal year, Kyocera had a lot to brag about. Company revenue grew to hit a new record high, and operating and net income both showed double-digit year-over-year growth. Document Solutions revenue was 17.6 percent higher than in the year-ago period as the company benefited from yen depreciation and increased sales of products, while the group’s business profit rose a more modest 3.5 percent.

- Ninestar: Ninestar’s most recent financial report focuses solely on its performance in the first half. However, Actionable Intelligence calculated Ninestar’s results for the three-month period ended in June based on the company’s performance in the first half and the first quarter. Ninestar had a very strong Q2—even stronger than the firm’s Q1—contributing significantly to the firm’s very strong first-half performance. In Q2 2022, Ninestar’s revenue grew 13.2 percent and operating profit grew 46.8 percent compared to Q1 2021. While we cannot break out Ninestar’s performance by business segment for Q2 2022 due to a lack of complete data for the various business segments for Q1 2022, Ninestar did share data about the performance of its business segments in the first half. Lexmark saw a 9.3 percent increase in revenue in the first half, but Lexmark’s earnings before interest, tax, depreciation and amortization (EBITDA) was down 8.0 percent year-over-year even as net profit soared 111.6 percent. In H1 2022, Pantum’s revenue increased 13.4 percent year-over-year and its net profit grew 2.7 percent. Apex saw revenue grow 54.9 percent and net profit grown 33.7 percent in H1 2022. Lastly, Ninestar’s general printing consumables business (third-party consumables) saw revenue increase 16.5 percent in H1 2022 as net profit rose 42.3 percent.

- Ricoh: Ricoh’s Q1 2022 represented a good start to the year. Ricoh’s net sales, operating profit, and net profit all showed marked improvement from the year-ago period. In the Digital Services segment, which is the business we follow most closely, net sales improved 6.4 percent year-over year and operating profit improved a whopping 120.1 percent. That said, profits in the business remain slim at ¥2.9 billion ($21.6 million), which gave the group an operating profit margin of 0.8 percent. Ricoh explained that in the former office printing business, total sales of edge devices decreased due to material shortages, but Ricoh took pricing actions to controlled costs to secure profits. Both revenue and profits in the Digital Services benefited from an increase in non-hardware sales as economic activity rebounded and more workers returned to offices.

- Sharp: It was not a good start to the year for Sharp. In Q1 2022, the company’s net sales and operating profit declined, although net profit increase due to improvements in non-operating and extraordinary income. The company laid the blame for its business downturn on the lockdown in Shanghai, a lack of semiconductors and raw materials, and growing production and logistics costs. The one business segment that actually posted growth was the 8K Ecosystem segment. This segment saw net sales grow 1.7 percent year-over-year and operating profit increase 4.9 percent. While it is hard to say how much of the improvement is due to the TV business and how much due to the MFP business, Sharp commented that its MFP business saw sales growth, and it attributed the improved profit in the 8K Ecosystem business to the MFP business.

- Toshiba Tec: Toshiba Tec reported modest net sales growth in Q1 2022, but operating profit tumbled over 90 percent year-over-year and the company posted a net loss. The firm’s Workplace Solutions business, however, performed better than the company as a whole. The Workplace Solutions business saw revenue increase 8.4 percent. Segment operating profit totaled ¥131 million ($1.0 million), a ¥274 million improvement over the segment’s ¥143 million loss in the year-ago period. Toshiba Tec noted that despite a “tight supply-demand balance,” soaring component and logistics costs, and ongoing depressed printing volumes, the Workplace Solutions group was able to grow MFP sales overseas. The group also benefited from favorable currency exchange.

- Xerox: Xerox’s Q2 2022 was weak, although the firm saw improvements in some crucial business areas. Revenue dipped modestly, but operating income plummeted, and the company reported yet another quarterly net loss. In Q2 2022, Print and Other revenue fell 2.3 percent year-over-year, and segment profit tumbled 83.8 percent. For the company as a whole, equipment revenue was down 14.7 percent as the company continued to struggle with product shortages and a growing backlog. Entry-level equipment revenue was down 4.3 percent. Entry-level A4 MFP installs were up 66 percent for color products, but monochrome entry-level A4 MFP installs contracted 34 percent. Xerox’s midrange equipment sales contracted a steep 19.9 percent. Midrange black-and-white and color installs were down 22 percent and down 17 percent, respectively. Revenue from the sale of Xerox’s high-end equipment decreased 5.0 percent. High-end color installs were actually up 13 percent, but the positive impact of higher color installs of revenue was offset by a 29 percent decline in monochrome high-end installs. Post-sale revenue was up 1.2 percent for the company and up 3.4 percent in the Print and Other segment alone. Xerox said post-sale revenue also improved sequentially as people return to the office and page volumes grew modestly.

Forecast Changes

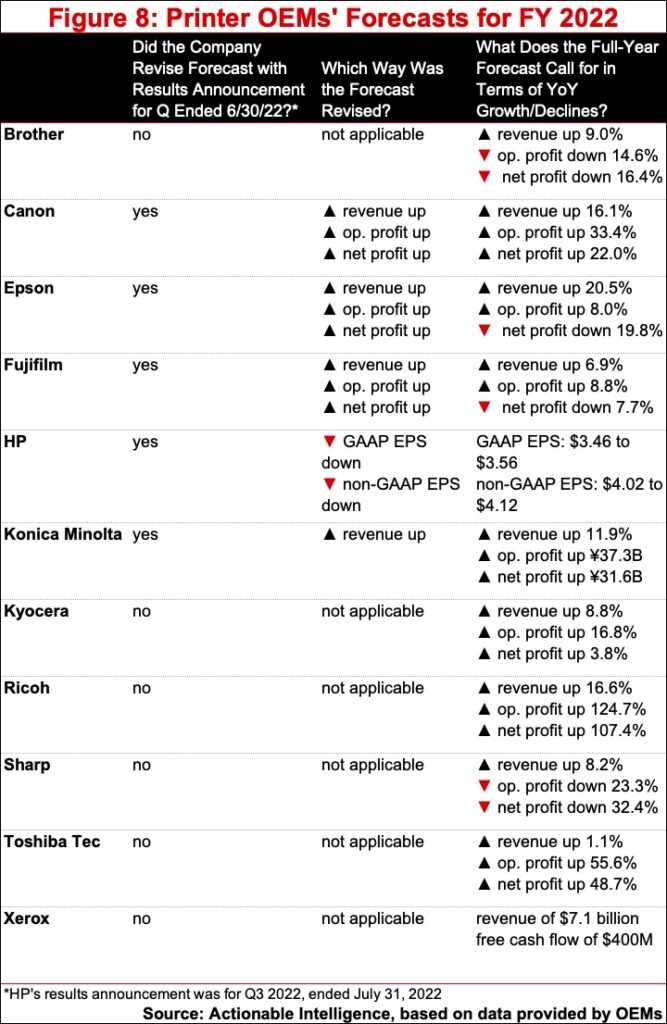

With their latest financial results announcements, five OEMs adjusted their forecasts for the year ahead (see Figure 8). Canon, Epson, and Fujifilm adjusted their outlooks for company revenue, operating profit, and net profit upward. Konica Minolta raised its revenue guidance for the year. A major reason for these firms’ upward revisions is that the yen depreciated more than anticipated. HP, however, revised its guidance in the other direction, lowering its earnings per share (EPS) guidance due to its concerns about the global economy, the softness it is seeing in the consumer segment, and expenses associated with its acquisition of Poly (see “HP Completes Poly Acquisition”).

Despite the fact that many OEMs saw improvements in the quarter ended in June and all the upward forecast revisions, most OEMs adopted a cautious tone in discussing their performance in the remainder of the year ahead.

If there was a word uttered time and again this quarter, particularly in regard to companies’ forecasts, it was uncertainty. OEMs said the outlook is uncertain whether they expect a year of growth or declines and whether they revised their forecasts upward or downward or left them unchanged. That isn’t new, of course. Ever since the global pandemic cratered the industry, OEMs have expressed concern about how uncertain the future looks. But this quarter, we saw a growing chorus of voices express concern about the business impact of geopolitical conflicts and potential conflicts, COVID-19, and whether there will be regional recessions or even a global recession that might crush hopes of a return to the office and a gradual recovery for OEMs’ office businesses.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.