In late July and throughout the month of August, original equipment manufacturers (OEMs) and vendors of single-function printers and multifunction printers (MFPs) announced financial results for the three-month period ended June 30, 2023. For most Japanese companies including Brother, Epson, Fujifilm, Konica Minolta, Kyocera, Ricoh, Sharp, and Toshiba Tec, the three-month period was the first quarter of fiscal 2023. For Canon, Ninestar, and Xerox, this period was the second quarter of fiscal 2023. HP is on a different financial calendar than all the other OEMs. Its third quarter of fiscal 2023 ran from May 1, 2023, through July 31, 2023.

Over the past three years, a number of extraordinary events drove big changes in the printer and MFP markets. In 2020, amid the early days of the COVID-19 pandemic and office and school closures, the entire industry took a hit financially, although some vendors saw strong sales of inkjet units and consumables for working and studying from home. The following year, 2021, was looking like a year of improvements until a shortage of chips and other crucial components and snarled logistics channel led to a severe shortage of products that hampered a return to growth for many vendors. The year 2022 brought a continuation of shortages in the first half, but product supply improved in the second part of the year and the first quarter of 2023, leading to improved sales, especially of A3 MFPs, as backorders were fulfilled; however, most vendors continued to see decreases in sales of inkjet devices and supplies.

Now, in the second calendar quarter of 2023, we are seeing a new trend and an unwelcome one. IDC reported worldwide hardcopy peripheral shipments fell sharply after three quarters of growth, with shipments down in the three biggest markets—China, the United States, and Western Europe (see “Worldwide Hardcopy Peripheral Shipment Growth Comes to an End in Q2 2023 with Sudden Drop”). Problems depressing demand are myriad. One is the economic downturns or slowing growth seen in certain regions. China’s sharp downturn in demand for printers and MFPs was something HP highlighted repeatedly in its earnings report. Around the world, the high cost of borrowing is making enterprises more reluctant to invest in equipment. Meanwhile, in the consumer market, many consumers recently refreshed their inkjet devices during the early days of the pandemic and are now printing infrequently at home, meaning less supplies usage. In addition, many consumers aren’t buying new devices because of inflationary pressure on discretionary spending. Last but not least, the ongoing shift away from print to digital technologies and workflows continues to mean less demand for printers and MFPs for both the office and consumer markets.

Conventional wisdom is that A3 MFP shipments will only decline over time while any pockets of growth will be in the A4 market. But the quarter ended in June turned this conventional wisdom on its head. Global printer and MFP shipments may have declined sharply, but most A3 MFP vendors reported strong growth in their A3 revenue and shipments as they continued to fulfill order backlogs following shortages in prior periods. This trend—combined with Japanese OEMs benefiting from the weak yen—made for a strong quarter for most of the OEMs and vendors we cover. But not everyone did well. We saw downbeat reports about A4 home and office hardware from the likes of Canon and HP, while Brother and Epson reported some areas of weakness including a downturn in laser units for Brother and a decline in inkjet units for Epson. Ninestar, as we will discuss below, also had a very tough quarter.

It seems very unlikely, however, that the A3 MFP market will buoy vendors’ results indefinitely. During the quarter, some A3 MFP makers talked about having fulfilled their big order backlogs or their backlogs normalizing, meaning that this will be less of a driver for sales moving forward. Once that happens—and we expect that when it happens will vary from vendor to vendor—we could see a return to OEMs posting revenue and profit declines.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, Ricoh, Sharp, Toshiba Tec, and Xerox. Here, we look specifically at the performance of OEMs’ business segments that include home and office printer hardware, supplies, and related software and services, for the latest three-month period.

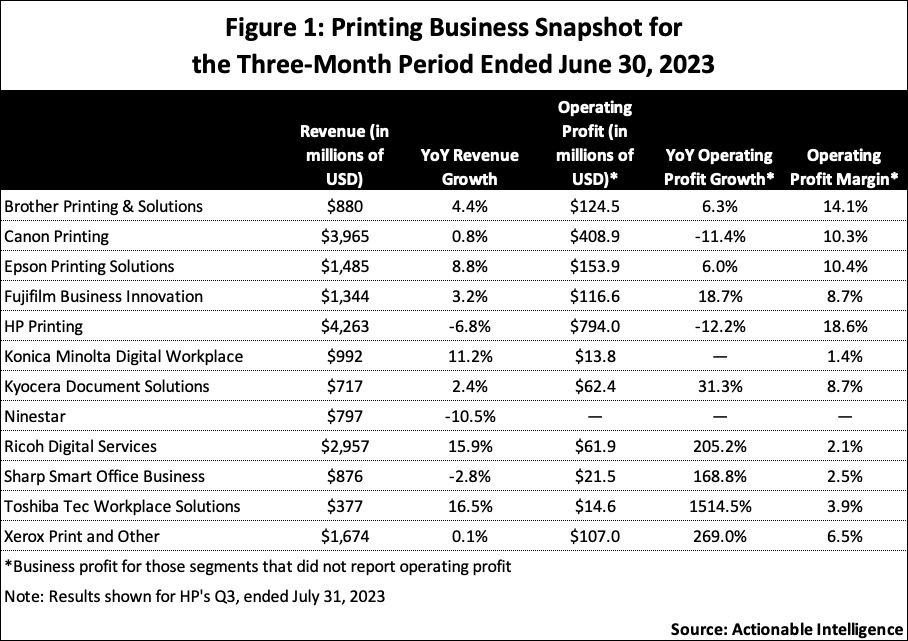

Figure 1 presents a snapshot of the financial performance of OEMs’ printing businesses for their most recent quarter.

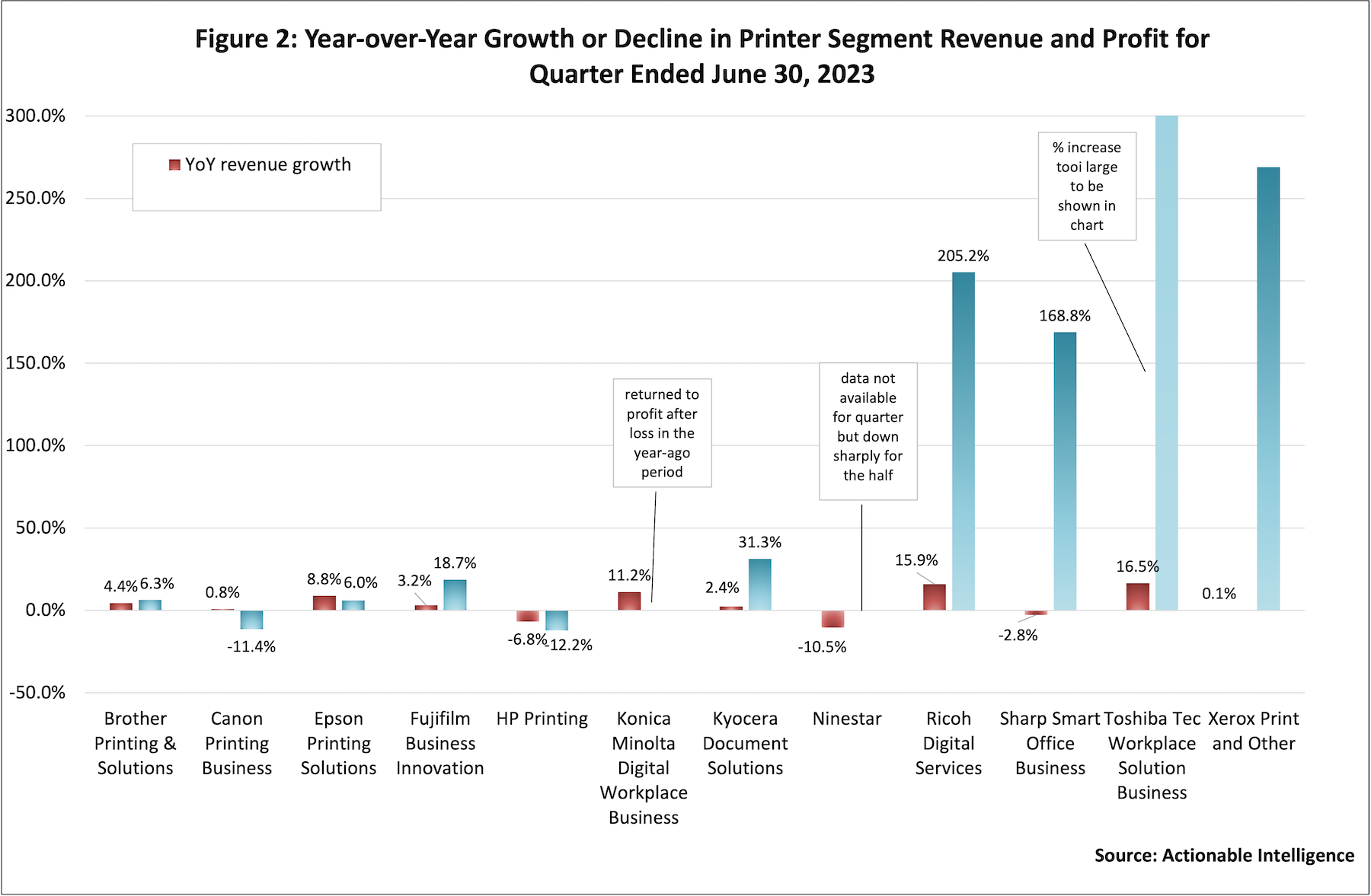

Figure 2 shows how OEMs’ printing businesses fared in terms of year-over-year revenue and profit growth or declines in their most recent quarter. Similar to last quarter (see “In Latest Quarter OEMs Benefit from Better Product Availability but See Weak Sales of Supplies for Home Printers”), eight out of twelve of the businesses we follow reported both revenue and profit growth—that’s up from six in the prior two quarters (see “OEM Financials for Quarter Ended December 2022 Show Revenue Shakeup” and “OEMs Post Mixed Results as Demand for A4 Supplies Drops”). This quarter, the eight vendors that could report both revenue and profit growth in their printing businesses were Brother Printing and Solutions, Epson Printing Solutions, Fujifilm Business Innovation, Konica Minolta Digital Workplace, Kyocera Document Solutions, Ricoh Digital Services, Toshiba Tec Workplace Solutions, and Xerox Print and Other. This is a slightly different list than last quarter: Brother Printing and Solutions was not on last quarter’s list but Ninestar was. As we can see, all the OEMs that focus mainly on A3 were able to post both revenue and profit growth in their segments, aside from Sharp.

Two vendors—Canon’s Printing Business and Sharp’s newly formed Smart Office Business—had mixed results. Canon’s Printing Business posted modest revenue growth and a profit decline due to downturns in its A4-focused Prosumer business. Sharp’s Smart Office Business saw its revenue shrink but profits grow.

Two vendors—HP’s Printing Business and Ninestar—saw revenue and operating profit shrink. Note that we do not have an operating profit figure for Ninestar for Q2 2023 specifically—just for the first-half. But given the size of the first-half decline and the downturn seen in revenue and net profit in Q2, it seems safe to say Ninestar’s operating profit was down in Q2 as well.

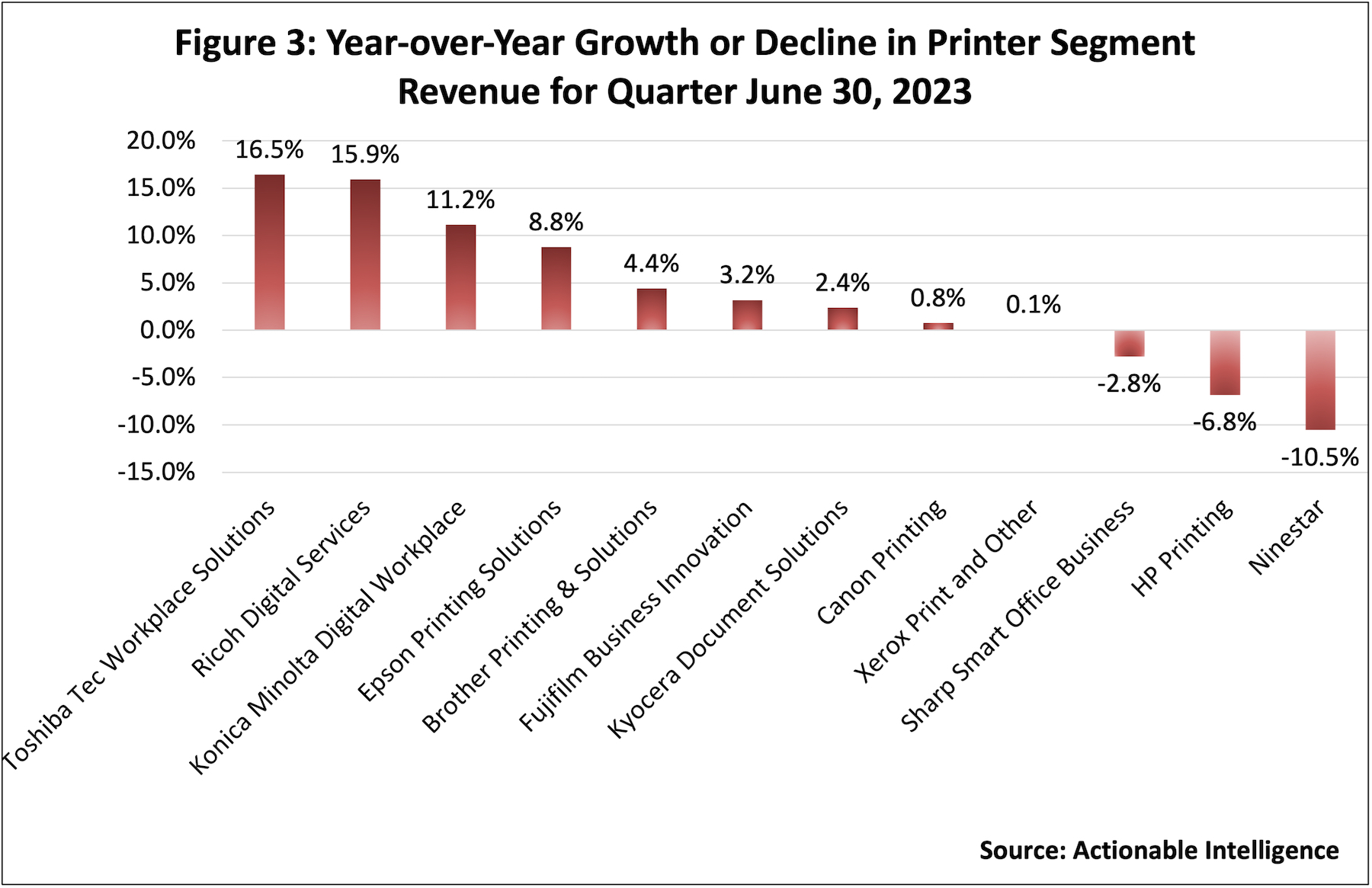

Figures 3 and 4 show these same numbers separately. Figure 3 shows year-over-year revenue growth or decline for the quarter. This quarter, three vendors saw double-digit revenue growth and unsurprisingly all three focus on A3—Toshiba Tec Workplace Solutions, Ricoh Digital Services, and Konica Minolta Digital Workplace. Three vendors saw revenue decline—Ninestar, HP Printing, and Sharp’s Smart Office Business.

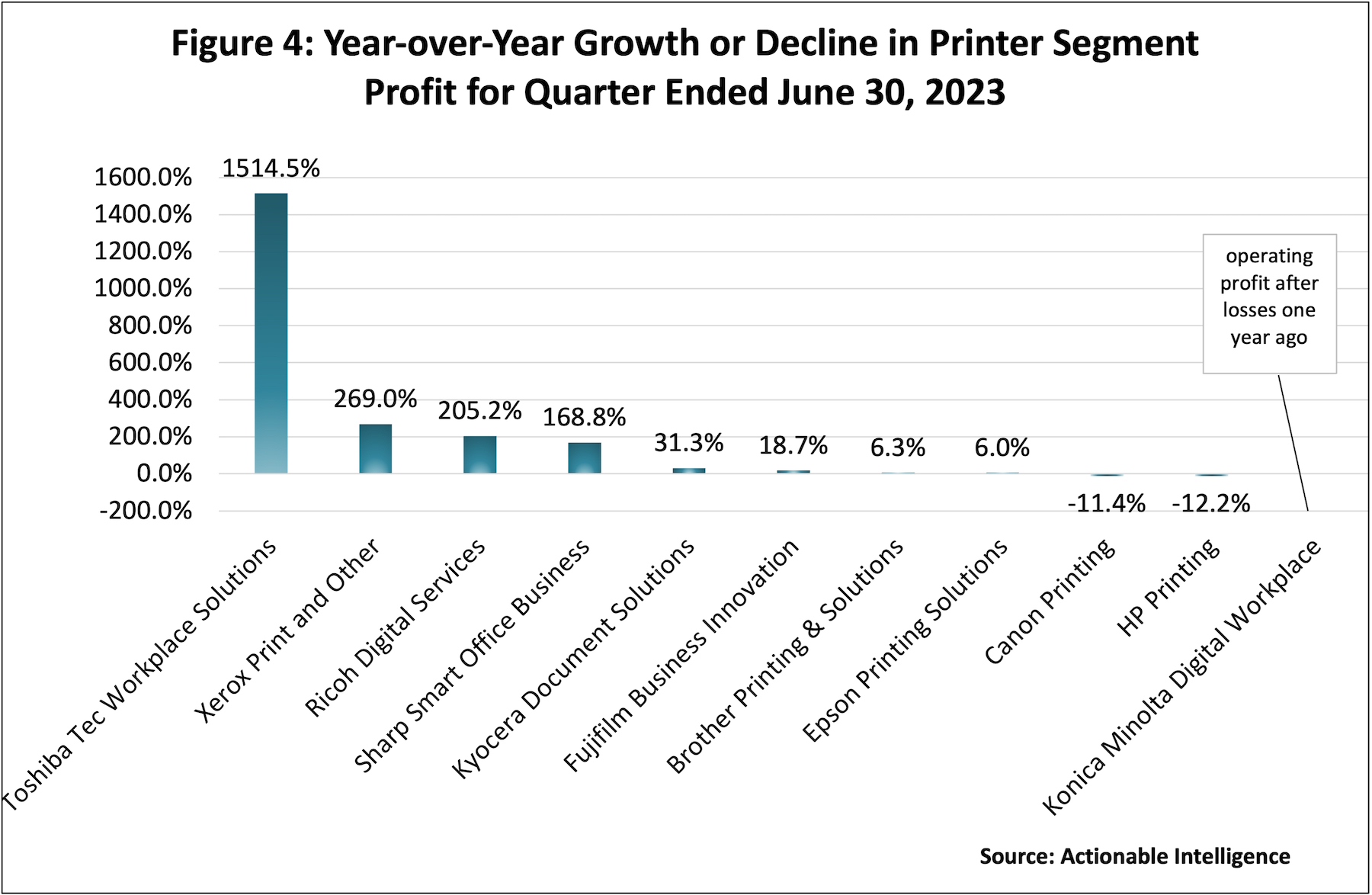

Figure 4 shows that most vendors saw improved profits in the quarter. The lone exceptions that saw declines are Canon Printing and HP Printing (and as noted we believe Ninestar is on this list as well). While some of the year-over-year increases were hefty in percentage terms, this is mostly because profits were so slim in the year-ago period. It doesn’t mean vendors were raking in record profits. Note that we can’t show a percentage increase for Konica Minolta Digital Workplace because it had a loss one year ago, but this segment too saw improved profit in the quarter.

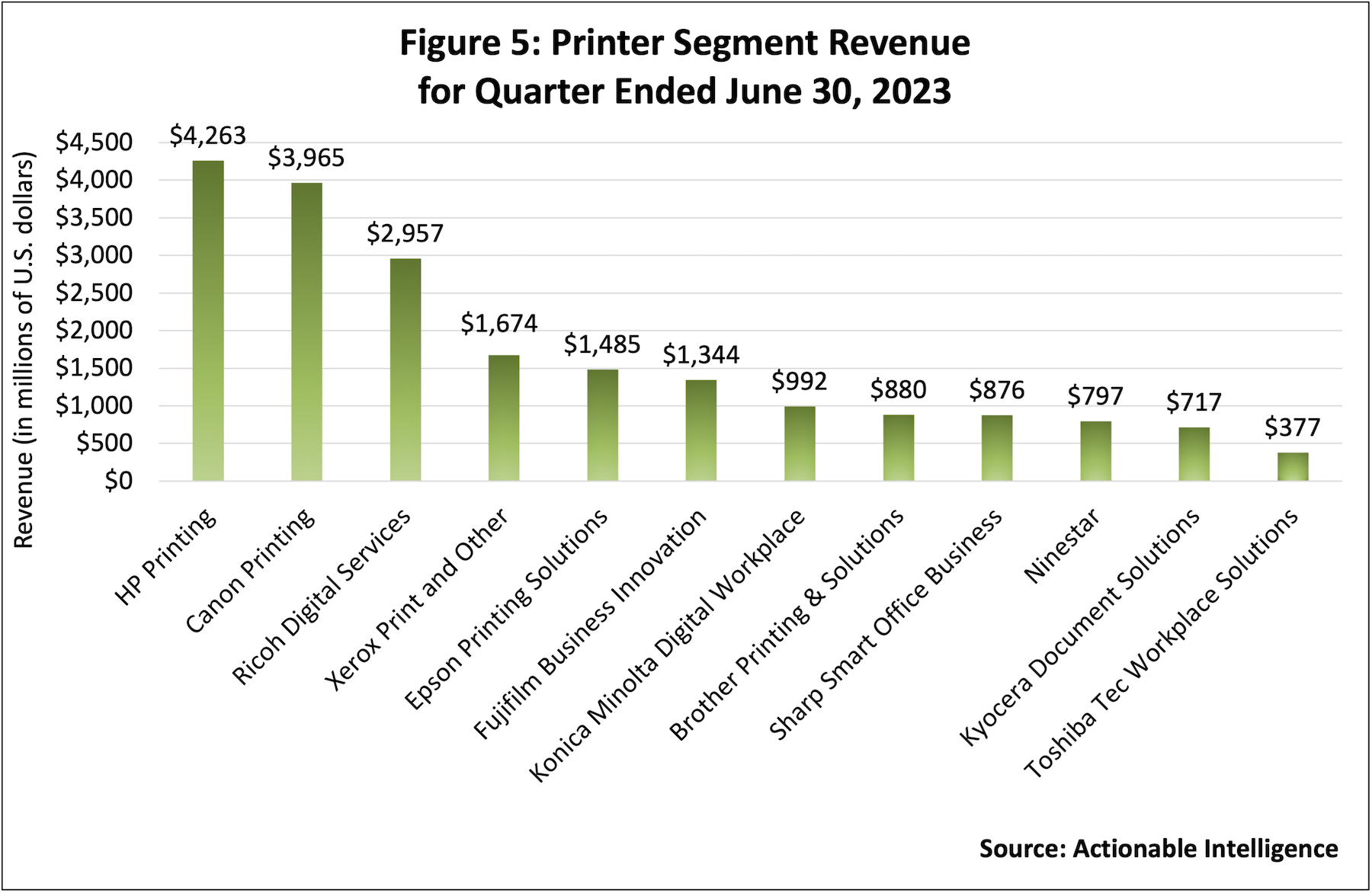

Figure 5 shows how much revenue in U.S. dollars each OEM’s printing business generated in the quarter ended June 30, 2023. There is some fluctuation in the middle of the ranks each quarter, but a few patterns have held relatively steady such as HP Printing, Canon Printing, and Ricoh Digital Services in the top three spots and Kyocera Document Solutions and Toshiba Tec Workplace Solutions bringing up the rear with smaller revenue than other vendors.

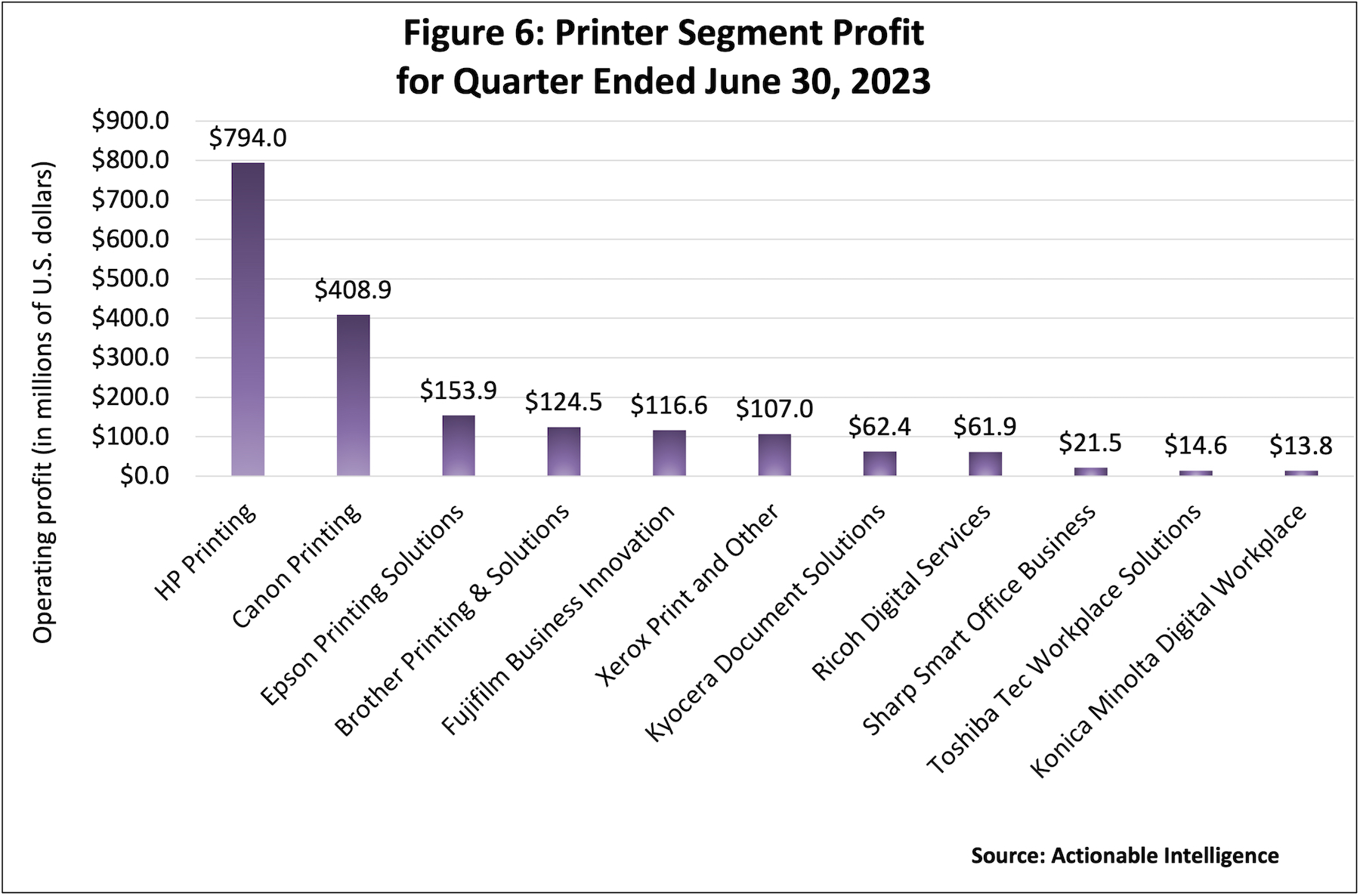

Figure 6 shows the OEMs’ printer segment profits in U.S. dollars. As always, this chart exemplifies the fact that big percentage increase don’t always translate into big profits. Toshiba Tec Workplace Solutions may have seen the biggest year-over-year increase in profit in percentage terms, but it has the second smallest total profit in dollars. Likewise, Xerox Print and Other, Ricoh Digital Services, and Sharp Smart Office Business all saw triple-digit increases in profit in percentage terms, but Xerox only ranks in the middle of the pack in terms of dollars brought in while Ricoh and Sharp are toward the end of the pack. Konica Minolta Digital Workplace had the least operating profit. In contrast, HP and Canon may have been the only vendors to see profits shrink, but they retain their customary positions as the firms bringing in the most profit in dollars.

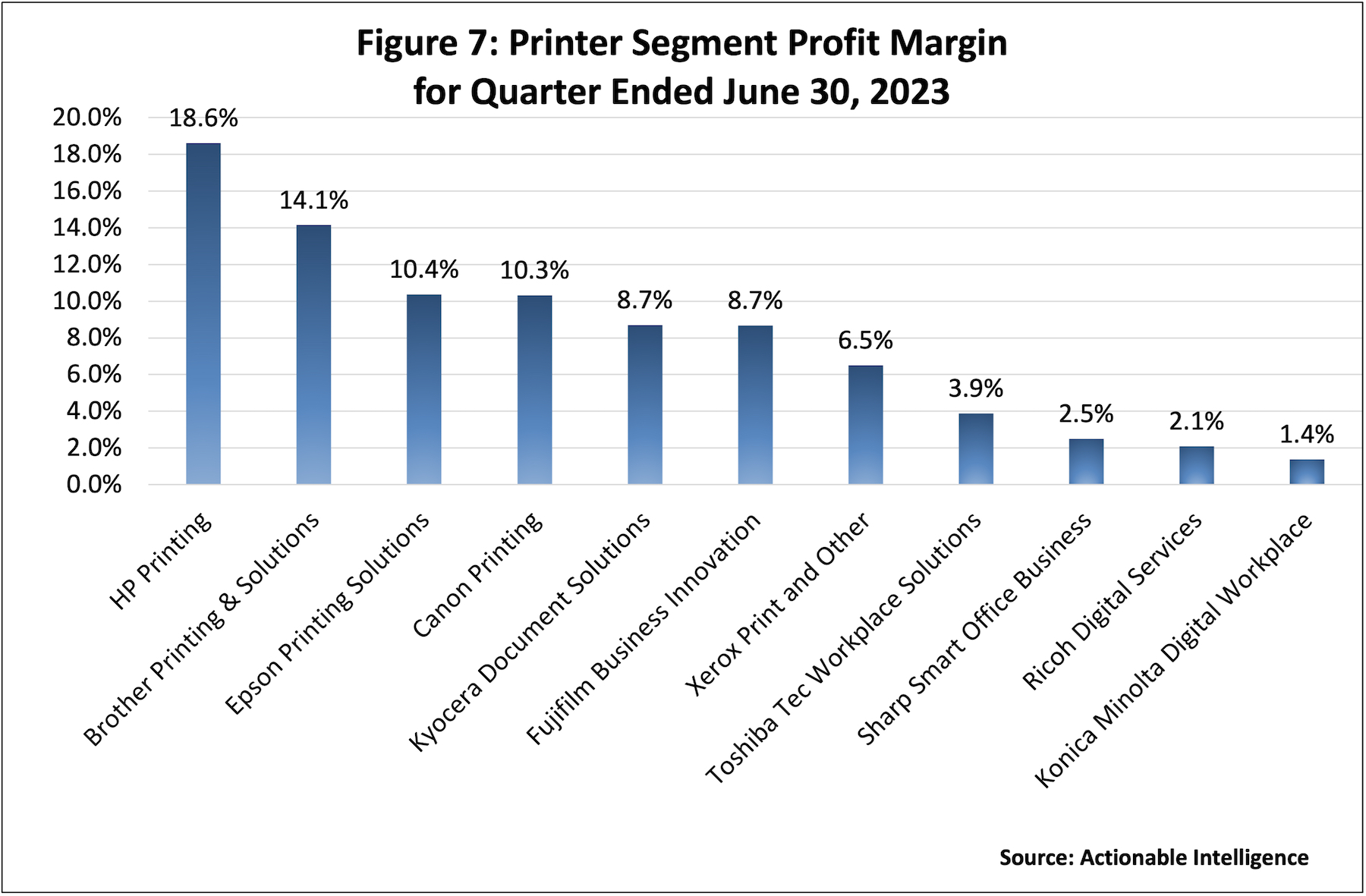

Figure 7 shows the operating profit margin in OEMs’ printing businesses. HP Printing remains the top vendor in this regard with an 18.6 percent operating profit margin. Other vendors reporting double-digit profit margins this quarter were Brother Printing and Solutions (14.1 percent), Epson Printing Solutions (10.4 percent), and Canon Printing (10.3 percent). Firms with a profit margin of less than 5 percent include Toshiba Tec Workplace Solutions (3.9 percent), Sharp Smart Office Business (2.5 percent), Ricoh Digital Services (2.1 percent), and Konica Minolta Digital Workplace (1.4 percent). Here we see another interesting trend—A4 vendors may have struggled with declining shipments in their latest quarter and A3 vendors may have seen shipments grow, but A4-focused vendors maintained beefier margins than firms focused mainly on A3.

Below we have summarized the performance of the various OEMs we track, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

Brother: While in Q1 2023 Brother’s total company revenue was flat and operating profit declined, this was due largely to declines in other segments. The Printing and Solutions segment had a good quarter, with revenue up 4.4 percent year-over-year and operating profit up 6.3 percent. Revenue growth in this segment is nothing new—it was the 11th straight quarter of Printing and Solutions revenue growth—but it marked the firm time since Q1 2022 that segment operating profit grew year-over-year. Brother’s inkjet MFP business delivered a strong performance. In Q1 2023, inkjet MFP hardware sales rose 5 percent on a 4 percent uptick in unit shipments, and inkjet consumables sales rose a hefty 15 percent. The firm’s laser printer and MFP business didn’t fare as well. Laser hardware revenue was up 4 percent but that was due largely to FOREX. Laser hardware unit shipments were also down 1 percent in Q1 2023. Meanwhile, Brother said that laser consumables revenue grew 3 percent year-over-year, but in local currency laser consumables revenue declined 3 percent.

Canon: Canon had a mixed Q2 2023: net sales and net income rose but operating profit dropped. The Printing segment experienced similar trends. Printing net sales rose a modest 0.8 percent, but Printing business operating profit contracted 11.4 percent. Net sales were up 14.2 percent in the Office subsegment and up 14.0 percent for office multifunction devices (MFDs). Breaking that down a bit further, office MFD hardware net sales grew 21 percent on a 17 percent increase in units, and office MFD non-hardware net sales improved 8 percent. The good news largely ended there, however. Prosumer revenue fell 13.0 percent year-over-year in Q2 2023. Laser printer revenue fell 15.0 percent. Laser printer hardware net sales were down 6 percent on a sharp 22 percent decline in units. Laser printer non-hardware sales fell an alarming 20 percent. Inkjet printer revenue declined 9.1 percent. Inkjet hardware net sales were down 19 percent on a 11 percent decline in units. Inkjet non-hardware net sales were flat, but that was due largely to favorable currency exchange.

Epson: In its Q1 2023, Epson reported an uptick in revenue, but business profit, operating profit, and net profit all fell due largely to lower profits in the Manufacturing-Related and Wearables Segment. The firm’s Printing Solutions segment fared better than the company as a whole with revenue up 8.8 percent and business profit up 6.0 percent. But improved profits came from the Commercial and Industrial subsegment, not the subsegment we are most interested in: Office and Home Printing. While Office and Home Printing revenue ticked upward 4.7 percent year-over-year, business profit tumbled 23.3 percent. Epson laid the blame for the lower profits in Q1 on higher SG&A costs due to a ramp-up in business activities. SOHO and home inkjet printer revenue grew just 1.3 percent with unit sales of inkjet printers dropping 7 percent. Epson said that the reason for the relatively flat revenue despite the downturn in units was an improved model mix, meaning more sales of high-capacity ink tank printers. Shared office inkjet printer revenue grew 28.3 percent due to an easing of supply constraints and its launch of the WorkForce Enterprise AM-Series. Epson said its ink sales increased by 9 percent.

Fujifilm: For the company as a whole, Fujifilm reported increases in revenue, operating income, and net income in Q1 2023. In the Business Innovation group, revenue increased 3.2 percent and operating income increased 18.7 percent. Segment revenue growth, however, was due largely to the Business Solutions subsegment, because the Office Solutions group we follow saw its revenue drop 2.3 percent. Fujifilm said it grew its business providing printers and MFPs to other OEMs and successfully implemented price hikes, but it had lower exports to Europe and the United States—meaning to Xerox.

HP: In Q3 2023, HP saw revenue, operating profit, and net earnings decrease compared to the year-ago period. Times remained tough for the Printing segment. Segment revenue declined 6.8 percent year-over-year, making this the seventh straight quarter in which printing revenue has dropped. Printing operating profit also contracted 12.2 percent. In Q3 2023, consumer hardware revenue fell 28.1 percent on a 20 percent decline in units. Meanwhile, commercial hardware revenue dropped a more modest 6.0 percent on an 8 percent decline in units. The firm pointed to decreased demand in China and aggressive price competition from Japanese rivals that are taking advantage of the weak yen as major factors in shrinking revenue in its printing hardware business. This quarter, supplies revenue declined 1.8 percent but that’s more modest than either the 4.0 percent dip posted in Q2 or the 6.9 percent decrease posted in Q1, and the firm said supplies revenue was flat in constant currency. HP attributed its better trajectory in supplies revenue to pricing proving resilient and better market share versus third parties.

Konica Minolta: In Q1 2023, Konica Minolta posted revenue growth, and while its operating profit and net profit remained stubbornly in the red, the losses were smaller than in the year-ago period. The Digital Workplace Business saw revenue grow 11.2 percent year-over-year. Segment operating profit improved over ¥6.2 billion from a loss of ¥4.25 billion reported in Q1 2022 to a profit of ¥2.0 billion ($13.8 million) in Q1 2023. In the Office subsegment, revenue increased 10.6 percent year-over-year. Konica Minolta reported a 15 percent increase in hardware revenue as sales volume of A3 MFPs increased among major regions, including Europe, the United States, Japan, and China. Sales volumes of all A3 MFPs were up 11 percent—the increase was 11 percent for both monochrome and color units. Hardware revenue growth in the Office subsegment was partially offset by a 4 percent decline in non-hardware revenue such as consumables and services. Regions where Office non-hardware revenue declined included Europe, the United States, and Japan, but the firm reported that certain markets such as India saw increases.

Kyocera: As a company, Kyocera has a tough start to the year, with revenue, operating profit, and net profit all dropping year-over-year. The firm’s Document Solutions group, however, outperformed the company as a whole, with revenue up 2.4 percent and business profit up 31.3 percent. Kyocera described sales of core products in the Document Solutions group as “robust” and said the group also benefited from the weak yen.

Ninestar: Ninestar shared lots of detail about its first-half results, but nothing about its Q2 2023 results. We calculate that the firm’s Q2 2023 revenue was down 10.5 percent. While the company didn’t say what happened with its operating profit in Q2, it is safe to assume it was down sharply given that the company first-half operating profit declined 76.4 percent. Ninestar closed the books on the first half just weeks after the U.S. government slapped an embargo on its products and those produced by several of its subsidiaries (see “Ninestar Imports Banned by U.S. Government Due to Forced Labor Concerns”). Because it was imposed so late in the first half, we feel that the U.S. ban played only a minor role in the firm’s overall lackluster performance. Rather, Ninestar’s challenging H1 2023 is attributable to the malaise that hit many Chinese companies this year as their domestic markets softened and demand in established overseas markets remained weak. Ninestar noted its Lexmark subsidiary saw an 11.8 percent decline in revenue in H1 2023. Lexmark’s earnings before interest, tax, depreciation and amortization (EBITDA) contracted 33 percent year-over-year, and Lexmark experienced a net loss in the first half. Lexmark’s OEM business was down sharply—while that may be due in part to the ban, the firm also noted this trend in Lexmark’s OEM business in Q1 2023 before the ban was in place. In the first half, Pantum’s revenue rose 3.7 percent and the group’s “non-net profit” shrank. Pantum’s printer unit shipments grew 11.2 percent in the first half.

Ricoh: Ricoh had an upbeat start to the year, reporting year-over-year growth in net sales, operating profit, and net profit in Q1 2023. This was due largely to the strong performance of the segment we are most interested in—Digital Services. In Q1 2023, Digital Services revenue rose 15.9 percent, and group profit soared 205.2 percent. The company attributed this to strong office services sales and a recovery in office printing hardware, combined with pricing controls. In Q1 2023, office printing sales increased 7.5 percent. Ricoh said its hardware sales in this group increased 10 percent year-over-year excluding FOREX; however, non-hardware sales fell 1 percent. Ricoh benefited from an uptick in sales of A3 MFPs and a recovery in its supply of A4 devices.

Sharp: Times remained tough for Sharp in Q1 2023 with company revenue down, an operating loss, and net profit down nearly 80 percent. Sharp is now including its MFPs, supplies, and related services as part of its Smart Office group, which also includes PCs, information displays, office solutions, and other “smart office products.” This segment delivered a mixed performance with revenue down 2.8 percent year-over-year but operating up a robust 168.8 percent. Sharp said its MFP business and office solutions performed well, especially in Europe and the United States, and MFP sales increased.

Toshiba Tec: Toshiba Tec reported several positive developments in Q1 2023: The company was able to boast of a double-digit increase in net sales, an enormous triple-digit increase in operating profit, and net profit that finally turned positive. Of the firm’s two businesses, the stronger performer is the one we follow: Workplace Solutions. Net sales in this segment rose 16.5 percent year-over-year, and Workplace Solutions operating profit soared 1,515 percent. While that sounds enormous, it reflect how small profits were in the year earlier, and even after this quarter’s growth profit remains slim. The firm said net sales of MFPs increased due to favorable foreign currency exchange, increased sales of models in the Americas and Europe, higher prices, and a shift to high-performance models.

Xerox: In Q2 2023, Xerox reported year-over-year increased in revenue and operating profit, but the firm had a net loss for the quarter—and a bigger one than in the year-ago period. The net loss was due to a charge stemming from Xerox’s donation of Palo Alto Research Center (PARC) to SRI International. Trends were generally positive in the Print and Other segment; segment revenue was about flat (up 0.1 percent year-over-year) but segment profit soared 269.0 percent as the group benefited from improved product supplies, lower logistics costs, favorable product mix, and the benefit of price and cost actions. For the company as a whole, equipment revenue increased 14.8 percent. Revenue in the entry-level segment declined 4.5 percent as entry-level installs fell 19 percent, with color installs down a startling 43 percent and black-and-white installs down 5 percent. Midrange equipment sales grew a robust 22.2 percent on a 19 percent uptick in installs (up 21 percent for color and up 16 percent for black-and-white). The firm’s high-end equipment revenue rose 7.9 percent as installs grew 7 percent (color installs were up 8 percent but black-and-white installs were down 8 percent). Xerox’s post-sale revenue contracted 3.4 percent, which the firm attributed to lower IT hardware and paper sales, lower finance income, and the cessation of Fujifilm royalties.

Forecast Changes

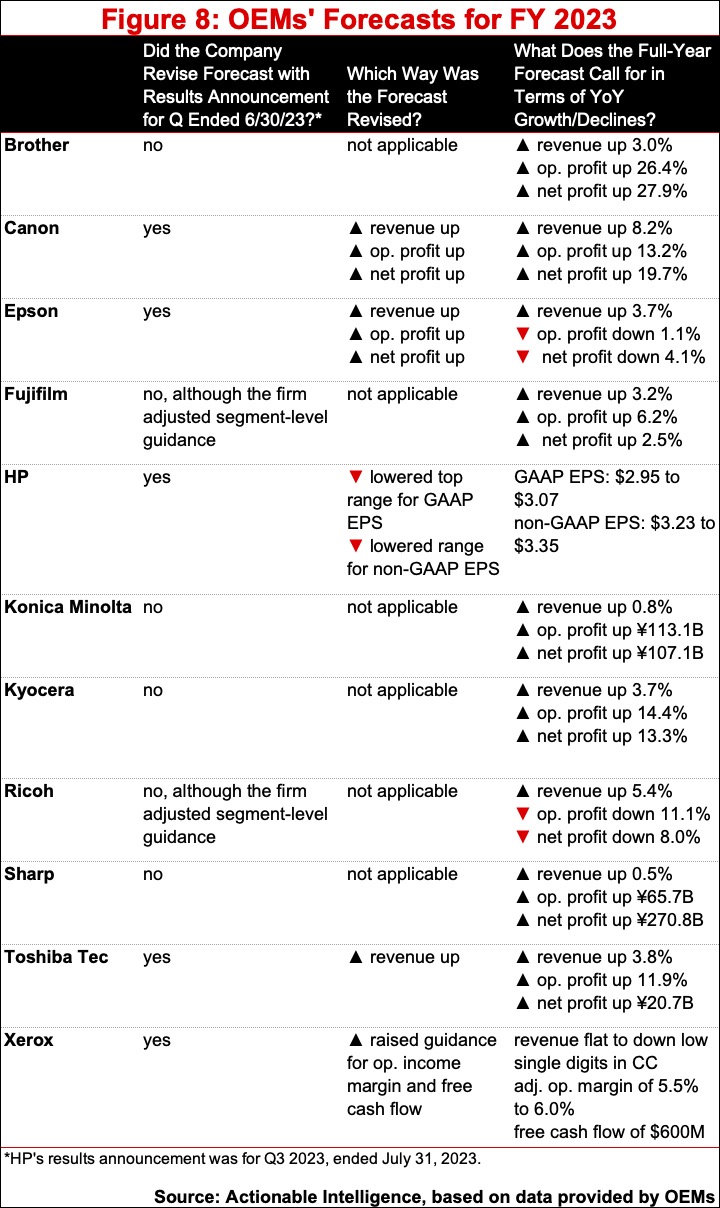

This quarter, we saw five vendors adjust their forecast for FY 2023, and nearly all of those adjustments were upward. Canon, Epson, Toshiba, and Xerox adjusted guidance upward. HP was the lone vendor adjusting guidance downward for the year.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.