On September 26, the U.S. Federal Trade Commission (FTC) and 17 state attorneys general filed an antitrust lawsuit against Amazon.com, Inc. As the FTC said in a press release, the complaint alleges that “the online retail and technology company is a monopolist that uses a set of interlocking anticompetitive and unfair strategies to illegally maintain its monopoly power.” The FTC added, “The FTC and its state partners say Amazon’s actions allow it to stop rivals and sellers from lowering prices, degrade quality for shoppers, overcharge sellers, stifle innovation, and prevent rivals from fairly competing against Amazon.”

This is the big FTC legal action against Amazon many had long anticipated (see, for example, articles in Ars Technica and Bloomberg). The FTC has filed other, less-sweeping complaints against Amazon. In June, the FTC announced it was suing Amazon over tactics it took to enroll customers in Prime (see the complaint). In May, the FTC and the Department of Justice announced they were suing Amazon for violating children’s privacy by keeping children’s Alexa voice recordings. That same month, the FTC also announced it sued Amazon’s Ring subsidiary over customer privacy and potential hacking concerns. But even as these earlier lawsuits were filed, the FTC was also reportedly engaged in a multi-year probe of Amazon looking at potential antitrust violations and considering a massive complaint that could lead to the restructuring or breakup of Amazon. In other words, the earlier lawsuits were amuse-bouches—this new complaint is the main course.

CNN reported on September 26 that FTC Chair Lina Khan declined to tell reporters whether it will be seeking a breakup of Amazon and that the focus for now is on “proving Amazon’s liability under federal antitrust law.”

Amazon almost immediately issued a brief statement about the FTC complaint. It reads in its entirety:

Today’s suit makes clear the FTC’s focus has radically departed from its mission of protecting consumers and competition. The practices the FTC is challenging have helped to spur competition and innovation across the retail industry, and have produced greater selection, lower prices, and faster delivery speeds for Amazon customers and greater opportunity for the many businesses that sell in Amazon’s store. If the FTC gets its way, the result would be fewer products to choose from, higher prices, slower deliveries for consumers, and reduced options for small businesses—the opposite of what antitrust law is designed to do. The lawsuit filed by the FTC today is wrong on the facts and the law, and we look forward to making that case in court.

The Complaint

The FTC filed its 172-page complaint on September 26 in the U.S. District Court for the Western District of Washington. Fellow plaintiffs include the following states: Connecticut, Delaware, Maine, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New Hampshire, New Mexico, Nevada, New York, Oklahoma, Oregon, Pennsylvania, Rhode Island, and Wisconsin. Amazon.com, Inc. is the lone defendant.

The plaintiffs’ complaint begins:

The early days of online trade were bursting with possibility. Competition flourished. A newly connected nation saw a wide-open frontier where anyone with a good idea would have a fair shot at success.

Today, however, this wide-open frontier has been enclosed. A single company, Amazon, has seized control over much of the online retail economy.

Amazon is a monopolist. It exploits its monopolies in ways that enrich Amazon but harm its customers: both the tens of millions of American households who regularly shop on Amazon’s online superstore and the hundreds of thousands of businesses who rely on Amazon to reach them.

As the FTC explains in its press release, the suit alleges, “Amazon’s anticompetitive conduct occurs in two markets—the online superstore market that serves shoppers and the market for online marketplace services purchased by sellers.”

The complaint goes on to detail this by explaining how Amazon takes half of every dollar the typical seller makes using Amazon fulfillment and how Amazon overcharges customers and directs them to “pay-to-play advertisements.” Moreover, it claims Amazon maintains control over customers and sellers via its monopoly power and employing unlawful strategies to “lock competition, stunt rivals’ growth, and cement its dominance.”

Count I in the complaint is holding monopoly power in the U.S. online superstore market and anticompetitive behavior in violation of Section 5(a) of the FTC Act, 15 U.S.C. § 45(a), and Section 2 of the Sherman Act, 15 U.S.C. § 2. Count II cites the same legal violations but focuses on Amazon maintaining monopoly power and its anticompetitive tactics in the worldwide market for online marketplace services for U.S. customers. Count III is unfair competition in violation of Section 5(a) of the FTC Act, 15 U.S.C. § 45(a). Count IV is unfair method of competition in violation of Section 5(a) of the FTC Act, 15 U.S.C. § 45(a). Count V is monopoly maintenance of the U.S. online superstore market in violation of Section 2 of the Sherman Act, 15 U.S.C. § 2. Count VI is monopoly maintenance of the online marketplace services market in violation of Section 2 of the Sherman Act, 15 U.S.C. § 2. Counts VII to XX focus on violations of various state laws.

In plain language, the plaintiffs are asking the court to “put an end to Amazon’s illegal course of conduct, ply loose Amazon’s monopolistic control, deny Amazon the fruits of its unlawful practices, and restore the lost promise of competition.” However, the prayer for relief spells out in more detail the legal findings the plaintiffs would like the court to make and requests injunctive relief against Amazon. The plaintiffs from the states also seek “equitable monetary relief” and the cost of filing suit.

The complaint is rich with detail—far more than we can share in an article of this nature. Interested readers should download the complaint.

No Direct Tie-in but Lots of Complaints about Amazon in Supplies World

The FTC’s complaint is about how Amazon’s alleged patterns of behavior impact consumers of all sorts of goods and sellers of all types of products. While there is no direct reference to ink and toner cartridges in the complaint, many of the allegations the FTC makes about the problems posed by the Amazon marketplace will ring familiar to those who are selling or have sold printer supplies on Amazon, as well as those who have bought cartridges on that marketplace. We have often observed that everyone buys on Amazon and everyone sells on Amazon, but it seems nearly everyone has a problem with the massive marketplace.

Moreover, whatever happens with the FTC’s massive lawsuit is likely to have some impact—perhaps an enormous one—on the printer and supplies market. Thus, we will be keeping eye on major developments in this case.

Over the years, Amazon has come to dominate the market for certain classes of printers and supplies. Actionable Intelligence wrote about this in a 2018 series of article (see “Age of Amazon” series, Parts 1, 2, 3, and 4, as well as a series overview “Seven Key Findings about Amazon’s Impact on the Printer Supplies Business”). And we have written about it periodically ever since (see “Third-Party Supplies Vendors Find a New Home on Amazon an “OEMs Tap into SOHO and Flirt with Higher Market Segments on Amazon”). We have also published too many articles to count about intellectual property holders removing infringing products from the Amazon marketplace, lawsuits filed over infringing Amazon listings, and Amazon’s efforts to better police itself.

But as Amazon has come to dominate the printer supplies market, just as it has done so many other businesses, problems have proliferated and criticism has grown increasingly sharp. In 2021, ML Products sued Ninestar, Aster Graphics, ,BillionTree Technology, Mountain Peak, and V4Ink claiming that these firms used multiple Amazon seller accounts, fake and paid reviews, brushing product listings, and other unfair tactics to boost their listings and completely dominate the Amazon marketplace for third-party supplies, thereby making it impossible for smaller vendors that don’t employ such unfair tactics to compete (see “ML Products Sues Ninestar, Aster, BillionTree, Mountain Peak, and V4INK for Unfair Competition on Amazon”). That lawsuit remains ongoing. This August, Planet Green Cartridges filed a lawsuit directly against Amazon for falsely advertising new-build compatible inkjet cartridges as remanufactured (see “Planet Green Sues Amazon for a Whopping $500 Million”). The lawsuit claims Amazon has making it impossible for legitimate remanufacturers like the plaintiff to compete, thereby hastening the demise of the U.S. remanufacturing industry and leading to the rise of non-recyclable compatible cartridges from China. That lawsuit, too, is ongoing.

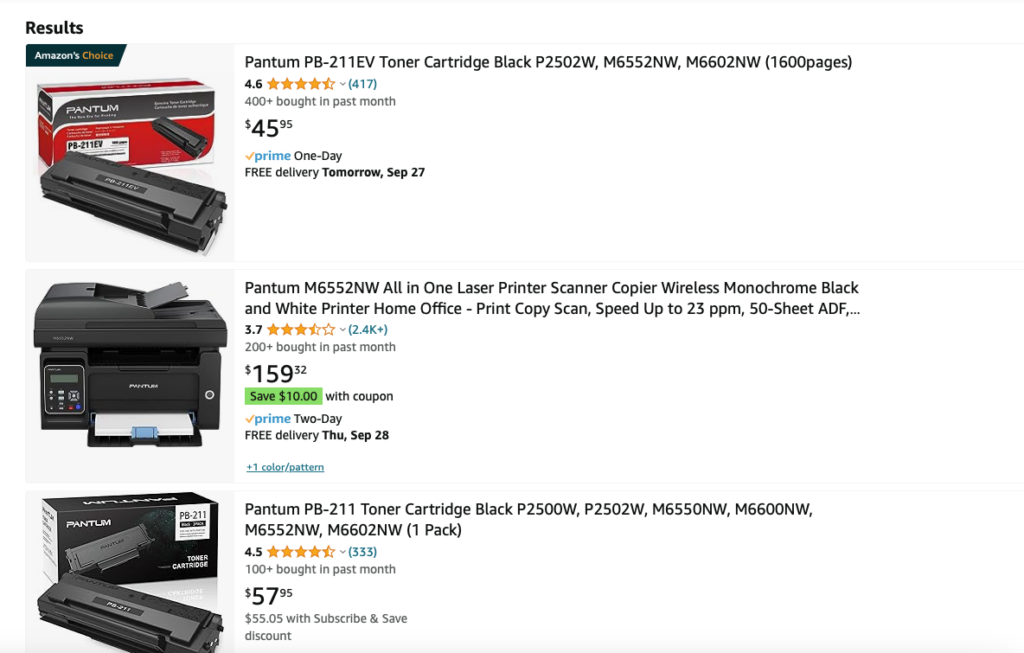

As these lawsuits and many others show, Amazon has long been criticized for not taking sufficient action against bad actors on its marketplace. In the printer and supplies industry, that chorus of complaints has grown notably louder in the wake of United States government banning imports from printer and supplies maker Ninestar Corporation and some of its subsidiaries due to a finding that they used forced labor in violation of the Uyghur Forced Labor Prevention Act (UFLPA) (see “Ninestar Imports Banned by U.S. Government Due to Forced Labor Concerns”). Despite the ban, many industry observers, including Actionable Intelligence, have noticed that Ninestar-made products remain abundant on the Amazon marketplace (see “A Closer Look at the UFLPA Ban on Ninestar Goods and the Impact So Far” and “Embargo Hasn’t Limited Ninestar’s Product Availability but Business May Be Slowing”). The same day this article was written, we could easily find Pantum printers on Amazon (Pantum is one of the banned Ninestar subsidiaries) including Pantum products proudly displaying the “Amazon’s Choice” label. Ninestar-manufactured cartridge brands like Lemero, myCartridge, and many others continue to abound three months after the United States said the ban was going into effect. It seems even a U.S. government ban on a company for using forced labor hasn’t spurred Amazon to act to remove listings.

Could the FTC action and other litigation and pressure spark real, massive, tangible change at Amazon? It is too soon to say. Of course, it is important to remember the European Commission also brought antitrust litigation against Amazon, resulting in a settlement and some seemingly minor changes at the online behemoth. We could see a settlement rather than something massive like a breakup happening in this case as well. Perhaps the FTC might glean some concessions it can crow about while Amazon remains the dominant online channel it has long been. But it is also possible that the FTC complaint could prove the tipping point for Amazon.

It often seems that things will stay the same they have always been until change comes abruptly. A quote from Ernest Hemingway’s The Sun Also Rises explaining how a character went bankrupt–“Two ways: gradually and then suddenly”—is often used to explain the pace at which change seems to happen. After all, decades ago it seemed inevitable that office superstores would remain the major channel for purchasing office supplies and book retailers the major channel for purchasing books until Amazon upended those dynamics and so many others. At Actionable Intelligence, we are eager to see if the FTC suit proves the catalyst that finally sparks change at Amazon.

[UPDATE: Amazon has since published a lengthier statement written by David Zapolsky, senior vice president of global public policy and general counsel, in response to the FTC’s lawsuit.]