In October and November, original equipment manufacturers (OEMs) of printers and MFPs announced their financial results for the three-month period ended September 30, 2022.

There was no one overarching trend this quarter but instead multiple trends impacting vendors in a multitude of ways. Key among them are the following:

- Most Japanese OEMs are benefiting from the yen’s depreciation, which provided a clear boost to revenue and, in many cases, profits as well.

- All OEMs are seeing profits pinched by inflationary pressures. Most OEMs have raised prices for products in response to seeing their own costs rise.

- Product shortages continue, although some vendors such as Canon, Fujifilm, Konica Minolta, Toshiba Tec. and others reported improved product supply, especially for A3 MFPs. Vendors talked about how they made design changes and obtained alternative components to get products from the factory to distributors. This enabled some vendors to turn some of their order backlog into revenue.

- Vendors are seeing some modest recovery in the office. Certain vendors talked about upticks in demand for A3 and higher-end A4 office-class hardware and supplies. However, some vendors that specialize in small-office/home-office (SOHO) printers and supplies are seeing a slowdown in that area of their business due to the waning of the work-from-home trend and inflationary pressure on buyers. Inkjet revenue and inkjet supplies sales were down for many vendors. Certain vendors saw lower laser printer supplies sales, too. This is the exact opposite of what we saw earlier in the pandemic, when the A3 MFP business shriveled up, and the consumer inkjet business and entry-level laser business were booming.

- While the A3 MFP hardware and supplies business may be improving for some vendors year-over-year, nobody is talking about getting all the way back to pre-pandemic print volumes or supplies sales. Most vendors said they were working to get back to 80 percent of 2019 levels.

Performance by Vendor

Actionable Intelligence currently covers financial results for the following printer OEMs: Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, Kyocera, Ninestar, Ricoh, Sharp, Toshiba Tec, and Xerox. For all the Japanese OEMs, except Canon, the period from July 1, 2022, through September 30, 2022, was the second quarter of the fiscal year ending March 31, 2023. For Canon, U.S.-based Xerox, and China-based Ninestar, this period was the third quarter of fiscal 2022. HP is on a different financial calendar than all the other OEMs. Its fourth quarter of fiscal 2022 ran from August 1, 2022, through October 31, 2022. Here, we look specifically at the performance of OEMs’ business segments that include home and office printer hardware, supplies, and related software and services.

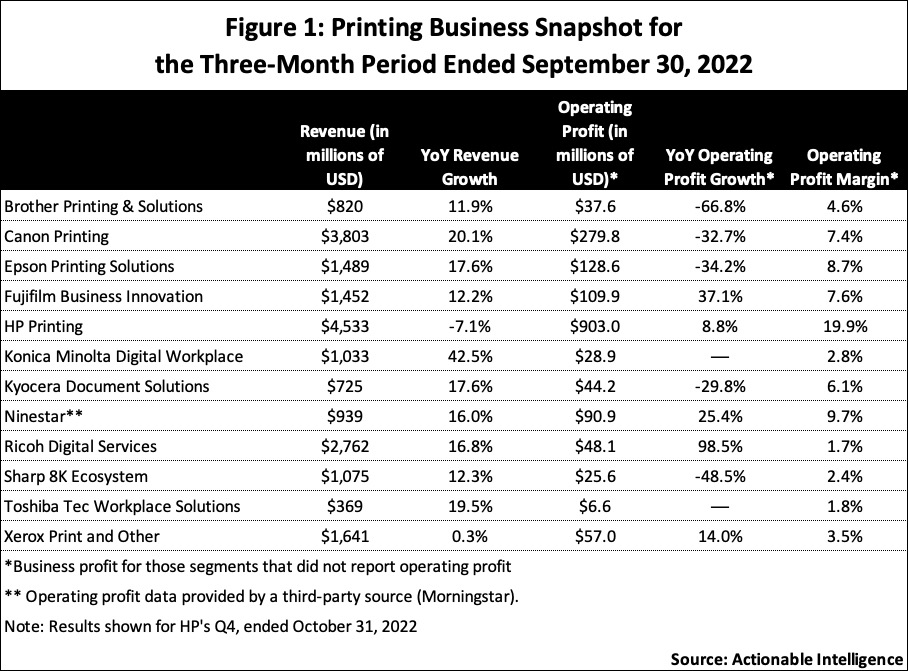

Figure 1 presents a snapshot of the financial performance of OEMs’ printing businesses for their most recent quarter. Readers should bear in mind that while the segments shown are those that include OEMs’ home and office printing hardware and supplies businesses and related software and services, OEMs other business lines in these segments, too. Most notably, Sharp includes its enormous TV business in its 8K Ecosystem Business. Meanwhile, because all of Ninestar is focused on home and office printing with the exception of a portion of its chip business, we show results for Ninestar as a whole.

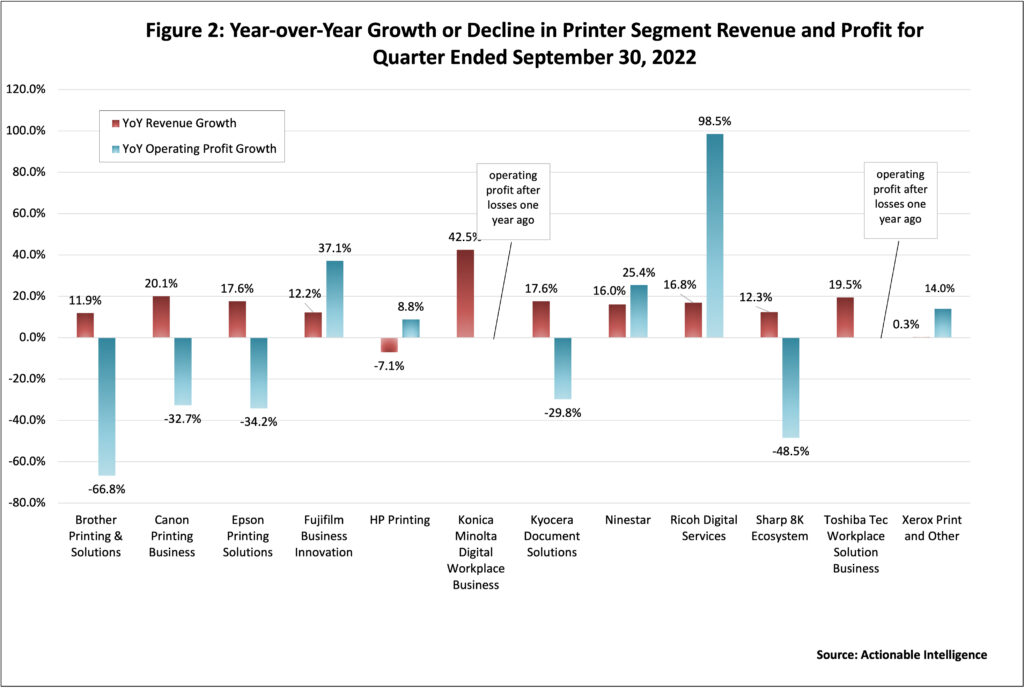

Figure 2 shows how OEMs’ printing businesses fared in terms of year-over-year revenue and profit growth or declines in their most recent quarter. Whereas last quarter eight of the twelve businesses we follow saw both revenue and operating profit growth (see “OEMs Mostly Have a Better Quarter but Problems Persist”), this quarter six did—Fujifilm Business Innovation, Konica Minolta Digital Workplace Business, Ninestar, Ricoh Digital Services, Toshiba Tec Workplace Solutions, and Xerox Print and Other. The other six vendors delivered mixed results. Brother Printing and Solutions, Canon Printing Business, Epson Printing Solutions, Kyocera Document Solutions, and Sharp 8K Ecosystem all saw revenue grow but profits decline. HP Printing saw the opposite—lower revenue but higher profit.

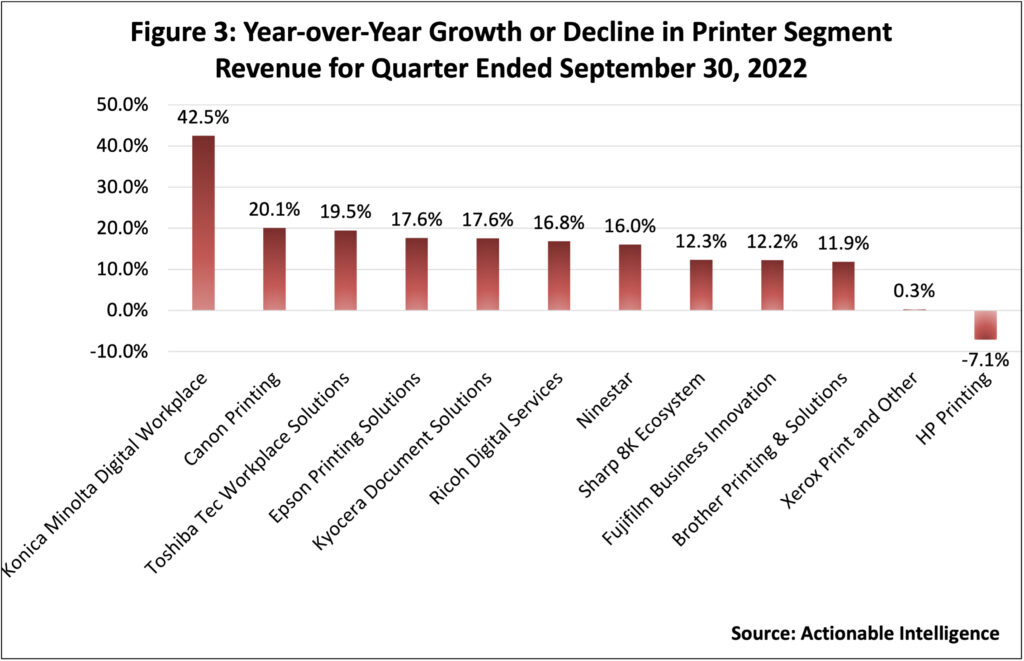

Figures 3 and 4 show these same numbers separately. Figure 3 shows year-over-year revenue growth or decline for the quarter. What stands out is that Konica Minolta’s Digital Workplace segment saw the strongest year-over-year revenue growth—a hefty 42.5 percent increase. The firm is beginning to see product shortages ease and was able to convert some of its enormous backlog of MFP orders into revenue. In contrast, one year ago, Konica Minolta’s Digital Workplace Business was the segment posting the biggest year-over-year revenue decline (see “OEMs Report Uneven Results in Quarter Ended in September 2021 as Supply-Chain Issues and Shortages Worsen”). Also notable is that Japanese OEMs are seeing strong revenue growth due to yen depreciation. Last quarter, three OEMs (Brother Printing and Solutions, Kyocera Document Solutions, and Canon Printing) saw double-digit year-over-year revenue growth. This quarter, a whopping 10 business segments—nine of them Japanese companies—reported double-digit year-over-year revenue growth. Ninestar of Zhuhai, China, also benefited from favorable currency exchange. The OEMs not benefiting from foreign currency exchange (FOREX) included Xerox Print and Other, which saw flat revenue, and HP Printing, which saw its revenue shrink 7.1 percent, more than any other vendor.

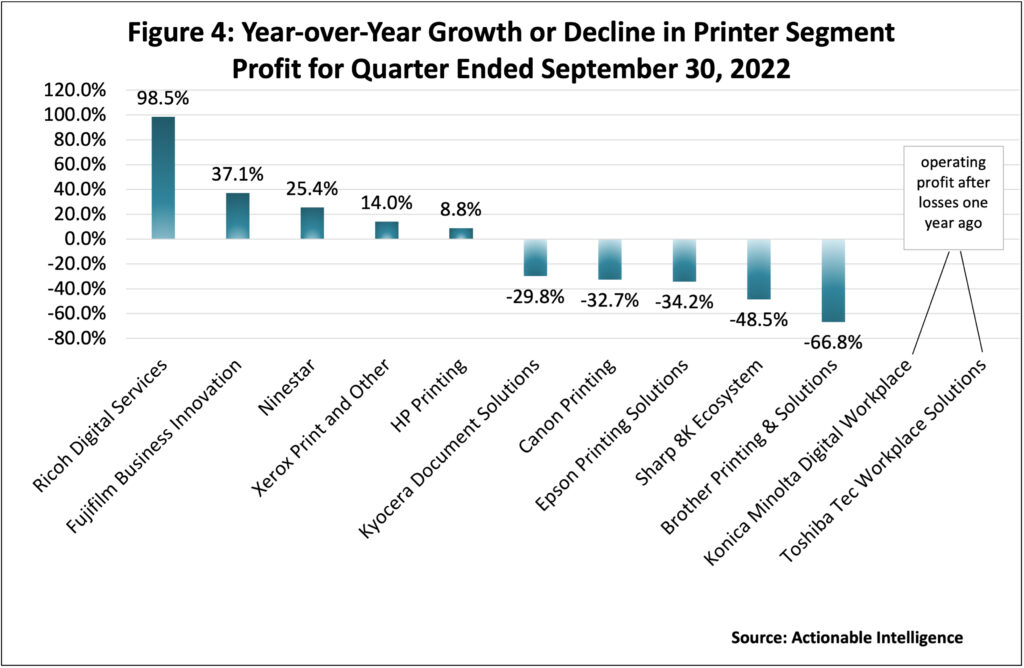

Figure 4 shows the year-over-year percentage change in segment operating profit. Those businesses reporting operating profit growth include Ricoh Digital Services, Fujifilm Business Innovation, Ninestar, Xerox Print and Other, and HP Printing. Konica Minolta’s Digital Workplace Business and Toshiba Tec’s Workplace Solution also saw improved profits but we can’t show year-over-year growth because these segments had losses in the year-ago period. Kyocera Document Solutions, Canon Printing, Epson Printing Solutions, Sharp 8K Ecosystem, and Brother Printing Solutions all reported big declines in profit. While the reason varied from company to company, it is important to note that all companies are struggling with higher costs. One figure weighing negatively on profits at Brother, Canon, Epson, and HP is lower sales of supplies for small-office/home-office printers as work-from-home demand has waned. Vendors like Epson noted increased ink bottle sales for refillable ink tank printers, but ink bottles bring in less profit than ink cartridges.

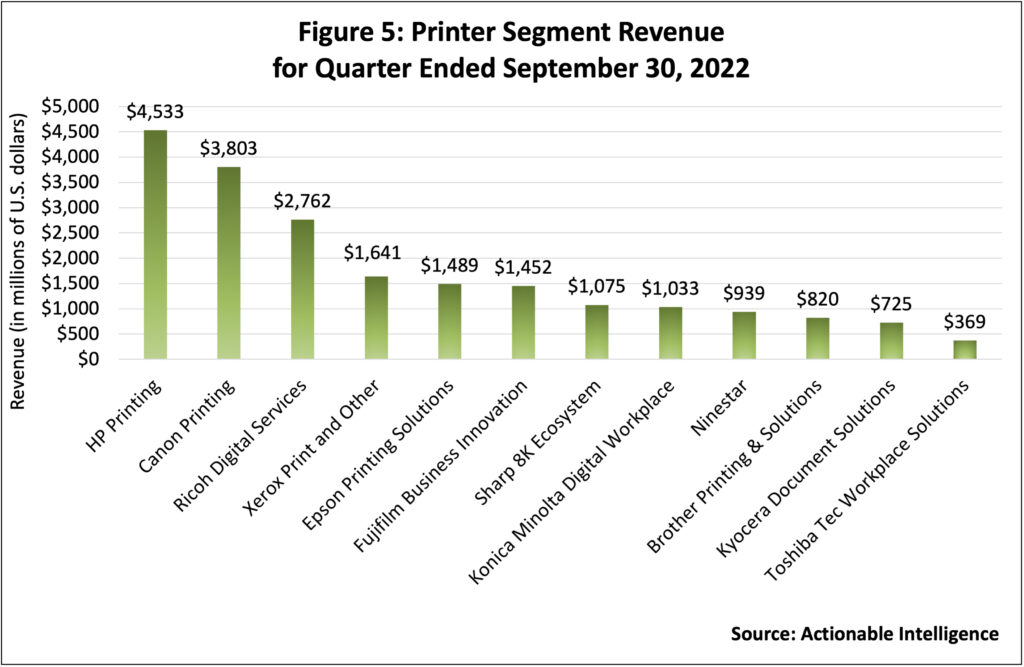

Figure 5 shows how much revenue in U.S. dollars each OEM’s printing business generated in the quarter ended September 30, 2022. There has been very little change in how vendors are ranked in terms of total revenue. HP Printing, Canon Printing, and Ricoh Digital Services remain the three biggest print-related businesses in terms of total revenue while Brother Printing and Solutions, Kyocera Document Solutions, and Toshiba Tec Workplace Solutions remain the three smallest. The only change we noticed is that whereas last quarter Ninestar brought in more revenue than Konica Minolta’s Digital Workplace Business, the opposite is true for the quarter ended September 30, 2022.

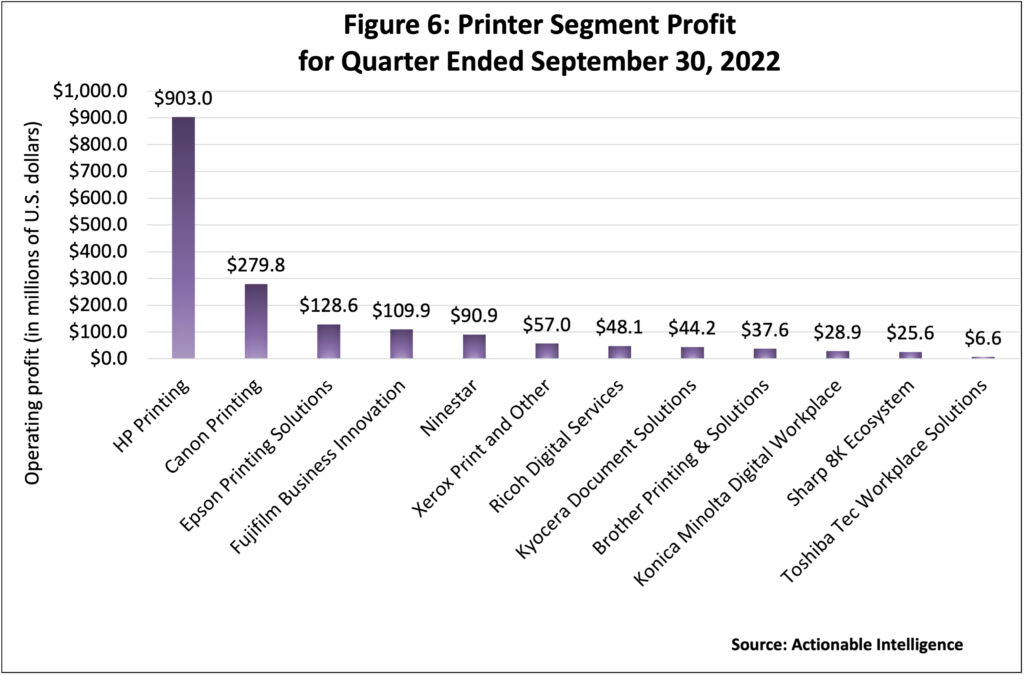

Figure 6 shows the OEMs’ printer segment profits in U.S. dollars. One thing that caught our attention is that for the first time in many quarters, no business had an operating loss—all were in the black. HP Printing, Canon Printing, and Epson Printing Solutions remain the three businesses that bring in the most profits. However, Fujifilm Business Innovation moved up to bring in the fourth most profits. Last quarter, Fujifilm Business Innovation was ranked sixth. Also notable is that Brother Printing and Solutions was ranked ninth in terms of profits this quarter—that’s down from being the fourth most profitable business in the prior quarter.

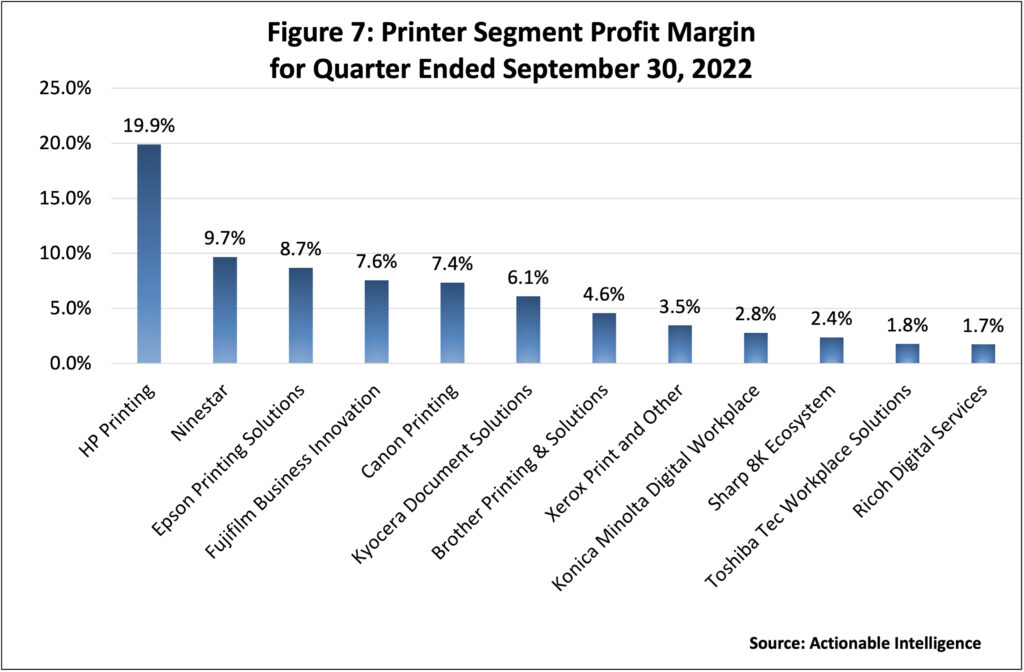

Figure 7 shows the operating profit margin in OEMs’ printing businesses. One thing that is notable is that HP remained the vendor with the best margin—19.9 percent, which is the exact same margin it had in the prior quarter. Another thing that grabbed our attention is that a number of firms are seeing margins dwindle due to higher costs, shrinking supplies sales, product shortages, or some combination thereof. Last quarter, four other businesses in addition to HP (Brother Printing and Solutions, Ninestar, Canon Printing, and Epson Printing Solutions) all has operating profit margins above 10 percent. This quarter, only HP had a double-digit operating profit margin.

Below we have summarized the performance of the various OEMs we track, keeping the focus on their home and office hardware and supplies businesses. For more information, click on the links below to access our detailed coverage of these companies’ financial results.

- Brother: In Q2 2022, Brother saw strong revenue growth as the firm benefited from the weak yen, but operating and net profit tumbled. In the Printing and Solutions business trends were similar. Segment revenue grew 11.9 percent year-over-year; however, favorable foreign currency exchange was a major reason for the growth as Brother said Printing and Solutions revenue would have decreased excluding FOREX. Still, Brother had another positive factor that helped drive sales: better product supply. In FY 2020, Brother struggled with a shortage of inkjet hardware and consumables, while in FY 2021 the firm saw a shortage of laser hardware. But in H1 2022, it seems that at long last product supply has improved. In Q2 2022, laser hardware revenue increased 45 percent year-over-year on 9 percent laser hardware unit growth. Meanwhile, inkjet all-in-one hardware revenue increased 32 percent in Q2 on robust 16 percent unit shipment growth. However, the news about consumables was not as rosy. In Q2 2022, laser consumables revenue was down 8 percent, while inkjet consumables revenue contracted 2 percent. Then firm explained that the problem was channel partners stocked up in the prior quarter in advance of consumables price increases. Shrinking consumables sales were a major reason for the sharp decline in Printing and Solutions operating profit. In Q2 2022, segment profit contracted a steep 66.8 percent year-over-year. In addition to saying that lower consumables sales hurt gross profits, Brother pointed to sharp rises in material costs and higher selling, general, and administrative (SG&A) expenses.

- Canon: Overall, Q3 2022 was a strong quarter for Canon, and the company reported double-digit year-over-year growth in revenue, operating profit, and net profit. However, the performance of the Printing Business was mixed. The group saw net sales grow 20.1 percent year-over-year, but operating profit in the Printing Business fell a steep 32.7 percent. Canon explained that it saw improvements in the supply of semiconductor chips and thus product supply improved, resulting in higher unit sales of hardware across all Printing subsegments. The problem, however, was that the firm saw a slowdown in demand for consumables for laser printers and inkjet printers as work-from-home demand waned. That, combined with higher costs of parts and logistics, was enough to cause segment profits to shrink. In the Office subsegment in Q3 2022, net sales rose a robust 31.6 percent. Net sales of office MFDs grew a whopping 75 percent on 35 percent growth in units. Office MFD non-hardware net sales also grew 14 percent. In Q3 2022, Prosumer net sales rose 6.2 percent year-over-year. Laser hardware net sales increased 53 percent on a 22 percent increase in units; however, non-hardware sales declined 8 percent. Inkjet printer hardware net sales increased 33 percent on 34 percent unit growth, but inkjet non-hardware sales fell by 18 percent.

- Epson: In Q2 2022, Epson was able to post double-digit year-over-year growth in revenue, operating profit, and net profit. However, similar to several other vendors, Epson’s Printing Solutions segment posted mixed results, with revenue growing 17.6 percent but business profit declining 34.2 percent. The firm attributed the segment’s revenue growth to higher prices on products due to ongoing product supplies issues and the lower profits to higher costs for materials and transportation. In the Office and Home Printing subsegment in Q2 2022, revenue increased 16.4 percent, but business profit fell a steep 45.9 percent. During the quarter, SOHO and home inkjet printer revenue increased 16.4 percent. While inkjet printer unit shipments were flat in Q2, Epson saw a shift in composition: fewer units of ink cartridge printers and more units of high-capacity ink printers. Office-shared inkjet printer grew 5.7 percent. Ink revenue increased by 3 percent in Q2, which the firm attributed to “an increase in sales of ink bottles for high-capacity ink tank printers and positive foreign exchange effects.” Although Epson did not comment on this topic, we believe the ongoing shift toward more ink bottle sales and fewer ink cartridge sales had a negative impact on both Office and Home Printing profits and Printing Solutions profits.

- Fujifilm: Q2 2022 was a strong quarter for Fujifilm, in which it saw revenue, operating income, and net income all grow by double digits. The firm’s Business Innovation segment was able to post both revenue and operating income growth for a second straight quarter—and growth rates were higher than in Q1. In Q2 2022, Business Innovation revenue grew 12.2 percent year-over-year, and segment operating income increased 37.1 percent. In Q2 2022, office solutions revenue grew 11.3 percent. The firm said it saw a recovery in product supply and thus saw higher revenue from exports of MFPs, printers, and consumables, mainly to the U.S. and Europe. When Fujifilm refers to growth in the Business Innovation segment in U.S. and Europe, this refers to its business supplying Xerox with products.

- HP: The headwinds HP experienced in Q3 2022 persisted in Q4 2022. In Q4 2022, revenue and operating profit fell by double-digits year-over-year, and the firm reported a net loss. The company announced a new Future Ready Transformation plan that entails laying off 4,000 to 6,000 employees. Personal Systems revenue tumbled 13 percent as unit shipments of notebooks fell 26 percent and desktop units contracted 3 percent. The Printing business also struggled. HP Printing revenue fell 7.1 percent year-over-year in Q4 2022, marking the fourth straight quarter of revenue declines in this business. Total printing hardware shipments declined 3 percent with shipments of consumer hardware down 4 percent and shipments of commercial devices up 5 percent. Consumer hardware revenue decreased 6.6 percent, while commercial hardware revenue grew 1.0 percent. HP supplies sales were down 10.1 percent due to ongoing weakness in the consumer segment, especially in the EMEA region, combined with a slow recovery in demand for office supplies. While HP Printing’s top line was under pressure in Q4, the group’s operating profit grew 8.8 percent and the segment’s operating margin was 19.9 percent. Operating profit benefited from increased supplies market share, higher prices, and increased sales of more profitable HP+ and “Big Tank” devices.

- Konica Minolta: Konica Minolta had a lot to crow about in Q2 2022. Revenue soared, and the firm was able to report both positive operating and net profit for the first time since Q1 2021. In the Digital Workplace Business, revenue grew by a whopping 42.5 percent year-over-year in Q2. While a lot of this was due to the yen’s depreciation, not all of it was—revenue would have been up 18 percent excluding FOREX. Moreover, segment operating profit improved ¥9.6 billion, rising from a loss of ¥5.4 billion in Q2 2021 to an operating profit of ¥4.2 billion ($28.9 million) in Q2 2022. One thing that really helped sales and profits in Q2 was that Konica Minolta saw a recovery in production volume and hence product supply and was able to make process in converting some of its enormous product backlog into revenue. For the Office subsegment in Q2 2022, revenue rose 45.7 percent. The firm said that hardware revenue improved to 93 percent of FY 2019 levels, while non-hardware revenue recovered to 85 percent of FY 2019 levels.

- Kyocera: In Q2, Kyocera delivered revenue growth, but it saw operating and net profit decline for the first time since in nearly two years. Similar to the company as a whole, the Document Solutions delivered a mixed performance. Document Solutions revenue grew 17.6 percent year-over-year, but segment profit fell by 29.8 percent. The company said the weaker yen benefited sales in the Document Solutions unit, but profits were negatively impacted by higher raw material prices and rising logistics costs.

- Ninestar: Q3 2022 was a good one for Ninestar. The company’s revenue rose 16.0 percent year-over-year, and net profit increased 59.9 percent. Ninestar did not break out operating profit, so we used operating profit calculations from Morningstar. Its data shows Ninestar’s operating profits improved 25.4 percent in Q2. Ninestar provided only limited data on its segment performance—and much of the data it did provide was for the first nine months of the year, not specifically for the third quarter. However, it appears that most of Ninestar’s business segments are doing well in the year to date. Lexmark’s revenue in the first nine months of the year was up 10 percent. Sales volumes of Lexmark printers increased by approximately 27 percent year-over-year in the first nine months of the year and were up 44 percent year-over-year in the third quarter as supply-chain issues eased and Lexmark was able to supply more printers. Lexmark’s earnings before interest, tax, depreciation and amortization (EBITDA) for the first three quarters of 2022 declined 11.5 percent year-over-year due to the cost of Ninestar refinancing Lexmark (see “Lexmark Gets New Credit Agreement from Morgan Stanley and Others”). Ninestar’s other printer business, Pantum, saw revenue in the first nine month of the year grow 21.0 percent and net profit grow 3.6 percent. In Q3 2022, Pantum’s printer unit sales grew 58 percent year-over-year. For the first three quarters of 2022, they grew 40 percent. Meanwhile, shipments of original consumables for Pantum printers grew 86 percent in Q3 and increased 60 percent in the first nine months of the year. In the integrated circuit business, revenue was up 43.0 percent in the first nine months of the year, while net profit improved 19.7 percent. Lastly, Ninestar’s general printing consumables business (third-party consumables) saw 15.0 percent growth in revenue in the first nine months of the year as net profit improved 27.7 percent.

- Ricoh: In Q2 2022, Ricoh delivered strong net sales, operating profit, and net profit growth for a second straight quarter. In the Digital Services segment, which is the business we follow most closely, net sales increased 16.8 percent year-over-year and operating profit essentially doubled, growing 98.5 percent. Total office printing revenue from sales of MFP and printer hardware grew 21.1 percent year-over-year. MFP revenue was up 23.2 percent, while printer revenue declined 1.6 percent. Ricoh noted that its supply of MFPs and printers did not recover to expected levels and that shortages of A4 MFPs were a particular problem. Hardware sales in Q2 2022 were only about 78 percent of 2019 or pre-pandemic levels, whereas they were 82 percent of 2019 levels in Q1 2022. Total MFP and printer non-hardware sales grew 12.7 percent year-over-year. Non-hardware sales for MFPs rose 12.1 percent, while non-hardware sales for printers increased 14.8 percent. Non-hardware sales were 80 percent of 2019 levels in both Q1 and Q2 2022.

- Sharp: In Q2 2022, Sharp delivered mixed results. Net sales were up 14.7 percent year-over-year, but the good news ended there, and the firm reported both operating and net losses. In addition to seeing higher costs for parts and logistics, Sharp had foreign exchange losses due to the yen’s depreciation and certain costs associated with making Sakai Display Products Corporation a consolidated subsidiary. In Q2 2022, Sharp’s 8K Ecosystem segment saw net sales grow 12.3 percent year-over-year but operating profit declined 48.5 percent. Sharp typically says very little about the performance of its MFP business, which makes up a portion of 8K Ecosystem sales and profits, but what it did say was positive. Sharp said that its MFP business “rose substantially in Europe, the Americas, Japan, and other regions.”

- Toshiba Tec: Toshiba Tec saw strong growth in both net sales and operating profit in Q2 2022; however, net profit proved more problematic. The company posted a net loss stemming from the anticipated costs of a settling a lawsuit filed against it in Japan. In Q2 2022, the Workplace Solutions Business saw net sales grow 19.5 percent. Meanwhile, segment operating profit improved by about ¥2.2 billion, climbing from a loss of ¥1.2 billion in Q2 2021 to an operating profit of ¥956 million ($6.6 million) in Q2 2022. Toshiba explained that it saw higher net sales of MFPs due to “steady” sales of units overseas and the favorable impact of FOREX. The firm said that although product shortages continued, the firm saw somewhat better availability of MFPs due to design changes, adoption of alternative components, and changes in transportation routes or methods.

- Xerox: In Q3 2022, Xerox’s revenue declined modestly, but operating income fell by double-digits. Moreover, Xerox posted a net loss because it took a goodwill impairment charge to account for the slower-than-expected recovery and supply-chain issues. However, Xerox’s Print and Other segment saw improvements. Print and Other revenue rose 0.3 percent year-over-year in Q3 2022, while segment profit improved 14.0 percent. For the company as a whole, equipment revenue grew 0.8 percent in Q3 2022, and the quarter was the first in which equipment revenue grew since supply constraints began last year. Entry-level equipment sales rose 7.2 percent. Color entry-level A4 MFP installs were up 28 percent, but black-and-white entry-level MFP installs shrank 28 percent. Xerox’s midrange equipment sales grew 0.8 percent. The growth was driven largely by color devices. Color midrange installs were up 10 percent but black-and-white midrange installs were down 21 percent. Revenue from the sale of Xerox’s high-end equipment declined 4.4 percent. High-end color installs increased 1 percent, but black-and-white installs fell by 10 percent. Companywide post-sale revenue declined 0.7 percent year-over-year. Services, maintenance, and rental revenue, which includes bundled supplies, declined 3.4 percent, and financing revenue was down 7.3 percent. However, supplies, paper, and other sales, including unbundled or transactional supplies sales, was up 11.2 percent. Xerox attributed this to pricing actions and a gradual recovery in print-related activity.

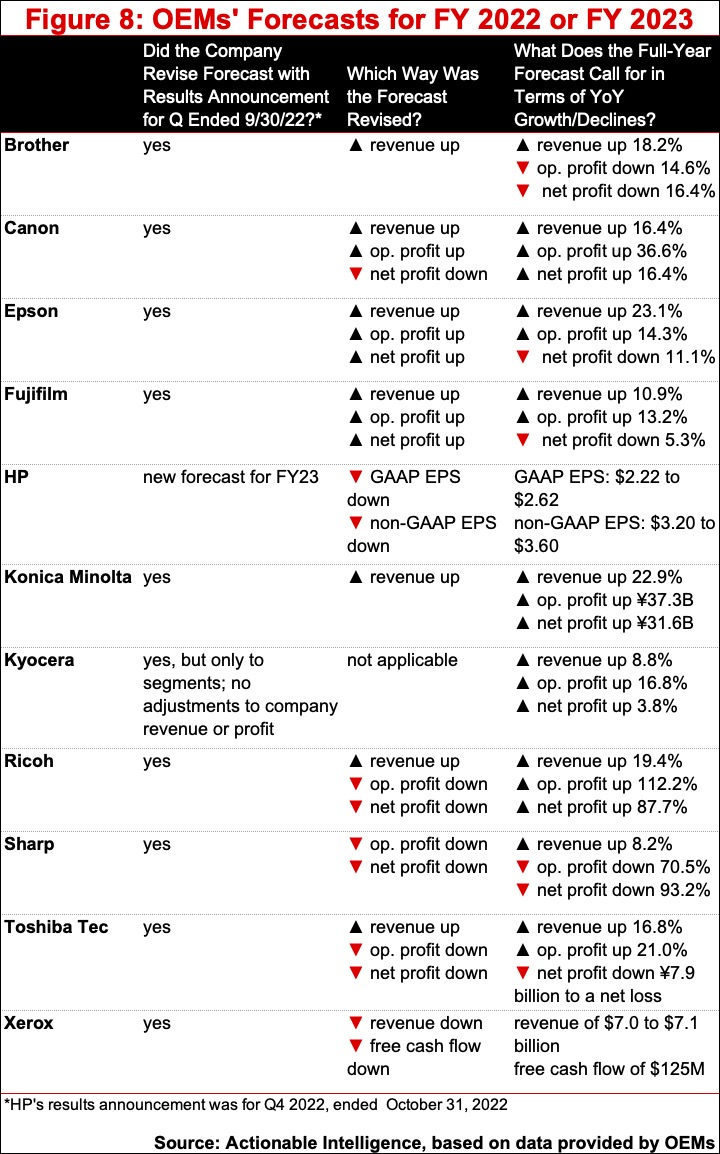

Forecast Changes

The quarter ended September 30, 2022, inspired nearly every single OEM to adjust its guidance. A whopping nine OEMs adjusted their companywide forecasts. One major reason for all the adjustments is Japanese companies are seeing steeper-than-expected yen depreciation. With favorable currency exchange as a headwind, Brother, Canon, Epson, Fujifilm, Konica Minolta, Ricoh, and Toshiba Tec all raised FY 2022 revenue guidance. Epson and Fujifilm said they expected higher operating and net profits, too. Canon raised its guidance for operating profit but lowered its projected net profit. Ricoh, Sharp, and Toshiba Tec all lowered operating and net profit guidance. Over in the United States where currency exchange is a headwind, Xerox lowered revenue guidance. HP provided its initiation forecast for FY 2023 and said it expects to see earnings per share decline.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.