In October and November, printer and copier OEMs reported quarterly financial results for the three-month period ended on September 30, 2017. For all the Japanese OEMs, except Canon, this period marked their fiscal second quarter. For Canon and Xerox, this period was the third quarter of the fiscal year that will end on December 31, 2017. HP is on a different financial calendar than the other OEMs. Its fourth quarter and fiscal 2017 closed on October 31, 2017.

In October and November, printer and copier OEMs reported quarterly financial results for the three-month period ended on September 30, 2017. For all the Japanese OEMs, except Canon, this period marked their fiscal second quarter. For Canon and Xerox, this period was the third quarter of the fiscal year that will end on December 31, 2017. HP is on a different financial calendar than the other OEMs. Its fourth quarter and fiscal 2017 closed on October 31, 2017.

Actionable Intelligence currently covers financial results from traditional printer and copier OEMs including Brother, Canon, Epson, Fujifilm, HP, Konica Minolta, OKI, Ricoh, Toshiba Tec, and Xerox. Our detailed coverage of these companies’ financial performance is available for Actionable Intelligence subscribers.

Key takeaways from these companies’ most recent financial quarters are as follows.

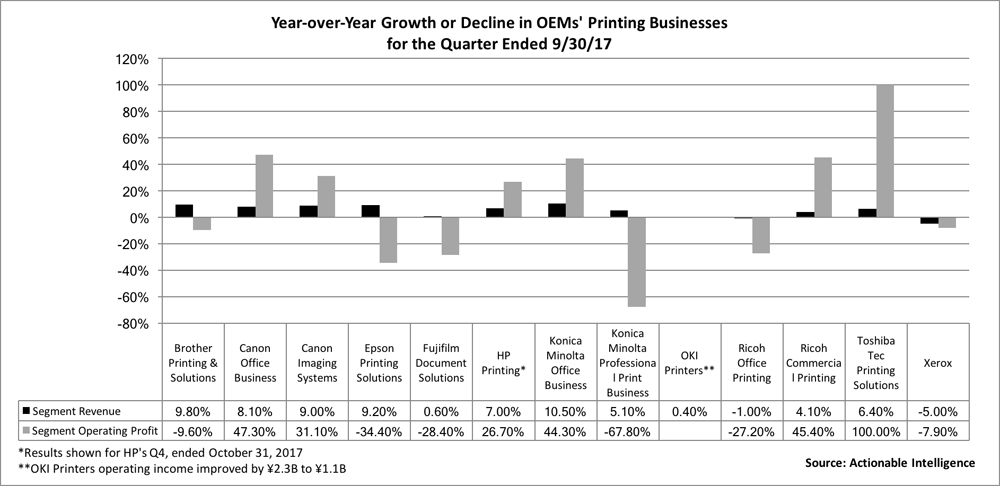

- After a string of tough quarters in calendar-year 2016, things started to improve for certain vendors in the first calendar quarter of 2017 ended in March (see “The Big Picture: OEM Financials for the Quarter Ended in March”). Many vendors saw further improvements in the second calendar quarter ended in June (see “The Big Picture: OEM Financials for the Quarter Ended in June”). That trend continued in the third calendar quarter ended in September. More OEMs saw year-over-year improvements to their printer and supplies businesses in the quarter than saw declines. That said, the growth in OEMs’ printer businesses is not universal, and some OEMs are continuing to struggle—and they are struggling despite more favorable currency exchange and an easy comparison to the tough period one year ago (see “The Big Picture: OEM Financials for the Quarter Ended in September”).

- The big winners in the quarter ended in September were Canon’s Office and Imaging Systems businesses, HP’s Printing segment, Konica Minolta’s Office business, OKI’s Printers business, Ricoh’s Commercial Printing business, and Toshiba Tec’s Printing Solutions segment. All these printing businesses reported year-over-year growth in revenue and operating profit for the quarter. The good news for Konica Minolta is that the Office business is also its biggest segment. The bad news for Ricoh is that the Commercial Printing segment isn’t its biggest business—it’s a relatively small one—and its main printing business shrank in the quarter.

- Certain OEMs’ printing businesses reported revenue growth but an operating profit decline in the quarter. These included Brother’s Printing and Solutions business, Epson’s Printing Solutions segment, Fujifilm’s Document Solutions business, and Konica Minolta’s Professional Print business.

- Two OEMs had printing businesses that saw both revenue and operating profit shrink in the quarter. One was Xerox—all of Xerox is now a printing business following the spinoff of Conduent. The other was Ricoh’s Office Business, which is its biggest printing segment.

- Certain OEMs including Brother and Canon reported strong sales in the laser printer/MFP market. HP also reported gains in its consumer hardware revenue (which includes personal lasers) and its commercial hardware revenue (which includes higher-end laser devices). Xerox, too, saw a strong uptick in shipments in the entry category (A4 laser/LED devices), although revenue in this category declined due to more demand for lower-priced models.

- Another category doing well for OEMs is refillable ink tank printers (also known as continuous ink supply system or CISS printers or high-capacity ink tanks printers). These are inkjet printers that have large ink tanks that are end-user-refillable using the ink bottles that ship with the printer. The advantage of such devices is they offer ultra-low output costs—an order of magnitude lower than conventional cartridge-based inkjets. Brother reported its sales of such units grew 20 percent, and Canon reported strong demand for such devices in emerging countries. Epson reported increased shipments of high-capacity ink tank printers in both emerging and developed economies, helping to drive revenue growth in the inkjet printer category.

- Although there were some exceptions, OEMs are feeling optimistic about their performance in fiscal 2017 compared to fiscal 2016. Of the ten vendors whose forecasts are shown in the table below, six adjusted their full-year outlooks for fiscal 2017 and one (HP) provided a forecast for fiscal 2018 after closing its fiscal 2017. Of the half-dozen companies adjusting their forecasts, five (Brother, Canon, Konica Minolta, Toshiba Tec, and Xerox) raised their outlooks. One company, Ricoh, which is continuing to be negatively impacted by problems with its Ricoh India subsidiary, raised its revenue outlook but drastically cut its forecast for profits.

- Several OEMs, including Brother, Canon, Epson, OKI, and Toshiba Tec, expect their revenue, operating profit, and net profit to grow in fiscal 2017 compared with the previous year. Fujifilm expects revenue and operating profit growth but a decline in net profit. Both Konica Minolta and Ricoh project increased revenue but decreased profits. Ricoh’s forecast is the worst of the lot. The company expects a 70.5 percent decrease in operating profit and a net loss for the year, which would be only the second full-year net loss for Ricoh in its corporate history.

If you want the most up-to-date information on printer OEMs’ financial performance, legal issues, new product introductions, and other topics impacting the printer and MFP hardware and supplies industry, subscribe to Actionable Intelligence.